Rio Tinto Weathers Storm Of Activist Investor Campaign

Table of Contents

H2: The Nature of the Activist Investor Campaign

The activist investor campaign targeting Rio Tinto was multifaceted, encompassing a range of demands and employing various pressure tactics. Understanding the specifics is crucial to analyzing the company's response.

H3: Key Demands of Activist Investors

Activist investors targeted Rio Tinto with several key demands, broadly categorized as follows:

- Increased Investment in Renewable Energy: Investors pushed for significant capital allocation towards renewable energy projects, aligning Rio Tinto’s operations with global climate change goals and reducing its carbon footprint. This reflected growing investor focus on ESG factors and the transition to a low-carbon economy.

- Improvements to Board Diversity: Concerns were raised about the lack of diversity on Rio Tinto’s board of directors, leading to calls for greater representation of women and individuals from diverse backgrounds. This reflects a broader trend of demanding better corporate governance and improved representation in the C-suite.

- Divestment from Certain Projects: Some activist investors called for Rio Tinto to divest from certain mining projects deemed environmentally damaging or socially controversial, highlighting the growing scrutiny of mining operations' social and environmental impact.

- Higher Dividend Payouts: A key financial demand involved increasing dividend payouts to shareholders, reflecting a desire for improved short-term returns on investment.

H3: Strategies Employed by Activist Investors

The activist investors employed a range of strategies to exert pressure on Rio Tinto, including:

- Public Shareholder Letter Campaigns: Open letters were published, publicly outlining concerns and demands, aiming to influence public opinion and pressure the company to respond.

- Engagement with Institutional Investors: Activist investors actively engaged with large institutional investors, encouraging them to support their demands and exert collective pressure on Rio Tinto's management.

- Proxy Fights: In some instances, activist investors attempted to influence shareholder votes at annual general meetings by nominating alternative board members or putting forward resolutions aligned with their demands.

- Media Outreach: Strategic media campaigns were used to raise awareness of the issues and put pressure on Rio Tinto through negative publicity.

H2: Rio Tinto's Response to Activist Pressure

Rio Tinto’s response to the activist pressure was a combination of defensive and proactive measures, demonstrating a strategic approach to managing shareholder activism.

H3: Defensive Strategies

Rio Tinto employed several defensive strategies to counter the activist campaign:

- Public Statements Defending Company Strategy: The company issued public statements defending its existing strategies, emphasizing its commitment to responsible mining practices and its long-term sustainability goals.

- Engagement with Activist Investors: Rio Tinto engaged in direct dialogue with the activist investors, attempting to address their concerns and negotiate potential compromises.

- Internal Policy Reviews: The company initiated internal reviews of its environmental and social policies, seeking to identify areas for improvement and enhance transparency.

- Enhanced Transparency Initiatives: Rio Tinto implemented initiatives to improve the transparency of its operations and communications with investors, aiming to build trust and address concerns.

H3: Proactive Measures

In addition to defensive tactics, Rio Tinto also adopted proactive measures to address the issues raised by activist investors:

- New Commitments to Renewable Energy: The company announced new commitments to invest in renewable energy sources, demonstrating a clear intention to reduce its carbon footprint.

- Improved Diversity Targets within the Company: Rio Tinto set more ambitious diversity targets, aiming to improve gender and ethnic representation at all levels of the organization.

- Strengthened Corporate Governance Structures: The company implemented changes to its corporate governance structures, aiming to enhance accountability and transparency.

- Enhanced ESG Reporting: Rio Tinto improved its ESG reporting, providing more detailed information on its environmental and social performance, showing greater commitment to stakeholders.

H2: Outcome and Impact on Rio Tinto's Financial Performance and Reputation

The activist campaign had both short-term and long-term impacts on Rio Tinto’s financial performance and reputation.

H3: Short-Term Impact

The immediate impact of the campaign included:

- Share Price Fluctuations: Rio Tinto's share price experienced some fluctuations in response to the activist pressure and news coverage.

- Changes in Investor Sentiment: Investor sentiment towards the company was impacted, with some investors expressing concerns about the company's ESG performance.

- Impact on Project Timelines: While not substantial, some project timelines might have been slightly affected due to the need to address concerns raised by activist investors.

H3: Long-Term Implications

The long-term implications of the activist campaign include:

- Changes to Long-Term Sustainability Goals: Rio Tinto's long-term sustainability goals were redefined to incorporate more stringent environmental and social targets.

- Impact on Brand Reputation: The campaign ultimately led to a heightened focus on Rio Tinto’s corporate social responsibility, potentially improving its brand reputation in the long run.

- Changes in Investor Relations Strategy: Rio Tinto likely adjusted its investor relations strategy to proactively engage with shareholders and address ESG concerns more effectively.

3. Conclusion

The activist investor campaign against Rio Tinto serves as a significant case study illustrating the increasing influence of ESG concerns and shareholder activism within the mining industry. While the campaign initially created short-term market volatility and pressure on the company, Rio Tinto's strategic response, encompassing both defensive and proactive measures, ultimately mitigated the negative impacts and strengthened its long-term sustainability trajectory. The company's willingness to engage and adapt demonstrates a vital lesson for other companies in the sector. Understanding how companies like Rio Tinto navigate activist investor campaigns is crucial for investors and stakeholders alike. Further research into the intersection of shareholder activism and responsible mining practices is essential for navigating the evolving landscape of corporate social responsibility.

