Should You Buy Palantir Stock In 2024? Investment Risks And Rewards

Table of Contents

Palantir's Growth Potential and Market Position

Palantir's success hinges on its ability to expand its reach in both the government and commercial sectors. Let's examine the key drivers of its growth potential.

Government Contracts and Revenue Streams

Palantir has historically relied heavily on government contracts for a significant portion of its revenue. These contracts, while potentially lucrative, present inherent risks. The stability of these revenue streams depends on government budgeting cycles and ongoing political priorities.

- Significant Government Contracts: Palantir has secured substantial contracts with various US government agencies and international partners, providing a foundation for steady revenue.

- Projected Growth Rates: While precise projections are difficult, analysts anticipate continued growth in government spending on data analytics and intelligence solutions, benefiting Palantir. However, these forecasts are subject to change based on evolving geopolitical landscapes and budget allocations.

- Risks Associated with Government Spending Fluctuations: Government spending can be unpredictable, making Palantir’s reliance on this sector a double-edged sword. Budget cuts or changes in policy could significantly impact revenue.

Commercial Market Expansion and Adoption

Palantir's success in expanding its commercial client base is crucial for long-term growth and reducing reliance on government contracts. The company is actively pursuing partnerships and expanding its product offerings to cater to diverse commercial needs.

- Successful Commercial Partnerships: Palantir has forged partnerships with several Fortune 500 companies, demonstrating its ability to deliver value in the commercial space. These partnerships showcase the applicability of Palantir's technology to diverse industries.

- Market Penetration Strategies: Palantir is employing various strategies, including targeted marketing, strategic acquisitions, and enhancing its product offerings, to penetrate the competitive commercial market. Success depends on effectively navigating the complexities of this market.

- Challenges in Competing with Established Players: The commercial analytics market is fiercely competitive, with established players possessing significant market share. Palantir faces challenges in differentiating itself and achieving widespread adoption.

Technological Innovation and Competitive Advantage

Palantir's proprietary technology forms the cornerstone of its competitive advantage. Its ability to innovate and stay ahead of the curve will be critical for sustained success.

- Key Technological Innovations: Palantir continues to invest heavily in R&D, developing cutting-edge algorithms and data analysis capabilities to maintain its competitive edge.

- Intellectual Property: Strong intellectual property protection safeguards Palantir's technology and ensures a significant barrier to entry for competitors.

- Competitive Differentiation: Palantir differentiates itself through its focus on highly secure and complex data integration and analysis, targeting clients with specific needs for advanced analytical capabilities.

Investment Risks Associated with Palantir Stock

Investing in Palantir shares involves inherent risks. Understanding these risks is paramount before making an investment decision.

Stock Volatility and Price Fluctuations

Palantir's stock price has demonstrated significant volatility in the past. Several factors contribute to this unpredictable nature.

- Past Performance Data: Analyzing Palantir's historical stock price performance highlights its susceptibility to market fluctuations and investor sentiment.

- Potential Market Triggers: News related to contracts, earnings reports, competitive landscape changes, and overall market trends can trigger significant price swings.

- Strategies to Mitigate Risk: Diversification, long-term investment horizons, and careful consideration of personal risk tolerance are crucial for mitigating risk.

Financial Performance and Profitability

Analyzing Palantir's financial statements is crucial for assessing its financial health and future profitability.

- Key Financial Ratios: Careful examination of key financial ratios like revenue growth, profit margins, and debt-to-equity ratios provides insight into Palantir's financial standing.

- Debt Levels: Understanding Palantir's debt levels and its ability to manage its financial obligations is critical for evaluating its long-term viability.

- Profitability Projections: While future profitability is uncertain, analyzing past trends and market forecasts can offer some insight.

Geopolitical Risks and Regulatory Concerns

Geopolitical events and regulatory changes can significantly impact Palantir's operations and stock price.

- Specific Geopolitical Factors: Changes in international relations, government policies, and global economic conditions can affect Palantir's business, especially its government contracts.

- Regulatory Risks (Data Privacy, Cybersecurity): Compliance with data privacy regulations and ensuring robust cybersecurity measures are crucial for Palantir's operations and reputation. Stringent regulations could increase operational costs.

