Rigetti Computing (RGTI) And IonQ: Analyzing The Quantum Stock Market In 2025

Table of Contents

Rigetti Computing (RGTI): A Deep Dive into its 2025 Prospects

RGTI's Technology and Market Position

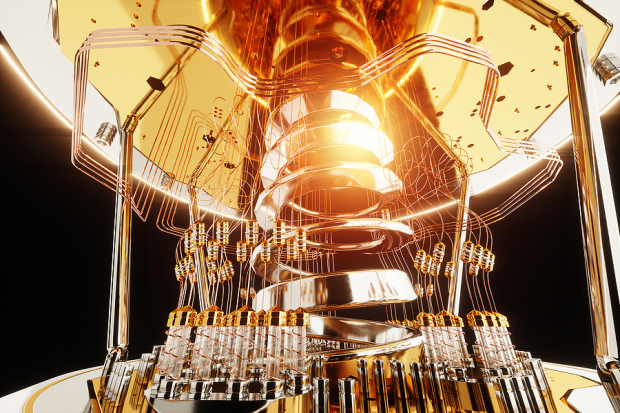

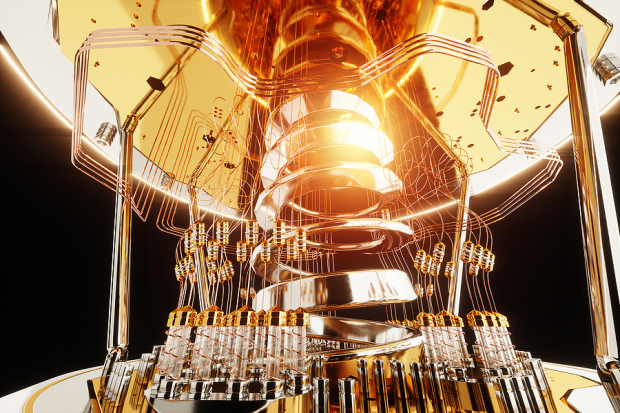

Rigetti Computing utilizes a superconducting qubits architecture, a leading approach in the field. This technology allows for the creation of quantum processors with potentially high qubit counts and coherence times. While precise quantum computing market share figures are difficult to obtain due to the early stage of the industry, Rigetti holds a notable position, competing with larger players. Their recent achievements include advancements in qubit connectivity and control, crucial for scaling up their quantum computers. Key RGTI partnerships with research institutions and corporations further solidify their position in the market.

- Unique Architecture: Rigetti's focus on scalable, modular superconducting qubit architecture sets them apart.

- Strategic Partnerships: Collaborations with major players bolster their technological development and market reach.

- Technological Advancements: Ongoing research and development efforts are pushing the boundaries of quantum computing capabilities.

RGTI's Financial Performance and Investment Analysis

Analyzing RGTI's financial performance requires careful consideration of the company's stage of development. While profitability may not be immediate, key metrics like revenue growth, securing funding rounds, and partnerships indicate potential for future growth. RGTI growth projections vary among analysts, reflecting the inherent uncertainty of the quantum computing market. Investors should carefully evaluate RGTI stock analysis reports, considering both the potential for high returns and the inherent quantum computing investment risks associated with a young, high-growth company.

- Revenue Streams: Focus on cloud access to quantum computers and potential future revenue from specialized applications.

- Funding and Investment: Track capital raises and the valuation of the company to assess investor confidence.

- Risk Assessment: Consider factors like technological challenges, competition, and regulatory uncertainties.

Key Challenges and Opportunities for RGTI in 2025

RGTI challenges in 2025 will likely include maintaining a competitive edge against established players and navigating the inherent difficulties in scaling quantum computing technology. Quantum computing competition is fierce, and staying ahead of the curve requires continuous innovation. However, substantial RGTI opportunities exist. The growing need for quantum computing solutions across various industries, coupled with potential government funding quantum computing initiatives, promises significant growth potential.

