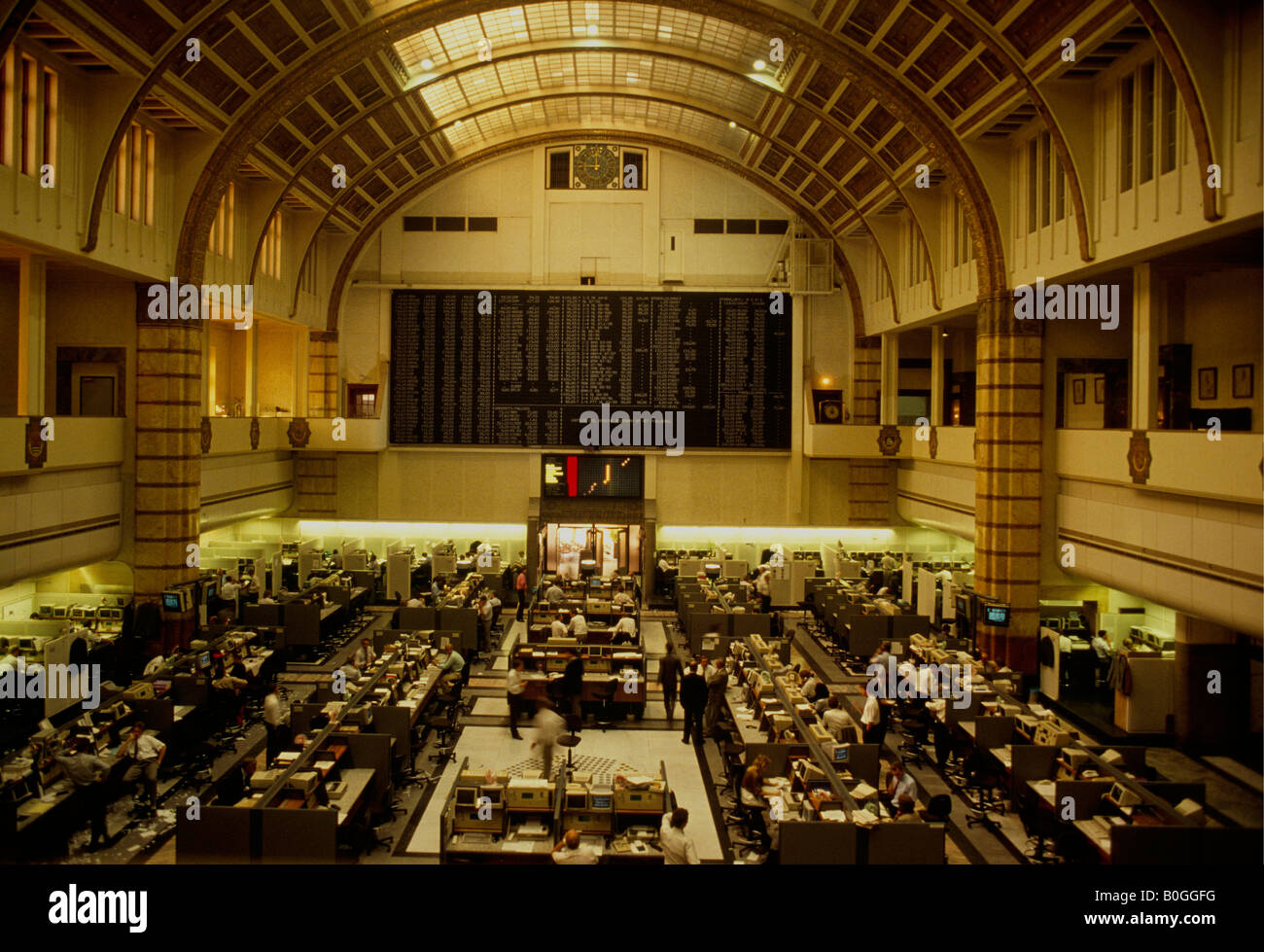

Sharp Decline On Amsterdam Stock Exchange: 11% Drop In Three Days

Table of Contents

Analyzing the Causes of the Amsterdam Stock Exchange Decline

The precipitous fall of the AEX wasn't an isolated incident; rather, it reflects a confluence of global and sector-specific factors contributing to this significant Amsterdam Stock Exchange decline.

Impact of Global Economic Uncertainty

The current global economic climate is characterized by considerable uncertainty. Several interconnected factors played a crucial role in the AEX's performance.

- Inflation and Rising Interest Rates: Persistent high inflation across the globe has prompted central banks, including the European Central Bank, to aggressively raise interest rates. This increases borrowing costs for businesses, dampening investment and economic growth, impacting stock markets like the AEX. For comparison, the Dow Jones Industrial Average experienced a similar, albeit less dramatic, dip during the same period, falling by approximately 5%.

- Geopolitical Tensions: The ongoing war in Ukraine continues to fuel energy price volatility and supply chain disruptions, further exacerbating global economic uncertainty. This uncertainty directly impacts investor confidence and market stability.

- Energy Crisis: The European energy crisis, largely stemming from the war in Ukraine and reduced Russian gas supplies, has placed immense pressure on businesses and consumers across the continent, impacting economic growth and negatively affecting market sentiment.

Sector-Specific Performance

The Amsterdam Stock Exchange decline did not affect all sectors equally. Certain industries bore the brunt of the downturn.

