Palantir Stock: 30% Decline – Buy, Sell, Or Hold?

Table of Contents

Understanding the 30% Decline in Palantir Stock

Recent Market Performance and News

The recent 30% drop in Palantir stock price isn't an isolated event. Analyzing the PLTR stock chart reveals a period of volatility, influenced by several factors. Recent news impacting Palantir stock price includes:

- Earnings Reports: Disappointing earnings reports, particularly those that fall short of analyst expectations, can significantly impact investor sentiment and lead to sell-offs. Scrutinizing Palantir's earnings reports – focusing on Palantir revenue, Palantir profit margin, and overall financial performance – is crucial.

- Regulatory Changes: Changes in government regulations, especially those affecting the technology sector or government contracts, can create uncertainty and negatively influence Palantir stock.

- Competitor Activity: Increased competition from established players or new entrants in the big data analytics market can impact Palantir's market share and growth potential, affecting the Palantir stock price.

Analyzing the Palantir stock price alongside these news events provides a more comprehensive understanding of the recent decline.

Analyzing Palantir's Financial Health

Beyond the headlines, a deep dive into Palantir's financial health is essential. Key indicators to consider include:

- Revenue Growth: Consistent and sustainable revenue growth is a sign of a healthy business. Examining Palantir revenue trends over time helps gauge the company's long-term viability.

- Profitability: Palantir's profit margin indicates its ability to generate profit from its operations. A declining profit margin might raise concerns about its financial health and future prospects.

- Debt Levels: High levels of debt can increase financial risk. Assessing Palantir debt relative to its assets and revenue is critical.

- Cash Flow: Positive cash flow demonstrates the company's ability to generate cash from its operations, crucial for sustaining operations and investing in future growth.

A thorough analysis of these factors, using publicly available financial statements, is crucial for evaluating Palantir's financial stability.

Evaluation of Palantir's Future Growth Prospects

Palantir's future growth hinges on several key factors:

- Government Contracts: Palantir's significant reliance on government contracts makes it susceptible to changes in government spending and priorities. The potential for securing new Palantir government contracts is paramount to its future growth.

- Commercial Growth: Expanding into the commercial sector is crucial for diversifying Palantir's revenue streams and reducing its dependence on government contracts. The success of Palantir commercial growth strategies is critical for long-term sustainability.

- Competitive Landscape: Palantir faces stiff competition from established players in the data analytics market. Analyzing Palantir competitors and their strategies is necessary to understand the company's competitive position.

The potential for Palantir to successfully navigate these challenges will significantly influence its future growth and stock price.

Factors to Consider Before Making a Decision on Palantir Stock

Risk Tolerance and Investment Goals

Before making any investment decisions, it's crucial to assess your risk tolerance and investment goals.

- Risk Assessment: Palantir stock is considered a high-risk investment due to its volatility. Investors with a low risk tolerance may want to avoid it.

- Investment Strategy: Align your investment decisions with your broader investment strategy. Does Palantir stock fit within your overall portfolio diversification plan?

- Financial Goals: Consider whether investing in Palantir aligns with your short-term and long-term financial objectives.

Technical Analysis of Palantir Stock

While fundamental analysis is crucial, a brief look at technical analysis, such as moving averages and support/resistance levels on the PLTR technical analysis charts, can provide additional insights into potential price movements. However, technical analysis should be used cautiously and in conjunction with fundamental analysis.

Fundamental Analysis of Palantir

Re-emphasizing the importance of fundamental analysis cannot be overstated. Understanding Palantir's business model, financial performance (Palantir valuation), and long-term prospects (Palantir future outlook) is paramount. Consult reputable financial sources for the most up-to-date information on Palantir's financials and news.

Buy, Sell, or Hold: A Recommendation for Palantir Stock

Given the recent volatility and the factors discussed above, a definitive "buy," "sell," or "hold" recommendation is difficult. The current situation presents both risks and potential rewards. The 30% decline might represent a buying opportunity for long-term investors with high risk tolerance who believe in Palantir's long-term prospects. However, continued volatility and potential for further decline should be considered. Thorough due diligence is essential before making any investment decisions.

Conclusion

The 30% decline in Palantir stock highlights the inherent risks associated with investing in this volatile company. While the drop might present an opportunity for some investors, the risks remain significant. The decision to buy, sell, or hold Palantir stock depends on your individual risk tolerance, investment goals, and a thorough understanding of the company's financials and future prospects. Conduct thorough research, consult with a financial advisor, and carefully consider your own risk tolerance and investment goals before making any decisions regarding Palantir stock. Remember to monitor Palantir stock price and Palantir news for any significant developments.

