Personal Loans: Current Interest Rates & Best Options

Table of Contents

Understanding Current Personal Loan Interest Rates

Securing a loan with a competitive interest rate is crucial for managing your finances effectively. Understanding the factors that influence these rates is the first step towards getting the best deal.

Factors Influencing Interest Rates:

-

Credit score: Your creditworthiness is a primary determinant of your interest rate. A higher credit score (like a high FICO score) reflects responsible borrowing and a lower risk to lenders, resulting in lower interest rates. A poor credit history, on the other hand, will likely lead to significantly higher rates. Regularly check your credit report from agencies like Experian, Equifax, and TransUnion to monitor your creditworthiness.

-

Loan amount: Generally, larger loan amounts may come with slightly higher interest rates. Lenders perceive larger loans as carrying a higher risk.

-

Loan term: The length of your repayment schedule significantly impacts your interest rate. A shorter loan term (e.g., 12 months) means higher monthly payments but lower overall interest paid. Conversely, a longer term (e.g., 60 months) results in lower monthly payments but higher total interest paid. Understanding loan amortization is key to making this decision.

-

Lender type: Different lenders offer varying interest rates. Banks often have established processes and competitive rates, while credit unions may offer lower rates to their members. Online lenders provide convenience but might have higher or lower rates depending on their risk assessment models. Carefully comparing bank loans, credit union loans, and online lender options is crucial.

-

Current economic conditions: Prevailing interest rates set by central banks influence the borrowing costs for lenders, which, in turn, affects personal loan rates. During periods of economic uncertainty, interest rates tend to rise.

-

Bullet Points:

-

The following table shows average interest rates (as of October 26, 2023). These are estimates and can vary significantly based on the factors above. | Lender Type | Average Interest Rate Range (%) | |-----------------|-------------------------------| | Banks | 7-18% | | Credit Unions | 6-15% | | Online Lenders | 8-25% |

-

Disclaimer: Interest rates are subject to change and are dependent upon individual creditworthiness and lender policies.

-

Check your credit score for free using resources like or .

-

Different Types of Personal Loans and Their Features

Personal loans come in various forms, each with distinct features and implications for your finances.

Unsecured Personal Loans:

Unsecured personal loans don't require collateral. This convenience comes at a cost—higher interest rates due to the increased risk for lenders. These loans are often used for debt consolidation, home improvements, or other purposes where collateral isn't readily available. Understanding unsecured loan interest rates is vital before applying.

Secured Personal Loans:

Secured personal loans use an asset you own (like a car or savings account) as collateral. This reduces the risk for lenders, resulting in lower interest rates compared to unsecured loans. Examples include auto title loans and secured lines of credit. Research secured loan interest rates to compare options.

Peer-to-Peer Lending:

Peer-to-peer (P2P) lending connects borrowers with individual lenders or groups through online platforms. It offers an alternative lending option, but interest rates can vary greatly depending on the platform and your credit profile. Understanding the benefits and risks of P2P lending is essential before using this method.

Finding the Best Personal Loan for Your Needs

Once you understand the basics, the next step is to strategically find the best loan for your specific needs.

Comparing Loan Offers:

Comparing loan offers is paramount. Don't just focus on the advertised interest rate; consider the Annual Percentage Rate (APR), which includes fees and interest. Carefully examine the total loan fees, repayment terms, and any prepayment penalties. Always read the loan agreement thoroughly before signing to avoid unexpected charges. Using an APR comparison tool can streamline this process.

Improving Your Chances of Loan Approval:

Before applying, consider strategies to improve your credit score. This can significantly impact your eligibility and the interest rate you receive. Prepare a strong loan application with accurate and complete information. Shopping around and comparing offers from multiple lenders increases your chances of finding the most favorable terms.

Conclusion

Securing a personal loan with favorable interest rates requires careful planning and comparison shopping. By understanding the factors that influence interest rates, exploring different loan types, and diligently comparing offers, you can find the best personal loan to meet your financial needs. Remember to check your credit score, compare APRs, and read the loan agreement thoroughly before committing. Start your search for the perfect personal loan today! Don't hesitate to use online tools and resources to help you compare personal loan interest rates and find the best option.

