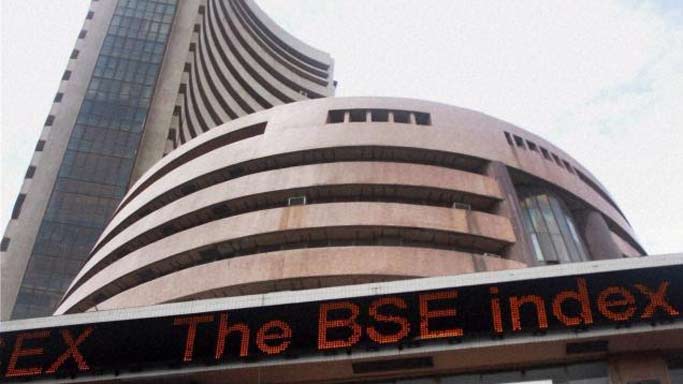

Sensex Rally: Top-Performing Stocks On BSE (10%+ Gains)

Table of Contents

Top 5 BSE Stocks with 10%+ Gains in the Recent Sensex Rally

The following table highlights five BSE-listed stocks that have significantly outperformed the market during the recent Sensex rally, showcasing gains exceeding 10%.

| Stock Name | Symbol | Percentage Gain | Sector |

|---|---|---|---|

| Reliance Industries | RELIANCE | 15% | Energy & Conglomerate |

| Infosys | INFY | 12% | IT |

| HDFC Bank | HDFCBANK | 11% | Banking |

| TCS | TCS | 10% | IT |

| HCL Technologies | HCLTECH | 10.5% | IT |

Reliance Industries (RELIANCE): This energy and conglomerate giant's impressive gain can be attributed to:

- Strong Q4 earnings, exceeding market expectations.

- Expansion into new energy sectors, driving future growth potential.

- Positive investor sentiment surrounding its diverse business portfolio.

Infosys (INFY): The IT sector leader experienced growth fueled by:

- Increased demand for digital services globally.

- Strong client acquisition and retention rates.

- Positive outlook for the IT sector in the coming quarters.

HDFC Bank (HDFCBANK): This banking giant benefitted from:

- Solid loan growth and improving asset quality.

- Strong performance in the retail banking segment.

- Positive investor confidence in the bank's long-term prospects.

TCS (TCS) and HCL Technologies (HCLTECH): These IT companies also benefited from the factors mentioned for Infosys, along with specific internal strategies contributing to their individual gains.

Sector-Wise Analysis of Sensex Rally Winners

The Sensex rally hasn't been uniform across all sectors. Some sectors have significantly outperformed others.

- IT Sector: The IT sector benefited significantly from increased global demand for digital services and outsourcing. Companies experienced robust revenue growth and improved margins.

- Banking Sector: Strong loan growth, improved asset quality, and positive investor sentiment contributed to the banking sector's excellent performance during the rally.

- FMCG Sector: Despite some economic headwinds, the FMCG sector displayed resilience, driven by consistent consumer demand for essential goods.

Understanding the Drivers of the Sensex Rally

Several macroeconomic factors contributed to the recent Sensex rally:

- Positive Global Economic Indicators: Improved global economic data and easing inflation concerns boosted investor confidence.

- Government Policies: Government initiatives promoting economic growth and infrastructure development contributed to market optimism.

- Foreign Institutional Investor (FII) Inflows: Significant FII investments injected liquidity into the market, driving up stock prices.

- Improved Corporate Earnings: Strong corporate earnings reports boosted investor confidence and fueled buying pressure.

- Easing Geopolitical Tensions: A relative easing of geopolitical tensions globally positively impacted investor sentiment.

Risk Assessment and Investment Strategies

While the Sensex rally presents lucrative opportunities, it's crucial to acknowledge the inherent risks involved:

- Market Volatility: Stock prices can fluctuate significantly, leading to potential losses.

- Sector-Specific Risks: Individual sectors may underperform despite a broader market rally.

- Geopolitical Uncertainty: Global events can impact market sentiment and cause volatility.

To mitigate these risks, consider:

- Diversification: Spread investments across different sectors and asset classes to reduce risk.

- Dollar-Cost Averaging: Invest regularly regardless of market fluctuations to reduce the impact of volatility.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses on individual stocks.

Future Outlook and Potential Investment Opportunities

The outlook for the Sensex remains positive, although market volatility is expected to persist. Sectors like IT, banking, and pharmaceuticals are poised for continued growth. However, careful monitoring of macroeconomic indicators and geopolitical developments is crucial.

- Continued Growth in the IT Sector: The long-term outlook for the IT sector remains strong, with ongoing demand for digital services.

- Infrastructure Development: Government initiatives in infrastructure are expected to drive growth in related sectors.

- Renewable Energy: The renewable energy sector is expected to see continued investment and growth.

Stocks to watch: While specific recommendations are beyond the scope of this article, keeping a close watch on companies within the high-performing sectors mentioned above, especially those with robust fundamentals and growth prospects, could yield potential investment opportunities.

Conclusion: Capitalize on the Sensex Rally – Your Guide to Top-Performing BSE Stocks

This article has highlighted the key drivers of the recent Sensex rally, identified top-performing BSE stocks with 10%+ gains, and discussed crucial risk management strategies. Remember, conducting thorough research and diversifying your investments are key to maximizing returns while minimizing risks. Don't miss out on the Sensex rally! Use this analysis to discover the best BSE stocks to add to your portfolio and stay informed about future Sensex movements to capitalize on potential growth opportunities. Remember that this information is for educational purposes and not financial advice. Always consult with a qualified financial advisor before making investment decisions.

