Palantir Stock: 30% Down – Investment Analysis And Outlook

Table of Contents

Understanding the 30% Decline in Palantir Stock Price

Several interconnected factors contributed to the substantial drop in Palantir stock price. Understanding these factors is crucial for assessing the current state of Palantir investment.

Market Sentiment and Overall Tech Stock Performance

The recent decline in Palantir stock isn't happening in a vacuum. The broader tech sector has experienced a significant downturn, impacting numerous companies, including Palantir. This downturn is largely attributable to several macroeconomic factors:

- Impact of rising interest rates on growth stocks: Higher interest rates increase borrowing costs, making it more expensive for growth companies like Palantir to fund expansion. This dampens investor enthusiasm for high-growth, but potentially less profitable, stocks.

- Investor flight to safer assets: In times of economic uncertainty, investors often shift their portfolios towards safer assets like government bonds, leading to a sell-off in riskier investments, including technology stocks.

- Correlation between Palantir's stock and the broader tech index (e.g., Nasdaq): Palantir stock price, like many tech companies, is highly correlated with the performance of the Nasdaq Composite Index. A decline in the Nasdaq directly impacts Palantir's stock price. The recent inflation concerns and interest rate hikes have negatively affected the Nasdaq, pulling Palantir stock down with it.

Palantir's Financial Performance and Growth Projections

Palantir's recent financial reports have also played a role in the stock price decline. While the company continues to show revenue growth, it may have fallen short of some investor expectations.

- Revenue growth compared to previous quarters/years: While Palantir has demonstrated consistent revenue growth, the rate of growth might have slowed compared to previous periods, leading to concerns among some investors.

- Profitability margins and their trends: Investors closely scrutinize profitability margins. Any perceived slowdown in margin improvement or widening losses could contribute to negative market sentiment.

- Analysis of key performance indicators (KPIs): A comprehensive look at Palantir's key performance indicators, including customer acquisition costs, customer churn rate, and average revenue per user (ARPU), offers insights into its operational efficiency and future growth trajectory. A negative trend in any of these KPIs may affect investor confidence.

Competitive Landscape and Industry Challenges

Palantir operates in a fiercely competitive market for big data analytics and government contracts. This competitive landscape presents challenges to maintaining market share and securing consistent growth.

- Analysis of major competitors (e.g., Databricks, Snowflake): Companies like Databricks and Snowflake offer competing solutions in the data analytics space, posing a challenge to Palantir's market dominance.

- Discussion of market saturation in certain sectors: Market saturation in specific sectors can limit growth opportunities for Palantir, forcing them to focus on expansion into new markets.

- Challenges in securing and retaining government contracts: A significant portion of Palantir's revenue comes from government contracts. The competitive bidding process and potential shifts in government priorities can impact their revenue stream.

Evaluating Palantir's Long-Term Investment Potential

Despite the recent downturn, Palantir's long-term investment potential remains a subject of debate.

Palantir's Strategic Advantages and Growth Opportunities

Palantir possesses several unique strengths that could fuel future growth:

- Strengths in artificial intelligence (AI) and machine learning (ML): Palantir's investment in AI and ML technologies provides a competitive edge in the data analytics market. These technologies are crucial for enhancing its platform's capabilities and attracting new clients.

- Growth potential in the commercial sector: Expanding its presence in the commercial sector beyond its strong government contracts portfolio can diversify its revenue streams and reduce its dependence on a single market segment.

- Government contract pipeline and future prospects: Palantir's existing relationships with government agencies and its pipeline of potential contracts represent a significant source of future revenue. Successful bidding on new contracts is crucial for sustaining growth.

Risk Assessment and Potential Downside

Investing in Palantir stock carries inherent risks:

- Dependence on government contracts: A significant portion of Palantir's revenue relies on government contracts. Changes in government spending or procurement policies can negatively impact its financial performance.

- Competition from larger, more established companies: Palantir faces competition from larger, more established players in the data analytics market, which can pressure margins and hinder growth.

- Valuation concerns relative to its market capitalization: Palantir's current market capitalization might be considered high relative to its current revenue and profitability, representing a potential risk for investors.

Analyst Ratings and Price Targets

Analyst opinions on Palantir stock are varied. While some analysts maintain a positive outlook and issue buy recommendations, others have expressed caution. Price targets range widely.

- Summary of buy, hold, and sell recommendations: Check reputable financial news sources for the latest analyst ratings.

- Average price target for Palantir stock: The average price target provides a general sense of analyst expectations, but remember that these are not guarantees.

- Disclaimer: Analyst opinions are not guarantees of future performance. They should be considered alongside your own research and risk tolerance.

Conclusion: Is Palantir Stock a Buy After the 30% Drop?

The 30% drop in Palantir stock price is a result of several factors, including the broader tech market downturn, concerns about Palantir's financial performance, and the competitive landscape. While the decline presents potential opportunities for long-term investors, it's crucial to acknowledge the inherent risks associated with this investment. Palantir's strengths in AI, its potential for growth in the commercial sector, and its government contract pipeline offer counterpoints to these challenges. However, dependence on government contracts and intense competition remain significant considerations.

While the 30% drop in Palantir stock presents potential opportunities, thorough due diligence is crucial before investing in PLTR stock. Consider your own risk tolerance and investment goals, carefully weigh the potential rewards against the inherent risks, and conduct your own comprehensive research before making any investment decisions concerning Palantir stock. Remember, this analysis is not financial advice.

Featured Posts

-

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Discussion

May 09, 2025

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Discussion

May 09, 2025 -

Will Jayson Tatum Play Tonight Celtics Nets Injury Update

May 09, 2025

Will Jayson Tatum Play Tonight Celtics Nets Injury Update

May 09, 2025 -

Nhls Next Generation 9 Players Who Could Surpass Ovechkin

May 09, 2025

Nhls Next Generation 9 Players Who Could Surpass Ovechkin

May 09, 2025 -

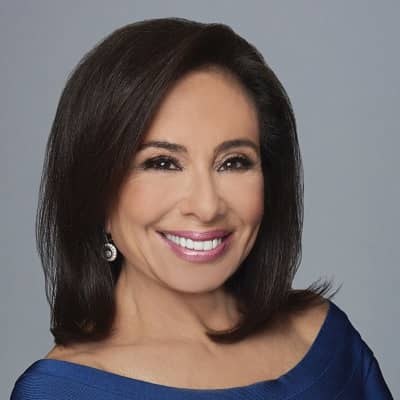

Us Citizens In El Salvador Prisons Jeanine Pirros Dismissal Of Due Process Rights

May 09, 2025

Us Citizens In El Salvador Prisons Jeanine Pirros Dismissal Of Due Process Rights

May 09, 2025 -

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025