Private Equity Buys Boston Celtics For $6.1 Billion: Impact On The Team

Table of Contents

Financial Implications for the Boston Celtics

The $6.1 billion price tag signifies a new era of financial possibilities for the Boston Celtics. This influx of capital presents both opportunities and challenges.

Increased Investment in Player Acquisition and Development

The most immediate impact will likely be increased investment in player personnel. The new owners will have significantly more financial resources to pursue top-tier free agents, bolster the team's draft position, and enhance player development programs.

- Aggressive free agency pursuit: The Celtics could target high-profile players previously unattainable, strengthening their roster significantly.

- Improved scouting and draft picks: Investing in advanced scouting technologies and analytical expertise could lead to smarter draft decisions and acquiring more valuable players.

- State-of-the-art training facilities: Enhanced training facilities and cutting-edge technology can optimize player performance and reduce injury risks.

- Advanced analytics and data-driven decisions: Utilizing data analytics to make informed decisions on player acquisition, development, and game strategy.

Improved Infrastructure and Fan Experience

Beyond player development, the significant investment could translate into substantial improvements to the fan experience and the team's infrastructure.

- TD Garden renovations and upgrades: Expect potential renovations to enhance the game-day experience for fans, including upgraded seating, improved concessions, and modernized amenities.

- Enhanced digital experiences: Investing in better mobile apps, improved online engagement, and enhanced digital content creation can cater to a broader audience.

- Improved marketing campaigns and fan engagement: Expect more aggressive marketing campaigns to broaden the Celtics brand reach and strengthen fan loyalty.

- Innovative loyalty programs and VIP experiences: Creating engaging loyalty programs to retain current fans and attract new ones.

Potential for Debt and Financial Risk

While the increased capital offers significant advantages, it's crucial to acknowledge the potential downsides of high leverage. The acquisition likely involves substantial debt, which could pose financial risks if not managed effectively.

- High interest payments: Managing significant debt obligations will require careful financial planning and a strategy to minimize interest expenses.

- Financial strain during economic downturns: Periods of economic uncertainty could strain the team's finances if revenue streams are impacted.

- Impact on long-term financial stability: The team's long-term financial health will depend on generating sufficient revenue to cover debt obligations and ongoing operational costs.

Impact on Team Management and Coaching

The change in ownership will inevitably bring changes to the team's management and coaching staff.

Changes in Team Leadership and Strategy

Private equity firms often prioritize efficiency and performance, leading to potential changes in the front office and coaching staff.

- New General Manager or front office restructuring: The new owners may implement a different management style or seek a GM with a specific vision for the team.

- Coaching staff changes: Changes in coaching philosophies and strategies are possible, potentially focusing on a data-driven approach.

- Shifts in player personnel decisions: The team's approach to acquiring and releasing players might become more aggressive or strategic.

- Increased focus on analytics: Private equity often employs data-driven approaches, which could lead to a stronger reliance on analytics in team management.

Pressure to Win and Achieve Success

The substantial investment will undoubtedly increase the pressure on the team to perform at the highest level. The new owners will expect a return on their investment, translating into higher expectations for wins and championships.

- Higher expectations from owners: Winning becomes paramount, and the pressure on the coaching staff and players will intensify.

- Potential for more aggressive trading strategies: The team might engage in more aggressive trades to acquire championship-caliber players quickly.

- Impact on team morale and pressure on players and coaches: The increased pressure can positively or negatively impact team morale and player performance.

Long-Term Effects on the Boston Celtics Franchise

The long-term impact of this private equity acquisition will depend on several factors, including the new owners' vision and management style.

Enhanced Brand Value and Global Reach

Private equity firms often possess expertise in branding and global expansion, potentially boosting the Celtics' brand value and international reach.

- Increased marketing efforts and global campaigns: Expect more focused and targeted marketing campaigns aimed at both domestic and international markets.

- Expansion into new international markets: The Celtics could expand their brand presence into new international markets through strategic partnerships and marketing initiatives.

- Collaborations with global brands: The team might forge strategic partnerships with international companies to enhance its global profile.

Sustainability and Long-Term Vision

The success of this acquisition hinges on the new owners' long-term vision for the franchise's sustainability and ethical practices.

