Rising Costs Jeopardize Offshore Wind Farm Investments

Table of Contents

Soaring Inflation and Material Costs

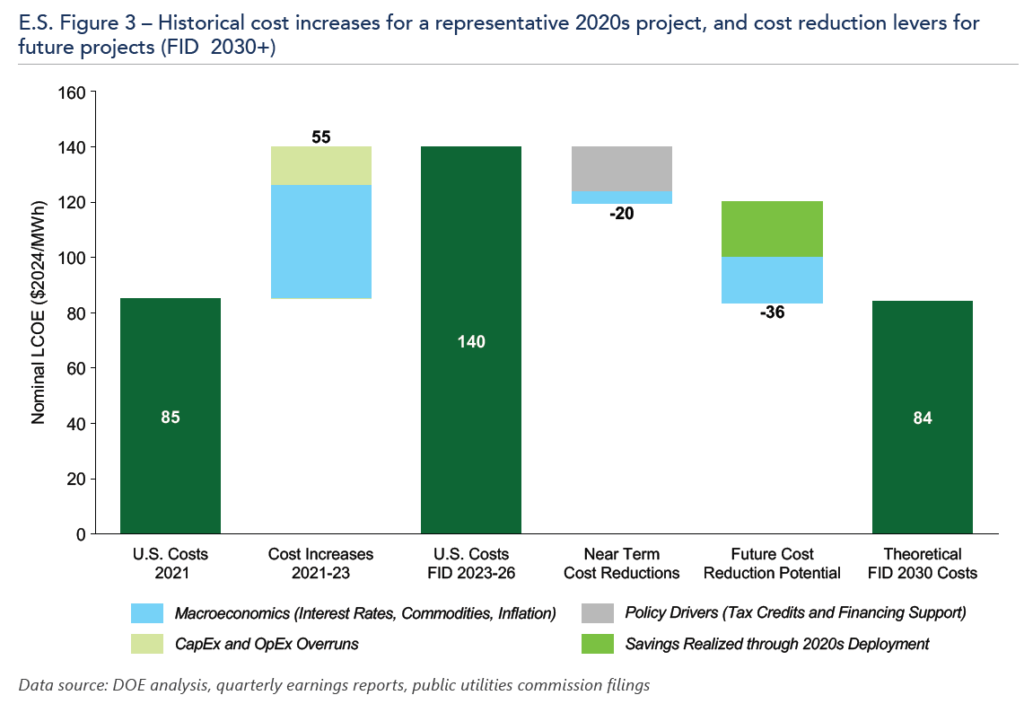

The surge in inflation has significantly impacted the cost of developing offshore wind farms. This increase affects virtually every aspect of project development, from the initial capital expenditure (CAPEX) to ongoing operating expenditure (OPEX).

Inflation's Impact on Wind Turbine Components

Inflation's effect on raw materials is particularly acute. The construction of wind turbines relies heavily on steel, concrete, copper, and various rare earth elements. The price increases in these materials have been substantial over the past few years.

- Steel: Prices have increased by an estimated 30-50% in some regions since 2020, driven by increased demand and supply chain disruptions.

- Concrete: The cost of cement and aggregates, essential components of wind turbine foundations, has also risen significantly due to energy price increases and transportation costs.

- Copper: Essential for electrical wiring and other components, copper prices have fluctuated wildly, impacting the overall cost of wind turbine manufacturing.

Geopolitical instability and ongoing supply chain disruptions further exacerbate the situation. The war in Ukraine, for instance, has severely impacted the availability and cost of several key materials, creating uncertainty and further price volatility.

Increased Transportation and Logistics Expenses

The sheer size and weight of wind turbine components necessitate specialized transportation methods, significantly increasing logistics expenses. This has been dramatically impacted by the surge in fuel prices.

- Shipping Costs: The cost of transporting massive wind turbine blades and nacelles to offshore installation sites has increased exponentially, often exceeding 50% in some cases.

- Specialized Vessels: The limited availability of heavy-lift vessels and specialized installation equipment further drives up costs and creates scheduling challenges.

- Port Congestion: Delays at ports due to congestion add additional costs and extend project timelines, potentially impacting the overall project profitability.

Supply Chain Bottlenecks and Delays

Beyond material costs, significant supply chain bottlenecks and delays are hindering offshore wind farm development and escalating project costs.

Shortage of Skilled Labor and Specialized Equipment

The construction and maintenance of offshore wind farms require a highly skilled workforce and specialized equipment. A shortage of both is driving up costs and delaying projects.

- Labor Shortages: The lack of trained technicians, engineers, and skilled laborers drives up wages and extends project timelines, pushing up labor costs.

- Specialized Vessels: The limited number of specialized installation vessels capable of deploying large wind turbines in deep waters causes significant scheduling bottlenecks and increased charter rates.

Manufacturing Capacity Constraints

The current manufacturing capacity for wind turbines and related components is struggling to keep pace with the rapidly growing demand for offshore wind energy. This constraint leads to longer lead times and increased costs.

