Reduce Student Loan Burden: Strategies From A Financial Planner

Table of Contents

Understanding Your Student Loan Debt

Before you can effectively tackle your student loan debt, you need a clear understanding of what you owe. This involves identifying the types of loans you have and calculating your total debt.

Types of Student Loans

Understanding the nuances of different loan types is crucial for effective repayment planning. Federal student loans, offered by the government, often come with more flexible repayment options and protections than private student loans, which are offered by banks and credit unions. Furthermore, subsidized loans don't accrue interest while you're in school (under certain conditions), whereas unsubsidized loans do. Knowing this distinction is key to understanding your overall loan costs.

Calculating Your Total Debt

To accurately assess your student loan burden, you need to determine your total loan balance. This includes the principal amount borrowed plus any accrued interest. Many borrowers are surprised by how much interest has accumulated.

- Utilize online student loan calculators: Several free online tools can help you estimate your total debt and project future payments.

- Gather all loan statements and consolidate information: Compile all your loan statements to get a complete picture of your debt. This includes noting the lender, loan amount, interest rate, and repayment terms for each loan.

- Understand the interest rates and repayment terms for each loan: Different loans have different interest rates and repayment periods, which significantly impact your total repayment costs. Higher interest rates mean you'll pay more over the life of the loan.

This detailed understanding of your "student loan repayment" landscape is crucial for effective planning and negotiating better terms with your lenders. Knowing your exact "loan balance" and "interest rates" allows you to make informed decisions about your repayment strategy.

Exploring Repayment Options

Once you understand your student loan debt, explore the various repayment options available to you. These options can significantly impact your monthly payments and overall repayment timeline.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment over a 10-year period. While straightforward, it may result in high monthly payments, particularly for borrowers with large loan balances.

Income-Driven Repayment Plans (IDRs)

IDRs, such as IBR (Income-Based Repayment), PAYE (Pay As You Earn), and REPAYE (Revised Pay As You Earn), base your monthly payments on your income and family size. These plans often lead to lower monthly payments but extend the repayment period, potentially resulting in higher overall interest costs. Eligibility requirements vary depending on the plan.

Loan Consolidation

Consolidating your federal student loans into a single loan can simplify repayment by combining multiple loans into one monthly payment. However, it may not always lower your interest rate, so careful consideration is crucial before consolidating. Consider the implications of "student loan refinancing" which could offer better terms.

Loan Forgiveness Programs

Certain professions, such as teaching and public service, may qualify for loan forgiveness programs like PSLF (Public Service Loan Forgiveness) and Teacher Loan Forgiveness. These programs require meeting specific eligibility criteria and making timely payments for a set number of years.

- Compare different repayment plan options: Carefully evaluate the pros and cons of each plan based on your individual financial circumstances and long-term goals.

- Research the specific requirements for loan forgiveness programs: Understanding the eligibility criteria for these programs is essential to determining if you qualify.

- Consult with your loan servicer: Your loan servicer can provide personalized guidance on available repayment options and answer any questions you may have. Understanding your "repayment plan options" is critical.

Strategies to Accelerate Repayment

Once you've chosen a repayment plan, you can implement several strategies to accelerate repayment and reduce student loan debt reduction.

Budgeting and Financial Planning

Creating a detailed budget is essential for prioritizing loan repayment. Track your spending, identify areas where you can cut back, and allocate as much money as possible towards your student loans.

Increasing Your Income

Exploring ways to increase your income can significantly accelerate repayment. This might involve seeking a higher-paying job, taking on a side hustle, or developing valuable in-demand skills.

Refinancing Student Loans

Refinancing your student loans with a private lender could potentially lower your interest rate, resulting in lower monthly payments and faster repayment. However, carefully weigh the benefits and risks, as refinancing might eliminate certain federal protections. Explore "student loan refinancing options" carefully.

Making Extra Payments

Even small extra payments can dramatically shorten your repayment timeline and save you money on interest. Automate extra payments to ensure consistency. These "extra loan payments" can add up to substantial savings over time.

- Track your spending habits: Use budgeting apps or spreadsheets to monitor your expenses and identify areas for potential savings.

- Explore career advancement opportunities: Invest in your professional development to increase your earning potential.

- Consider refinancing your loans only if it results in significant savings: Don't refinance solely for the sake of it. Compare offers before committing.

- Automate extra loan payments: Set up automatic payments to ensure you consistently make extra payments.

Conclusion

Successfully reducing your student loan burden requires a multi-pronged approach. This involves understanding your loan details, exploring all available repayment options, and strategically implementing measures to accelerate repayment. By understanding your "student loan repayment" options, creating a comprehensive budget, and actively pursuing strategies to increase your income, you can significantly improve your financial situation. Start taking control of your student loan debt today! Use the strategies outlined in this article to begin reducing your student loan burden and pave the way for a brighter financial future. Don't hesitate to seek professional financial advice to create a personalized plan to lowering student loan debt and effectively managing student loan payments. Take charge of your financial future and start reducing student loan payments today.