- Potential Impact on Palantir's Operations and Stock Price: Negative geopolitical developments or regulatory changes can lead to decreased revenue, increased costs, and negative investor sentiment, resulting in stock price drops.

Valuation and Investment Strategy for Palantir Stock

A thorough valuation analysis and a well-defined investment strategy are crucial for navigating the complexities of investing in Palantir shares.

Comparing Palantir's Valuation to Competitors

Comparing Palantir's valuation metrics to its competitors provides context for assessing its current market valuation.

- Comparative Analysis with Key Competitors: Analyzing Palantir's valuation multiples (P/E ratio, Price-to-Sales ratio) in relation to competitors helps determine whether it's overvalued or undervalued.

- Valuation Multiples: Different valuation multiples offer different perspectives on a company's value and should be considered holistically.

- Justification for Current Market Valuation: Understanding the factors influencing Palantir's current market valuation requires considering its growth potential, competitive landscape, and overall market conditions.

Long-Term vs. Short-Term Investment Horizons

Palantir stock’s suitability depends on your investment timeframe and risk tolerance.

- Risk Tolerance Considerations: High-risk investors with a longer time horizon might be more comfortable with Palantir's volatility. Conservative investors might prefer less volatile options.

- Expected Return Rates for Different Investment Timeframes: Long-term investments offer the potential for higher returns but also carry higher risk. Short-term investments offer lower potential returns and less risk.

- Appropriate Investment Strategies: A long-term buy-and-hold strategy might be suitable for some investors, while others may prefer a more active trading approach.

Diversification and Portfolio Allocation

Diversification is crucial for mitigating investment risk.

- Portfolio Allocation Strategies: Palantir stock should be a part of a diversified portfolio rather than a sole investment.

- Asset Class Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) reduces the overall portfolio's volatility.

- Risk Management Techniques: Employing various risk management strategies, like stop-loss orders, can help protect against significant losses.

Conclusion: Should You Invest in Palantir Stock in 2024? A Final Verdict

Investing in Palantir stock presents both significant opportunities and considerable risks. Its growth potential in the government and commercial sectors is substantial, driven by technological innovation and a growing need for data analytics solutions. However, its stock price volatility, reliance on government contracts, and competition in the commercial market necessitate a cautious approach.

Ultimately, the decision of whether or not to invest in Palantir stock depends on your individual risk tolerance, investment horizon, and portfolio diversification strategy. While Palantir's long-term prospects appear promising, its short-term performance remains uncertain.

Final Recommendation: Thorough due diligence is essential before investing in Palantir shares. Consider your financial goals, risk profile, and the potential impact of geopolitical and regulatory factors before making an investment decision.

Call to Action: Make an informed decision about whether Palantir stock is right for your investment portfolio. Conduct your own comprehensive research and consult with a financial advisor before investing in Palantir or any other stock. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Potential Les Miserables Boycott Over Trumps Kennedy Center Attendance

