Stock Market Update: Dow Futures Indicate Positive Week Close

Table of Contents

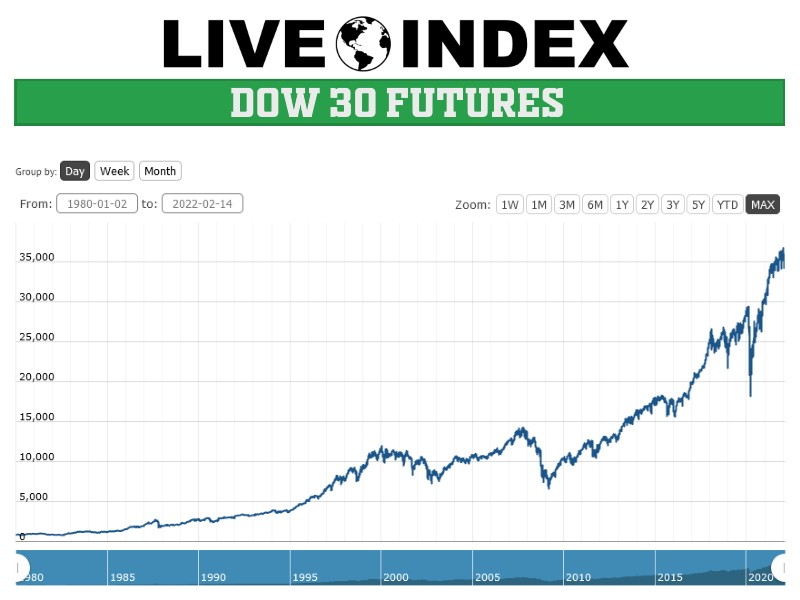

Analyzing Dow Futures Performance

Dow futures are derivative contracts that track the performance of the Dow Jones Industrial Average (DJIA). They act as a powerful predictor of the overall stock market's direction, offering a glimpse into the anticipated performance of the broader market before the actual opening bell. Their significance lies in their ability to reflect investor sentiment and expectations regarding the upcoming trading sessions.

- Specific Data Points: As of [Date and Time], Dow Jones Industrial Average futures rose by 200 points, representing a 0.6% increase. This upward trajectory reflects a growing confidence among investors.

- Significant Price Movements: The most significant price movement occurred between [Time Period], during which futures surged by [Number] points, suggesting a strong positive reaction to [News Event or Economic Indicator].

- Reliable Data Sources: This data is sourced from [Source 1, e.g., CME Group] and [Source 2, e.g., Bloomberg].

Key Economic Indicators Influencing Market Sentiment

Positive Dow futures are often influenced by favorable economic indicators. Several key factors appear to be driving the current positive market sentiment.

- Employment Data: The latest employment report showed a [Number]% increase in non-farm payroll jobs, exceeding expectations and signaling a robust labor market. This positive employment data typically boosts investor confidence.

- Inflation Reports: While inflation remains a concern, recent reports indicate a slight slowdown in the rate of inflation, easing fears of aggressive interest rate hikes by the Federal Reserve. This moderation in inflation often supports positive market sentiment.

- Consumer Confidence Index: The consumer confidence index has shown a [Percentage]% increase, suggesting that consumers are feeling more optimistic about the economy. Increased consumer spending fuels economic growth, positively impacting the stock market.

- Sources: Data for these indicators can be found on websites like the Bureau of Labor Statistics (BLS) and the Federal Reserve.

Sector-Specific Performance and Their Impact on Dow Futures

The positive trend in Dow futures isn't solely driven by overall market sentiment; certain sectors are significantly outperforming others.

- Top-Performing Sectors: The technology sector is showing robust gains, driven by positive earnings reports and advancements in AI. The energy sector is also performing strongly due to [Reason, e.g., rising oil prices]. The financial sector has experienced a boost from [Reason, e.g., increased interest rates].

- Reasons for Strong Performance: Strong corporate earnings, positive economic forecasts, and investor optimism are all contributing to sector-specific gains.

- Potential Risks and Challenges: While these sectors are currently performing well, investors should be aware of potential risks such as [Risk 1, e.g., geopolitical instability] and [Risk 2, e.g., rising interest rates]. These risks could impact future performance.

Expert Opinions and Market Predictions

Leading financial analysts are offering a range of predictions based on the current positive Dow futures performance.

- Analyst Quotes: "[Quote from Analyst 1 about positive market outlook]", according to [Source]. Another expert, [Analyst 2], states: "[Quote from Analyst 2 regarding potential risks and opportunities]".

- Short-Term and Long-Term Predictions: Many analysts are predicting a continued upward trend in the short term, with the potential for further gains depending on the release of upcoming economic data and corporate earnings reports. Long-term predictions are more varied, depending on broader economic conditions.

- Sources: These opinions were gathered from reputable financial news sources such as [Source 1, e.g., The Wall Street Journal] and [Source 2, e.g., CNBC].

Conclusion: Stock Market Update: Dow Futures Indicate Positive Week Close – Your Next Steps

This stock market update has highlighted the positive outlook suggested by strong Dow futures performance, driven by favorable economic indicators and strong sector-specific growth. Key economic data, such as positive employment figures and moderating inflation, are contributing to increased investor confidence. While certain sectors are outperforming others, potential risks should be considered. Experts offer a mixed bag of short-term and long-term predictions, underscoring the need for ongoing market monitoring. The upward trend in Dow futures indicates a potentially positive week close, but staying informed is crucial for informed investment decisions. Stay tuned for our next stock market update to further analyze the Dow futures and make the most of this potentially positive week close. Learn more about managing your portfolio effectively by [link to relevant resource].

