Riot Platforms (RIOT) And Coinbase (COIN): A Comparative Stock Analysis

Table of Contents

Business Model Comparison: Riot Platforms (RIOT) vs. Coinbase (COIN)

Riot Platforms (RIOT): Bitcoin Mining Operations

Riot Platforms' business model centers on Bitcoin mining. They utilize sophisticated mining hardware to solve complex cryptographic problems, earning Bitcoin as a reward. This process, however, is energy-intensive, making electricity costs a major factor in their profitability. The difficulty of mining Bitcoin also plays a significant role, as it constantly adjusts based on the overall network's hash rate.

- Factors influencing RIOT's profitability:

- Bitcoin price volatility: The price of Bitcoin directly impacts the value of Riot's mined Bitcoin. A price surge translates to increased profits, while a downturn can severely impact revenue.

- Energy costs: Electricity expenses are a substantial operational cost. Fluctuations in energy prices directly affect Riot's profitability margins.

- Mining efficiency: The efficiency of Riot's mining hardware, including its hash rate and power consumption, determines its competitive edge in the Bitcoin mining landscape. Upgrades and technological advancements are critical for maintaining profitability.

- Mining difficulty: As more miners join the Bitcoin network, the difficulty of mining increases, making it harder to generate Bitcoin and potentially impacting profitability.

Coinbase (COIN): Cryptocurrency Exchange Platform

Coinbase operates as a cryptocurrency exchange, facilitating the buying, selling, and trading of various cryptocurrencies. Its revenue streams are primarily derived from trading fees, custody services (secure storage of crypto assets), and institutional client services. The regulatory environment significantly impacts Coinbase's operations, affecting its ability to expand its services and attract new clients.

- Factors influencing COIN's profitability:

- Trading volume: Higher trading volume directly translates to increased trading fees and revenue for Coinbase. Market conditions and investor sentiment strongly influence trading volume.

- Transaction fees: The fees charged on transactions are a key revenue generator. Coinbase's pricing strategy and competitive landscape influence its ability to set optimal fee levels.

- Regulatory compliance: Navigating the evolving regulatory landscape for cryptocurrencies is crucial for Coinbase's operational stability and growth. Stricter regulations can limit its business activities and increase compliance costs.

- Institutional investors: Coinbase actively targets institutional investors, offering them specialized services and potentially generating significant revenue streams.

Financial Performance and Valuation

Revenue and Profitability Analysis

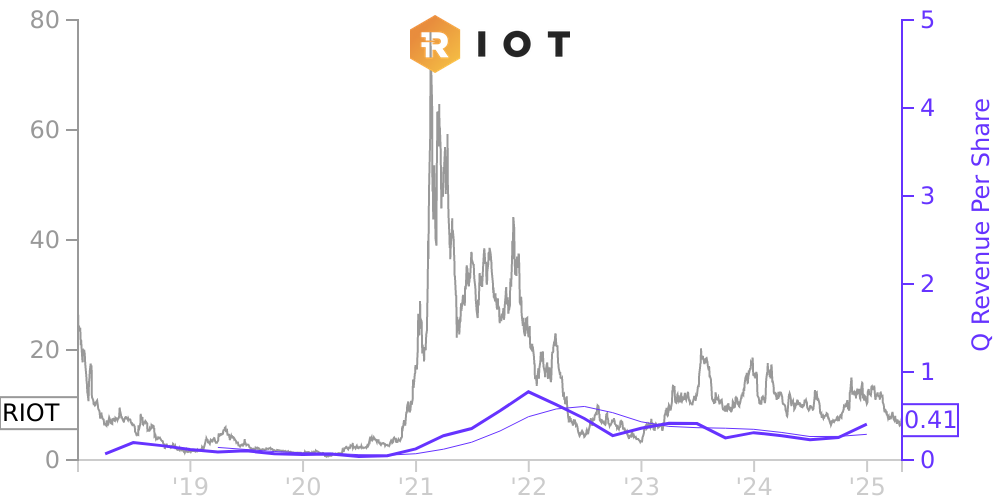

Comparing the revenue and profitability of RIOT and COIN requires analyzing their financial statements. While RIOT's revenue is directly tied to Bitcoin mining and its price, COIN's revenue is more diverse, reflecting its multifaceted exchange platform. Charts and graphs comparing revenue growth, profit margins, and earnings per share (EPS) would provide a clearer picture of their financial performance over time. (Note: This section would ideally include visual representations of financial data for a more comprehensive analysis.)