Featured Posts

-

Prakiraan Cuaca Jawa Barat Besok 7 5 Antisipasi Curah Hujan Tinggi

May 28, 2025

Prakiraan Cuaca Jawa Barat Besok 7 5 Antisipasi Curah Hujan Tinggi

May 28, 2025 -

Are Torpedo Bats The Future Of Marlin Fishing

May 28, 2025

Are Torpedo Bats The Future Of Marlin Fishing

May 28, 2025 -

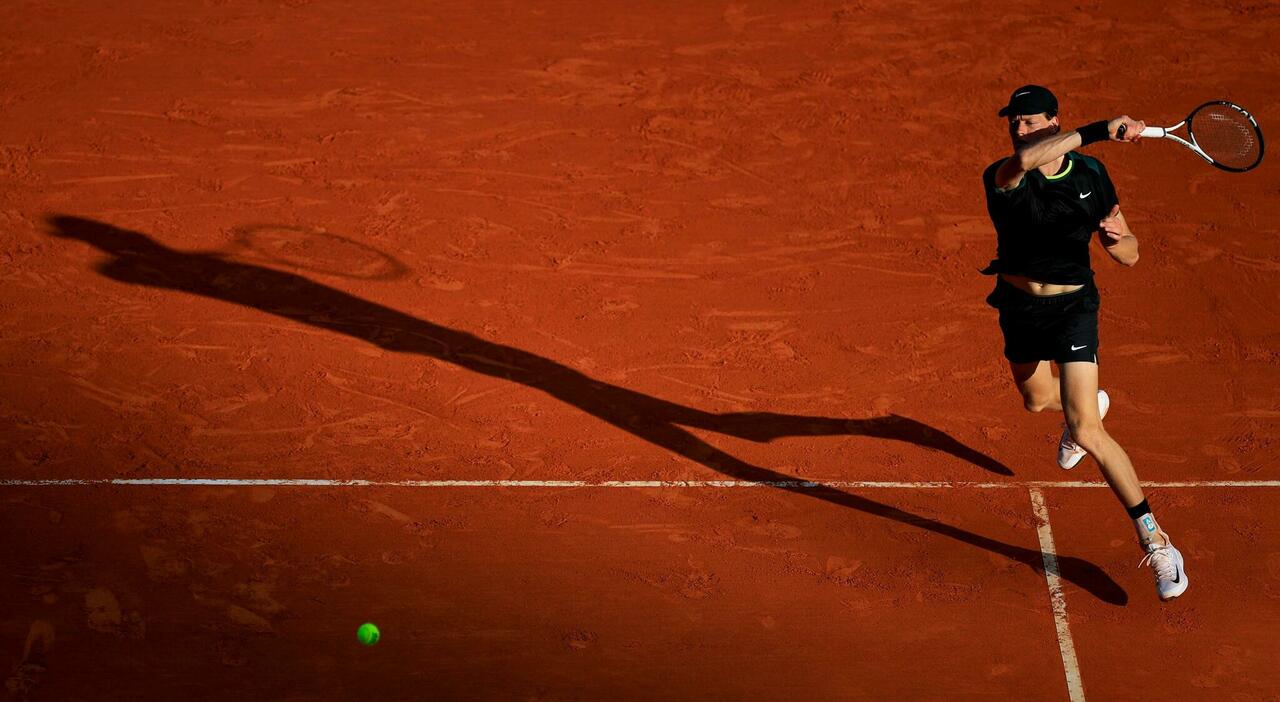

Sinner Claims Top Spot After Zverevs Monte Carlo Loss

May 28, 2025

Sinner Claims Top Spot After Zverevs Monte Carlo Loss

May 28, 2025 -

San Diego Padres Start 7 0 Merrills Home Run Key To Victory Against Cleveland

May 28, 2025

San Diego Padres Start 7 0 Merrills Home Run Key To Victory Against Cleveland

May 28, 2025 -

Italian Open Sinners Relief No Grand Slam Miss Despite Doping Ban

May 28, 2025

Italian Open Sinners Relief No Grand Slam Miss Despite Doping Ban

May 28, 2025

Latest Posts

-

Southern California Bioluminescent Waves Peak Season Guide

May 30, 2025

Southern California Bioluminescent Waves Peak Season Guide

May 30, 2025 -

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025 -

Killer Seaweed Extermination Of Australian Marine Life

May 30, 2025

Killer Seaweed Extermination Of Australian Marine Life

May 30, 2025 -

France Vietnam Cooperation Renforcee Pour Une Mobilite Durable

May 30, 2025

France Vietnam Cooperation Renforcee Pour Une Mobilite Durable

May 30, 2025 -

Spring And Fall Best Times For Bioluminescent Waves In Southern California

May 30, 2025

Spring And Fall Best Times For Bioluminescent Waves In Southern California

May 30, 2025