Featured Posts

-

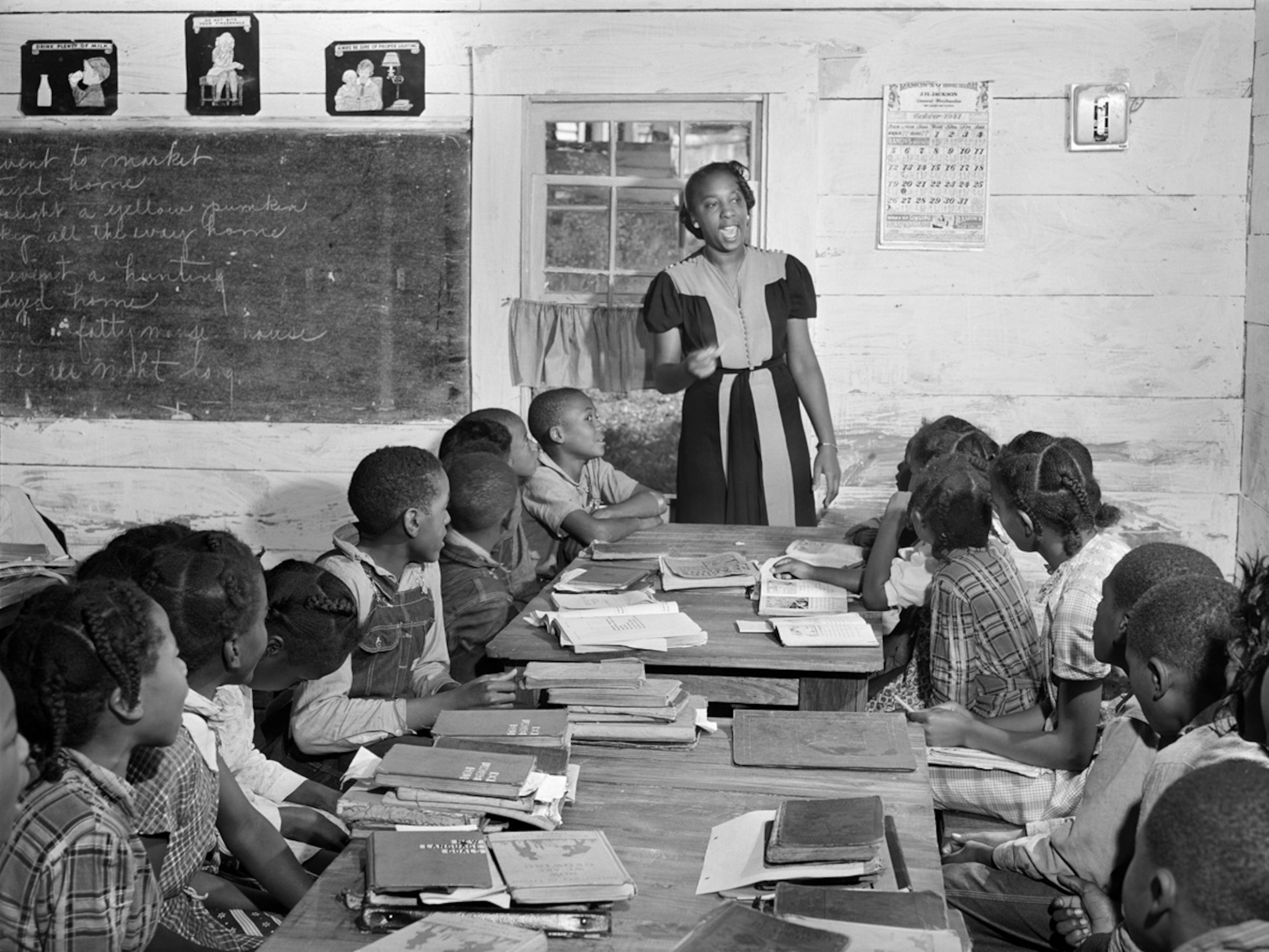

Justice Department Ends School Desegregation Order What This Means For Schools

May 02, 2025

Justice Department Ends School Desegregation Order What This Means For Schools

May 02, 2025 -

Eskort V Moskve Pochemu Kladovki Stali Novym Domom

May 02, 2025

Eskort V Moskve Pochemu Kladovki Stali Novym Domom

May 02, 2025 -

Merrie Monarch Festival A Showcase Of Pacific Island Cultures

May 02, 2025

Merrie Monarch Festival A Showcase Of Pacific Island Cultures

May 02, 2025 -

400 Xrp Increase Is This Rally Sustainable Investment Implications

May 02, 2025

400 Xrp Increase Is This Rally Sustainable Investment Implications

May 02, 2025 -

Would You Wear A Smart Ring To Prove Your Fidelity

May 02, 2025

Would You Wear A Smart Ring To Prove Your Fidelity

May 02, 2025

Latest Posts

-

Bbc Announces New Show Starring Daisy May And Charlie Cooper

May 02, 2025

Bbc Announces New Show Starring Daisy May And Charlie Cooper

May 02, 2025 -

Celebrity Traitors Two Stars Departure Shakes Up Bbc Show

May 02, 2025

Celebrity Traitors Two Stars Departure Shakes Up Bbc Show

May 02, 2025 -

Unexpected Exits Two Stars Leave Celebrity Traitors Uk

May 02, 2025

Unexpected Exits Two Stars Leave Celebrity Traitors Uk

May 02, 2025 -

After Celeb Traitors Daisy May And Charlie Coopers Next Tv Venture

May 02, 2025

After Celeb Traitors Daisy May And Charlie Coopers Next Tv Venture

May 02, 2025 -

Bbc Faces Celebrity Traitors Fallout As Stars Exit

May 02, 2025

Bbc Faces Celebrity Traitors Fallout As Stars Exit

May 02, 2025