OPEC+ Meeting: Big Oil's Resistance To Production Increases

Table of Contents

Geopolitical Instability and Strategic Oil Reserves

Geopolitical uncertainty plays a significant role in OPEC+'s decision-making regarding oil production. The current global landscape is marked by considerable instability, directly impacting the availability and price of crude oil. The ongoing conflict in Ukraine, for example, has created significant disruptions to global oil supply chains. Sanctions imposed on Russia, a major oil producer, have further exacerbated the situation, limiting its ability to export oil and impacting the overall global supply.

- Impact of the Ukraine conflict on oil markets: The war has created significant volatility, leading to price spikes and supply chain disruptions.

- Sanctions against Russia and their effect on global oil supply: Reduced Russian oil exports have created a supply deficit, pushing prices higher.

- OPEC+'s use of production as a geopolitical tool: Maintaining lower production levels can be used to exert influence and leverage power in international relations.

- The role of strategic petroleum reserves in influencing decisions: Countries holding significant reserves can influence market decisions based on their release or retention strategies. The strategic use, or lack thereof, of these reserves plays a significant role in global oil price dynamics.

Internal Disagreements within OPEC+

The OPEC+ alliance, while powerful, is not without its internal tensions. Disagreements among member states regarding production quotas and individual national interests frequently arise. This often leads to protracted negotiations and compromises that may not fully address the global demand for crude oil. The conflicting interests of key players like Saudi Arabia and Russia often complicate matters. Saudi Arabia, for instance, might favor a more gradual increase to maintain higher prices, while Russia might have different priorities based on its current geopolitical situation and sanctions.

- Differing production capacities among OPEC+ members: Variations in production capabilities lead to unequal contributions and potential conflicts.

- Conflicts of interest between major oil producers: National interests often outweigh collective goals, hindering unified decisions on production increases.

- Negotiating production quotas and the challenges involved: Reaching consensus on production targets requires intricate negotiations and compromises among diverse stakeholders.

- Impact of internal disagreements on market stability: Internal conflicts within OPEC+ contribute to market volatility and price uncertainty.

The Role of Investment and Profit Maximization

A key driver behind the reluctance to increase production is the potential for profit maximization. By limiting supply, OPEC+ members can maintain higher oil prices, leading to increased revenues for oil companies. Increasing production significantly would likely lead to a decrease in prices, potentially reducing overall profits despite higher sales volumes. Moreover, expanding production capacity requires substantial long-term investment in exploration, infrastructure, and technology. Companies must weigh the costs of this expansion against the potential long-term return on investment (ROI), a factor that may influence their decision to maintain current production levels.

- Impact of increased production on oil prices: A surge in supply often results in lower prices, potentially reducing profits despite increased sales.

- The role of shareholder value and profit maximization: Oil companies prioritize maximizing shareholder returns, and this often influences production decisions.

- The long-term investment needed for increased oil production: Significant capital investment is required to expand production capacity, potentially outweighing short-term gains.

- Analysis of current oil company profits versus potential future gains: Weighing current high profits against uncertain future gains from increased production capacity plays a crucial role in decision-making.

Concerns about Future Demand and Market Saturation

The global energy transition presents another layer of complexity. The increasing adoption of renewable energy sources, such as solar and wind power, poses a long-term threat to the demand for oil. OPEC+ members are likely considering this shift in the energy landscape and the potential for market saturation in the future. Over-investing in increased oil production capacity now might lead to an oversupply in the future, potentially causing a price collapse. This concern adds another dimension to their cautious approach to production increases.

- Growth of renewable energy and its impact on oil demand: The expansion of renewable energy sources is steadily reducing the overall demand for fossil fuels.

- OPEC+'s long-term strategic planning considering the energy transition: OPEC+ members are likely strategizing for a future with reduced oil demand.

- Concerns about oversupply in the future and the potential for price collapse: Significant increases in production could lead to oversupply and drastically lower prices in the future.

- The role of technological advancements in influencing oil demand: Technological advancements in energy efficiency and alternative fuels are expected to further decrease oil demand.

Conclusion

The OPEC+ meeting's outcome underscores the multifaceted reasons behind Big Oil's resistance to significantly increasing oil production. Geopolitical instability, internal disagreements, profit maximization strategies, and concerns about future demand all play crucial roles. Understanding these factors is vital for comprehending the current dynamics of the global oil market.

Call to Action: Stay informed about the evolving situation by following further updates on OPEC+ meetings and analyses of the global oil market. Understanding the complexities surrounding OPEC+ oil production decisions is crucial for navigating the ever-changing landscape of the energy sector. Keep an eye on key indicators like crude oil prices, geopolitical events, and the global energy transition to better predict future market trends.

