OPEC+ Decision Looms As Big Oil Remains Unmoved On Production

Table of Contents

The Imminent OPEC+ Meeting: Expected Outcomes and Market Impact

The scheduled OPEC+ meeting is a crucial event, with potential decisions ranging from significant production cuts to maintaining current levels or even increasing output. Geopolitical factors heavily influence this decision-making process. The ongoing war in Ukraine, fluctuating global demand, and the persistent presence of US shale oil production all play a role in shaping the OPEC+ strategy.

-

Potential Scenarios and Their Implications for Oil Prices: A substantial production cut could send oil prices soaring, potentially exacerbating inflation. Conversely, maintaining or increasing production could lead to lower prices, benefiting consumers but potentially impacting the profitability of OPEC+ member nations.

-

Historical Precedents of OPEC+ Decisions and Their Market Consequences: Past OPEC+ decisions have shown a significant impact on crude oil prices. Analyzing these historical precedents provides valuable insight into potential future market reactions. For example, past production cuts have often resulted in short-term price spikes, while increases have generally led to price declines.

-

Analyst Predictions Regarding the Upcoming OPEC+ Announcement: Numerous analysts offer diverse predictions, creating a spectrum of potential outcomes. Some anticipate substantial cuts, while others foresee a more cautious approach, depending on their interpretation of market signals and geopolitical developments. Closely monitoring these predictions can help assess the prevailing market sentiment leading up to the announcement. Keywords: OPEC+ meeting, oil price forecast, production cuts, geopolitical risks, crude oil prices.

Big Oil's Production Strategy: Why the Unwavering Stance?

Major oil companies appear unfazed by the potential repercussions of the OPEC+ decision. Their unwavering production strategy is driven by several key factors.

-

Profit Maximization in the Current High-Price Environment: With oil prices remaining relatively high, many Big Oil companies prioritize maximizing their current profits. Increasing production beyond their current levels might flood the market, potentially driving down prices and reducing overall profitability.

-

Long-Term Investment Plans and Infrastructure Limitations: Significant changes in production require substantial long-term investment and adjustments to existing infrastructure. These are not decisions made lightly and often require considerable lead time.

-

Shareholder Pressure and Return on Investment Expectations: Oil companies face intense pressure from shareholders to deliver strong returns on investment. Decisions regarding production levels are often made with an eye towards maximizing shareholder value, even if it means a more conservative approach to short-term market fluctuations.

-

Analysis of Major Oil Companies' Recent Production Figures: Reviewing recent production data from major players like ExxonMobil, Chevron, and Shell reveals a consistent trend of relatively stable output, despite the uncertainty surrounding the OPEC+ meeting.

-

Statements from Major Oil Executives on Their Production Strategies: Public statements from these executives often emphasize long-term investment plans and a focus on sustainable profitability, offering further insight into their production strategies.

-

Exploration of Potential Conflicts of Interest Between OPEC+ and Individual Oil Companies: The relationship between OPEC+ and individual oil companies isn't always harmonious. While some companies benefit from price increases orchestrated by OPEC+ cuts, others might prefer a more competitive, lower-price environment. Keywords: Big Oil, oil production strategy, shareholder value, oil company profits, production capacity.

The Interplay Between OPEC+ and Big Oil: A Complex Relationship

The relationship between OPEC+, primarily comprised of Middle Eastern and other nations, and independent oil producers, especially those in the US, is complex and dynamic. Both significantly influence global oil supply and prices.

-

Historical Examples of Cooperation and Conflict Between OPEC+ and Big Oil: Throughout history, periods of cooperation have been followed by conflicts, demonstrating the fluid nature of this relationship. For example, periods of high oil prices have often led to increased US shale oil production, thereby countering OPEC+'s influence.

-

The Role of Market Speculation and Trader Sentiment: Market speculation and trader sentiment play a crucial role in amplifying the impact of both OPEC+'s actions and Big Oil's production decisions, often leading to price volatility.

-

Potential Implications for Future Oil Market Stability: The ongoing interplay between these entities will continue to shape the future stability of the global oil market. Understanding this dynamic relationship is crucial for predicting future oil price trends. Keywords: OPEC+ influence, oil market dynamics, oil supply chain, US shale oil production, oil price volatility.

Looking Ahead: Potential Scenarios and Market Implications

Several scenarios could unfold following the OPEC+ decision.

-

Scenario 1: OPEC+ Cuts Production – Impact on Prices and Supply: A production cut would likely lead to a price surge, potentially impacting global economies. The extent of this impact would depend on the magnitude of the cut and overall market conditions.

-

Scenario 2: OPEC+ Maintains Production – Impact on Prices and Competition: Maintaining current production levels might create a more stable market, but could also intensify competition among producers. Prices would likely remain relatively volatile, influenced by other factors like global demand.

-

Scenario 3: OPEC+ Increases Production – Impact on Prices and Market Share: An increase in production would likely suppress oil prices, benefiting consumers but potentially eroding the market share of OPEC+ members.

These scenarios highlight the significant uncertainty surrounding the upcoming OPEC+ decision and its far-reaching consequences. Keywords: Oil price outlook, future of oil, global energy market, energy security, economic impact of oil.

