Schroders Q1 Losses: Clients Withdraw Amid Stock Market Uncertainty

Table of Contents

Significant Client Withdrawals: A Key Driver of Q1 Losses

Schroders' Q1 losses were significantly impacted by substantial client redemptions, resulting in considerable net outflows. While the exact figures may vary depending on the final reporting, initial indications point to a considerable drop in assets under management (AUM). This highlights a shift in investor sentiment, characterized by increased risk aversion in the face of market downturn. Several factors contributed to this exodus:

- Increased market volatility and investor concerns about future returns: The fluctuating equity markets and unpredictable economic landscape fueled investor anxieties about future returns, prompting many to seek safer havens for their investments.

- Shifting investor preferences towards alternative asset classes: Some investors shifted their portfolios away from traditional equities and bonds, opting for alternative investments perceived as less vulnerable to market volatility. This includes a surge in interest in private equity, real estate, and infrastructure.

- Concerns about specific Schroders fund performance: While Schroders boasts a strong track record, specific fund underperformance in the volatile Q1 market may have contributed to some client redemptions.

- Impact of geopolitical uncertainty and economic slowdown: Geopolitical tensions and concerns about a potential global economic slowdown further exacerbated investor uncertainty, triggering a wave of risk aversion and prompting withdrawals.

Bullet points summarizing key reasons for client withdrawals:

- Heightened market volatility

- Shifting investor preferences

- Concerns about specific fund performance

- Geopolitical and economic uncertainty

Impact of Stock Market Uncertainty on Schroders' Performance

The pervasive stock market uncertainty directly impacted Schroders' portfolio performance across various asset classes. The volatility in equity markets, particularly in the technology sector, negatively affected the performance of Schroders' equity funds. Similarly, fluctuations in bond yields impacted the returns of their fixed-income offerings. While alternative investments may have offered some resilience, the overall market climate significantly dampened Schroders' Q1 results. Schroders' investment strategies, while generally considered robust, were not immune to the unprecedented volatility. Their risk management approach, though designed to mitigate losses, faced considerable challenges in navigating such unpredictable market conditions.

Bullet points listing key market factors negatively impacting Schroders' performance:

- Equity market volatility

- Fluctuating bond yields

- Uncertainty in alternative investment markets

- Geopolitical risks

Schroders' Response to Q1 Losses and Future Outlook

In response to the Q1 losses, Schroders has initiated several strategic initiatives to address the challenges and regain investor confidence. These actions likely include cost-cutting measures to enhance efficiency and profitability, as well as a renewed focus on attracting new clients and bolstering existing relationships. The company may also be exploring new product launches tailored to the evolving demands of investors in this uncertain market. While the specific details of their future plans remain to be fully unveiled, Schroders' commitment to adapting to the changing market landscape is crucial for future growth.

Bullet points summarizing Schroders' key actions and plans:

- Cost-cutting measures

- Client relationship enhancement

- Potential new product launches

- Adapting investment strategies to market volatility

Analyzing the Broader Implications for the Asset Management Industry

Schroders' Q1 losses are not isolated incidents. They reflect broader industry trends and the impact of increased market volatility on the asset management landscape. The competitive landscape is becoming increasingly intense, with firms vying for investor attention and assets. This period of uncertainty is likely to lead to further market consolidation, with larger firms potentially acquiring smaller ones to enhance their market share and resilience. The changing behavior of investors, particularly their heightened risk aversion, necessitates a more agile and adaptable approach from asset management firms. Furthermore, regulatory changes may also play a role in shaping the industry's future trajectory.

Conclusion

Schroders' substantial Q1 losses, primarily attributable to significant client withdrawals amidst widespread stock market uncertainty, highlight the challenges facing the asset management industry. The company's response, along with the broader implications for the sector, underscore the need for adaptive strategies in a volatile market. The shifting investor landscape demands a proactive approach from asset managers.

Call to Action: Stay informed on the evolving situation with Schroders and the wider impact of stock market uncertainty on your investments. Follow our updates for further analysis of Schroders' Q1 losses and the ongoing challenges in the asset management sector. Understanding these factors is crucial for navigating the complexities of the market and making informed investment decisions.