Featured Posts

-

Focus On De Escalation Key Outcomes Of U S China Trade Talks This Week

May 10, 2025

Focus On De Escalation Key Outcomes Of U S China Trade Talks This Week

May 10, 2025 -

Trumps Billionaire Friends Fortune Reversal After Liberation Day Tariffs

May 10, 2025

Trumps Billionaire Friends Fortune Reversal After Liberation Day Tariffs

May 10, 2025 -

Predicting The Top Storylines In The Nhls 2024 25 Season

May 10, 2025

Predicting The Top Storylines In The Nhls 2024 25 Season

May 10, 2025 -

Will Apple Dominate Ai Or Fall Behind Analyzing Apples Ai Strategy

May 10, 2025

Will Apple Dominate Ai Or Fall Behind Analyzing Apples Ai Strategy

May 10, 2025 -

High Potentials Bold Finale Why Abc Was Impressed

May 10, 2025

High Potentials Bold Finale Why Abc Was Impressed

May 10, 2025

Latest Posts

-

Tragedie A Dijon Un Jeune Ouvrier Decede Apres Une Chute Du 4e Etage

May 10, 2025

Tragedie A Dijon Un Jeune Ouvrier Decede Apres Une Chute Du 4e Etage

May 10, 2025 -

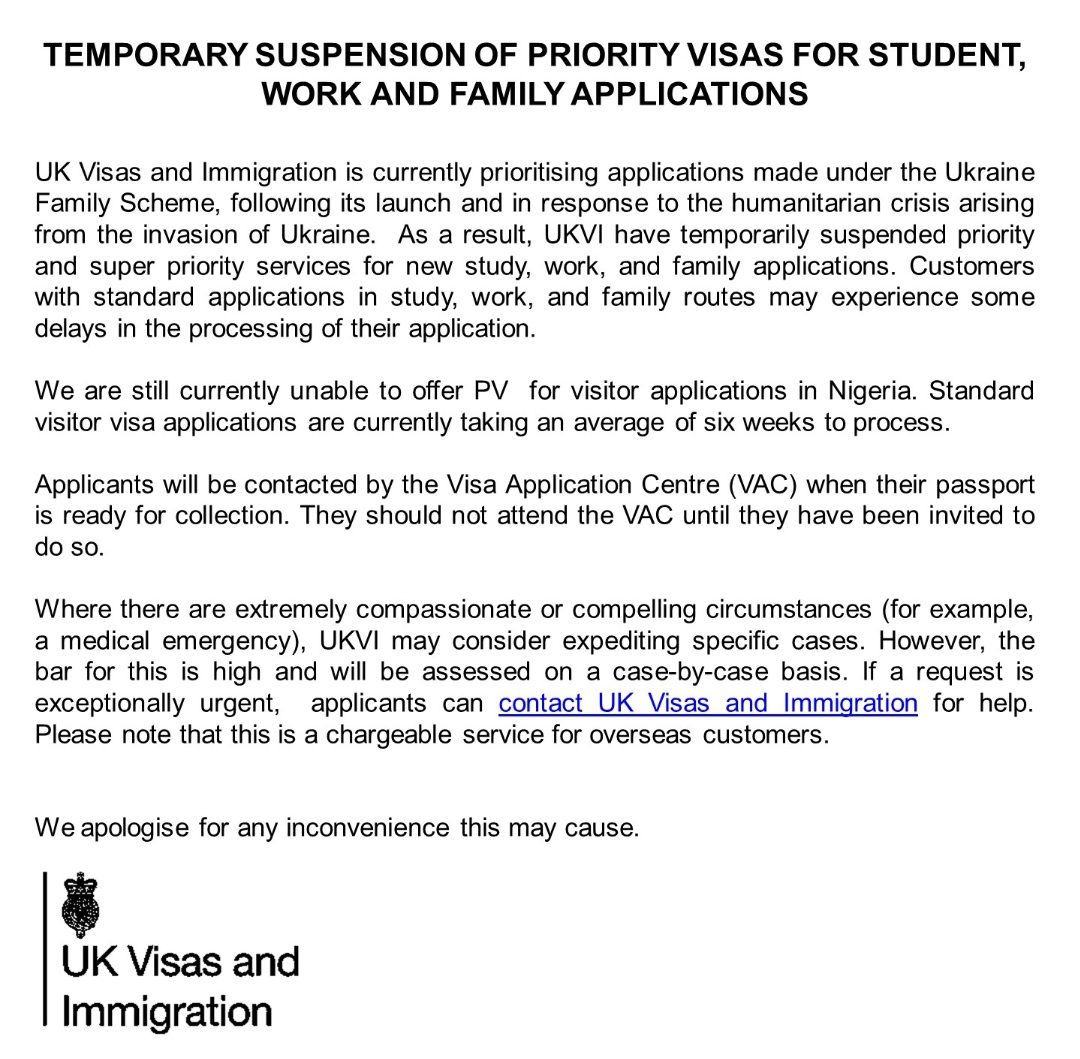

New Uk Immigration Rules Potential Impact On International Students

May 10, 2025

New Uk Immigration Rules Potential Impact On International Students

May 10, 2025 -

Dijon Chute Mortelle D Un Jeune Ouvrier Du 4e Etage

May 10, 2025

Dijon Chute Mortelle D Un Jeune Ouvrier Du 4e Etage

May 10, 2025 -

Changes To Uk Visa Application Process For Nigeria And Pakistan

May 10, 2025

Changes To Uk Visa Application Process For Nigeria And Pakistan

May 10, 2025 -

Uk Visa Restrictions Impact On Nigerian And Pakistani Nationals

May 10, 2025

Uk Visa Restrictions Impact On Nigerian And Pakistani Nationals

May 10, 2025