Shein's Stalled London IPO: The US Tariff Fallout

Table of Contents

Shein's Ambitious Growth and the Planned London IPO

Shein's success story is remarkable. Its ultra-fast fashion model, leveraging e-commerce and a vast supply chain, has disrupted the industry, capturing significant market share globally. The planned London IPO was intended to capitalize on this success, injecting significant capital into the company and potentially valuing it at tens of billions of dollars. Shein initially expressed considerable optimism about the IPO, anticipating strong investor interest driven by its phenomenal growth trajectory and market dominance.

- Shein's Global Market Share: Shein holds a substantial share of the online fast-fashion market, particularly amongst younger demographics. Precise figures vary, but independent analyses consistently place it among the leading players globally.

- Projected IPO Valuation: Pre-delay estimations suggested a potential IPO valuation ranging from $45 billion to $100 billion, making it one of the largest tech IPOs in recent years.

- Reasons for Choosing a London Listing: London's status as a major global financial center, its proximity to key European markets, and its relatively straightforward IPO regulations were likely key factors in Shein's initial decision.

The Looming Threat of Increased US Tariffs on Shein's Products

The US fast-fashion market is a significant contributor to Shein's revenue. However, the current US tariff landscape, particularly on imports from China, presents a formidable challenge. Increased tariffs would dramatically increase the cost of Shein's products, potentially impacting its competitiveness and profitability in the US market. The uncertainty surrounding future US trade policies adds to this risk, making long-term financial projections incredibly difficult.

- Specific Tariff Rates Affecting Shein's Product Categories: The exact tariff rates vary depending on the specific product category (clothing, accessories, etc.), but an increase could significantly impact Shein's already razor-thin margins.

- Analysis of the Potential Cost Increase Due to Tariffs: Even a seemingly small percentage increase in tariffs can translate into substantial cost increases, given Shein's enormous volume of imports. This could force price hikes, impacting sales and consumer demand.

- Shein's Potential Strategies to Mitigate Tariff Impacts: Shein might explore options such as diversifying its sourcing to countries with more favorable trade agreements, potentially shifting production away from China. This, however, would be a complex and time-consuming undertaking.

The Direct Link Between US Tariffs and the Postponed IPO

The postponement of Shein's London IPO is strongly linked to investor concerns regarding the potential impact of increased US tariffs. These tariffs introduce significant uncertainty into Shein's financial projections, making it a riskier investment for potential shareholders. The delay allows Shein to navigate these complexities, potentially renegotiating trade terms or adjusting its business model before proceeding with the public listing.

- Statements from Shein or its Representatives Regarding the IPO Delay: While official statements have been somewhat vague, the company hasn't directly refuted the connection between tariff concerns and the delay.

- Expert Opinions on the Influence of US Tariffs on Investor Sentiment: Financial analysts have widely cited the US tariff situation as a major factor impacting investor confidence in Shein's IPO prospects.

- Potential Alternative Strategies Shein Might Consider in Light of the Delay: Beyond sourcing diversification, Shein may focus on internal cost-cutting measures, enhancing its brand image to justify potential price increases, or seeking alternative investment strategies to fund its expansion.

Shein's IPO Delay: A Cautionary Tale of US Tariff Impacts

The delay of Shein's London IPO serves as a stark reminder of the significant influence US trade policies can have on global businesses. The threat of increased tariffs introduced considerable uncertainty, impacting investor confidence and forcing a postponement. The future for Shein remains uncertain; it may revise its IPO strategy, adapt its business model, or even seek alternative funding sources. The outcome will likely influence how other fast-fashion companies approach their own expansion plans and investment strategies. Follow the developments surrounding Shein's IPO and the impact of US tariffs to understand the evolving landscape of global trade and its consequences for fast fashion.

Featured Posts

-

Body Language Reveals The Truth Decoding Blake Lively And Anna Kendricks Tense Encounters

May 05, 2025

Body Language Reveals The Truth Decoding Blake Lively And Anna Kendricks Tense Encounters

May 05, 2025 -

Virginia Derby Stones Official Announcement At Colonial Downs

May 05, 2025

Virginia Derby Stones Official Announcement At Colonial Downs

May 05, 2025 -

How To Stream The Kentucky Derby 2025 A Comprehensive Guide To Online Viewing

May 05, 2025

How To Stream The Kentucky Derby 2025 A Comprehensive Guide To Online Viewing

May 05, 2025 -

Ryujinx Emulator Project Ends A Report On Nintendos Involvement

May 05, 2025

Ryujinx Emulator Project Ends A Report On Nintendos Involvement

May 05, 2025 -

How Middle Managers Drive Performance And Improve Employee Satisfaction

May 05, 2025

How Middle Managers Drive Performance And Improve Employee Satisfaction

May 05, 2025

Latest Posts

-

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025 -

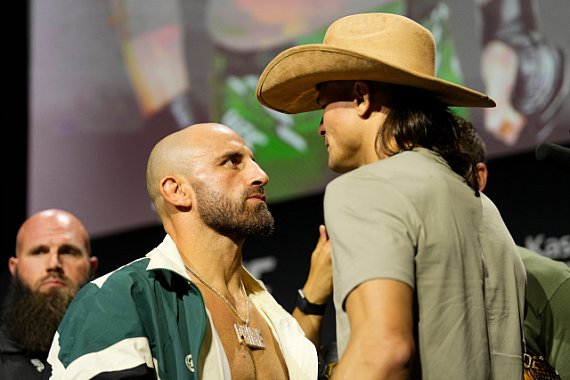

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025 -

Ufc 314 Ppv Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Ppv Everything You Need To Know About Volkanovski Vs Lopes

May 05, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Who Won And Lost

May 05, 2025 -

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card

May 05, 2025

Ufc 314 Volkanovski Lopes Headliner And Complete Fight Card

May 05, 2025