- Commitment to community engagement: A commitment to social responsibility and community engagement would foster positive relationships with the local community.

- Environmental initiatives: Adopting sustainable practices and implementing environmental initiatives aligns with growing societal concerns.

- Ethical business practices: Transparency and ethical business practices build trust and maintain a positive reputation.

- Long-term financial stability: Establishing a long-term financial strategy ensures the continued success and stability of the franchise.

Conclusion

The $6.1 billion private equity acquisition of the Boston Celtics marks a pivotal moment in the franchise's history. While the increased investment promises enhanced player acquisition, infrastructure upgrades, and potential global reach, it also introduces financial risks and increased pressure to win. The long-term success of this venture will depend on the new owners' vision, management style, and ability to balance financial goals with the team's legacy and the needs of its players and fans. What do YOU think will happen to the Boston Celtics now? Share your predictions on the future of the team after this massive private equity buy-in! Discuss the impact of this major investment on the Boston Celtics franchise below.

Featured Posts

-

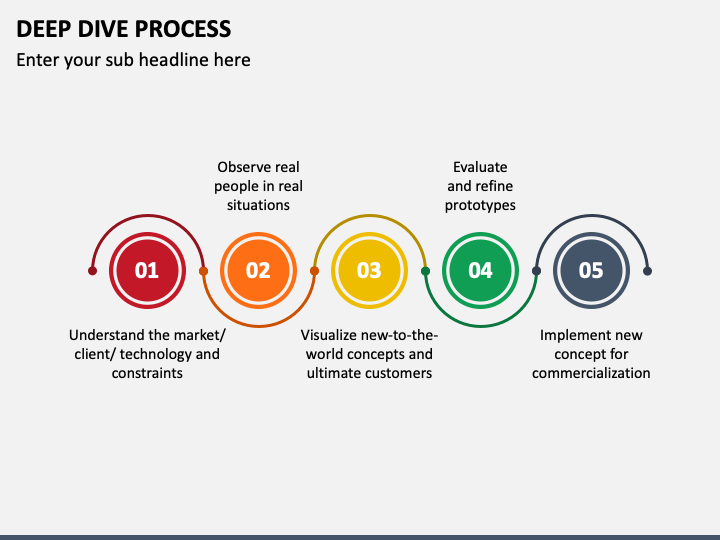

Decreasing Sales In China A Deep Dive Into The Experiences Of Bmw And Porsche

May 17, 2025

Decreasing Sales In China A Deep Dive Into The Experiences Of Bmw And Porsche

May 17, 2025 -

