Posthaste: Analyzing The Impact Of The Recent Tariff Decision On Canada

Table of Contents

Immediate Economic Impacts of the Tariff Decision

The immediate impact of the new tariffs is multifaceted, affecting various sectors and leading to significant economic consequences.

Impact on Specific Industries

The ripple effect of these tariffs is clearly visible across several key Canadian industries.

-

Canadian Automotive Sector: The automotive industry is particularly vulnerable. Increased costs of imported parts, including engines, transmissions, and electronics, directly impact production costs. This reduces the competitiveness of Canadian-made vehicles in both domestic and international markets, potentially leading to decreased production and job losses. The increased price of auto parts also impacts repair costs, further burdening consumers. Navigating these challenges requires a careful assessment of the import tariffs and their impact on the supply chain.

-

Lumber Exports: The lumber industry faces the potential threat of retaliatory tariffs from affected countries. Reduced export demand, coupled with increased domestic costs, can significantly impact profitability and lead to decreased production. This situation highlights the complexities of the current trade war and its effects on key Canadian exports like softwood lumber.

-

Canadian Agriculture: The agricultural sector is also feeling the pinch. Increased prices for imported agricultural inputs, such as fertilizers and machinery, raise production costs. Furthermore, potential export restrictions or retaliatory tariffs from trading partners could severely limit market access for Canadian agricultural products, impacting farmers' incomes and the overall competitiveness of the Canadian agriculture sector. The impact on food prices is also a key concern for consumers.

Consumer Price Increases

The immediate effect of the tariffs is a rise in consumer prices.

-

Higher Prices Across Product Categories: Tariffs directly translate to higher prices for a wide range of consumer goods, from automobiles and lumber products to food and agricultural products. This increase in the cost of living disproportionately affects low-income households.

-

Impact on Inflation and Consumer Spending: The rising prices contribute to increased inflation, eroding purchasing power and potentially leading to a decrease in consumer spending. This reduction in spending can have a cascading effect on the economy, further impacting businesses and employment.

-

Disparity in Impact Across Income Levels: The impact of higher prices isn't evenly distributed. Low-income families, who spend a larger proportion of their income on essential goods, will be hit hardest. This widening income inequality adds another layer of complexity to the economic consequences of the Canada tariff impact.

Long-Term Implications for Canadian Businesses

The long-term consequences of these tariffs extend beyond immediate price increases and could significantly reshape the Canadian business landscape.

Investment and Job Creation

The uncertainty created by the tariffs has the potential to severely impact Canada's economic future.

-

Foreign Direct Investment (FDI): Uncertainty regarding future trade policies can deter foreign direct investment (FDI), a crucial source of capital and innovation for the Canadian economy. This could slow economic growth and hinder job creation.

-

Job Losses or Employment Shifts: Industries heavily reliant on imported goods or exports could experience job losses or be forced to shift production elsewhere. This necessitates workforce retraining programs and proactive adaptation strategies for workers affected by these changes. The Canada tariff impact on employment needs careful monitoring and strategic response.

-

Competitiveness in the Global Market: Increased production costs make Canadian businesses less competitive in the global marketplace. This could lead to a loss of market share and further economic hardship.

Supply Chain Disruptions

The reliance on global supply chains makes Canadian businesses vulnerable to tariff-related disruptions.

-

Sourcing Raw Materials and Components: Canadian businesses face challenges in sourcing raw materials and components from affected countries, leading to production delays and increased costs.

-

Mitigating Supply Chain Risks: Companies need to develop strategies to mitigate these risks, such as diversifying their supply chains, exploring alternative sourcing options, and investing in domestic production capabilities.

-

Reshoring or Nearshoring Initiatives: The tariffs could accelerate reshoring (returning production to Canada) or nearshoring (moving production to nearby countries) initiatives, potentially creating new investment opportunities and jobs but requiring substantial investment.

Government Response and Mitigation Strategies

The Canadian government is crucial in mitigating the negative impacts of these tariffs.

Government Policies and Initiatives

Several policy responses are needed to address the challenges posed by the tariffs.

-

Government Support Programs: The government needs to implement targeted support programs to assist affected industries, including financial assistance, tax breaks, and investment incentives. These programs need to be tailored to the specific needs of each sector.

-

Effectiveness of Mitigation Policies: The effectiveness of these policies must be carefully monitored and evaluated. Adaptive measures might be needed based on the actual impact and evolving economic conditions.

-

Future Policy Responses: Long-term strategies are needed to promote greater resilience in the Canadian economy, including diversification of trade partners and investments in innovation and technology.

International Trade Negotiations

International collaboration is crucial in resolving trade disputes and reducing barriers.

-

Ongoing Trade Negotiations: Canada needs to actively engage in ongoing trade negotiations with key trading partners to address the concerns raised by the tariffs and seek mutually beneficial solutions.