- Scaling Challenges: Scaling up manufacturing to meet the projected growth in offshore wind capacity presents considerable challenges, including securing funding, skilled labor, and the necessary infrastructure.

- Geopolitical Factors: Factory closures, supply chain disruptions, and geopolitical instability further constrain manufacturing capacity and add to the uncertainty surrounding project delivery and costs.

Rising Interest Rates and Financing Challenges

The increase in interest rates presents another significant obstacle to offshore wind farm investment. Securing project financing has become considerably more expensive, impacting the overall financial viability of projects.

Increased Project Financing Costs

Higher interest rates translate directly into increased debt servicing costs for project developers. This reduced profitability makes it more difficult to secure necessary financing for new projects.

- Debt Servicing Costs: The higher interest payments reduce the project's internal rate of return (IRR) and make it less attractive to investors.

- Return on Investment (ROI): The increase in financing costs directly impacts the overall return on investment for investors, potentially deterring participation in future projects.

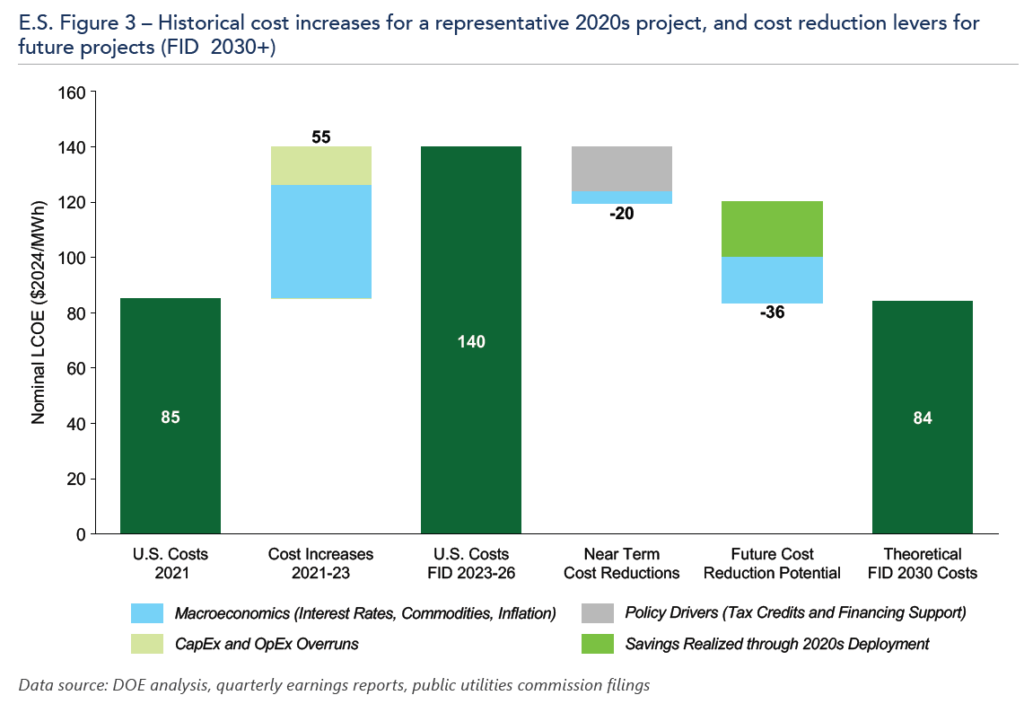

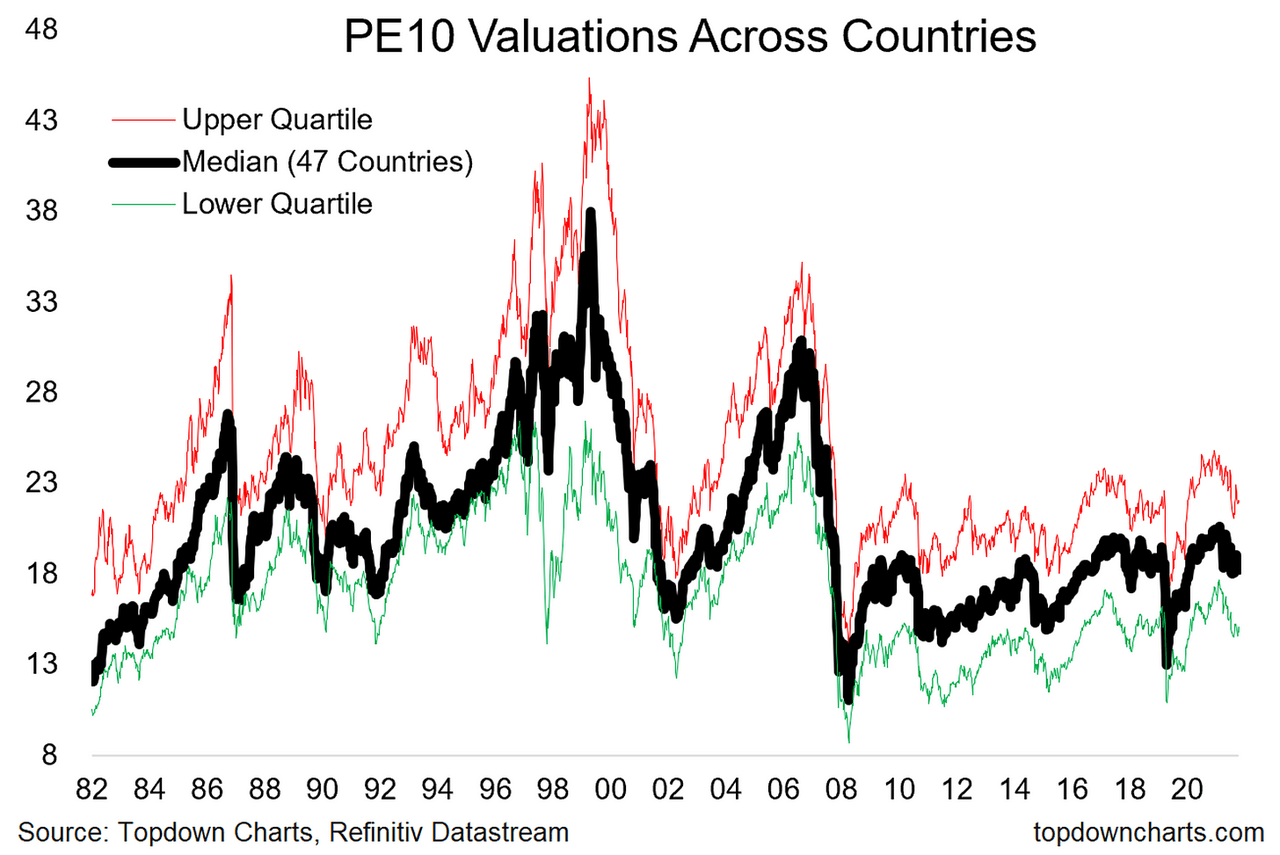

Reduced Investor Confidence

Rising costs and uncertainty are causing a decline in investor confidence in the offshore wind sector. This reduced investor confidence translates into a greater challenge in securing the significant capital needed for these large-scale projects.

- Project Cancellations: Some projects are being cancelled or delayed due to the inability to secure financing at acceptable rates.

- Government Subsidies: While government subsidies and incentives play a critical role, they might not be sufficient to completely offset the impact of sharply rising costs.

Conclusion

