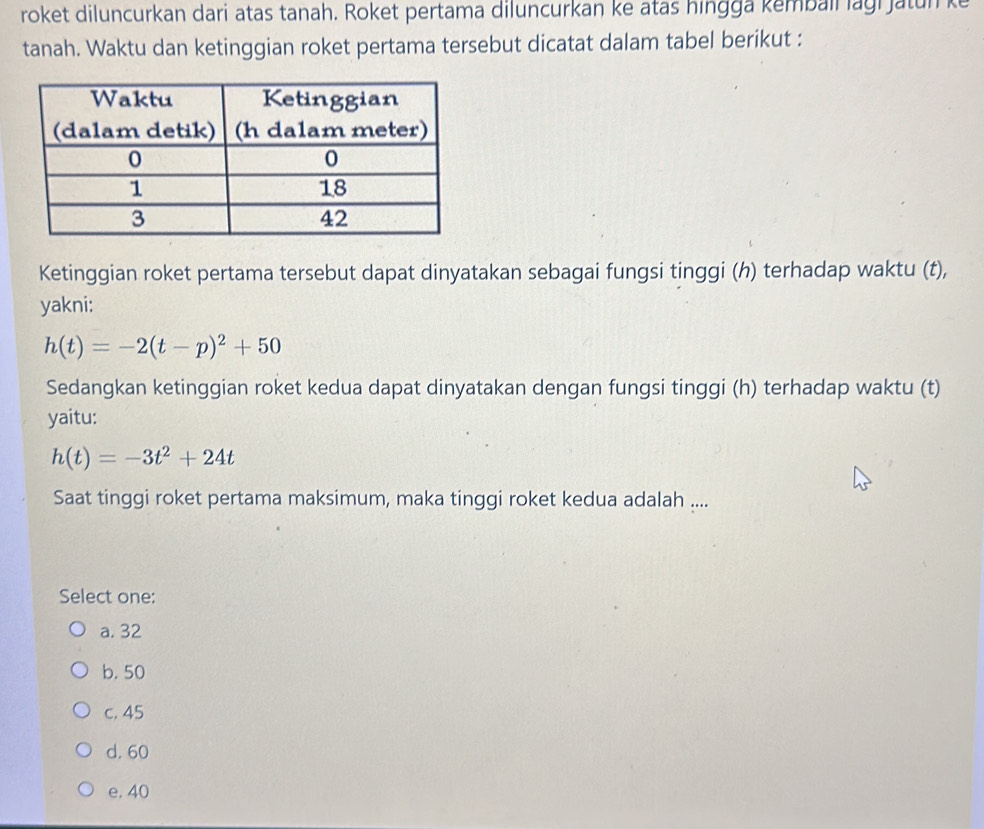

Saudi Arabia Investment Push: Deutsche Bank's Global Strategy

Table of Contents

Vision 2030: The Catalyst for Investment

Saudi Arabia's Vision 2030 is a transformative economic and social reform plan aimed at diversifying the Kingdom's economy away from its reliance on oil. This ambitious initiative is attracting substantial foreign investment and reshaping Saudi Arabia into a global investment powerhouse. The plan's impact on attracting foreign investment is undeniable, fueled by several key pillars:

-

Diversification away from oil dependence: Vision 2030 prioritizes developing non-oil sectors, creating a more resilient and sustainable economy. This diversification strategy is attracting investors seeking less volatile markets. Saudi Arabia economic diversification is a key element of Vision 2030’s success.

-

Infrastructure development projects (Neom, Red Sea Project): Mega-projects like Neom, a futuristic city, and the Red Sea Project, a luxury tourism development, represent massive investment opportunities. These projects require significant capital investment, creating lucrative opportunities for international firms like Deutsche Bank. Neom investment alone is projected to attract hundreds of billions of dollars.

-

Focus on technology, renewable energy, and tourism: Vision 2030 identifies technology, renewable energy, and tourism as key growth sectors. This strategic focus aligns with global investment trends, further enhancing Saudi Arabia's attractiveness to international investors. Vision 2030 investment opportunities abound in these high-growth sectors.

-

Increased privatization and public-private partnerships (PPPs): The Saudi government is actively promoting privatization and PPPs, creating opportunities for private sector participation in various sectors. This approach allows foreign investors to collaborate with the government on major projects, mitigating some of the inherent risks.

These factors contribute to making Saudi Arabia an attractive investment destination. Recent projections indicate a significant increase in GDP growth and foreign direct investment (FDI) inflows in the coming years, further solidifying the Kingdom's position as a global investment hub.

