Should I Buy Palantir Stock Now? A 2025 Growth Projection Analysis

Table of Contents

Palantir's Current Market Position and Financial Performance

Revenue Growth and Profitability

Palantir's recent financial performance reveals a mixed picture. While revenue has shown consistent year-over-year growth, profitability remains a key focus area. Let's examine some key figures:

- Year-over-Year Revenue Growth: [Insert latest figures from Palantir's financial reports. Example: 20% in Q3 2024]. This demonstrates consistent expansion, but the sustainability of this rate needs further analysis.

- Net Income: [Insert latest figures. Example: A modest net income increase, or still operating at a loss, depending on the latest reports]. Profitability is crucial for long-term investor confidence.

- Operating Margin: [Insert latest figures]. Improving operating margins are a positive sign of efficiency and cost management.

Significant government contracts, particularly with US defense and intelligence agencies, have significantly contributed to Palantir's revenue. However, increasing commercial partnerships are vital for long-term growth and diversification, mitigating reliance on government contracts. Comparing Palantir's performance to competitors like Databricks and Snowflake is crucial for evaluating its market standing and potential for future growth. The competitive landscape is constantly evolving, and a comparative analysis is essential for a complete understanding of Palantir's position.

Government vs. Commercial Contracts

Palantir's revenue is currently split between government and commercial sectors. While government contracts provide a stable revenue stream, their renewal isn't always guaranteed, and future budgets may influence this sector.

- Government Contracts: These contracts offer predictability but may be subject to political and budgetary changes. Long-term growth requires diversification away from sole reliance on these contracts.

- Commercial Contracts: The commercial sector presents significant growth potential, but competition is fierce. Palantir's success in this area will depend on its ability to attract and retain clients in a rapidly evolving market. Winning large commercial contracts is critical for showcasing the platform's broader applicability and driving increased revenue.

Growth Drivers and Catalysts for Palantir Stock in 2025

Technological Innovation and Product Development

Palantir's continuous investment in AI, machine learning, and advanced data analytics capabilities positions it for substantial future growth.

- AI-powered solutions: Palantir's focus on AI-driven solutions caters to the increasing demand for intelligent data analytics across various industries.

- New product launches: [Mention any new product launches or planned updates and their potential market impact. For example, advancements in Foundry, the core platform, and its integration with other technologies.]

- Strategic acquisitions: Any acquisitions to expand capabilities or enter new markets should be considered as positive growth drivers.

Expansion into New Markets and Customer Acquisition

Palantir's expansion into new markets and its customer acquisition strategies are key to its future success.

- Target Markets: Focusing on sectors like healthcare, finance, and energy presents substantial growth opportunities. Success in these markets will require tailored solutions and strong partnerships.

- Sales and Marketing: Effective sales and marketing strategies are vital for reaching new customers and showcasing the platform's value proposition.

- Competitive Landscape: Analyzing the competitive landscape in these new markets will reveal both opportunities and challenges. Palantir's ability to differentiate itself from competitors will be paramount.

Macroeconomic Factors and Industry Trends

Broader macroeconomic conditions will influence Palantir's growth trajectory.

- Economic Downturns: Economic slowdowns might reduce government and commercial spending on data analytics, impacting revenue growth.

- Geopolitical Events: Global instability can influence government spending priorities and affect contract awards.

- Long-term Outlook: The long-term outlook for the big data analytics market remains positive, fuelled by increasing data volumes and the need for advanced analytics across all sectors.