The escalating costs associated with offshore wind farm development are presenting a significant challenge to the global transition to renewable energy. Inflation, supply chain issues, and higher interest rates are all contributing factors that jeopardize the financial viability of numerous projects. Addressing these rising costs is crucial for the continued growth of the offshore wind industry. Governments, investors, and developers need to collaborate to find innovative solutions and mitigate the risks associated with rising costs in offshore wind farm investments. This requires a multifaceted approach including improved supply chain management, investment in skilled labor, and the exploration of alternative financing models. Only then can we ensure the successful deployment of this critical renewable energy source and continue the vital transition to a cleaner energy future.

Featured Posts

-

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 04, 2025

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 04, 2025 -

High Stock Market Valuations A Bof A Analysts Take

May 04, 2025

High Stock Market Valuations A Bof A Analysts Take

May 04, 2025 -

Narco Submarines And Potent Cocaine Driving Forces Behind A Global Crisis

May 04, 2025

Narco Submarines And Potent Cocaine Driving Forces Behind A Global Crisis

May 04, 2025 -

Faa Staff Walkout Major United Airlines Flight Cancellations At Newark

May 04, 2025

Faa Staff Walkout Major United Airlines Flight Cancellations At Newark

May 04, 2025 -

Nigel Farages Shrewsbury Visit Flat Cap G And T And Attack On Conservative Road Plans

May 04, 2025

Nigel Farages Shrewsbury Visit Flat Cap G And T And Attack On Conservative Road Plans

May 04, 2025

Latest Posts

-

The Domenicali Effect How Formula 1 Achieved Global Domination

May 04, 2025

The Domenicali Effect How Formula 1 Achieved Global Domination

May 04, 2025 -

Formula 1s Everywhere Stefano Domenicalis Vision And Its Results

May 04, 2025

Formula 1s Everywhere Stefano Domenicalis Vision And Its Results

May 04, 2025 -

Analyzing The Grand Theft Auto Vi Trailer New Insights

May 04, 2025

Analyzing The Grand Theft Auto Vi Trailer New Insights

May 04, 2025 -

Palestinian American Family Hate Crime 53 Year Sentence Imposed

May 04, 2025

Palestinian American Family Hate Crime 53 Year Sentence Imposed

May 04, 2025 -

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 04, 2025

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 04, 2025