Featured Posts

-

Andrew Goldstone Joins Milk And Honey As Head Of Electronic

May 02, 2025

Andrew Goldstone Joins Milk And Honey As Head Of Electronic

May 02, 2025 -

Christina Aguilera Fan Faces Backlash After Inappropriate Kiss

May 02, 2025

Christina Aguilera Fan Faces Backlash After Inappropriate Kiss

May 02, 2025 -

Strengthening Productivity The Importance Of Robust Mental Health Policies

May 02, 2025

Strengthening Productivity The Importance Of Robust Mental Health Policies

May 02, 2025 -

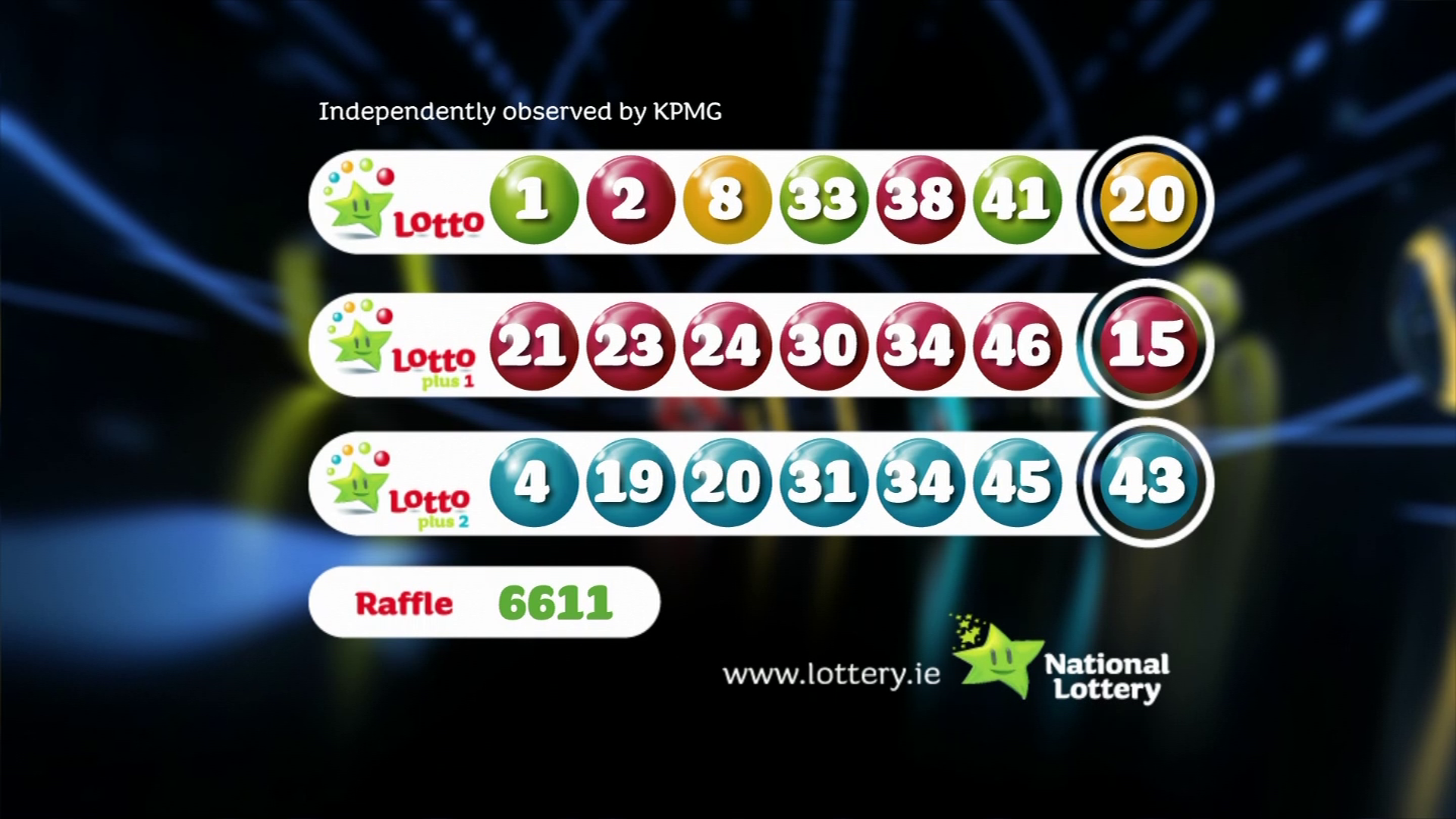

Saturday April 12th Lotto Winning Numbers Announced

May 02, 2025

Saturday April 12th Lotto Winning Numbers Announced

May 02, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 02, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 02, 2025