Conclusion: The Long-Term Outlook for OPEC+ and Big Oil Production

The upcoming OPEC+ decision is a watershed moment. Big Oil's steady production, coupled with the various potential outcomes of the OPEC+ meeting, paints a picture of a complex and evolving global energy market. The interplay between OPEC+ and independent oil producers will continue to shape oil prices and global energy security. The long-term outlook depends heavily on how these entities navigate the challenges and opportunities in the coming years.

To stay informed about the OPEC+ decision and its impact on Big Oil production, subscribe to our updates or follow reputable news sources covering global energy markets. Understanding these dynamics is crucial for investors, policymakers, and anyone interested in the future of global energy.

Featured Posts

-

Trumps Executive Order Targeting Perkins Coie Struck Down

May 05, 2025

Trumps Executive Order Targeting Perkins Coie Struck Down

May 05, 2025 -

Analyzing Chunk Of Golds Potential A 2025 Kentucky Derby Prediction

May 05, 2025

Analyzing Chunk Of Golds Potential A 2025 Kentucky Derby Prediction

May 05, 2025 -

Norways Sovereign Wealth Fund And The Trump Tariff Challenge Nicolai Tangens Actions

May 05, 2025

Norways Sovereign Wealth Fund And The Trump Tariff Challenge Nicolai Tangens Actions

May 05, 2025 -

Can The Golden Knights Win The Stanley Cup A Deep Dive

May 05, 2025

Can The Golden Knights Win The Stanley Cup A Deep Dive

May 05, 2025 -

Australian National Election 2024 Reflecting Global Political Trends

May 05, 2025

Australian National Election 2024 Reflecting Global Political Trends

May 05, 2025

Latest Posts

-

Concert Spotlight Lizzos Show Stopping Curves In Los Angeles

May 05, 2025

Concert Spotlight Lizzos Show Stopping Curves In Los Angeles

May 05, 2025 -

Lizzos Transformation How She Achieved Her Weight Loss Goals

May 05, 2025

Lizzos Transformation How She Achieved Her Weight Loss Goals

May 05, 2025 -

Lizzos Dramatic Weight Loss Stuns Fans Online

May 05, 2025

Lizzos Dramatic Weight Loss Stuns Fans Online

May 05, 2025 -

Lizzos Boyfriend Myke Wright Net Worth Job And Relationship Details

May 05, 2025

Lizzos Boyfriend Myke Wright Net Worth Job And Relationship Details

May 05, 2025 -

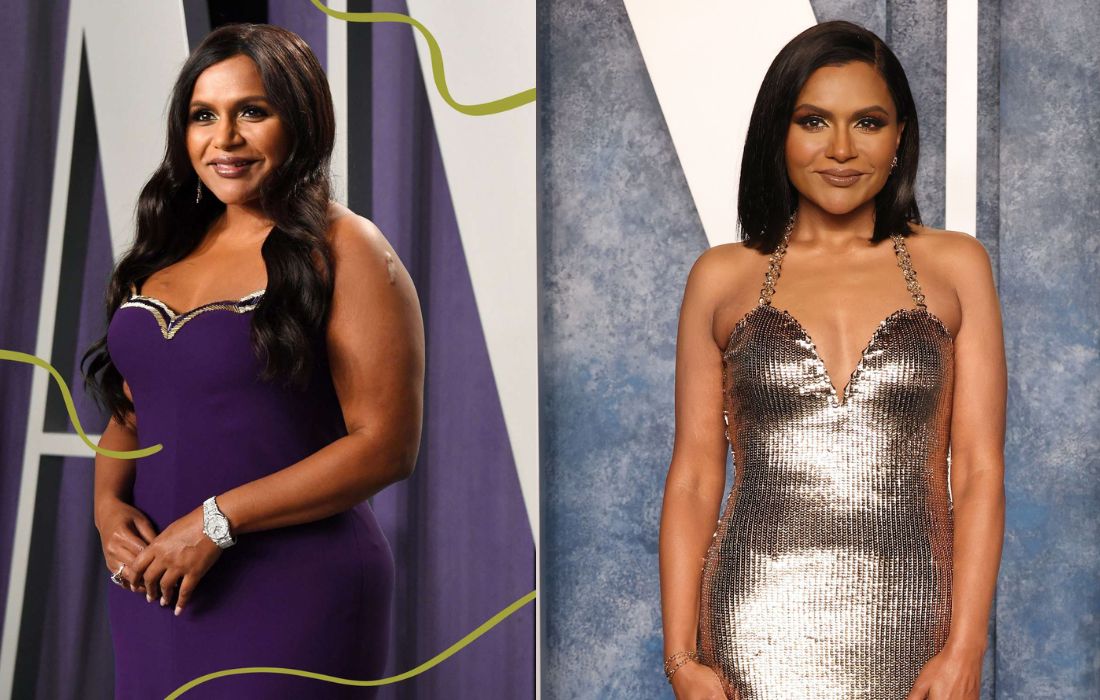

Lizzos Weight Loss Journey Before And After Oscars Photos

May 05, 2025

Lizzos Weight Loss Journey Before And After Oscars Photos

May 05, 2025