Featured Posts

-

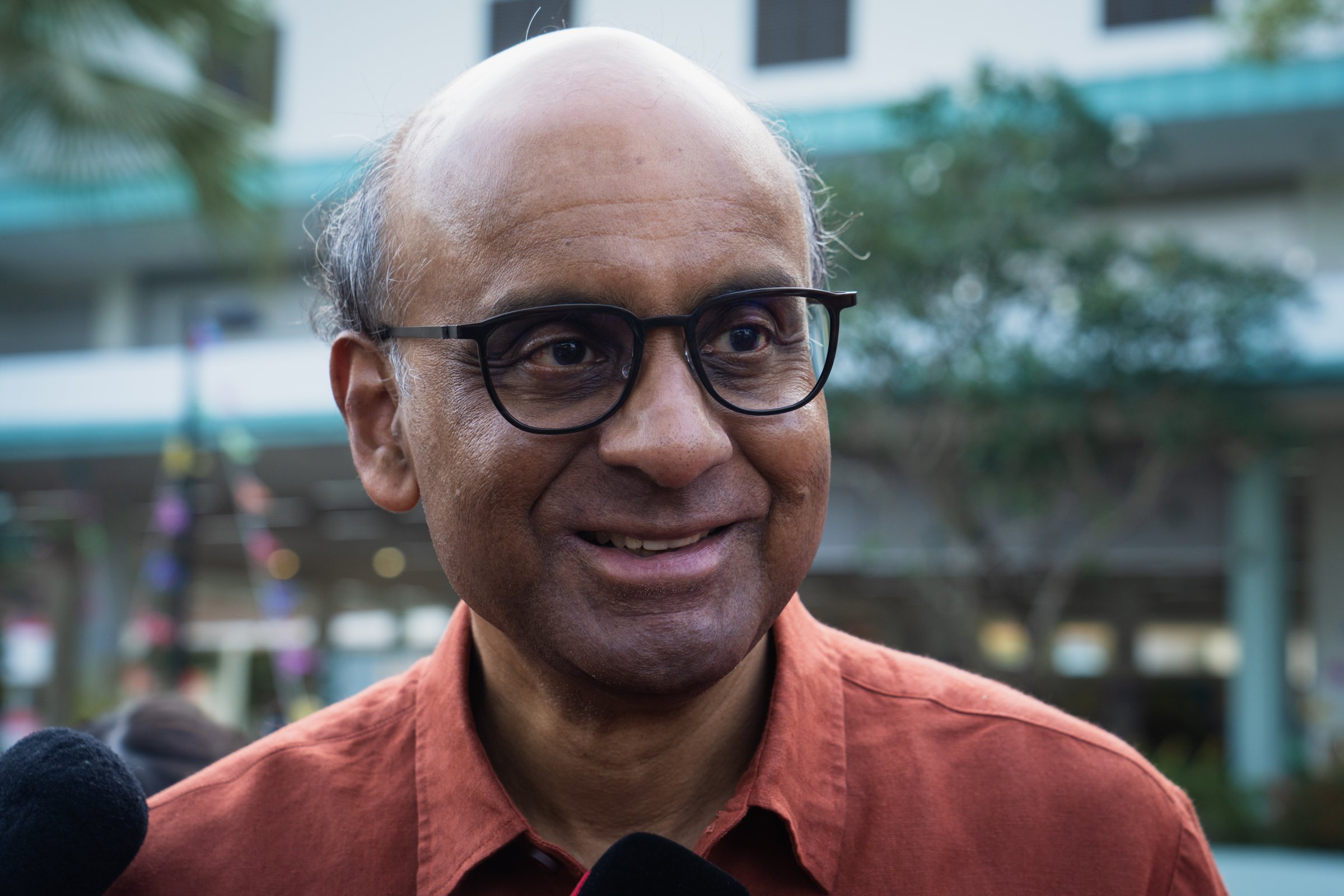

Singapore Votes Ruling Partys Dominance Challenged

May 05, 2025

Singapore Votes Ruling Partys Dominance Challenged

May 05, 2025 -

Max Verstappen Fatherhood And The Miami Grand Prix

May 05, 2025

Max Verstappen Fatherhood And The Miami Grand Prix

May 05, 2025 -

Holi 2024 West Bengal Braces For High Tide And Scorching Temperatures

May 05, 2025

Holi 2024 West Bengal Braces For High Tide And Scorching Temperatures

May 05, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025 -

Hate Crime Conviction 53 Years For Attack On Palestinian American Mother And Son

May 05, 2025

Hate Crime Conviction 53 Years For Attack On Palestinian American Mother And Son

May 05, 2025

Latest Posts

-

Ufc 314 Pimbletts Concerns About Chandlers Fighting Style

May 05, 2025

Ufc 314 Pimbletts Concerns About Chandlers Fighting Style

May 05, 2025 -

Paddy Pimbletts Plea To Referee Regarding Michael Chandlers Tactics At Ufc 314

May 05, 2025

Paddy Pimbletts Plea To Referee Regarding Michael Chandlers Tactics At Ufc 314

May 05, 2025 -

Ufc 314 Ppv Updated Lineup After Prates And Neal Bout Cancelled

May 05, 2025

Ufc 314 Ppv Updated Lineup After Prates And Neal Bout Cancelled

May 05, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025 -

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025