Featured Posts

-

Weekly Review Identifying And Addressing Failures

May 17, 2025

Weekly Review Identifying And Addressing Failures

May 17, 2025 -

Blockchain Analytics Leader Chainalysis Expands With Alterya Acquisition

May 17, 2025

Blockchain Analytics Leader Chainalysis Expands With Alterya Acquisition

May 17, 2025 -

Seattle Mariners Rhp Bryce Miller 15 Day Il For Elbow

May 17, 2025

Seattle Mariners Rhp Bryce Miller 15 Day Il For Elbow

May 17, 2025 -

How Tom Thibodeaus Adaptability Rescued The New York Knicks

May 17, 2025

How Tom Thibodeaus Adaptability Rescued The New York Knicks

May 17, 2025 -

Yankees Vs Mariners Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Yankees Vs Mariners Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Latest Posts

-

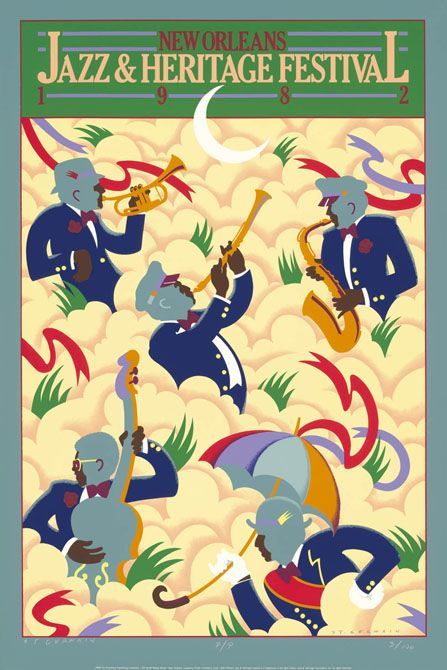

Experience The Best Of New Orleans Jazz Fest Planning Your Trip

May 17, 2025