- Energy Sector: The energy sector, already grappling with volatile prices, saw some of the steepest falls, with companies heavily reliant on gas and oil experiencing significant drops in their share prices. Shell, a major player on the AEX, saw a 7% decline in its share price during this period.

- Financial Sector: Banks and other financial institutions were also significantly affected, reflecting anxieties about the wider economic outlook and the potential for increased loan defaults.

- Technology Sector: The tech sector, sensitive to interest rate hikes, also experienced a noticeable decline, mirroring trends seen in other major tech indices like the Nasdaq.

Investor Sentiment and Market Volatility

A palpable shift in investor sentiment contributed significantly to the Amsterdam Stock Exchange decline. Fear and uncertainty drove widespread selling.

- Increased Volatility: Trading volumes surged as investors reacted to the news, demonstrating a marked increase in market volatility.

- Selling Pressure: Many investors opted to sell their holdings to limit potential losses, exacerbating the decline.

- Analyst Downgrades: Several financial analysts issued downgrades for AEX-listed companies, further fueling the negative sentiment and contributing to the selloff.

Potential Consequences of the Amsterdam Stock Exchange Drop

The sharp decline in the AEX carries significant implications for both the Dutch economy and individual investors.

Impact on the Dutch Economy

The Amsterdam Stock Exchange decline is likely to have a ripple effect on the Dutch economy.

- Reduced Investment: Lower stock prices can discourage investment, potentially hindering economic growth.

- Job Security: Companies struggling due to the market downturn may implement cost-cutting measures, including job losses.

- Consumer Confidence: A weakening stock market can erode consumer confidence, impacting spending and overall economic activity.

- Government Intervention: The Dutch government might need to implement measures to support affected industries and stimulate economic growth.

Long-Term Implications for Investors

The downturn presents both challenges and opportunities for investors.

- Portfolio Diversification: Investors should consider diversifying their portfolios across different asset classes to mitigate risks.

- Risk Management: Effective risk management strategies, including setting stop-loss orders, become even more crucial in volatile markets.

- Value Investing Opportunities: The decline may present opportunities for value investors to acquire stocks at discounted prices, provided a thorough due diligence is carried out.

Looking Ahead: Recovery and Future Predictions for the Amsterdam Stock Exchange

Predicting the future of the AEX is inherently challenging, but analyzing analyst predictions and potential catalysts for recovery offers valuable insights.

Analyst Predictions and Market Outlook

Financial analysts offer varying predictions regarding the AEX's future.

- Cautious Optimism: Some analysts predict a gradual recovery, contingent on improvements in global economic conditions and reduced geopolitical uncertainty.

- Further Decline: Others warn of the potential for further declines, citing lingering economic headwinds.

- Range of Predictions: Forecasts vary widely, suggesting the market's uncertain trajectory and the difficulty of making precise predictions.

Potential Catalysts for Recovery

Several factors could potentially trigger a rebound in the AEX.

- Easing Inflation: A sustained decrease in inflation could lead to a more positive market sentiment.

- Resolution of Geopolitical Tensions: A de-escalation of the war in Ukraine could alleviate some of the economic uncertainties.

- Improved Energy Security: Increased energy independence for Europe could significantly boost investor confidence.

Conclusion

The 11% drop in the Amsterdam Stock Exchange represents a significant event with far-reaching consequences. The decline is attributable to a complex interplay of global economic uncertainty, sector-specific vulnerabilities, and shifting investor sentiment. The potential impact on the Dutch economy, ranging from reduced investment to potential job losses, underscores the gravity of the situation. However, opportunities may exist for value investors. Staying informed about the evolving situation is crucial. Stay updated on the latest developments affecting the Amsterdam Stock Exchange decline, the AEX performance, and Dutch stock market trends by subscribing to our newsletter and following our expert analysis.

Featured Posts

-

Inside Ferraris First Official Bengaluru Service Centre A Detailed Look

May 25, 2025

Inside Ferraris First Official Bengaluru Service Centre A Detailed Look

May 25, 2025 -

Fastest Standard Production Ferraris A Top 10 Fiorano Track Ranking

May 25, 2025

Fastest Standard Production Ferraris A Top 10 Fiorano Track Ranking

May 25, 2025 -

A Realistic Escape To The Country What To Expect And How To Prepare

May 25, 2025

A Realistic Escape To The Country What To Expect And How To Prepare

May 25, 2025 -

Egyedi Porsche 911 80 Millioert Az Extrakban

May 25, 2025

Egyedi Porsche 911 80 Millioert Az Extrakban

May 25, 2025 -

Is Kyle Walker Peters Heading To Leeds Transfer Rumours

May 25, 2025

Is Kyle Walker Peters Heading To Leeds Transfer Rumours

May 25, 2025

Latest Posts

-

Hollywood Shut Down The Double Strikes Impact On Film And Television

May 25, 2025

Hollywood Shut Down The Double Strikes Impact On Film And Television

May 25, 2025 -

300 Million Cyberattack Impact On Marks And Spencers Finances

May 25, 2025

300 Million Cyberattack Impact On Marks And Spencers Finances

May 25, 2025 -

Anchor Brewing Companys Closure A Legacy Of Craft Beer Ends

May 25, 2025

Anchor Brewing Companys Closure A Legacy Of Craft Beer Ends

May 25, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

May 25, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Tell All This Fall

May 25, 2025 -

Blue Origins Rocket Launch Canceled A Vehicle Subsystem Issue

May 25, 2025

Blue Origins Rocket Launch Canceled A Vehicle Subsystem Issue

May 25, 2025