Sharp Drop In Amsterdam Stock Market: Trade War Uncertainty At Play

Table of Contents

Trade War Uncertainty: The Primary Culprit

The ongoing global trade war, characterized by escalating tariffs and trade restrictions, is the primary culprit behind the recent slump in the Amsterdam Stock Market. The Netherlands, a highly export-oriented nation, is particularly vulnerable to these disruptions. The impact extends beyond mere speculation; it's a tangible threat to the nation's economic stability.

-

Specific Trade Disputes: Dutch businesses, particularly those in sectors like agriculture and technology, are facing significant challenges due to trade disputes impacting exports to key markets such as the US and China. Increased tariffs on Dutch agricultural products have reduced competitiveness, while technology companies are grappling with supply chain disruptions and increased production costs.

-

Increased Uncertainty & Decreased Investment: The unpredictability inherent in the trade war creates immense uncertainty for businesses. This uncertainty discourages investment, as companies are hesitant to commit resources in a volatile global environment. Reduced investment translates directly into lower stock valuations, contributing to the decline in the Amsterdam Stock Market.

-

Vulnerable Sectors: The technology and agricultural sectors are particularly vulnerable. The technology sector relies heavily on international supply chains, making it susceptible to disruptions caused by tariffs and trade restrictions. The agricultural sector, a significant part of the Dutch economy, faces reduced export opportunities and increased competition due to protectionist measures in other countries.

-

Market Data: Recent data shows a [insert percentage]% decline in the Amsterdam Stock Market index over the past [time period], with several key companies experiencing double-digit percentage drops in their stock prices. For example, [mention a specific company and its performance].

Investor Sentiment and Market Volatility

Investor confidence is intrinsically linked to global economic stability, and the current trade war uncertainty is significantly eroding that confidence. The Amsterdam Stock Market is no exception.

-

Investor Psychology: During periods of uncertainty, investors tend towards risk aversion. Fear of further market declines prompts them to sell their assets, contributing to the downward spiral. This is a classic example of a self-fulfilling prophecy in the stock market.

-

Market Sentiment and Speculation: Negative news regarding trade negotiations fuels speculation, exacerbating market volatility. This creates a domino effect, with each negative headline further impacting investor sentiment and leading to more selling pressure.

-

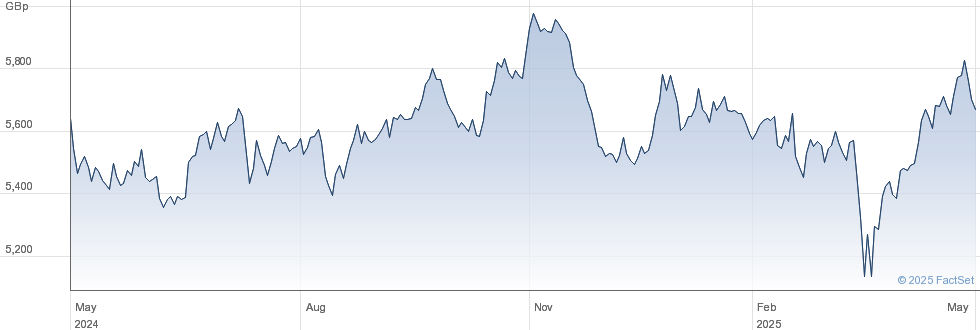

Increased Volatility: Charts clearly illustrate the increased volatility in the Amsterdam Stock Market. [Insert chart/graph visualizing market volatility]. The daily fluctuations are significantly wider than during periods of greater economic stability, reflecting the heightened uncertainty.

-

Capital Flight: Many investors are moving their capital to safer havens, such as government bonds or other less volatile markets, further depleting liquidity and driving down the Amsterdam Stock Market.

The Dutch Economy's Exposure

The Netherlands' economy is deeply intertwined with international trade, making it particularly susceptible to the negative effects of a global trade war.

-

Major Trading Hub: The Netherlands' position as a major trading hub in Europe means that disruptions in global trade directly impact its economy. Its reliance on exports and imports leaves it vulnerable to trade restrictions and tariffs.

-

Ripple Effects on Employment & Growth: The decline in the Amsterdam Stock Market is not an isolated incident; it's a reflection of broader economic anxieties. Decreased business activity could lead to job losses and slower economic growth in the Netherlands.

-

Government Response: The Dutch government is [mention government responses, such as fiscal stimulus or trade negotiations]. However, the effectiveness of these measures remains uncertain, as the trade war situation is dynamic and unpredictable.

-

Economic Forecasts: Several economic forecasts predict [mention specific predictions about the Dutch economy's growth, unemployment etc., citing sources].

A Comparative Analysis

Compared to other major European markets, the Amsterdam Stock Market's decline is [relatively more/less] significant. [Insert data comparing Amsterdam Stock Market performance to other European markets, such as the DAX or CAC 40]. This difference might be attributed to the Netherlands' higher reliance on exports and its vulnerability to specific trade disputes. The relatively high concentration of certain sectors in the Amsterdam Stock Market also plays a role, making it more sensitive to changes in global trade patterns.

Conclusion

The sharp drop in the Amsterdam Stock Market is primarily attributed to the uncertainty surrounding the global trade war. This uncertainty is eroding investor confidence, leading to increased market volatility and a negative impact on the Dutch economy. The interconnectedness of the global economy highlights the far-reaching consequences of trade disputes. Monitor the Amsterdam Stock Market closely, stay updated on trade war developments affecting the Amsterdam Stock Market, and understand the impact of trade war uncertainty on the Amsterdam Stock Market for informed investment decisions. By staying informed about the latest developments, you can better navigate this turbulent period and make more informed investment decisions related to the Amsterdam Stock Market.

