Stock Market Valuation Concerns: BofA Offers Investors A Reason For Calm

Table of Contents

BofA's Key Arguments Against Overvaluation Concerns

BofA's reassessment of stock market valuations rests on three pillars: robust earnings growth projections, a nuanced understanding of interest rate impacts, and a focus on long-term growth potential.

Earnings Growth Projections

BofA projects healthy corporate earnings growth, suggesting that current valuation multiples are not as alarming as they might initially appear.

- Strong Growth Sectors: The firm anticipates particularly strong growth in technology, healthcare, and select consumer discretionary sectors, driven by innovation and recovering consumer spending. These sectors are expected to significantly contribute to overall earnings growth, mitigating concerns about overvaluation in the broader market.

- Justifying Current Valuations: BofA's projections suggest that anticipated earnings growth will justify, or at least significantly lessen, current valuation multiples over the coming years. This means that even with seemingly high valuations, the underlying fundamentals support future growth and potential returns.

- Caveats and Assumptions: It is important to note that BofA's projections rely on certain assumptions, including sustained economic growth and the absence of major geopolitical shocks. These assumptions, while reasonable, carry inherent uncertainties.

Interest Rate Impacts and Valuation

Rising interest rates typically exert downward pressure on stock valuations, as they increase the discount rate used in discounted cash flow models, reducing the present value of future earnings.

- Discounted Cash Flow Models: BofA acknowledges the influence of interest rates on valuation models. However, their analysis suggests that the current interest rate environment, while higher than in recent years, is still within a manageable range for many companies with solid fundamentals.

- Interest Rate Assessment: BofA anticipates a potential plateauing or even slight decline in interest rates in the future, which would lessen their negative impact on stock valuations. This forecast is dependent on inflation trends and central bank policy decisions.

- Alternative Perspectives: It is crucial to acknowledge that not all analysts share BofA's optimistic view on interest rates. Some predict more aggressive rate hikes, which could put further downward pressure on stock prices. It is important for investors to consider various perspectives before making any investment decisions.

Long-Term Growth Potential

BofA emphasizes the importance of considering long-term growth potential when assessing current stock market valuations. Short-term market fluctuations should not overshadow the potential for long-term growth.

- Growth Drivers: The firm highlights several long-term growth drivers, including technological advancements (AI, renewable energy), the expansion of emerging markets, and ongoing innovation across various sectors. These drivers are anticipated to fuel significant economic expansion over the long term.

- Positive Outlook: BofA argues that these long-term growth drivers support a positive outlook for stock market performance, even given current valuation levels. Investors with a longer time horizon may find current valuations less concerning.

- Short-Term vs. Long-Term: The key takeaway here is the importance of differentiating between short-term market noise and long-term investment potential. Focusing solely on short-term fluctuations can lead to poor investment decisions.

Understanding Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in market volatility, often exacerbating short-term fluctuations. BofA addresses these emotional factors to provide a more balanced perspective.

Addressing Investor Anxiety

Fear, uncertainty, and doubt (FUD) are common emotions during periods of market uncertainty. BofA acknowledges the impact of these emotions on investor behavior.

- Media Hype and Market Noise: The financial media can amplify anxieties, often focusing on negative news and creating a sense of panic. Investors should be aware of this tendency and filter information critically.

- Risk Management Strategies: BofA advocates for a disciplined approach to risk management, including diversification, strategic asset allocation, and a focus on long-term goals.

- Maintaining a Rational Perspective: Investors should strive to maintain a rational perspective, separating emotion from sound investment decisions. Focusing on fundamental analysis rather than reacting to daily market fluctuations is key.

Historical Context and Market Cycles

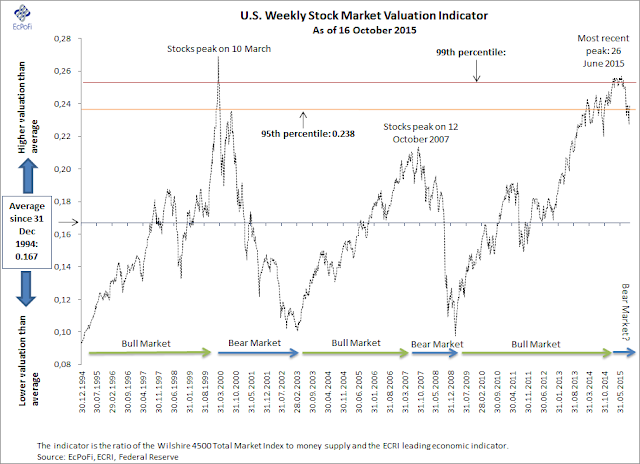

Analyzing historical market cycles provides valuable context for understanding current valuations.

- Historical Valuations: A review of historical stock market valuations reveals that periods of high valuations have often been followed by significant market growth.

- Market Cycles and Long-Term Strategies: The stock market operates in cycles, with periods of growth and correction. Long-term investors should anticipate and adjust to these cycles.

- Past Market Corrections: History shows that even significant market corrections have ultimately been followed by recovery and renewed growth. This provides historical evidence to support a long-term perspective.

Conclusion

BofA's analysis presents a compelling case for a more optimistic outlook on stock market valuations. By considering projected earnings growth, the nuanced impact of interest rates, and the significant potential for long-term growth, investors can temper their anxieties surrounding current market conditions. The key takeaway is to focus on long-term investment strategies, managing emotional responses to market fluctuations, and maintaining a well-diversified portfolio. Don't let short-term stock market valuation concerns deter you from a sound long-term investment strategy. Consult with a financial advisor to create a plan that aligns with your goals and risk tolerance. Remember to carefully consider your personal financial situation and seek professional advice before making any investment decisions.

Featured Posts

-

Inter Milans Out Of Contract Players In 2026 A Detailed Look

May 08, 2025

Inter Milans Out Of Contract Players In 2026 A Detailed Look

May 08, 2025 -

Bmw And Porsches China Challenges A Wider Industry Problem

May 08, 2025

Bmw And Porsches China Challenges A Wider Industry Problem

May 08, 2025 -

Open Ai And Chat Gpt Federal Trade Commission Investigation

May 08, 2025

Open Ai And Chat Gpt Federal Trade Commission Investigation

May 08, 2025 -

Potential Canada Post Labour Dispute Key Dates And Concerns

May 08, 2025

Potential Canada Post Labour Dispute Key Dates And Concerns

May 08, 2025 -

Canadas Trade Deficit Narrows 506 Million In Latest Figures

May 08, 2025

Canadas Trade Deficit Narrows 506 Million In Latest Figures

May 08, 2025

Latest Posts

-

Growth Investor Forecasts 1 500 Bitcoin Price Appreciation

May 08, 2025

Growth Investor Forecasts 1 500 Bitcoin Price Appreciation

May 08, 2025 -

Exploring The Unique Double Performances In Okc Thunders Record Books

May 08, 2025

Exploring The Unique Double Performances In Okc Thunders Record Books

May 08, 2025 -

Bitcoin Price Prediction 1 500 Rise In Five Years Examining The Claims

May 08, 2025

Bitcoin Price Prediction 1 500 Rise In Five Years Examining The Claims

May 08, 2025 -

Five Year Bitcoin Outlook Potential For 1 500 Growth

May 08, 2025

Five Year Bitcoin Outlook Potential For 1 500 Growth

May 08, 2025 -

Is A 1 500 Bitcoin Surge Possible Analyzing The Prediction

May 08, 2025

Is A 1 500 Bitcoin Surge Possible Analyzing The Prediction

May 08, 2025