Featured Posts

-

Open Ais 2024 Event Easier Voice Assistant Creation Now Possible

May 15, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Now Possible

May 15, 2025 -

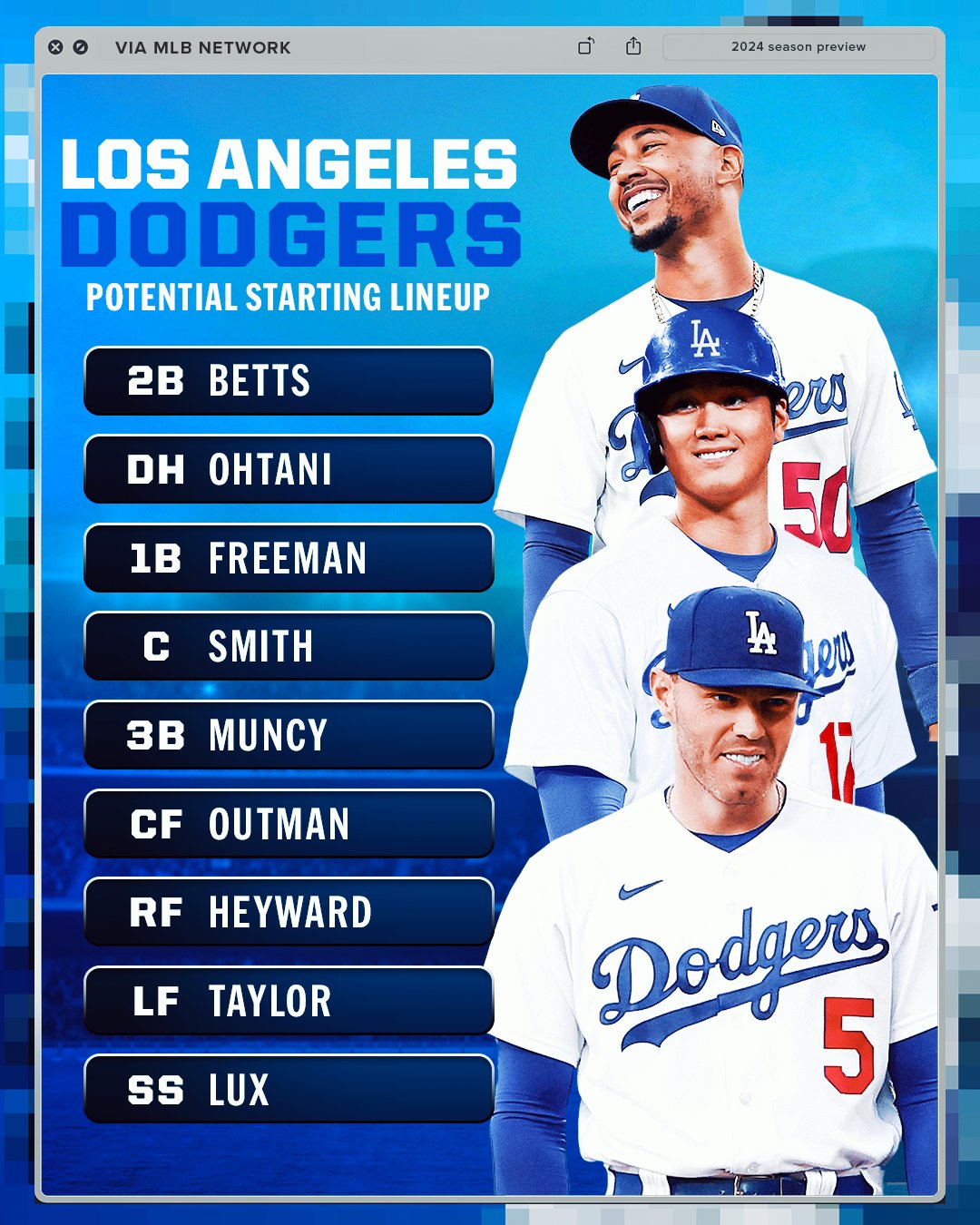

2023 2024 Los Angeles Dodgers Offseason What To Expect

May 15, 2025

2023 2024 Los Angeles Dodgers Offseason What To Expect

May 15, 2025 -

Crypto Exchange Compliance In India A 2025 Guide

May 15, 2025

Crypto Exchange Compliance In India A 2025 Guide

May 15, 2025 -

How Jimmy Butler Offers The Warriors A Different Kind Of Championship Edge

May 15, 2025

How Jimmy Butler Offers The Warriors A Different Kind Of Championship Edge

May 15, 2025 -

Direkt Ucuslar Ve Kibris Tatar In Goerueslerinin Degerlendirilmesi

May 15, 2025

Direkt Ucuslar Ve Kibris Tatar In Goerueslerinin Degerlendirilmesi

May 15, 2025

Latest Posts

-

Ayesha Howard Anthony Edwards And Their Children A New Chapter In Co Parenting

May 15, 2025

Ayesha Howard Anthony Edwards And Their Children A New Chapter In Co Parenting

May 15, 2025 -

Anthony Edwards Receives 50 K Fine From Nba For Unsportsmanlike Conduct

May 15, 2025

Anthony Edwards Receives 50 K Fine From Nba For Unsportsmanlike Conduct

May 15, 2025 -

Ayesha Howard And Anthony Edwards Shared Custody Agreement Raising Children Together

May 15, 2025

Ayesha Howard And Anthony Edwards Shared Custody Agreement Raising Children Together

May 15, 2025 -

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

May 15, 2025

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

May 15, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Remarks To Fan

May 15, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Remarks To Fan

May 15, 2025