Palmeiras 2 0 Bolivar Resultado Resumen Y Goles Del Partido

May 17, 2025

Palmeiras 2 0 Bolivar Resultado Resumen Y Goles Del Partido

May 17, 2025 -

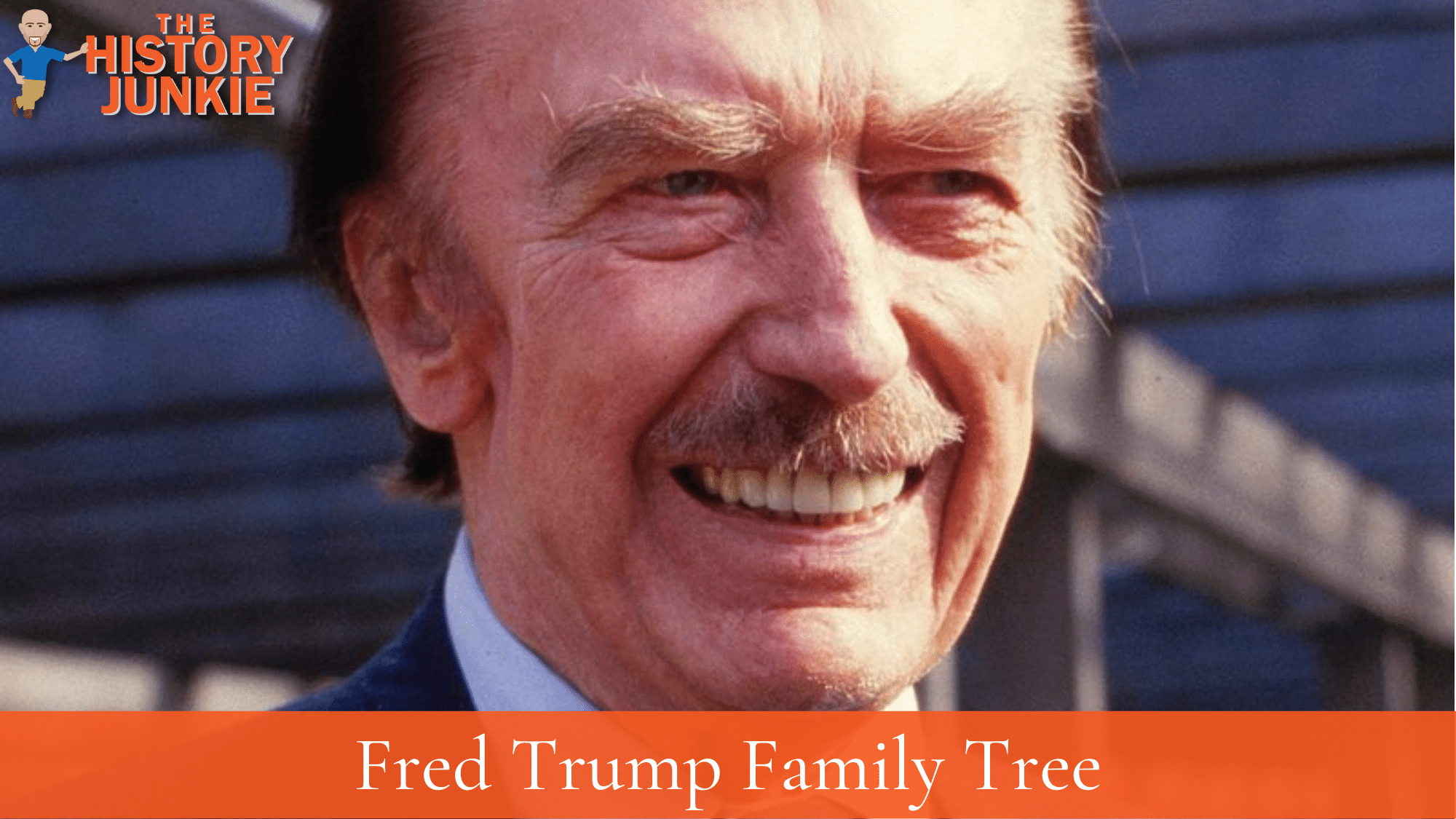

Alexander Arrives An Update On The Trump Family Tree

May 17, 2025

Alexander Arrives An Update On The Trump Family Tree

May 17, 2025 -

La Landlord Price Gouging A Real Estate Agents Perspective On The Fire Aftermath

May 17, 2025

La Landlord Price Gouging A Real Estate Agents Perspective On The Fire Aftermath

May 17, 2025 -

Full Andor Season 2 Trailer Breakdown Death Star And Yavin 4 Explained

May 17, 2025

Full Andor Season 2 Trailer Breakdown Death Star And Yavin 4 Explained

May 17, 2025

Latest Posts

-

Understanding Reddits Increased Scrutiny Of Violent Content Upvotes

May 18, 2025

Understanding Reddits Increased Scrutiny Of Violent Content Upvotes

May 18, 2025 -

Reddit Targets Violent Content Changes To Upvote System And User Policies

May 18, 2025

Reddit Targets Violent Content Changes To Upvote System And User Policies

May 18, 2025 -

Examining Bayern Munichs Academy The Angelo Stiller Perspective

May 18, 2025

Examining Bayern Munichs Academy The Angelo Stiller Perspective

May 18, 2025 -

Reddit Service Disruption Page Not Found Reports Flood Us

May 18, 2025

Reddit Service Disruption Page Not Found Reports Flood Us

May 18, 2025 -

Reddit Intensifies Fight Against Violent Content Upvote Crackdown Explained

May 18, 2025

Reddit Intensifies Fight Against Violent Content Upvote Crackdown Explained

May 18, 2025