Retail Investor Activity During Market Swings: A Case Study

Table of Contents

Increased Trading Activity During Market Swings

Market volatility significantly impacts retail investor activity, often leading to increased trading volume. This heightened activity is largely driven by psychological factors and the influence of external information sources.

Fear and Greed as Driving Forces

Market swings trigger powerful emotional responses in retail investors. Fear and greed are primary drivers of impulsive decisions.

- Increased trading volume during sharp market drops (panic selling): During market crashes, fear often leads to panic selling, where investors rush to liquidate their assets regardless of the underlying value. This contributes to a downward spiral, exacerbating the market decline.

- Chasing high-performing stocks during market rallies (fear of missing out, or FOMO): Conversely, during market rallies, greed and the fear of missing out (FOMO) can lead to investors chasing high-performing stocks, often at inflated prices. This speculative behavior can create unsustainable bubbles.

- Examples of specific market events and their impact on retail investor behavior: The dot-com bubble burst in 2000 and the 2008 financial crisis serve as prime examples of how fear and greed significantly impacted retail investor behavior, resulting in both substantial losses and missed opportunities.

The Role of Social Media and Online Forums

Social media and online investment forums play a significant role in shaping retail investor sentiment and influencing trading decisions during market swings.

- Spread of misinformation and "hot tips": The rapid spread of misinformation and unsubstantiated "hot tips" on platforms like Twitter and Reddit can lead to herd behavior and impulsive trading decisions.

- Herd mentality and its effect on trading strategies: The herd mentality, where investors mimic the actions of others without conducting their own due diligence, often amplifies market trends, both positive and negative.

- Examples of social media-driven trading frenzies: The meme stock phenomenon of 2021, where retail investors coordinated their buying activity through social media, demonstrates the potent influence of online platforms on market dynamics and retail investor activity.

Impact of Market Timing Strategies on Retail Investors

Many retail investors attempt to time the market, buying low and selling high. However, this strategy is notoriously difficult to execute successfully.

The Illusion of Perfect Timing

Accurately timing the market is exceptionally challenging, and attempting to do so often leads to poor investment outcomes.

- Emotional decision-making hindering rational investment strategies: Fear and greed interfere with rational decision-making, making it difficult for investors to stick to a long-term plan.

- Statistical evidence of the difficulty of consistently outperforming the market through timing: Numerous studies demonstrate that consistently outperforming the market through timing is extremely difficult, even for professional investors.

- Long-term vs. short-term investment horizons: A long-term investment horizon minimizes the impact of short-term market fluctuations and allows for greater potential returns.

Buy-and-Hold vs. Active Trading Strategies

Buy-and-hold and active trading represent contrasting investment approaches.

- Analysis of historical data demonstrating the performance of both strategies: Historical data consistently shows that buy-and-hold strategies generally outperform active trading strategies over the long term, particularly for retail investors.

- Risk tolerance and the suitability of different strategies for varying investor profiles: The best strategy depends on individual risk tolerance and investment goals. Buy-and-hold is suitable for risk-averse investors with long-term horizons, while active trading is more appropriate for risk-tolerant investors with shorter timeframes.

- Long-term wealth building and the benefits of a disciplined approach: A disciplined, long-term investment approach, such as buy-and-hold, is crucial for building wealth over time and mitigating the impact of market swings on retail investor portfolios.

Analyzing Specific Case Studies of Market Swings

Examining past market events provides valuable insights into retail investor behavior during periods of significant volatility.

The 2008 Financial Crisis

The 2008 financial crisis provides a stark illustration of the impact of market volatility on retail investors.

- Specific data points illustrating retail investor activity during this period: Widespread panic selling led to significant losses for many retail investors.

- Lessons learned from the crisis regarding investor behavior: The crisis highlighted the importance of diversification, risk management, and emotional discipline in navigating market downturns.

The COVID-19 Market Crash and Recovery

The COVID-19 pandemic triggered a sharp market downturn followed by a rapid recovery, showcasing the unpredictable nature of market swings.

- The impact of government stimulus packages on retail investor activity: Government stimulus measures played a role in the market's subsequent recovery, influencing investor sentiment and trading activity.

- The rise of meme stocks and their impact on market dynamics: The surge in meme stock trading highlighted the growing influence of social media and retail investor coordination on market dynamics.

- Lessons learned from this recent market event: The pandemic underscored the importance of staying informed, maintaining a long-term perspective, and avoiding impulsive decisions driven by fear or hype.

