Shein's London IPO Delay: The Impact Of US Tariffs

Table of Contents

The Rising Tide of US Tariffs on Chinese Imports

The imposition of US tariffs on Chinese goods, particularly within the apparel and textile sectors, has created a turbulent environment for businesses like Shein. These tariffs, implemented over several years, significantly increase the cost of importing clothing and accessories from China into the US market. Shein, heavily reliant on Chinese manufacturing, is directly impacted by these increased import duties. Specific tariff rates vary depending on the type of garment and material, but the cumulative effect is a substantial increase in Shein's production costs.

This rise in import duties has a ripple effect throughout Shein's operations. The increased costs affect their profit margins, impacting their overall financial health and ability to attract investors. This situation leads to several key consequences:

- Increase in import duties: Directly impacting Shein's bottom line and reducing profitability.

- Impact on supply chain: Disrupting established logistics and potentially leading to delays.

- Potential price increases for consumers: Shein may be forced to pass increased costs onto consumers, potentially impacting sales.

- Shifting production locations: The company may explore moving manufacturing to countries with more favorable trade agreements with the US, a costly and time-consuming undertaking.

Shein's Financial Vulnerability and the IPO Decision

Shein's financial performance, already facing the pressure of intense competition in the fast-fashion market, is further strained by the increased tariffs. These increased costs significantly impact revenue and profitability, directly affecting its attractiveness to potential investors. The uncertainty surrounding future tariff policies adds to the risk profile, making it challenging for Shein to present a compelling valuation during its IPO. Investor confidence is fragile, and any perceived vulnerability to further tariff hikes could lead to a lower valuation or even deter investment.

The impact on Shein's financial outlook can be summarized as follows:

- Impact on revenue and profitability: Reduced margins due to higher production costs.

- Investor concerns regarding tariff vulnerability: Uncertainty about future tariff policies makes Shein a riskier investment.

- Revised IPO valuation: The delay suggests the company is reassessing its valuation in light of the tariff challenges.

- Potential for decreased investor interest: The risk of continued tariff escalation discourages investors.

Alternative Strategies for Shein to Navigate Tariff Challenges

To mitigate the impact of the US tariffs, Shein needs to adopt strategic adjustments. A key strategy involves diversifying its supply chain. This could involve shifting a portion of its manufacturing to countries with more favorable trade agreements with the US, such as Vietnam or Bangladesh. However, this requires significant investment and time.

Other potential strategies include:

- Restructuring supply chains: Diversifying production locations to reduce reliance on China.

- Negotiating better deals with suppliers: Seeking cost reductions through improved negotiation and efficiency.

- Investing in automation to reduce labor costs: Improving productivity and lowering the cost of manufacturing.

- Price adjustments and consumer reaction: Carefully balancing price increases with the need to maintain market competitiveness.

The Future of Shein's IPO in the Face of Uncertainty

The timeline for Shein's IPO remains uncertain. The company will likely need to address the concerns raised by the increased tariffs before attempting another IPO. A successful IPO hinges on several factors, including favorable market conditions, positive investor sentiment, and a demonstrably resilient business model. The current climate presents considerable challenges. The impact extends beyond Shein, with other fast-fashion brands facing similar pressures from US-China trade relations.

Key considerations for the future include:

- Revised IPO plans and timelines: A significant delay is likely until tariff uncertainties are resolved.

- Market conditions and investor sentiment: Favorable market conditions and investor confidence are crucial for a successful IPO.

- Long-term impact on Shein's growth: The tariff impact will influence Shein’s long-term growth trajectory.

- Implications for the fast-fashion industry: Shein's experience highlights the challenges faced by the entire fast-fashion sector.

Conclusion: Shein's London IPO Delay: A Complex Equation

The delay of Shein's London IPO highlights the complex interplay between global trade policies and the financial decisions of even the most successful companies. The weight of US tariffs on Chinese imports presents a significant challenge, impacting Shein's profitability, valuation, and investor confidence. The uncertainty surrounding future tariff policies adds another layer of complexity. Shein’s response will be critical, not only for its own future but also as a case study for other fast-fashion brands navigating similar challenges. Stay updated on the latest developments in the Shein IPO saga and the ongoing impact of US tariffs on the fast-fashion industry.

