Significant Drop In Indonesia's Forex Reserves: Rupiah's Struggle Impacts Reserves

Table of Contents

The Weakening Indonesian Rupiah (IDR): A Primary Driver

The depreciation of the Indonesian Rupiah is a major driver of the decline in Indonesia's forex reserves. This weakening is influenced by both global and domestic factors.

Global Economic Headwinds

Global economic uncertainties significantly impact emerging market currencies like the IDR.

- Rising Interest Rates in Developed Countries: The aggressive interest rate hikes by the US Federal Reserve and other central banks to combat inflation attract capital away from emerging markets like Indonesia, putting downward pressure on the Rupiah. This capital flight weakens the IDR and reduces demand for Indonesian assets.

- Strong US Dollar: The strength of the US dollar against other major currencies, including the IDR, further exacerbates the situation. This makes Indonesian imports more expensive and reduces the value of Indonesia's foreign exchange earnings.

- Global Inflation: High global inflation reduces purchasing power and dampens economic growth globally, impacting demand for Indonesian exports and further weakening the Rupiah. The IDR has depreciated by X% against the USD and Y% against the Euro in the last Z months (insert actual data here).

Domestic Economic Factors

Internal economic pressures also contribute to the Rupiah's weakness and the depletion of Indonesia's forex reserves.

- Current Account Deficit: A persistent current account deficit, where imports exceed exports, puts pressure on the Rupiah. This deficit necessitates increased demand for foreign currency to finance the gap, leading to downward pressure on the IDR.

- Rising Import Costs: Increased global commodity prices, particularly for essential imports, inflate the cost of imports, widening the current account deficit and weakening the Rupiah.

- Commodity Price Fluctuations: Indonesia's reliance on commodity exports makes it vulnerable to price fluctuations in the global market. A decline in commodity prices reduces export earnings, impacting the supply of foreign currency and putting downward pressure on the IDR.

- Domestic Political and Economic Uncertainties: Any political instability or uncertainty in domestic economic policies can erode investor confidence, leading to capital flight and further weakening the Rupiah.

Impact on Forex Reserves

The direct consequence of a weakening Rupiah is a depletion of Indonesia's forex reserves. The Bank Indonesia (BI), Indonesia's central bank, often intervenes in the foreign exchange market to support the Rupiah by buying the currency and selling its reserves.

- This intervention, while attempting to stabilize the currency, directly reduces the level of Indonesia's forex reserves.

- Recent data shows a decline of Z% in Indonesia's forex reserves over the past Y months (insert actual data).

- Reduced reserves limit Indonesia's ability to manage external debt, service its import needs, and withstand future economic shocks.

Implications for the Indonesian Economy

The decline in Indonesia's forex reserves and the weakening Rupiah have significant implications for the Indonesian economy.

Inflationary Pressures

A weaker Rupiah directly contributes to inflationary pressures.

- Increased import prices due to currency depreciation translate into higher consumer prices, impacting purchasing power.

- This inflation can reduce consumer spending and slow down economic growth.

- To combat inflation, BI might raise interest rates, which could further dampen economic activity.

Impact on Investment

Currency volatility discourages both domestic and foreign investment.

- Foreign Direct Investment (FDI) is likely to decline as investors seek more stable markets.

- Capital flight might occur as investors move their funds to safer havens.

- Reduced investment hinders Indonesia's ability to finance crucial infrastructure projects and achieve sustainable economic growth.

Debt Servicing Challenges

A weaker Rupiah increases the cost of servicing Indonesia's external debt.

- Repaying foreign debt denominated in other currencies becomes more expensive when the Rupiah depreciates.

- This could necessitate additional borrowing or even necessitate seeking assistance from international organizations like the IMF.

- A weaker currency can also negatively impact Indonesia's credit rating, making future borrowing more expensive.

Potential Solutions and Future Outlook

Addressing the decline in Indonesia's forex reserves requires a comprehensive approach.

Central Bank Interventions

BI can utilize several tools to stabilize the Rupiah and manage reserves:

- Interest Rate Hikes: Increasing interest rates can attract foreign investment and support the Rupiah.

- Forex Market Interventions: Strategic interventions in the forex market can help manage the Rupiah's volatility.

Fiscal Policy Adjustments

The Indonesian government can play a crucial role through fiscal policies:

- Reducing the Current Account Deficit: Policies that promote exports and reduce imports are essential.

- Boosting Economic Growth: Stimulating domestic demand and economic activity can strengthen the Rupiah.

Diversification Strategies

Reducing reliance on specific commodities and diversifying export markets is vital for long-term stability:

- Exploring new export markets and developing a more diverse range of export products can reduce vulnerability to commodity price fluctuations.

Conclusion

The significant drop in Indonesia's forex reserves, primarily driven by the weakening Rupiah, poses a considerable challenge to the Indonesian economy. Addressing this requires a multi-faceted approach involving coordinated central bank interventions, prudent fiscal policies, and a strategic focus on economic diversification. Continuous monitoring of Indonesia's forex reserves is crucial for investors and policymakers to understand the ongoing impact on Indonesia's economic stability and the future of the Indonesian Rupiah. Stay informed about the dynamics of Indonesia's forex reserves and the Indonesian Rupiah to make informed decisions.