Deutsche Bank's Strategic Objectives in Saudi Arabia

Deutsche Bank's strategic objectives in Saudi Arabia are multifaceted and aligned with the opportunities presented by Vision 2030. The bank aims to establish a strong foothold in the Kingdom's rapidly expanding financial sector, achieving several key goals:

-

Gaining market share in the rapidly expanding Saudi financial sector: This involves offering a comprehensive range of financial services to cater to the growing demands of Saudi businesses and individuals.

-

Providing financial services to Saudi Arabian businesses and government entities: Deutsche Bank aims to become a key financial partner for both the private and public sectors, participating in major projects and providing crucial financial support.

-

Participation in infrastructure projects financing: The bank is actively seeking to finance major infrastructure projects, leveraging its expertise in project finance to support the development of Vision 2030 initiatives.

-

Leveraging its global expertise in areas like wealth management and investment banking: Deutsche Bank intends to utilize its global expertise to provide sophisticated financial solutions to high-net-worth individuals and large corporations in Saudi Arabia. Wealth management Saudi Arabia is a significant target market.

The potential benefits for Deutsche Bank are substantial, including increased revenue streams, enhanced global standing, and the opportunity to play a significant role in shaping the future of the Saudi Arabian economy. The bank's Deutsche Bank Saudi Arabia strategy positions it for substantial growth. Global investment banking Saudi Arabia is a key focus area for this strategy.

Challenges and Risks Associated with the Investment Push

While the opportunities are significant, Deutsche Bank faces several challenges and risks in its Saudi Arabia investment push:

-

Geopolitical risks and regional instability: The geopolitical landscape in the Middle East presents inherent risks that could impact investment returns. Geopolitical risk Saudi Arabia is a factor that requires careful consideration.

-

Regulatory hurdles and compliance requirements: Navigating the regulatory landscape and ensuring compliance with local regulations is crucial for success. Regulatory compliance Saudi Arabia demands meticulous attention to detail.

-

Competition from other international banks already established in the region: Deutsche Bank faces competition from established international banks with existing operations in Saudi Arabia.

-

Potential volatility in the global and Saudi Arabian economies: Global economic fluctuations and potential volatility within the Saudi Arabian economy could affect investment performance.

To mitigate these risks, Deutsche Bank will likely employ a range of strategies, including thorough due diligence, robust risk management systems, and close collaboration with local partners.

Opportunities in Specific Sectors (Optional)

Deutsche Bank is likely to focus its efforts on specific sectors aligning with Vision 2030's priorities. For example, the renewable energy investment Saudi Arabia sector offers immense potential, given the Kingdom's commitment to diversifying its energy mix. Similarly, the Saudi Arabia tech sector investment presents a significant opportunity, with the government actively promoting technological innovation. The tourism sector, particularly with projects like the Red Sea Project, also presents significant investment opportunities.

Conclusion

Deutsche Bank's investment push in Saudi Arabia, driven by the ambitious Vision 2030 plan, represents a significant strategic move. While challenges exist, the potential rewards – both financially and in terms of global market positioning – are substantial. The bank's success will depend on its ability to navigate the geopolitical landscape, meet regulatory requirements, and effectively compete in a dynamic market.

Call to Action: Learn more about Deutsche Bank's global investment strategy and the exciting opportunities emerging from the Saudi Arabia investment push. Stay informed about the latest developments in this rapidly evolving market and explore the potential for participation in the Kingdom's economic transformation. Understanding the Saudi Arabia investment push is key to navigating the future of global finance.

Featured Posts

-

Tiga Jet Ski Premium Kawasaki Resmi Diluncurkan Kemewahan Di Atas Air

May 30, 2025

Tiga Jet Ski Premium Kawasaki Resmi Diluncurkan Kemewahan Di Atas Air

May 30, 2025 -

Jet Ski Kawasaki Premium Tiga Model Baru Untuk Pecinta Personal Watercraft

May 30, 2025

Jet Ski Kawasaki Premium Tiga Model Baru Untuk Pecinta Personal Watercraft

May 30, 2025 -

Measles Detected In Sacramento County Wastewater What You Need To Know

May 30, 2025

Measles Detected In Sacramento County Wastewater What You Need To Know

May 30, 2025 -

Emission Europe 1 Soir Week End Aurelien Veron Et Laurent Jacobelli

May 30, 2025

Emission Europe 1 Soir Week End Aurelien Veron Et Laurent Jacobelli

May 30, 2025 -

Monte Carlo Masters Alcaraz Secures Sixth Masters 1000 Crown

May 30, 2025

Monte Carlo Masters Alcaraz Secures Sixth Masters 1000 Crown

May 30, 2025