IonQ: Evaluating its Potential in the Quantum Computing Landscape of 2025

IonQ's Technological Differentiation and Market Strategy

IonQ employs trapped ion technology, another promising approach to quantum computing. This technology offers advantages in terms of qubit coherence and scalability, although it presents different engineering challenges compared to superconducting qubits. IonQ market strategy centers on providing cloud-based access to its quantum computers, targeting both research institutions and commercial clients. Their IonQ competitive advantage lies in their focus on high-fidelity qubits and a well-defined business model.

- Trapped Ion Superiority: Highlight the potential advantages of trapped ion technology compared to competing architectures.

- Cloud-Based Access: Emphasize the ease of access and scalability offered by IonQ's cloud-based platform.

- Target Markets: Discuss the specific industries and research areas where IonQ is focusing its efforts.

IonQ's Financial Outlook and Investment Considerations

Similar to RGTI, assessing IonQ's financial performance needs to consider the developmental stage of the company. IonQ financial projections depend on market adoption rates and technological advancements. While profitability might be distant, metrics like revenue growth and successful partnerships are crucial for investors. Understanding the IonQ risk assessment is vital before investing, considering factors like technological hurdles and market competition. This will help investors weigh the quantum computing investment opportunities against potential downsides.

IonQ's Future Trajectory and Potential Disruptions

IonQ future outlook appears promising, with potential IonQ innovation leading to breakthroughs in various sectors. Quantum computing disruption across fields like materials science, drug discovery, and finance is a real possibility. IonQ long-term vision points towards a future where their technology becomes integral to solving complex scientific and industrial problems.

Comparing RGTI and IonQ: A Comparative Analysis for 2025

| Feature | Rigetti Computing (RGTI) | IonQ |

|---|---|---|

| Technology | Superconducting Qubits | Trapped Ion Qubits |

| Market Position | Strong, growing | Strong, growing |

| Financial Status | Developing, high growth potential | Developing, high growth potential |

| Key Strengths | Scalable architecture, partnerships | High-fidelity qubits, cloud access |

| Key Weaknesses | Scaling challenges | Less established ecosystem |

Based on this comparison, both RGTI and IonQ present compelling investment opportunities. However, the choice between them depends on an investor's risk tolerance and investment strategy.

Conclusion: Investing Wisely in the Quantum Computing Stock Market of 2025

The quantum computing stock market is an exciting but risky space. Both Rigetti Computing (RGTI) and IonQ show significant potential, but their success depends on overcoming technological hurdles and gaining significant market traction. Our analysis highlights the strengths and weaknesses of both companies. Remember that investing in this sector requires thorough quantum stock market analysis and careful consideration of the inherent risks. Conduct further research and consult financial advisors before making any quantum computing investment strategy decisions. The future of quantum computing investment in 2025, particularly concerning RGTI investment and IonQ investment, hinges on their ability to deliver on their ambitious promises. This requires understanding both the opportunities and the considerable risks associated with the industry's rapid growth. Remember to conduct your own due diligence before investing in any quantum computing stocks.

Featured Posts

-

Kaellmanin Ja Hoskosen Puola Ura Paeaettyi

May 21, 2025

Kaellmanin Ja Hoskosen Puola Ura Paeaettyi

May 21, 2025 -

Bribery Prosecution Of Four Star Admiral Uncovering Deep Rooted Navy Cultural Issues

May 21, 2025

Bribery Prosecution Of Four Star Admiral Uncovering Deep Rooted Navy Cultural Issues

May 21, 2025 -

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025 -

Analyzing Big Bear Ai Bbai Is It A Smart Ai Penny Stock Investment

May 21, 2025

Analyzing Big Bear Ai Bbai Is It A Smart Ai Penny Stock Investment

May 21, 2025 -

Could This Be The Year The Trans Australia Run Record Falls

May 21, 2025

Could This Be The Year The Trans Australia Run Record Falls

May 21, 2025