Featured Posts

-

The Weight Loss Drug Market And Weight Watchers Financial Troubles

May 10, 2025

The Weight Loss Drug Market And Weight Watchers Financial Troubles

May 10, 2025 -

Credit Suisse Whistleblower Settlement Up To 150 Million Awarded

May 10, 2025

Credit Suisse Whistleblower Settlement Up To 150 Million Awarded

May 10, 2025 -

Indonesias Falling Reserves Analyzing The Rupiahs Recent Weakness

May 10, 2025

Indonesias Falling Reserves Analyzing The Rupiahs Recent Weakness

May 10, 2025 -

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025

Trumps Transgender Military Ban Decoding The Double Speak

May 10, 2025 -

Individual Charged With Millions In Office365 Account Breaches

May 10, 2025

Individual Charged With Millions In Office365 Account Breaches

May 10, 2025

Latest Posts

-

7 Years Later Familiar Faces Reunite In The High Potential Finale

May 10, 2025

7 Years Later Familiar Faces Reunite In The High Potential Finale

May 10, 2025 -

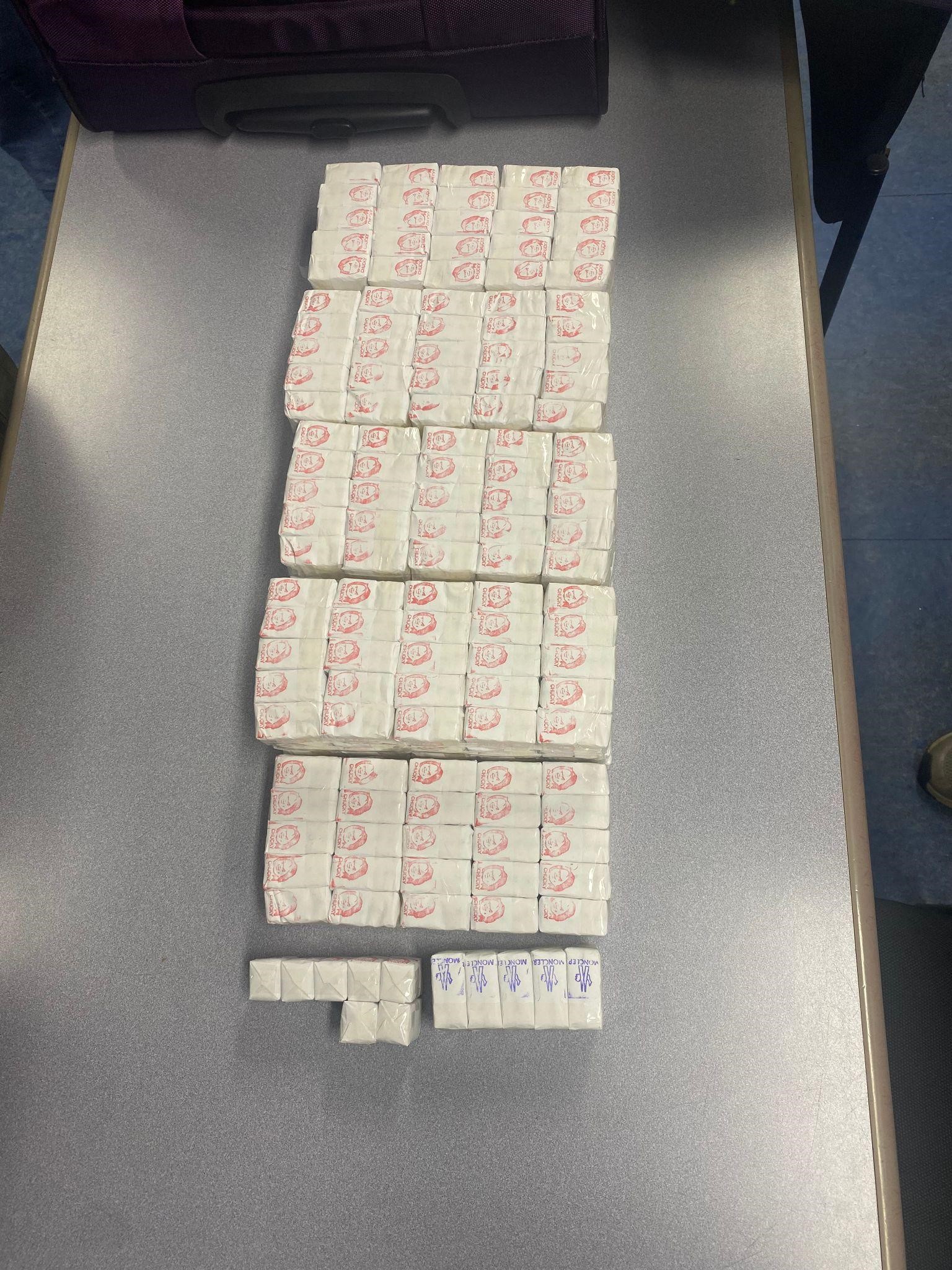

Attorney Generals Fentanyl Prop Public Response And Criticism

May 10, 2025

Attorney Generals Fentanyl Prop Public Response And Criticism

May 10, 2025 -

High Potential Finale A 7 Year Reunion Of Abc Series Actors

May 10, 2025

High Potential Finale A 7 Year Reunion Of Abc Series Actors

May 10, 2025 -

The Attorney General And The Fake Fentanyl Examining The Politics

May 10, 2025

The Attorney General And The Fake Fentanyl Examining The Politics

May 10, 2025 -

Fake Fentanyl Display By Attorney General Implications And Reactions

May 10, 2025

Fake Fentanyl Display By Attorney General Implications And Reactions

May 10, 2025