Refinancing Federal Student Loans: Comparing Private And Government Options

Table of Contents

Understanding Federal Student Loan Refinancing

What is Federal Student Loan Refinancing?

Refinancing your federal student loans involves replacing your existing federal loans with a new loan, typically from a private lender. This process aims to consolidate your debt into a single loan with potentially more favorable terms, such as a lower interest rate or shorter repayment period. It's crucial to understand that the federal government itself does not offer a program to refinance existing federal loans into a new federal loan. The refinancing process usually means working with a private lender. The potential benefits include lower monthly payments and faster debt repayment.

Types of Federal Student Loans Eligible for Refinancing

Most private lenders will accept a range of federal student loans for refinancing, including:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans (for graduate or professional students)

- Consolidated federal student loans

However, eligibility criteria vary among private lenders. It's essential to check directly with potential lenders to confirm which loan types they accept before applying. Some lenders may have restrictions based on your credit score, income, and debt-to-income ratio.

The Implications of Refinancing Federal Loans

Before you refinance, carefully consider the potential implications:

- Loss of Federal Protections: Refinancing your federal student loans means losing crucial federal protections, such as income-driven repayment plans (IDR), deferment, and forbearance options. These programs can provide crucial financial relief if you experience job loss or unexpected financial hardship.

- Credit Score Impact: Private lenders will perform a credit check as part of the application process. A hard inquiry can temporarily lower your credit score, although the impact is usually minor. Additionally, your creditworthiness will play a significant role in determining your interest rate.

- Long-Term Financial Implications: Carefully analyze the new loan terms and calculate your monthly payments to ensure they are manageable within your budget. A shorter repayment term might lead to higher monthly payments, while a lower interest rate might lead to lower monthly payments but extend the repayment period.

Private Refinancing Options for Federal Student Loans

Finding the Right Private Lender

Choosing the right private lender for federal student loan refinancing is critical. Consider these factors:

- Interest Rates: Compare interest rates from several lenders; they can vary significantly. Look for the lowest interest rate you qualify for.

- Fees: Be aware of any origination fees, prepayment penalties, or other charges associated with the loan. These can impact your overall borrowing costs.

- Customer Service: Read reviews and check the lender's reputation for customer service and responsiveness.

- Repayment Options: Explore different repayment options offered, such as fixed-rate or variable-rate loans, and choose the one that best aligns with your financial situation.

Use online resources and comparison tools to gather information from multiple lenders before making a decision.

Pros and Cons of Private Refinancing

Pros:

- Potentially lower interest rates than your current federal loans.

- Shorter repayment terms, leading to faster debt elimination.

- Fixed interest rates can provide predictability and stability.

Cons:

- Loss of federal student loan protections.

- Stricter eligibility requirements compared to federal loan programs.

- Potential for higher fees compared to federal loan consolidation.

Understanding Private Loan Terms

Understand the terms of any private student loan refinancing offer thoroughly:

- Fixed vs. Variable Interest Rates: Fixed rates remain constant throughout the loan term, while variable rates fluctuate with market conditions.

- Repayment Terms: The repayment term affects your monthly payment amount. Shorter terms result in higher monthly payments, while longer terms result in lower monthly payments but increased interest paid over the loan's life.

- Prepayment Penalties: Some lenders may charge a fee if you repay your loan early. Make sure to check for any prepayment penalties before signing the loan agreement.

Alternatives to Refinancing: Consolidation and Income-Driven Repayment Plans

Federal Loan Consolidation

Federal loan consolidation is a different process from refinancing. It involves combining multiple federal student loans into a single new federal loan, typically with a fixed interest rate. This simplifies payments but does not necessarily lower your interest rate. Importantly, you retain all federal protections.

- Benefits: Simplifies payments, potential for lower interest rate (depending on current loan types), maintains federal protections.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. They can significantly lower your monthly payment, making your debt more manageable.

