Palantir's Financial Performance: A Detailed Analysis Of Its Valuation

Table of Contents

Revenue Growth and Key Revenue Streams

Analyzing Palantir's revenue growth is crucial to understanding its valuation. Over the past few years, Palantir has demonstrated consistent revenue growth, albeit with periods of varying acceleration. A key aspect of this analysis is understanding the breakdown of its revenue streams: Government versus Commercial.

- Government Revenue: This sector has historically been a major contributor to Palantir's revenue, fueled by substantial contracts with intelligence agencies and defense departments worldwide. The stability and long-term nature of these contracts provide a predictable revenue base. However, government budget cycles and geopolitical factors can influence the pace of growth in this segment.

- Commercial Revenue: Palantir's commercial sector has shown significant growth potential, targeting large enterprises across various industries such as finance, healthcare, and energy. This segment offers opportunities for higher growth and diversification, mitigating reliance on government contracts.

Bullet Points:

- Year-over-year revenue growth has consistently been in the double digits for the past several years, though the exact percentage fluctuates based on quarterly reports and contract timing.

- The percentage breakdown between government and commercial revenue varies, with government initially dominating but a clear shift towards a more balanced portfolio evidenced in recent years.

- Significant new contracts, particularly large-scale commercial partnerships, have been key drivers of revenue acceleration in recent periods. These are often announced in press releases and financial reports.

- The sustainability of current revenue streams depends on Palantir's continued success in securing and retaining both government and commercial clients, alongside the successful expansion of its product offerings.

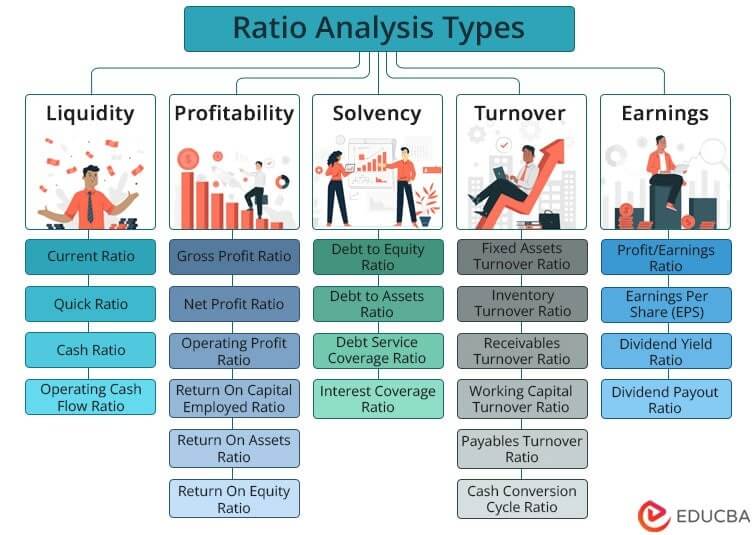

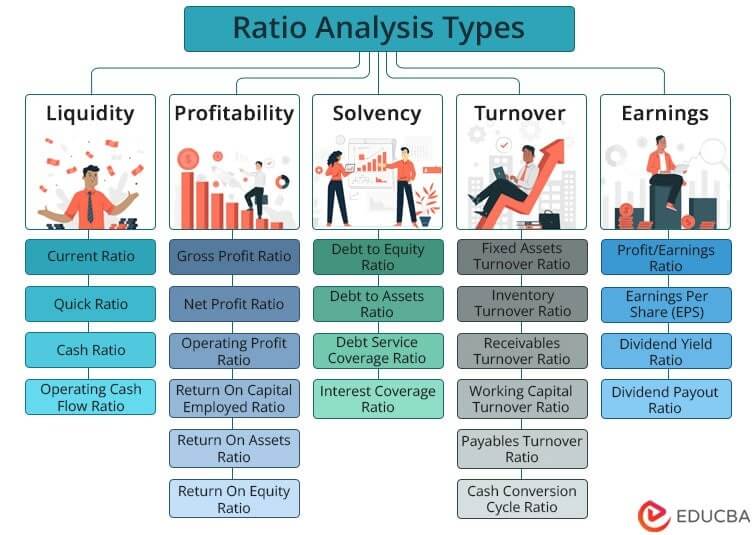

Profitability and Operating Margins

Examining Palantir's profitability provides another critical perspective on its valuation. While Palantir has demonstrated consistent revenue growth, achieving sustained profitability has been a key focus. This involves scrutinizing operating income, net income, and operating margins.

Factors Affecting Profitability:

- Research and Development (R&D) Spending: Significant investment in R&D is crucial for a technology company like Palantir to remain competitive. High R&D spending can impact short-term profitability but is essential for long-term growth and innovation. Analyzing R&D spending as a percentage of revenue helps assess the balance between investment and profitability.

- Sales and Marketing Costs: Acquiring and retaining customers in the competitive big data analytics market requires substantial investment in sales and marketing. Optimizing these costs is key to improving profitability.

- Operating Efficiencies: Streamlining operations and improving internal efficiencies can significantly impact operating margins. Palantir’s focus on improving operational efficiency has been a key component in its pursuit of improved profitability.

Bullet Points:

- Palantir's operating margin percentage has shown improvement over the past few years, although it may still be below some industry averages, reflecting the ongoing investment in growth. Specific figures are readily available in their quarterly earnings reports.

