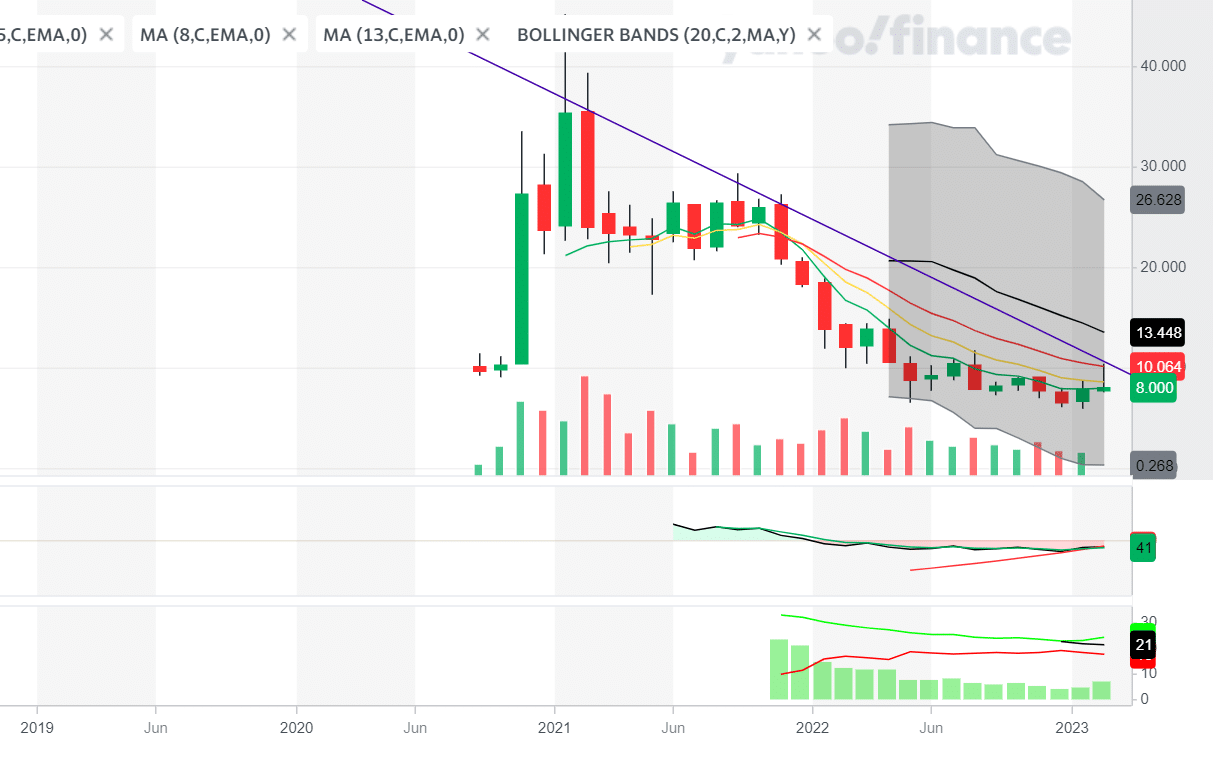

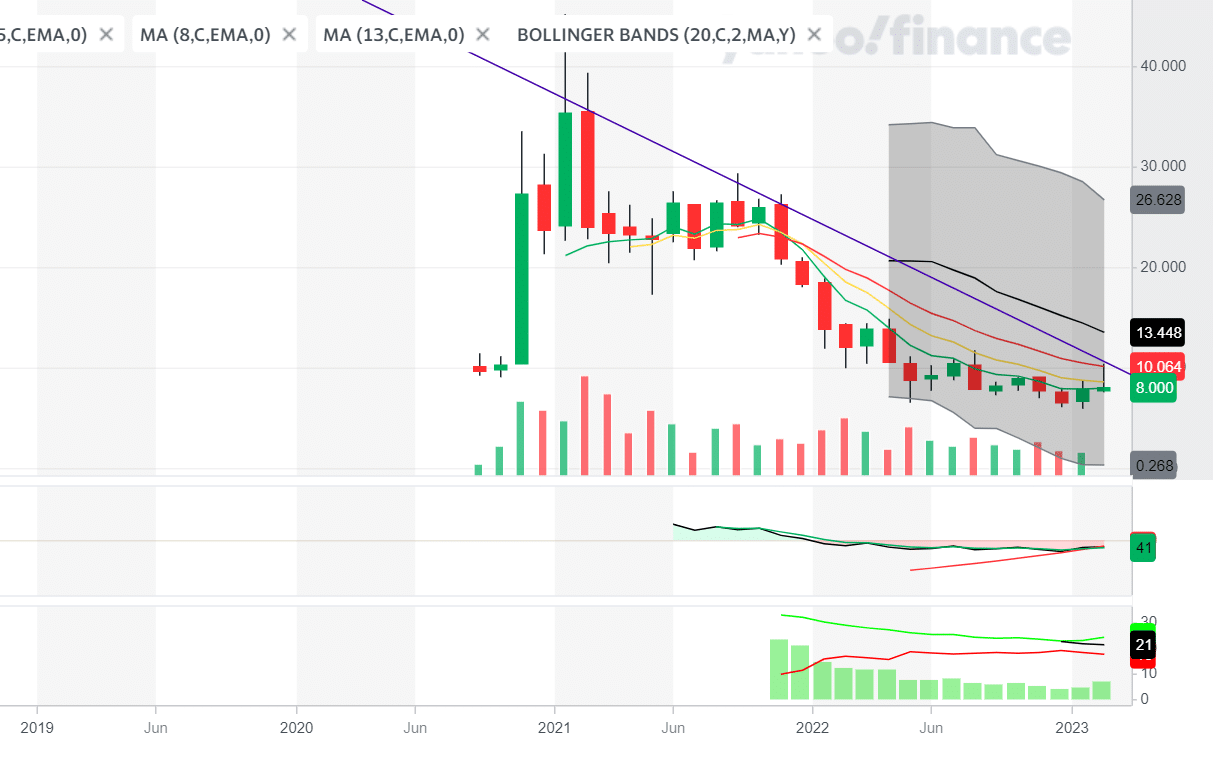

Palantir Stock: A Timely Investment Decision Before May 5th

Table of Contents

Palantir's Recent Performance and Financial Health

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings report offered a mixed bag for investors. While revenue growth was positive, exceeding expectations in some areas, profitability remained a focus for the company. Let's examine the key figures:

- Revenue: [Insert Q4 2022 Revenue Figure] representing a [percentage]% increase compared to Q4 2021. This demonstrates continued growth, although the rate of growth may vary compared to prior periods.

- Net Income: [Insert Q4 2022 Net Income Figure], showing [positive/negative] results. This figure is essential in assessing the overall financial health of the company.

- Profitability: Key metrics such as operating margin and net income margin should be analyzed to understand the company's progress in achieving profitability. [Insert relevant figures and analysis].

- Comparison to Industry Benchmarks: Compared to other big data analytics companies, Palantir's growth shows [Positive/Negative assessment based on comparison to competitors]. [Include a brief overview of relevant competitors].

The Q4 earnings report offered both positive and negative surprises, with revenue growth being a positive highlight, but the path to consistent profitability remains a key area of focus for investors evaluating PLTR stock.

Key Partnerships and Contract Wins

Palantir's strategic partnerships and contract wins significantly influence its future revenue streams and overall growth trajectory. Recent successes include:

- [Partnership 1]: [Details of the partnership and its potential impact on PLTR stock].

- [Partnership 2]: [Details of the partnership and its potential impact on PLTR stock].

- Government Contracts: A significant portion of Palantir's revenue comes from government contracts, particularly in the US and allied nations. The stability and potential growth of these contracts are critical for long-term Palantir investment.

The long-term impact of these partnerships is substantial, potentially driving further growth for PLTR stock and making it an attractive investment opportunity for some.

Future Prospects and Growth Potential for Palantir

Expanding into New Markets

Palantir is actively expanding into new sectors, such as:

- Healthcare: Palantir is leveraging its data analytics capabilities to improve healthcare efficiency and patient outcomes. This is a massive market with significant growth potential.

- Financial Services: The company is targeting financial institutions with its solutions for risk management, fraud detection, and regulatory compliance.

- Commercial Enterprises: Palantir is expanding its reach beyond government to commercial clients across various industries.