- Benefits: Lower monthly payments based on income, preservation of federal benefits, no need for refinancing.

These options offer ways to manage your federal student loan debt without sacrificing the benefits of federal loan programs.

Conclusion

Refinancing federal student loans can offer significant advantages, like lower monthly payments and a shorter repayment period, but it's crucial to weigh the pros and cons carefully. Private lenders offer competitive options, but remember that you'll lose access to federal protections. Exploring alternatives like federal loan consolidation and income-driven repayment plans might be better suited for your needs. Before deciding whether to refinance your federal student loans, thoroughly research your options, compare rates and terms from multiple lenders, and consider the long-term implications. Make informed decisions about your federal student loan refinancing strategy to achieve your financial goals.

Featured Posts

-

Josh Hart The Knicks Unsung Hero Mirroring Draymond Greens Influence

May 17, 2025

Josh Hart The Knicks Unsung Hero Mirroring Draymond Greens Influence

May 17, 2025 -

Jazz Fest New Orleans Your Guide To The Ultimate New Orleans Music Experience

May 17, 2025

Jazz Fest New Orleans Your Guide To The Ultimate New Orleans Music Experience

May 17, 2025 -

Network18 Media And Investments Stock Current Price Technical Analysis And Predictions April 21 2025

May 17, 2025

Network18 Media And Investments Stock Current Price Technical Analysis And Predictions April 21 2025