Featured Posts

-

Look Ahead Planning Your April With Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest

Apr 26, 2025

Look Ahead Planning Your April With Indie Bookstore Day Dutch Kings Day And Tumbleweeds Film Fest

Apr 26, 2025 -

2024 Nfl Draft What To Expect From The First Round In Green Bay

Apr 26, 2025

2024 Nfl Draft What To Expect From The First Round In Green Bay

Apr 26, 2025 -

Open Ai Facing Ftc Investigation Understanding The Potential Consequences

Apr 26, 2025

Open Ai Facing Ftc Investigation Understanding The Potential Consequences

Apr 26, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 26, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Star Speaks Out

Apr 26, 2025 -

Zoete Nederlandse Broodjes Een Culinaire Paradox

Apr 26, 2025

Zoete Nederlandse Broodjes Een Culinaire Paradox

Apr 26, 2025

Latest Posts

-

How Colman Domingo Elevates Mens Style

May 06, 2025

How Colman Domingo Elevates Mens Style

May 06, 2025 -

10 Perfect Mcu Roles For Colman Domingo Besides Kang

May 06, 2025

10 Perfect Mcu Roles For Colman Domingo Besides Kang

May 06, 2025 -

From Craigslist To The Oscars Colman Domingos Journey

May 06, 2025

From Craigslist To The Oscars Colman Domingos Journey

May 06, 2025 -

Rihannas Latest Look Out To Dinner In Santa Monica

May 06, 2025

Rihannas Latest Look Out To Dinner In Santa Monica

May 06, 2025 -

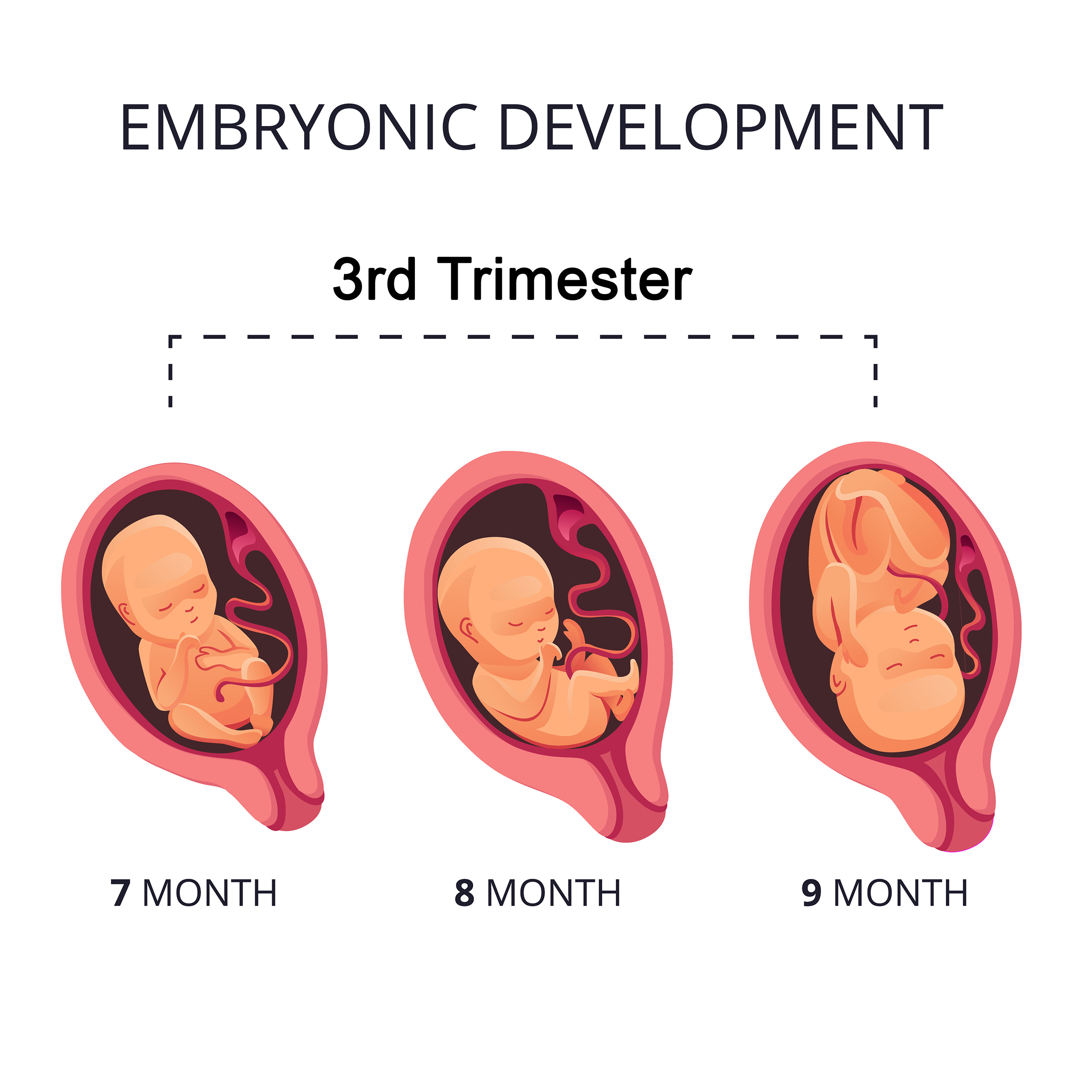

Rihannas Third Pregnancy Public Appearances And Speculation

May 06, 2025

Rihannas Third Pregnancy Public Appearances And Speculation

May 06, 2025