Featured Posts

-

Especificacoes Tecnicas Ferrari 296 Speciale 880 Cv Hibrido

May 25, 2025

Especificacoes Tecnicas Ferrari 296 Speciale 880 Cv Hibrido

May 25, 2025 -

Image Gallery 2025 Porsche Cayenne Interior And Exterior Design Details

May 25, 2025

Image Gallery 2025 Porsche Cayenne Interior And Exterior Design Details

May 25, 2025 -

Analyzing The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

Analyzing The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

Aktienmarkt Frankfurt Dax Entwicklung Und Futures Verfall Am 21 Maerz 2025

May 25, 2025

Aktienmarkt Frankfurt Dax Entwicklung Und Futures Verfall Am 21 Maerz 2025

May 25, 2025 -

Famous Figures 17 Sudden Career Downfalls

May 25, 2025

Famous Figures 17 Sudden Career Downfalls

May 25, 2025

Latest Posts

-

3 Billion Slash To Sse Spending Analysis And Implications

May 25, 2025

3 Billion Slash To Sse Spending Analysis And Implications

May 25, 2025 -

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 25, 2025

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 25, 2025 -

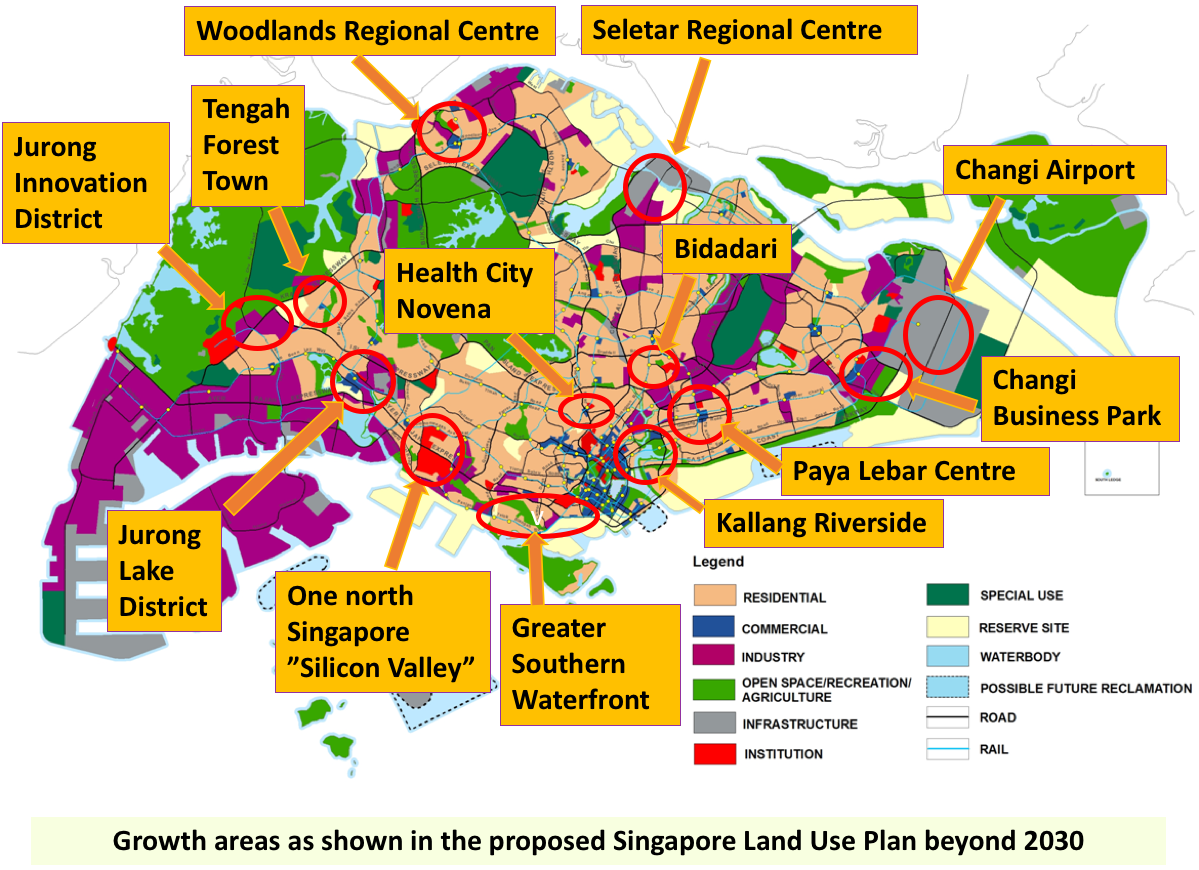

Exploring The Countrys Business Hotspots Opportunities And Challenges

May 25, 2025

Exploring The Countrys Business Hotspots Opportunities And Challenges

May 25, 2025 -

The Countrys Evolving Business Map Key Growth Areas

May 25, 2025

The Countrys Evolving Business Map Key Growth Areas

May 25, 2025 -

Where To Invest A Comprehensive Guide To The Countrys Best Business Locations

May 25, 2025

Where To Invest A Comprehensive Guide To The Countrys Best Business Locations

May 25, 2025