Conclusion

This case study highlights the significant impact of market swings on retail investor activity. Emotional biases, social media influence, and the pursuit of market timing often lead to suboptimal investment decisions. A disciplined, long-term approach is generally more effective than attempting to time the market. Understanding retail investor activity during market swings is key to making informed investment decisions. By learning from past market events and mitigating behavioral biases, you can improve your own investment strategies and navigate market volatility more effectively. Learn more about managing your investments during periods of market volatility and develop a robust, long-term investment plan. Further research into retail investor activity will help you refine your approach to market swings and build a more resilient portfolio.

Featured Posts

-

Martinsvilles Last Lap A Detailed Look At Bubba Wallaces Race

Apr 28, 2025

Martinsvilles Last Lap A Detailed Look At Bubba Wallaces Race

Apr 28, 2025 -

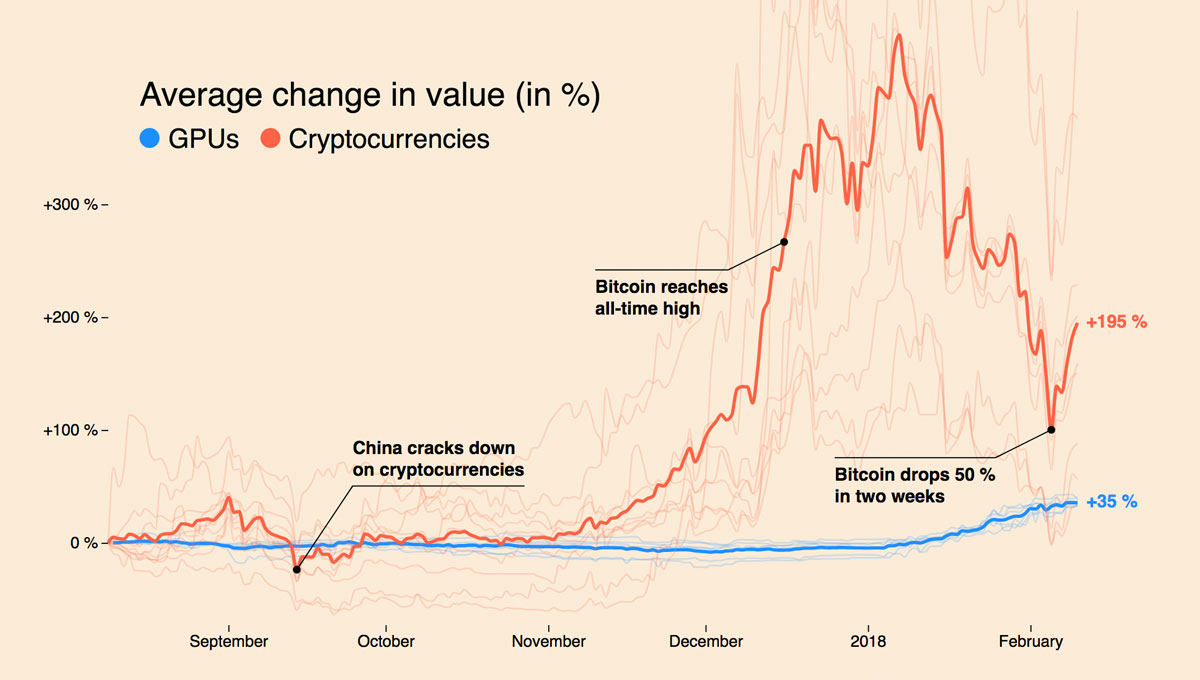

Are Gpu Prices Unreasonably High A Market Analysis

Apr 28, 2025

Are Gpu Prices Unreasonably High A Market Analysis

Apr 28, 2025 -

Why Current Stock Market Valuations Are Not A Cause For Alarm According To Bof A

Apr 28, 2025

Why Current Stock Market Valuations Are Not A Cause For Alarm According To Bof A

Apr 28, 2025 -

Grim Retail Sales Data Implications For Bank Of Canada Monetary Policy

Apr 28, 2025

Grim Retail Sales Data Implications For Bank Of Canada Monetary Policy

Apr 28, 2025 -

Addressing The Issue Of Excessive Truck Size In America

Apr 28, 2025

Addressing The Issue Of Excessive Truck Size In America

Apr 28, 2025