Shopify's 14%+ Stock Surge: Nasdaq 100 Impact Analyzed

Table of Contents

Understanding Shopify's Recent Performance

Before analyzing the surge, it's crucial to understand Shopify's recent financial health and any preceding events. Leading up to the stock price jump, Shopify had shown signs of strong, albeit fluctuating, performance. While specific financial details vary depending on the reporting period, several key performance indicators (KPIs) likely contributed to the positive investor sentiment.

- Revenue Growth: Shopify consistently demonstrates robust revenue growth, driven by the increasing adoption of its e-commerce platform by businesses of all sizes. This sustained growth, particularly in specific sectors, signals a healthy trajectory.

- Profit Margins: While profit margins might have fluctuated, any improvement or positive trend in this area would significantly boost investor confidence.

- Customer Acquisition Costs (CAC): A decrease in CAC suggests improved efficiency in acquiring new merchants, enhancing long-term profitability and positively impacting the Shopify stock price.

Positive factors contributing to the surge could include:

- Positive financial news: Stronger-than-expected quarterly earnings reports or upward revisions of future earnings projections.

- New product releases or strategic partnerships: Introduction of innovative features or successful collaborations that expand market reach and enhance platform capabilities.

- Positive market sentiment towards e-commerce: A general bullish sentiment surrounding the e-commerce industry, driven by factors such as continued online shopping growth and technological advancements.

Analyzing the Drivers Behind the 14%+ Surge

The 14%+ surge wasn't a spontaneous event; several factors likely contributed to this significant jump in Shopify's stock price. Let's explore the potential catalysts:

- Impact of positive earnings reports: Exceeding market expectations in key financial metrics invariably leads to increased investor confidence and a subsequent rise in stock price.

- Influence of broader market trends: A positive overall sentiment in the tech sector and the broader market can lift even strong performing stocks like Shopify to new heights. This is especially true during periods of strong investor confidence.

- Speculation about future growth potential: Market speculation regarding Shopify's future growth prospects, driven by its expansion into new markets or innovative product development, can significantly influence stock valuations.

- Reaction to competitor performance: Shopify's performance relative to its competitors in the e-commerce space can also influence investor sentiment. If competitors underperform, it may boost investor confidence in Shopify's market leadership.

Shopify's Influence on the Nasdaq 100

Shopify's substantial market capitalization gives it significant weight within the Nasdaq 100 index. Consequently, its stock price movements have a ripple effect on the overall index performance.

- Impact on the Nasdaq 100's overall performance: A significant surge in Shopify's stock price contributes positively to the overall performance of the Nasdaq 100, boosting the index's value.

- Correlation with other tech stocks: Shopify's performance often correlates with other tech stocks within the Nasdaq 100. A positive surge in Shopify's stock can influence similar movements in related companies.

- Potential for further influence: The magnitude of Shopify's influence on the Nasdaq 100's future trajectory depends on several factors, including the sustainability of its growth and the broader market conditions.

Risk Assessment and Future Outlook for Shopify Stock

While the recent surge is undeniably positive, it's crucial to consider potential risks and uncertainties:

- Potential downside risks: Increased competition, an economic slowdown, or changes in consumer spending habits could negatively impact Shopify's future performance.

- Analyst predictions and price targets: While analyst predictions can provide insights, they are not guarantees, and investors should conduct their own thorough research.

- Long-term growth prospects: Shopify's long-term growth prospects depend on its ability to innovate, adapt to market changes, and maintain its competitive edge.

Conclusion: Navigating Shopify's Stock Surge and its Implications for the Nasdaq 100

Shopify's recent 14%+ stock surge, driven by a combination of strong financial performance, positive market sentiment, and speculation about future growth, significantly impacted the Nasdaq 100. Understanding the dynamics behind this surge is crucial for investors seeking to navigate the complexities of the tech market. While the outlook appears promising, it’s essential to consider potential risks and conduct thorough research before making any investment decisions related to Shopify's stock surge or the Nasdaq 100. Stay informed about Shopify's performance and its broader implications for investors interested in maximizing returns from the Shopify's stock surge and related investment opportunities within the Nasdaq 100. Further research into diversification strategies and risk management is highly recommended.

Featured Posts

-

Giants Legend A Continuing Influence On The Franchise

May 14, 2025

Giants Legend A Continuing Influence On The Franchise

May 14, 2025 -

Klarnas Us Ipo Filing Reveals 24 Revenue Surge

May 14, 2025

Klarnas Us Ipo Filing Reveals 24 Revenue Surge

May 14, 2025 -

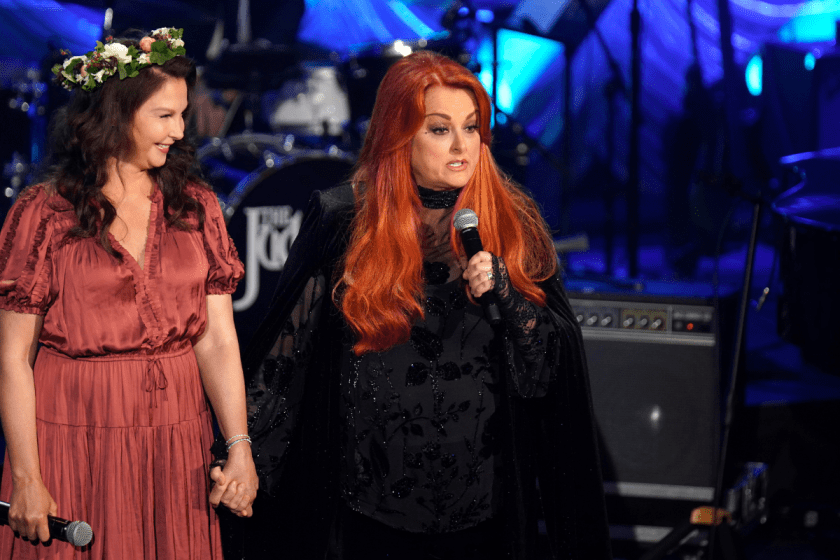

Wynonna And Ashley Judd Open Up About Family Life In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family Life In New Docuseries

May 14, 2025 -

Alberta Government Halts Industrial Carbon Tax Increase

May 14, 2025

Alberta Government Halts Industrial Carbon Tax Increase

May 14, 2025 -

Central London Welcomes Lindts Chocolate Paradise

May 14, 2025

Central London Welcomes Lindts Chocolate Paradise

May 14, 2025