Featured Posts

-

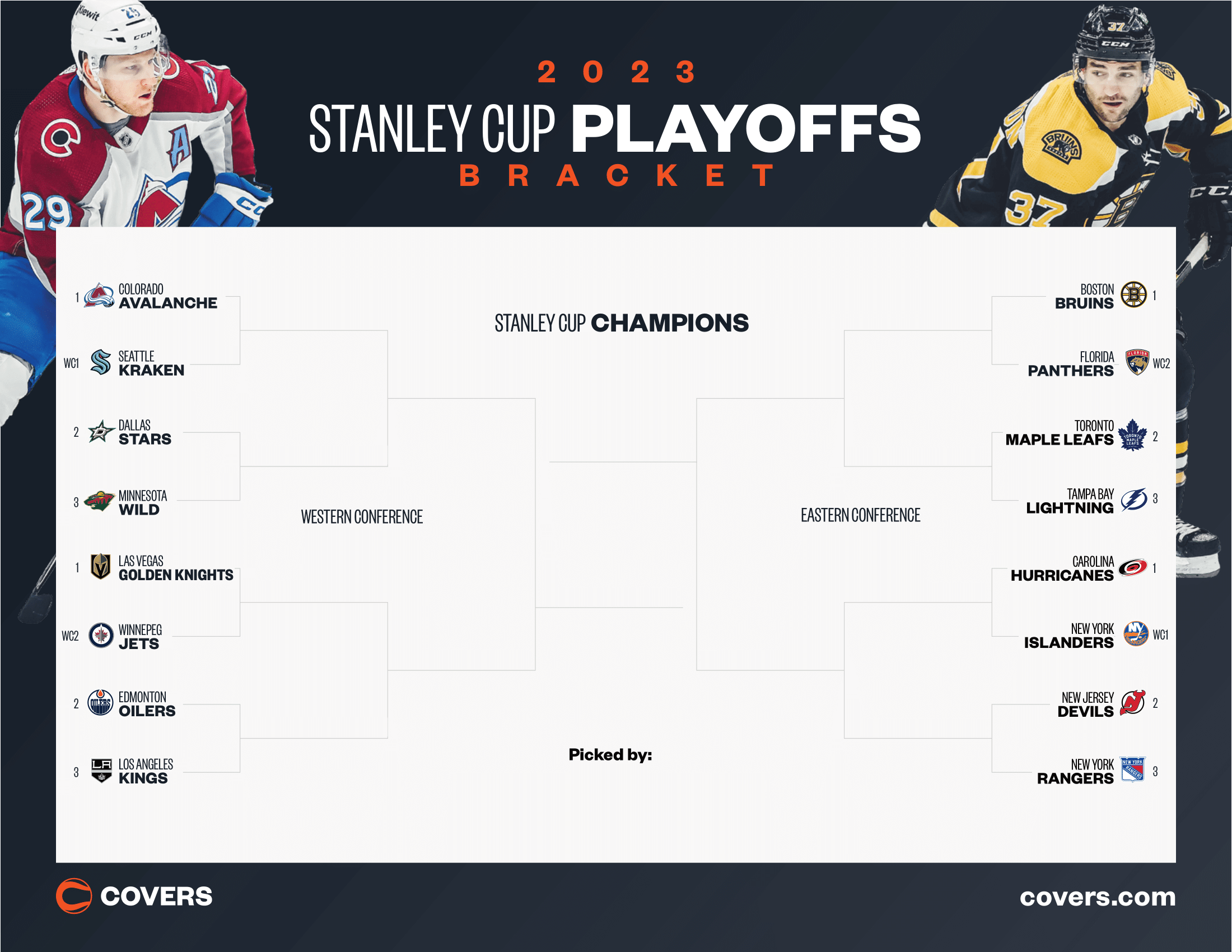

Understanding The Nhl Playoffs Key First Round Insights

May 04, 2025

Understanding The Nhl Playoffs Key First Round Insights

May 04, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 04, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Automakers