- Net income trends show a clear path toward profitability, with recent quarters reflecting positive net income figures.

- R&D spending remains a significant portion of revenue, illustrating Palantir's commitment to innovation and future growth in the data analytics market.

- Cost-cutting measures, focused on operational efficiencies, have played a significant role in improving profitability.

Customer Acquisition and Retention

Palantir's ability to acquire and retain customers, particularly high-value contracts, is fundamental to its long-term valuation. High customer retention rates translate into predictable and recurring revenue streams, boosting investor confidence.

Key Metrics:

- Customer Acquisition: The number of new customers acquired each year, particularly large enterprises and government agencies, provides insights into market penetration and growth potential.

- Customer Churn Rate: A low customer churn rate indicates strong customer satisfaction and loyalty, contributing to the stability and predictability of future revenue.

- Average Contract Value: This metric reveals the value of individual contracts, showcasing Palantir’s ability to secure lucrative agreements. High average contract value suggests a strong value proposition and pricing power.

Strategies for Customer Retention:

- Product Enhancements: Continuous improvement and innovation of Palantir's products are crucial for retaining existing clients and attracting new ones.

- Exceptional Customer Support: Providing responsive and effective customer support fosters strong relationships and reduces churn.

Bullet Points:

- Palantir's number of new customers acquired yearly reflects its growth in both government and commercial sectors.

- The customer churn rate has shown improvement in recent years, reflecting the effectiveness of customer retention strategies.

- The average contract value reflects the significant value Palantir delivers to its clients, leading to strong recurring revenues.

Impact of the Geopolitical Landscape on Palantir's Valuation

Palantir's business is significantly impacted by geopolitical factors. Increased government spending on defense and intelligence, particularly in response to global instability, can create significant opportunities for Palantir. Conversely, shifts in geopolitical alliances or reductions in defense budgets can negatively affect its revenue streams. Therefore, understanding the geopolitical landscape is vital for assessing Palantir's future prospects. This includes potential risks associated with international relations and opportunities arising from increased demand for data analytics in areas experiencing conflict or instability.

Comparison to Competitors and Industry Benchmarks

Comparing Palantir's financial performance and valuation to its main competitors in the big data analytics market offers valuable perspective. Key metrics such as revenue growth, profitability, and market share should be compared against industry averages and those of companies such as Tableau, Qlik, and Microsoft. This comparative analysis helps determine Palantir’s relative strength and competitiveness within the broader market landscape. This analysis helps determine Palantir’s position in terms of market share, innovation, and overall financial performance.

Conclusion

This analysis of Palantir's financial performance reveals a company with strong revenue growth, improving profitability, and a solid customer base. However, its valuation remains subject to various factors, including the geopolitical landscape and the competitive dynamics within the big data analytics market. Palantir's continued investment in R&D and its expansion into the commercial sector are crucial for sustaining its growth trajectory. While challenges remain, Palantir’s financial performance shows potential for continued growth and improvement in the future.

Future Outlook: Palantir's future prospects are promising, driven by the increasing demand for data analytics across various sectors and its ongoing technological advancements. However, sustained competition and potential shifts in geopolitical priorities present challenges.

Call to Action: For a more in-depth understanding of Palantir's valuation, explore further financial analysis and industry reports. Regularly review Palantir's financial statements and industry news to stay informed about its performance and future prospects. Analyzing Palantir's valuation requires ongoing monitoring of its financial performance and the broader market dynamics.

Featured Posts

-

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Soars Past Bitcoin And Other Cryptos

May 07, 2025

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Soars Past Bitcoin And Other Cryptos

May 07, 2025 -

Mariners First Inning Offensive Surge Results In 14 0 Victory Over Marlins

May 07, 2025

Mariners First Inning Offensive Surge Results In 14 0 Victory Over Marlins

May 07, 2025 -

Steve Kerr On Stephen Currys Injury A Speedy Recovery Expected

May 07, 2025

Steve Kerr On Stephen Currys Injury A Speedy Recovery Expected

May 07, 2025 -

Betting On The Nba Playoffs Warriors Vs Rockets Matchup Analysis And Predictions

May 07, 2025

Betting On The Nba Playoffs Warriors Vs Rockets Matchup Analysis And Predictions

May 07, 2025 -

Casablanca Flights From Stansted Royal Air Maroc Announces New Route

May 07, 2025

Casablanca Flights From Stansted Royal Air Maroc Announces New Route

May 07, 2025

Latest Posts

-

James Gunn Celebrates Jimmy Olsens 85th Anniversary With A Cryptic Daily Planet Photo

May 08, 2025

James Gunn Celebrates Jimmy Olsens 85th Anniversary With A Cryptic Daily Planet Photo

May 08, 2025 -

Quick News Update F4 Elden Ring Possum And Superman

May 08, 2025

Quick News Update F4 Elden Ring Possum And Superman

May 08, 2025 -

Saving Private Ryans Reign Ends A New Best War Film

May 08, 2025

Saving Private Ryans Reign Ends A New Best War Film

May 08, 2025 -

Latest News F4 Elden Ring Possum And Superman Updates

May 08, 2025

Latest News F4 Elden Ring Possum And Superman Updates

May 08, 2025 -

From Historic Home To County Park A Pierce County Redevelopment Project

May 08, 2025

From Historic Home To County Park A Pierce County Redevelopment Project

May 08, 2025