Experience The Best Of New Orleans Jazz Fest Planning Your Trip

May 17, 2025 -

Jazz Fest New Orleans Your Guide To The Ultimate New Orleans Music Experience

May 17, 2025

Jazz Fest New Orleans Your Guide To The Ultimate New Orleans Music Experience

May 17, 2025 -

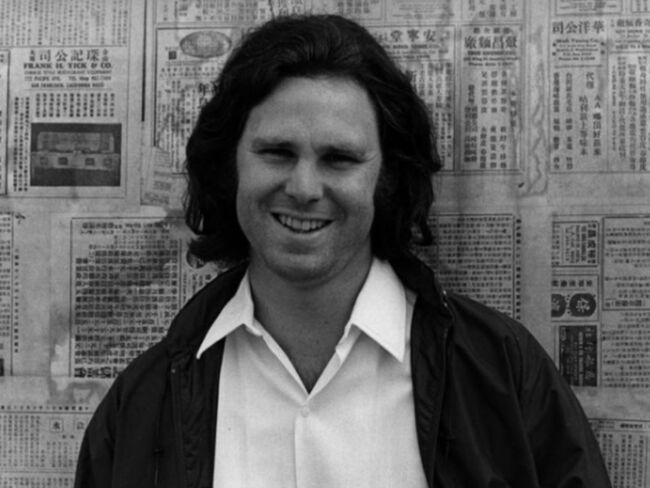

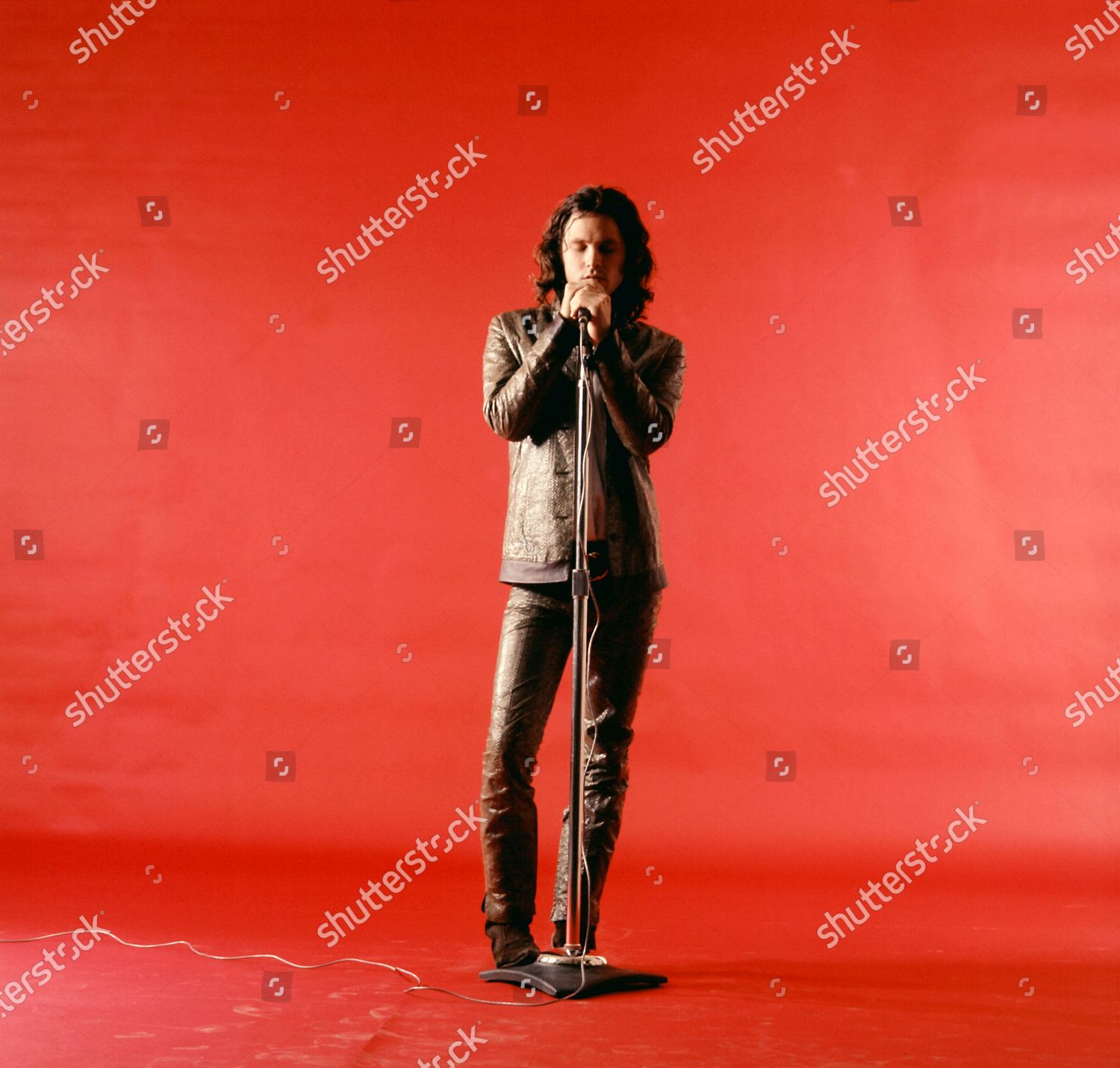

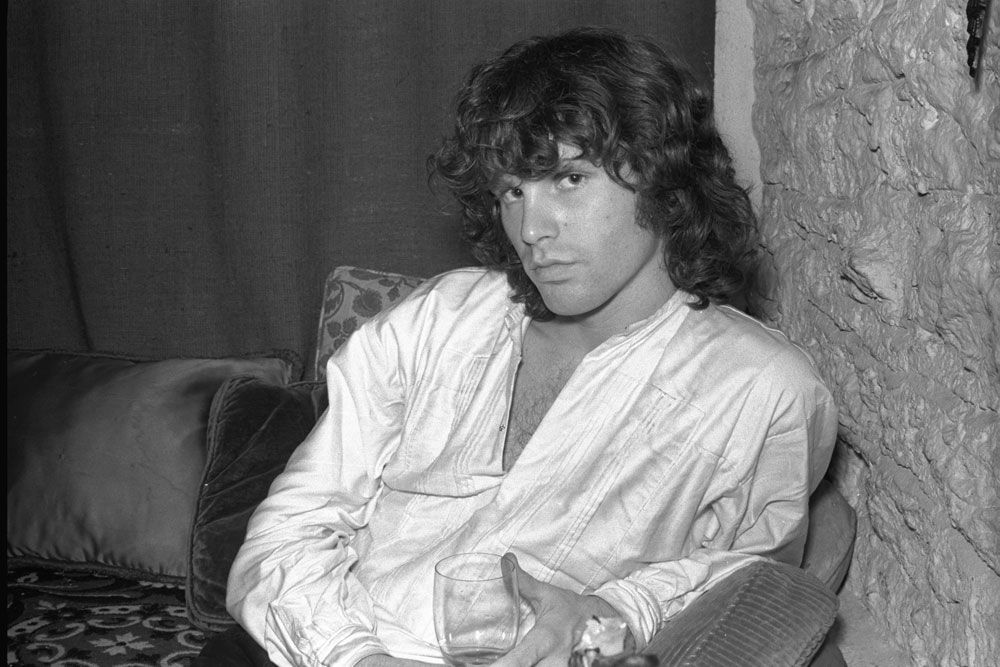

Did Jim Morrison Fake His Death The New York Maintenance Man Theory

May 17, 2025

Did Jim Morrison Fake His Death The New York Maintenance Man Theory

May 17, 2025 -

The Doors Jim Morrison A New York Maintenance Man Fans Claim Investigated

May 17, 2025

The Doors Jim Morrison A New York Maintenance Man Fans Claim Investigated

May 17, 2025 -

Is Jim Morrison Still Alive A New York Maintenance Man Claim

May 17, 2025

Is Jim Morrison Still Alive A New York Maintenance Man Claim

May 17, 2025