Valuation Metrics and Comparison

Key valuation metrics such as the Price-to-Earnings ratio (P/E), market capitalization, and price-to-sales ratio can offer insights into the relative valuations of RIOT and COIN. Comparing these metrics allows investors to gauge whether either stock is overvalued or undervalued relative to its peers and future prospects. More sophisticated valuation techniques, such as discounted cash flow (DCF) analysis, could provide further insights into their intrinsic value.

Risk Assessment and Investment Considerations

Risks Associated with Riot Platforms (RIOT)

- Bitcoin price volatility: The price of Bitcoin significantly impacts Riot's profitability. A sharp decline in Bitcoin's price can lead to substantial losses.

- Regulatory uncertainty: Changes in regulations concerning cryptocurrency mining could negatively affect Riot's operations.

- Energy price fluctuations: High and volatile energy prices directly impact the cost of Bitcoin mining, potentially squeezing profit margins.

- Mining hardware obsolescence: The rapid technological advancements in mining hardware mean that Riot's investments could become obsolete quickly, leading to potential write-downs.

Risks Associated with Coinbase (COIN)

- Regulatory scrutiny: Coinbase operates in a heavily regulated industry, and changes in regulations could significantly impact its business model.

- Cybersecurity risks: As a cryptocurrency exchange, Coinbase is a target for hackers. A successful security breach could lead to substantial financial losses and reputational damage.

- Competition: The cryptocurrency exchange market is highly competitive, with new entrants and established players vying for market share.

- Market manipulation: The cryptocurrency market is susceptible to manipulation, which can negatively affect Coinbase's operations and profitability.

- Liquidity risks: Sudden changes in market sentiment can lead to liquidity issues, making it difficult for Coinbase to meet its obligations.

Diversification and Portfolio Allocation

Diversification is crucial for any investment portfolio. Including both RIOT and COIN might not be ideal for a diversified portfolio, as both are heavily exposed to the cryptocurrency market. Investors should consider their risk tolerance and overall investment strategy before including either stock in their portfolio.

Conclusion: Making Informed Decisions on Riot Platforms (RIOT) and Coinbase (COIN)

Riot Platforms and Coinbase represent two distinct approaches to investing in the cryptocurrency market. RIOT's business model relies heavily on Bitcoin mining and its inherent volatility, while COIN offers exposure to the broader cryptocurrency ecosystem through its exchange platform. Both companies face unique risks and challenges. This comparative stock analysis highlights the need for thorough due diligence before investing in either company. Remember to conduct further research, assess your risk tolerance, and consult with a financial advisor before making any investment decisions related to Riot Platforms (RIOT) and Coinbase (COIN) stocks. A deeper dive into individual financial reports and expert stock analysis will further aid your decision-making process.

Featured Posts

-

Reform Uks Peril Five Factors Threatening Its Success

May 03, 2025

Reform Uks Peril Five Factors Threatening Its Success

May 03, 2025 -

Riot Stock Price Falls Understanding The Recent Decline Riot

May 03, 2025

Riot Stock Price Falls Understanding The Recent Decline Riot

May 03, 2025 -

Fortnite Cosmetic Changes Refund Indicates Policy Shift

May 03, 2025

Fortnite Cosmetic Changes Refund Indicates Policy Shift

May 03, 2025 -

Farage Faces Backlash From Teaching Union Over Far Right Claim

May 03, 2025

Farage Faces Backlash From Teaching Union Over Far Right Claim

May 03, 2025 -

Wsayl Alielam Alerbyt Tudyn Alhjwm Alisrayyly Ela Alqaflt Alinsanyt Fy Almtwst

May 03, 2025

Wsayl Alielam Alerbyt Tudyn Alhjwm Alisrayyly Ela Alqaflt Alinsanyt Fy Almtwst

May 03, 2025