-

Bilateral Agreements: Strengthening bilateral agreements can help reduce trade barriers and create more predictable and stable trade relationships.

-

Role of International Organizations: International organizations like the World Trade Organization (WTO) can play a vital role in resolving trade disputes and fostering a more rules-based international trading system.

Conclusion

The recent tariff decision on Canada presents significant challenges and uncertainties across various economic sectors. Understanding the posthaste effects, both immediate and long-term, is crucial for businesses and policymakers alike. From increased consumer prices to potential job losses and supply chain disruptions, the consequences are far-reaching. Effective government policies, combined with proactive strategies by Canadian businesses, will be essential to navigate this turbulent period and mitigate the negative impact of the Canada tariff. For more in-depth analysis and to stay updated on the evolving situation, continue to monitor developments related to the Canada tariff impact and its effects on various sectors of the Canadian economy.

Featured Posts

-

Novak Djokovic Tenis Tarihine Gecen Bir Basari

May 31, 2025

Novak Djokovic Tenis Tarihine Gecen Bir Basari

May 31, 2025 -

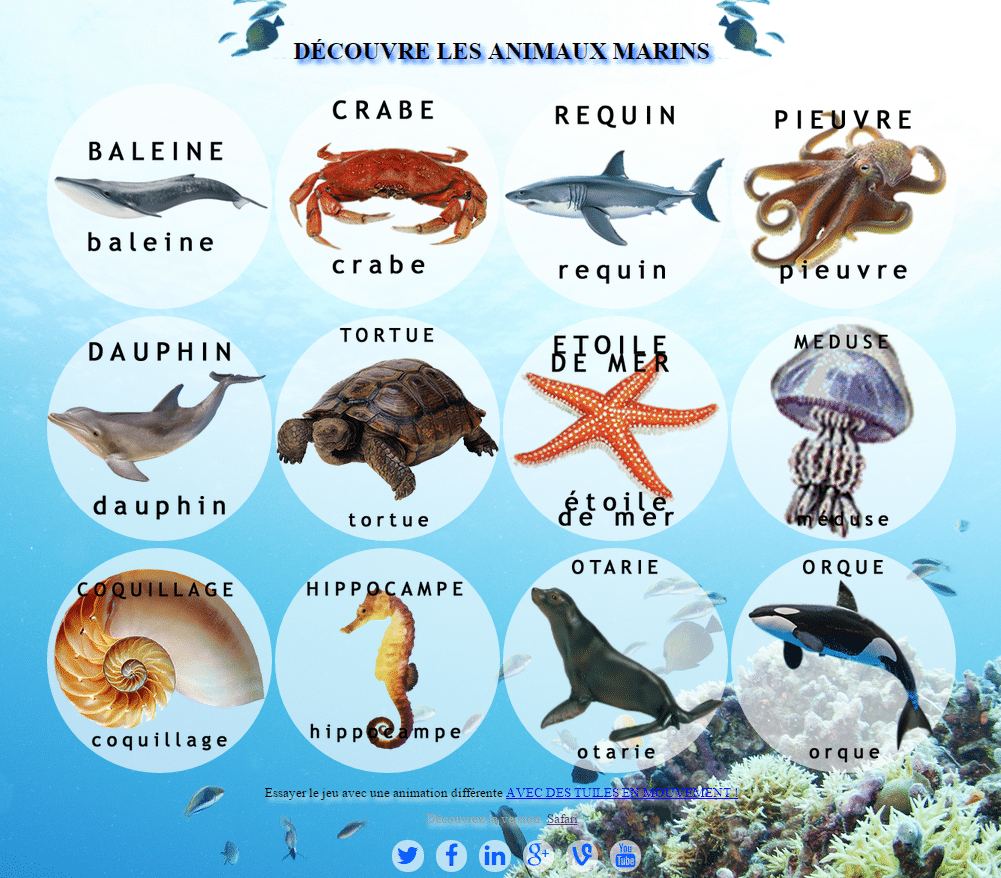

Un Jour En Mer Guide Complet Pour Tous Les Marins

May 31, 2025

Un Jour En Mer Guide Complet Pour Tous Les Marins

May 31, 2025 -

Progressive Field Twins Guardians Game Delay April 29th Updates

May 31, 2025

Progressive Field Twins Guardians Game Delay April 29th Updates

May 31, 2025 -

Ecb Rate Cut More Likely After Unexpected Drop In Spanish Inflation

May 31, 2025

Ecb Rate Cut More Likely After Unexpected Drop In Spanish Inflation

May 31, 2025 -

Jaime Munguias Rematch Victory Strategic Adjustments Pay Off Against Bruno Surace

May 31, 2025

Jaime Munguias Rematch Victory Strategic Adjustments Pay Off Against Bruno Surace

May 31, 2025