Risks and Challenges Associated with Investing in Palantir Stock

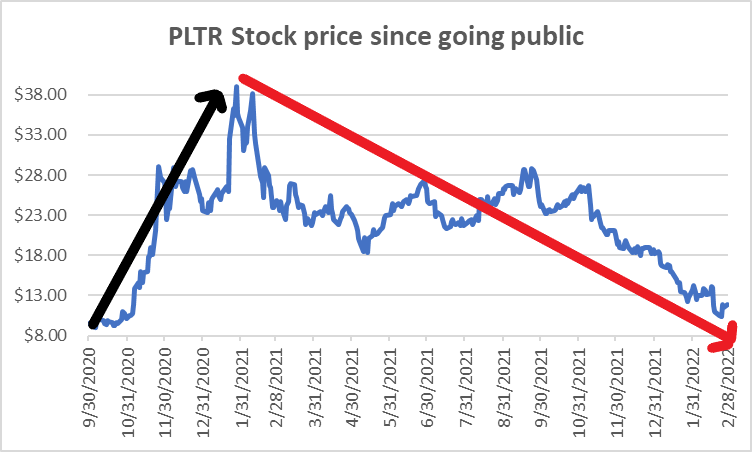

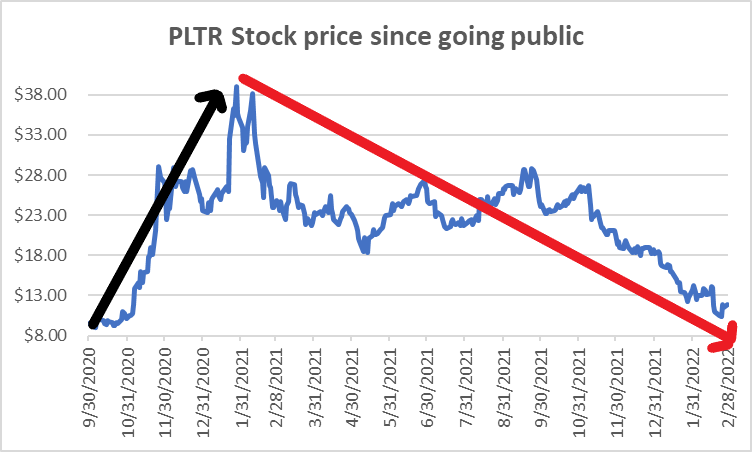

Valuation and Stock Price Volatility

Palantir's valuation is a critical factor to consider.

- Peer Comparison: Comparing Palantir's valuation metrics (e.g., Price-to-Sales ratio) with its competitors is necessary to assess its relative attractiveness.

- Price Fluctuations: Palantir's stock price can be volatile, influenced by factors such as earnings reports, contract wins, and macroeconomic conditions.

Competition and Market Saturation

The data analytics market is highly competitive.

- Key Competitors: Identify key competitors and analyze their strengths and weaknesses.

- Competitive Advantages: Palantir needs to maintain its competitive advantage through continuous innovation and a strong focus on customer needs.

Dependence on Key Contracts and Customers

Reliance on a limited number of large contracts poses a risk.

- Contract Loss: Losing a major contract could significantly impact revenue and profitability.

- Risk Mitigation: Diversifying its customer base and developing new revenue streams will help mitigate this risk.

Conclusion

Palantir's future growth prospects depend on its ability to sustain revenue growth, improve profitability, successfully navigate a competitive market, and capitalize on emerging technological advancements. While its current revenue trajectory is positive, the reliance on specific government contracts and high stock price volatility represent significant risks. A 2025 Palantir projection is optimistic, but heavily dependent on the factors discussed above.

Investment Recommendation: For investors with a high-risk tolerance and a long-term investment horizon, Palantir stock may be considered. However, investors with lower risk tolerance should proceed with caution. Thorough due diligence is essential before any investment decision regarding Palantir stock.

Call to Action: Before investing in Palantir stock, conduct thorough research, carefully consider your personal investment goals and risk tolerance, and consult with a qualified financial advisor. Remember, this analysis is for informational purposes only and should not be considered financial advice.

Featured Posts

-

Uk Visa Restrictions New Plans Target Specific Nationalities

May 09, 2025

Uk Visa Restrictions New Plans Target Specific Nationalities

May 09, 2025 -

Alshyft Alryadyt Barbwza Ykhsr Asnanh Fy Marakana

May 09, 2025

Alshyft Alryadyt Barbwza Ykhsr Asnanh Fy Marakana

May 09, 2025 -

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025

Palantir Stock Prediction 2025 Should You Invest Now

May 09, 2025 -

Todays Sensex Sharp Gains Nifty Above 18 500 Sectoral Analysis

May 09, 2025

Todays Sensex Sharp Gains Nifty Above 18 500 Sectoral Analysis

May 09, 2025 -

Palantir Stock Should You Buy Before The May 5th Earnings Report

May 09, 2025

Palantir Stock Should You Buy Before The May 5th Earnings Report

May 09, 2025