May 17, 2025 -

Canada China Trade Relations Ambassador Suggests Path To Formal Deal

May 17, 2025

Canada China Trade Relations Ambassador Suggests Path To Formal Deal

May 17, 2025 -

Jack Bit The Top Bitcoin Casino In The Usa

May 17, 2025

Jack Bit The Top Bitcoin Casino In The Usa

May 17, 2025

Latest Posts

-

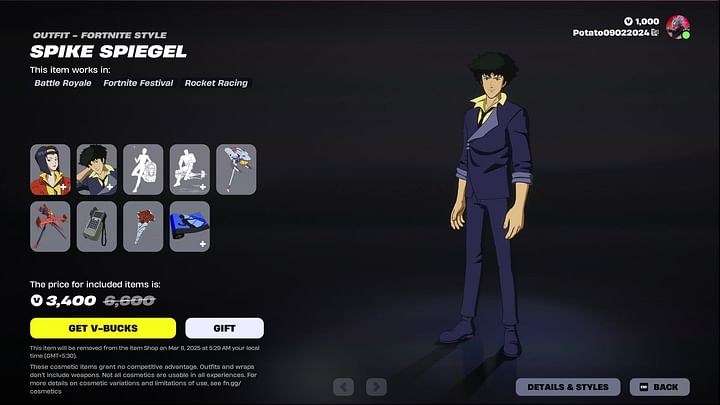

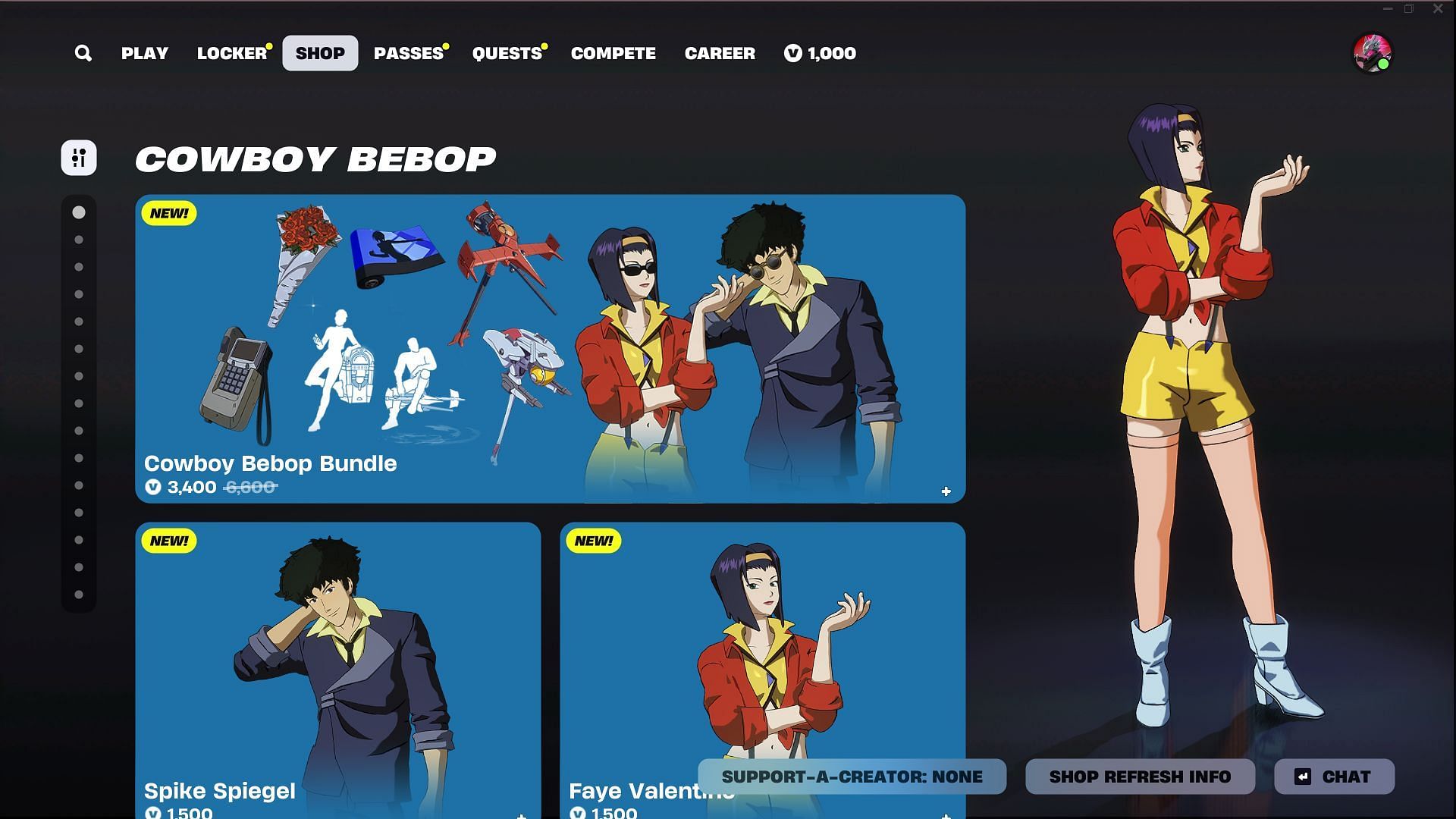

Are The Faye Valentine And Spike Spiegel Fortnite Skins Worth The Price

May 17, 2025

Are The Faye Valentine And Spike Spiegel Fortnite Skins Worth The Price

May 17, 2025 -

Faye Valentine And Spike Spiegel Fortnite Skins Bundle Price And Where To Buy

May 17, 2025

Faye Valentine And Spike Spiegel Fortnite Skins Bundle Price And Where To Buy

May 17, 2025 -

Fortnite Item Shop Update The Return Of Classic Skins After 1000 Days

May 17, 2025

Fortnite Item Shop Update The Return Of Classic Skins After 1000 Days

May 17, 2025 -

Fortnite Cowboy Bebop Skin Bundle Price And Availability Of Faye Valentine And Spike Spiegel

May 17, 2025

Fortnite Cowboy Bebop Skin Bundle Price And Availability Of Faye Valentine And Spike Spiegel

May 17, 2025 -

Real Money Online Casinos New Zealand 7 Bit Casino Review And Guide

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino Review And Guide

May 17, 2025