'Sell America' Returns: Moody's 5% 30-Year Yield And Market Implications

Table of Contents

The Resurgence of the "Sell America" Trade

The "Sell America" trade refers to a strategic investment approach where investors reduce their holdings of US assets in favor of assets in other countries. This strategy is driven by a belief that returns elsewhere will be more favorable, either due to higher growth potential or less risk. Historically, "Sell America" periods have been linked to various economic and geopolitical events, with mixed results. Some instances have proven lucrative, while others have resulted in significant losses.

Currently, several factors are fueling the renewed interest in this trade:

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs in the US, making US assets less attractive compared to markets with lower interest rates.

-

Geopolitical Uncertainties: Ongoing global conflicts and political instability in various regions are increasing risk aversion, pushing investors to seek safer havens or markets perceived as less vulnerable.

-

Concerns about US Debt: The rising US national debt and concerns about the country's long-term fiscal health are contributing to investor apprehension, potentially leading to capital flight.

-

Comparative Attractiveness of Other Markets: Emerging markets, particularly in Asia, are experiencing robust growth, presenting potentially higher returns for investors willing to take on greater risk.

Moody's 5% 30-Year Yield: A Catalyst for "Sell America"?

Moody's assigning a 5% yield to the 30-year Treasury bond is a significant development. This yield signifies the return an investor can expect over 30 years and reflects the current market assessment of risk and opportunity within US government bonds. Historically, such high yields on long-term Treasuries have been relatively rare. Comparing this yield to historical levels and yields on similar-maturity bonds in other developed economies is crucial to understanding its impact. A 5% yield might seem attractive in isolation, but it must be assessed against the potential for higher returns and lower risks in other markets.

The implications of this yield for investors are multifaceted:

-

Attractiveness of US Bonds Versus Other Assets: The 5% yield makes US Treasuries more competitive compared to some other fixed-income investments, potentially attracting capital from international investors. However, this must be weighed against the risks associated with holding US assets in a "Sell America" environment.

-

Impact on Long-Term Investment Strategies: Investors with long-term horizons might find the 5% yield appealing, but they must also consider the potential for inflation erosion and currency fluctuations.

-

Potential for Capital Flight: If investors perceive better opportunities elsewhere, the high yield might not be enough to offset the risks associated with holding US assets, leading to further capital flight.

Market Implications: Sectors and Asset Classes Affected

The potential impact of the "Sell America" trade and Moody's 5% 30-year yield is widespread, affecting various sectors and asset classes:

Sectors:

-

Technology Sector: The tech sector, often sensitive to interest rate changes, could experience a downturn as higher borrowing costs make expansion and innovation more challenging.

-

Real Estate Market: Higher interest rates tend to cool the real estate market, impacting both residential and commercial property values.

-

Manufacturing and Industrial Sectors: These sectors, dependent on investment and consumer spending, could feel the pinch from reduced economic activity.

Asset Classes:

-

US Equities: A "Sell America" trend might lead to a decline in US stock prices as investors shift their portfolios toward international markets.

-

US Dollar: Capital flight might weaken the US dollar relative to other currencies.

-

Emerging Market Assets: Emerging markets could experience increased capital inflows as investors seek higher returns and diversification.

Alternative Investment Strategies in the Face of "Sell America"

Given the potential downsides of a continued "Sell America" trend, investors need to consider hedging and diversification strategies:

-

Hedging Strategies: Strategies like currency hedging can help mitigate losses stemming from currency fluctuations.

-

Diversification Strategies: Diversifying investments across multiple geographies and asset classes is critical to reducing risk exposure.

-

Alternative Investment Opportunities:

- International Diversification: Investing in assets outside the US can reduce dependence on the US market's performance.

- Alternative Asset Classes: Consider investing in commodities, real estate, or other asset classes less correlated with US equities.

- Defensive Investment Strategies: Focus on investments that are relatively stable during times of economic uncertainty, such as high-quality bonds or dividend-paying stocks.

Conclusion: Navigating the "Sell America" Landscape

The resurgence of the "Sell America" trade, amplified by Moody's 5% 30-year yield, presents significant challenges and opportunities for investors. Understanding the nuances of the "Sell America" trade is crucial for making informed investment decisions. The impact will be felt across various sectors and asset classes, requiring careful analysis and adaptation of investment strategies. Don't miss out on navigating the "Sell America" market effectively. Conduct thorough research, consider diversifying your portfolio, and consult with a qualified financial advisor to develop a personalized plan that mitigates risk and capitalizes on emerging opportunities within this dynamic market environment.