The potential for market penetration in these new sectors remains significant, suggesting strong future growth prospects for Palantir stock. The competitive landscape varies across these sectors but Palantir's unique technology gives it a distinct advantage.

Innovation and Technological Advancements

Palantir's continued investment in R&D fuels innovation and technological advancements. Recent developments include:

- [Specific Technology 1]: [Description and potential impact].

- [Specific Technology 2]: [Description and potential impact].

These advancements provide Palantir with a sustained competitive advantage, making PLTR stock an interesting prospect for investors.

Government Contracts and Geopolitical Factors

Government contracts form a substantial portion of Palantir's revenue. However, this reliance also presents risks:

- Budgetary Constraints: Changes in government spending could impact Palantir's revenue.

- Geopolitical Instability: Global events can affect government priorities and contract awards.

Careful consideration of these geopolitical factors is crucial before making a Palantir investment.

Risks Associated with Investing in Palantir Stock Before May 5th

Market Volatility and Economic Uncertainty

The current market climate presents inherent risks to Palantir stock:

- Interest Rate Hikes: Rising interest rates can impact investor sentiment and lead to market volatility.

- Inflation: Inflation can erode profitability and impact investment decisions.

- May 5th Impact: The specific date of May 5th could act as a catalyst for market fluctuations, depending on announcements or events related to the company. Investors should be aware of this increased risk around this date.

Competition and Market Share

Palantir faces competition from established players and new entrants in the big data analytics market:

- [Competitor 1]: [Analysis of their strengths and weaknesses relative to Palantir].

- [Competitor 2]: [Analysis of their strengths and weaknesses relative to Palantir].

Maintaining market share and managing competitive pressures are crucial factors to consider when evaluating Palantir investment.

Conclusion

Palantir stock (PLTR stock) presents a complex investment opportunity. While its recent performance shows growth, and its future prospects appear promising, significant risks associated with market volatility, competition, and reliance on government contracts must be carefully considered, particularly before the potentially pivotal date of May 5th. This article has highlighted key factors to consider when assessing the Palantir investment opportunity before May 5th. Remember that this information is for educational purposes only and should not be interpreted as financial advice.

Call to Action: Before making any decisions about your Palantir stock investment, conduct thorough due diligence. Assess the Palantir investment opportunity before May 5th, carefully weighing the risks and rewards of investing in PLTR. Consult with a financial advisor to make informed decisions about your Palantir stock investment and tailor your strategy to your specific risk tolerance and investment goals.

Featured Posts

-

New Xbox Handheld From Microsoft And Asus Appears In Leaks

May 10, 2025

New Xbox Handheld From Microsoft And Asus Appears In Leaks

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Performance And Trading Insights

May 10, 2025

Indian Stock Market Update Sensex Nifty Performance And Trading Insights

May 10, 2025 -

Nhl Playoffs Edmonton Oilers Likely To Defeat Los Angeles Kings Betting Outlook

May 10, 2025

Nhl Playoffs Edmonton Oilers Likely To Defeat Los Angeles Kings Betting Outlook

May 10, 2025 -

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

May 10, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Regulations

May 10, 2025 -

Unlocking The Stock Market Jazz Cash And K Trades Joint Venture

May 10, 2025

Unlocking The Stock Market Jazz Cash And K Trades Joint Venture

May 10, 2025

Latest Posts

-

Understanding The Link Between Mental Health And Violence Where Academia Has Failed

May 10, 2025

Understanding The Link Between Mental Health And Violence Where Academia Has Failed

May 10, 2025 -

Academic Neglect Examining The Misconceptions Surrounding Mental Illness And Violent Crime

May 10, 2025

Academic Neglect Examining The Misconceptions Surrounding Mental Illness And Violent Crime

May 10, 2025 -

Harry Styles New Mustache A Nod To The Seventies

May 10, 2025

Harry Styles New Mustache A Nod To The Seventies

May 10, 2025 -

London Outing Harry Styles Sports A Seventies Stache

May 10, 2025

London Outing Harry Styles Sports A Seventies Stache

May 10, 2025 -

The Misrepresentation Of Mentally Ill Killers A Critical Analysis Of Academic Failures

May 10, 2025

The Misrepresentation Of Mentally Ill Killers A Critical Analysis Of Academic Failures

May 10, 2025