Secure The Lowest Personal Loan Interest Rate Today

Table of Contents

Understanding Your Credit Score and its Impact

Your credit score is the cornerstone of securing a low personal loan interest rate. Lenders use your credit score—a three-digit number that summarizes your creditworthiness—to assess the risk of lending you money. A higher credit score signals lower risk, resulting in more favorable interest rates. Conversely, a lower credit score often leads to higher interest rates or even loan rejection.

- How to check your credit report: You're entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Checking your report regularly allows you to identify and correct any errors.

- Improving your credit score:

- Pay all bills on time. This is the single most important factor influencing your credit score.

- Keep your credit utilization low (ideally below 30%). Credit utilization refers to the amount of credit you're using compared to your total available credit.

- Maintain a diverse mix of credit accounts (credit cards, installment loans).

- Avoid opening multiple new accounts in a short period.

- Dispute any inaccuracies on your credit report promptly.

- Impact of credit score ranges on interest rates: Generally, a FICO score of 700 or higher qualifies you for the best personal loan rates. Scores below 670 may result in significantly higher interest rates, while scores below 600 could make it difficult to secure a loan at all. Understanding your credit score and its impact on your personal loan interest rate is the first step in securing a great deal.

Shopping Around for the Best Personal Loan Rates

Don't settle for the first offer you receive! Shopping around and comparing offers from multiple lenders is essential for securing the lowest personal loan interest rate. Different lenders have different criteria and interest rate structures.

- Types of lenders:

- Banks: Traditional banks often offer competitive rates, especially for borrowers with excellent credit.

- Credit Unions: Credit unions are member-owned financial institutions that frequently offer lower rates than banks, particularly to their members.

- Online Lenders: Online lenders are becoming increasingly popular, often offering convenient applications and potentially competitive rates.

- Key factors to compare:

- Annual Percentage Rate (APR): The APR represents the total cost of borrowing, including the interest rate and any fees. Focus on comparing APRs rather than just interest rates.

- Fees: Pay close attention to origination fees, prepayment penalties, and late payment fees. These can significantly impact the overall cost.

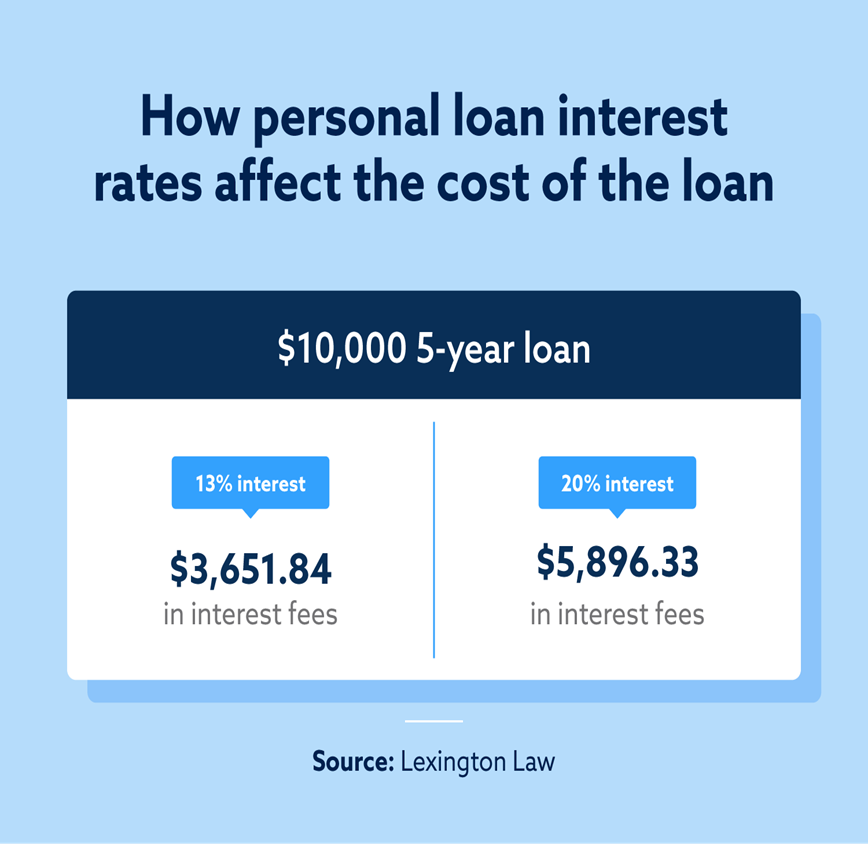

- Loan Terms: Consider the loan term (length of the loan) and its impact on your monthly payment and total interest paid.