Featured Posts

-

Nyt Mini Crossword Solution Marvel The Avengers Clue Explained

May 20, 2025

Nyt Mini Crossword Solution Marvel The Avengers Clue Explained

May 20, 2025 -

Why No Murder In Agatha Christies Towards Zero Episode 1

May 20, 2025

Why No Murder In Agatha Christies Towards Zero Episode 1

May 20, 2025 -

Suomi Vastustaja Huuhkajien Avauskokoonpano Paljastettu Naemae Muutokset Heraettaevaet Huomiota

May 20, 2025

Suomi Vastustaja Huuhkajien Avauskokoonpano Paljastettu Naemae Muutokset Heraettaevaet Huomiota

May 20, 2025 -

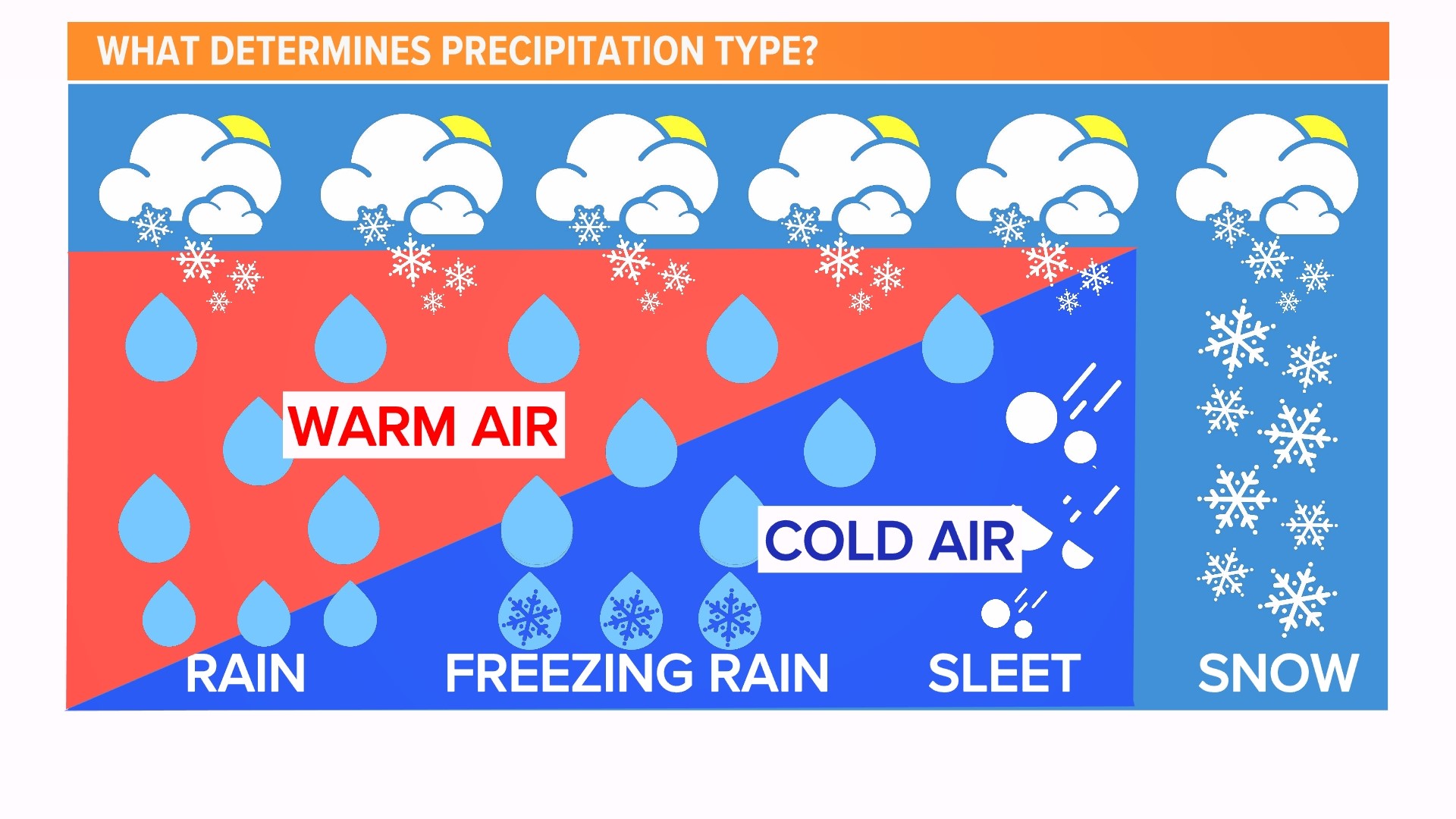

Understanding A Wintry Mix Rain Snow And Ice

May 20, 2025

Understanding A Wintry Mix Rain Snow And Ice

May 20, 2025 -

I Tzenifer Lorens Kai O Koyki Maroni Kalosorizoyn To Deytero Paidi Toys

May 20, 2025

I Tzenifer Lorens Kai O Koyki Maroni Kalosorizoyn To Deytero Paidi Toys

May 20, 2025