May 04, 2025 -

Australias National Election A Barometer Of Global Political Trends

May 04, 2025

Australias National Election A Barometer Of Global Political Trends

May 04, 2025 -

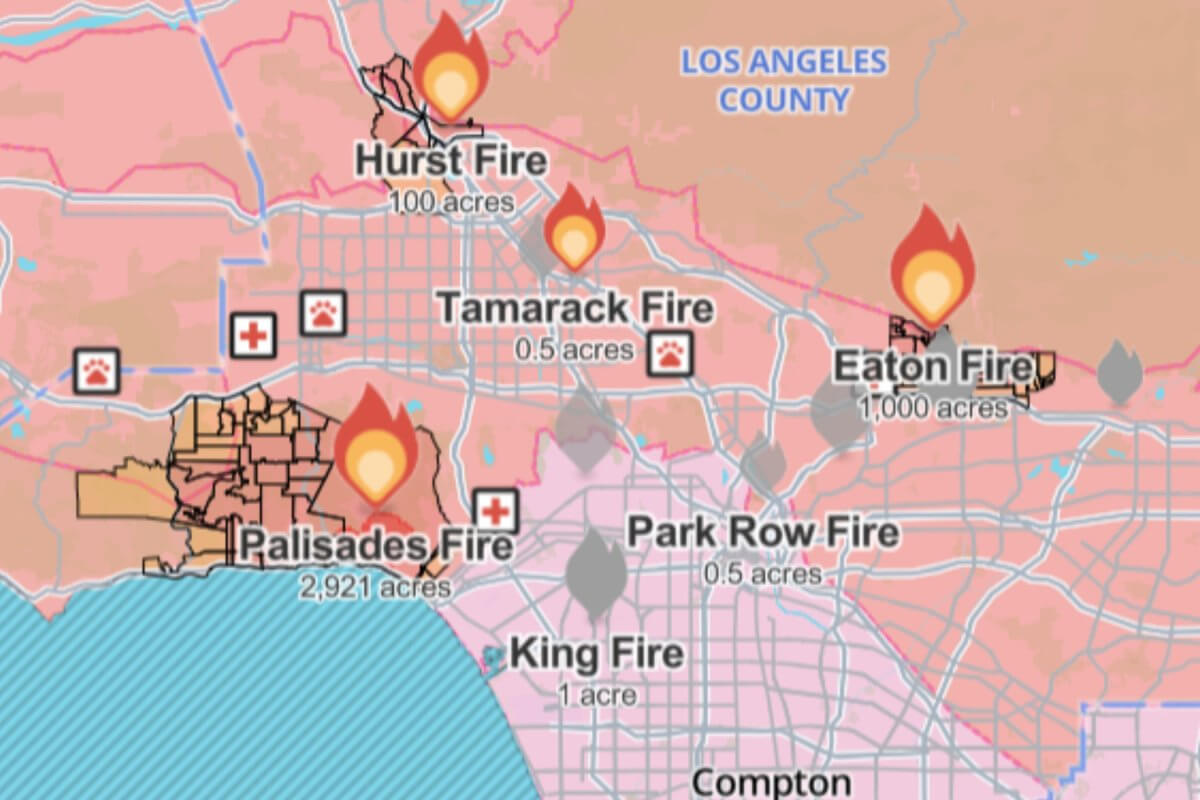

Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Betting Markets

May 04, 2025

Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Betting Markets

May 04, 2025 -

Kivinin Kabugu Yenir Mi Faydalari Zararlari Ve Tueketim Oenerileri

May 04, 2025

Kivinin Kabugu Yenir Mi Faydalari Zararlari Ve Tueketim Oenerileri

May 04, 2025

Latest Posts

-

Betting On Ufc 314 A Comprehensive Look At Chandler Vs Pimblett Odds

May 04, 2025

Betting On Ufc 314 A Comprehensive Look At Chandler Vs Pimblett Odds

May 04, 2025 -

Ufc 314 Co Main Event Prediction Analyzing Chandler Vs Pimblett

May 04, 2025

Ufc 314 Co Main Event Prediction Analyzing Chandler Vs Pimblett

May 04, 2025 -

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025 -

Ufc 314 Star Studded Lineup Takes Hit With Neal Prates Cancellation

May 04, 2025

Ufc 314 Star Studded Lineup Takes Hit With Neal Prates Cancellation

May 04, 2025 -

Paddy Pimblett Addresses Michael Chandlers Potential Foul Play Before Ufc 314 Bout

May 04, 2025

Paddy Pimblett Addresses Michael Chandlers Potential Foul Play Before Ufc 314 Bout

May 04, 2025