May 10, 2025

Potential Les Miserables Boycott Over Trumps Kennedy Center Attendance

May 10, 2025 -

Is Palantir Stock A Good Investment In 2024 Risks And Rewards

May 10, 2025

Is Palantir Stock A Good Investment In 2024 Risks And Rewards

May 10, 2025 -

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 10, 2025

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 10, 2025 -

Palantir Stock Buy Before May 5th Earnings Report A Detailed Look

May 10, 2025

Palantir Stock Buy Before May 5th Earnings Report A Detailed Look

May 10, 2025 -

Nhl Playoff Picture Predictions Following The 2025 Trade Deadline

May 10, 2025

Nhl Playoff Picture Predictions Following The 2025 Trade Deadline

May 10, 2025

Latest Posts

-

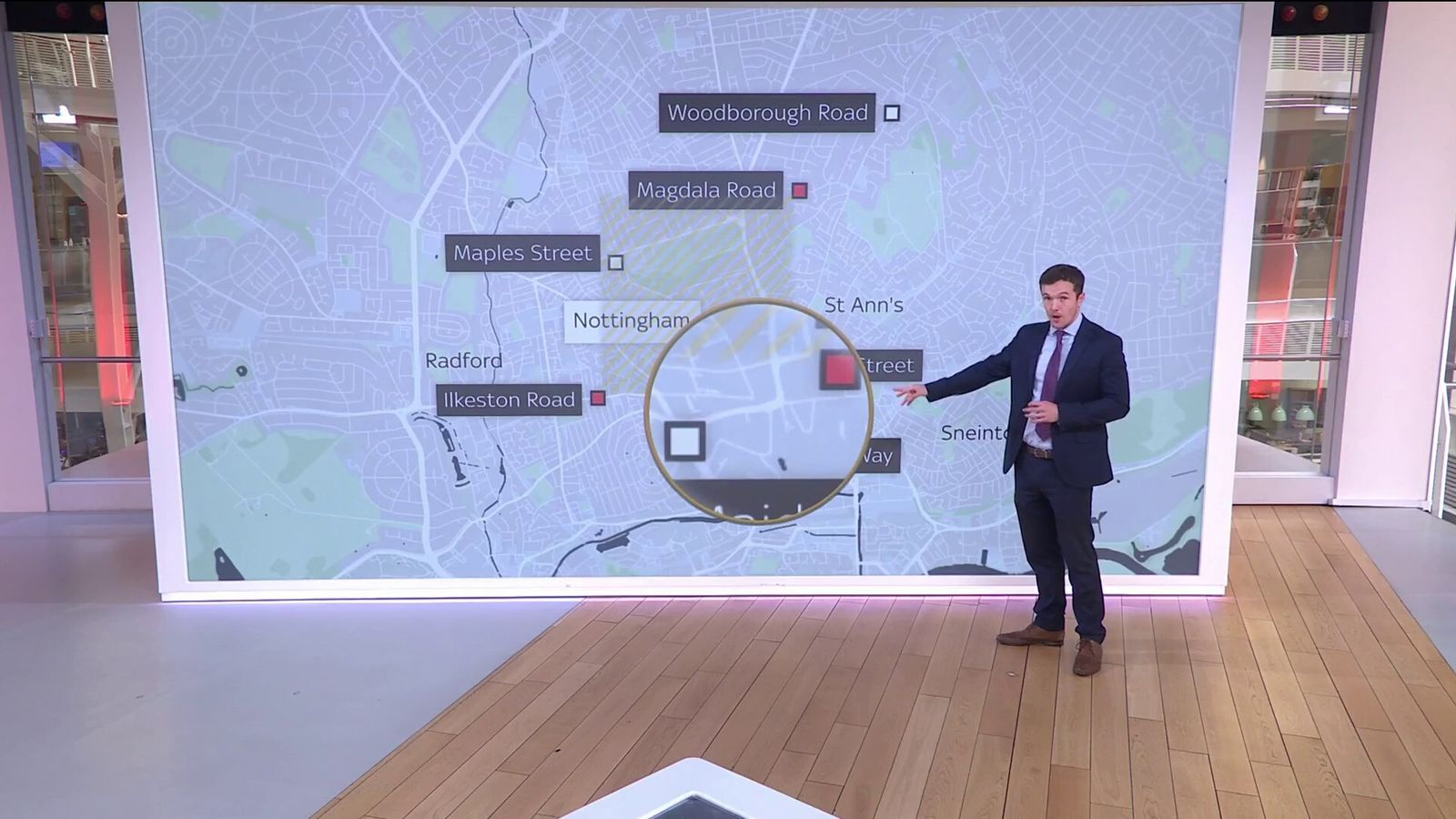

Investigation Into Police Conduct In Wake Of Nottingham Tragedy

May 10, 2025

Investigation Into Police Conduct In Wake Of Nottingham Tragedy

May 10, 2025 -

Harry Styles 70s Inspired Mustache A London Appearance

May 10, 2025

Harry Styles 70s Inspired Mustache A London Appearance

May 10, 2025 -

Nottingham Attacks Police Misconduct Meeting Scheduled

May 10, 2025

Nottingham Attacks Police Misconduct Meeting Scheduled

May 10, 2025 -

Joanna Pages Scathing Remarks About Wynne Evans During Bbc Show

May 10, 2025

Joanna Pages Scathing Remarks About Wynne Evans During Bbc Show

May 10, 2025 -

The Nottingham Attacks Survivors Recount Their Experiences

May 10, 2025

The Nottingham Attacks Survivors Recount Their Experiences

May 10, 2025