- Pre-qualification: Pre-qualifying for a loan allows you to get an estimate of the interest rate you might qualify for without impacting your credit score significantly. This gives you a better idea of what to expect before formally applying.

Negotiating a Lower Personal Loan Interest Rate

Once you’ve found a lender you like, don't be afraid to negotiate! A strong financial history and a high credit score are excellent bargaining chips.

- Strategies for negotiating:

- Highlight your strong financial history: Emphasize your consistent on-time payments, low credit utilization, and long credit history.

- Research competitor offers: Show the lender that you've shopped around and received other offers with lower rates.

- Be polite and professional: Maintain a respectful tone throughout the negotiation process.

- Consider a co-signer: A co-signer with excellent credit can significantly improve your chances of securing a lower interest rate.

- Remember, even a small reduction in your personal loan interest rate can save you considerable money over the life of the loan. Effective negotiation can be the key to unlocking the best personal loan rates.

Hidden Fees and Charges to Watch Out For

Many personal loans come with hidden fees that can dramatically increase the overall cost. Be sure to thoroughly review the loan agreement to avoid unexpected charges.

- Common hidden fees:

- Origination fees: A fee charged by the lender for processing your loan application.

- Prepayment penalties: A fee charged if you pay off your loan early.

- Late payment fees: Fees assessed if you miss a payment.

- Strategies to avoid hidden fees:

- Read the fine print carefully: Don’t skip over the terms and conditions.

- Ask questions: If anything is unclear, ask the lender for clarification.

- Compare fees across lenders: Some lenders may have lower fees than others.

Choosing the Right Loan Term for Your Needs

The loan term—the length of time you have to repay the loan—significantly impacts your monthly payment and the total interest you pay.

- Loan term and interest rates: Longer loan terms typically result in lower monthly payments but higher total interest costs. Shorter loan terms result in higher monthly payments but lower overall interest costs.

- Choosing the right term: Consider your financial goals and budget. If you can afford higher monthly payments, a shorter loan term will save you money in the long run. If you need lower monthly payments, a longer term might be more manageable, even if it means paying more interest overall.

Conclusion

Securing the lowest personal loan interest rate requires a multi-faceted approach. By checking your credit score, comparing offers from various lenders, negotiating effectively, and being aware of hidden fees, you can significantly reduce the overall cost of your loan. Don't settle for a high interest rate! Start securing the lowest personal loan interest rate today by using the tips outlined in this guide. Compare lenders, improve your credit score, and negotiate for the best possible terms. Find the perfect low interest personal loan for your financial needs and begin your journey towards financial success!

Featured Posts

-

Is Wes Andersons New Movie As Empty As Ai Generated Content

May 28, 2025

Is Wes Andersons New Movie As Empty As Ai Generated Content

May 28, 2025 -

Leeds United Transfer News Verbal Agreement Reached Players Stance Revealed

May 28, 2025

Leeds United Transfer News Verbal Agreement Reached Players Stance Revealed

May 28, 2025 -

Understanding Todays Personal Loan Interest Rates

May 28, 2025

Understanding Todays Personal Loan Interest Rates

May 28, 2025 -

Prakiraan Cuaca Jawa Barat 22 April Fokus Bandung Hujan Pukul 1

May 28, 2025

Prakiraan Cuaca Jawa Barat 22 April Fokus Bandung Hujan Pukul 1

May 28, 2025 -

Kanye Wests Wife Bianca Censori Shows Off Bra And Thong In New Look

May 28, 2025

Kanye Wests Wife Bianca Censori Shows Off Bra And Thong In New Look

May 28, 2025

Latest Posts

-

A69 Le Chantier Reprend Il Au Detriment De La Justice

May 30, 2025

A69 Le Chantier Reprend Il Au Detriment De La Justice

May 30, 2025 -

Controverse A69 Ministres Et Parlementaires Accuses De Contourner La Justice

May 30, 2025

Controverse A69 Ministres Et Parlementaires Accuses De Contourner La Justice

May 30, 2025 -

Autoroute A69 Un Contournement Judiciaire Pour La Relance Du Projet

May 30, 2025

Autoroute A69 Un Contournement Judiciaire Pour La Relance Du Projet

May 30, 2025 -

Bordeaux Les Opposants A La Piste Secondaire Appellent A La Mobilisation

May 30, 2025

Bordeaux Les Opposants A La Piste Secondaire Appellent A La Mobilisation

May 30, 2025 -

A69 La Justice Contournee Pour Relancer Le Projet Autoroutier

May 30, 2025

A69 La Justice Contournee Pour Relancer Le Projet Autoroutier

May 30, 2025