Stock Market Valuation Concerns? BofA Offers Reassurance.

Table of Contents

BofA's Key Arguments for a Less Pessimistic Outlook

BofA's recent report challenges the widespread pessimism surrounding stock market valuations. Their assessment incorporates various valuation metrics and considers several key factors contributing to a more optimistic outlook.

Addressing Overvaluation Fears

BofA employs a multifaceted approach to assess valuations, utilizing metrics such as Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and other fundamental analyses. They argue against the notion of widespread overvaluation based on several key points:

- Strong Corporate Earnings Growth: Many companies have demonstrated robust earnings growth despite economic headwinds, suggesting underlying strength in the market. BofA cites specific examples of sectors exceeding expectations (data source needed here, referencing BofA report).

- Resilient Consumer Spending: Despite inflationary pressures, consumer spending has remained relatively resilient in key markets, supporting ongoing corporate revenue. (Data source needed, referencing BofA report)

- Technological Advancements Driving Future Growth: Innovation and technological advancements continue to fuel long-term growth prospects across various sectors, offsetting some near-term concerns. (Data source needed, referencing BofA report)

These factors, according to BofA's analysis, suggest that current valuations, while perhaps elevated in some sectors, are not universally overinflated.

Identifying Undervalued Sectors/Stocks

BofA's analysis highlights specific sectors and stocks that they believe are currently undervalued, presenting opportunities for strategic investors.

- Energy Sector Poised for Growth: The energy sector, driven by global demand and geopolitical factors, is identified as a potential area of undervaluation. BofA points to specific companies with strong fundamentals and growth projections. (Specific company examples and data source needed, referencing BofA report).

- Tech Stocks Showing Signs of Recovery: Certain segments within the technology sector are showing signs of recovery after a period of correction, presenting attractive entry points for long-term investors. (Specific company examples and data source needed, referencing BofA report).

- Specific Company Examples with Strong Fundamentals: BofA’s report likely features specific examples of companies with solid financial positions, strong management, and promising future prospects that are currently trading at discounted valuations. (Specific examples and data source needed, referencing BofA report)

Long-Term Growth Prospects

BofA maintains a positive outlook on long-term economic growth, believing it will significantly influence stock market performance. Their optimism stems from several factors:

- Technological Innovation: Continued breakthroughs in technology are expected to drive productivity gains and create new economic opportunities.

- Demographic Shifts: Changing demographics in certain regions may lead to increased demand for goods and services.

- Government Policies: Supportive government policies (e.g., infrastructure investments) can further stimulate economic growth.

These factors, according to BofA, help mitigate current valuation concerns and support the case for long-term investment in the stock market.

Addressing Remaining Risks and Cautions

While BofA presents a relatively optimistic outlook, they acknowledge significant risks and uncertainties that could impact stock market valuations.

Inflationary Pressures

Inflation continues to be a major concern, impacting corporate profitability and consumer spending. BofA emphasizes the need for careful monitoring of inflation trends and their potential effect on future market performance. They may suggest hedging strategies or adjustments to investment portfolios to mitigate inflation risk. (Details on BofA's suggested strategies needed, referencing BofA report)

Geopolitical Uncertainty

Geopolitical events, such as ongoing conflicts and trade tensions, introduce significant uncertainty into the market. BofA's analysis likely incorporates geopolitical risk assessment and suggests strategies for managing such uncertainty within an investment portfolio. (Details on BofA's geopolitical risk assessment and strategies needed, referencing BofA report)

Interest Rate Hikes

The Federal Reserve's monetary policy, particularly interest rate hikes, significantly impacts stock valuations and market sentiment. BofA's assessment likely includes an analysis of the Fed's actions and their potential effects on the market, providing insights into how investors should navigate this environment. (Details on BofA's assessment of the Fed's policy and its impact needed, referencing BofA report)

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Insights

BofA's analysis offers a balanced perspective on current stock market valuation concerns. While acknowledging risks associated with inflation, geopolitical events, and interest rate hikes, their report highlights factors supporting a less pessimistic outlook, including strong corporate earnings, resilient consumer spending, and long-term growth prospects fueled by technological advancements. Key sectors and individual stocks are identified as potentially undervalued, providing opportunities for strategic investors. While stock market valuation concerns remain, BofA's analysis offers valuable insights. Review their complete report to better understand the current market landscape and make informed investment decisions. Don't let valuation concerns paralyze you; understand the nuances and act strategically. Remember to seek professional financial advice tailored to your individual circumstances.

Featured Posts

-

Models Night Out Leads To Poisoning Allegations The Annie Kilner And Kyle Walker Story

May 25, 2025

Models Night Out Leads To Poisoning Allegations The Annie Kilner And Kyle Walker Story

May 25, 2025 -

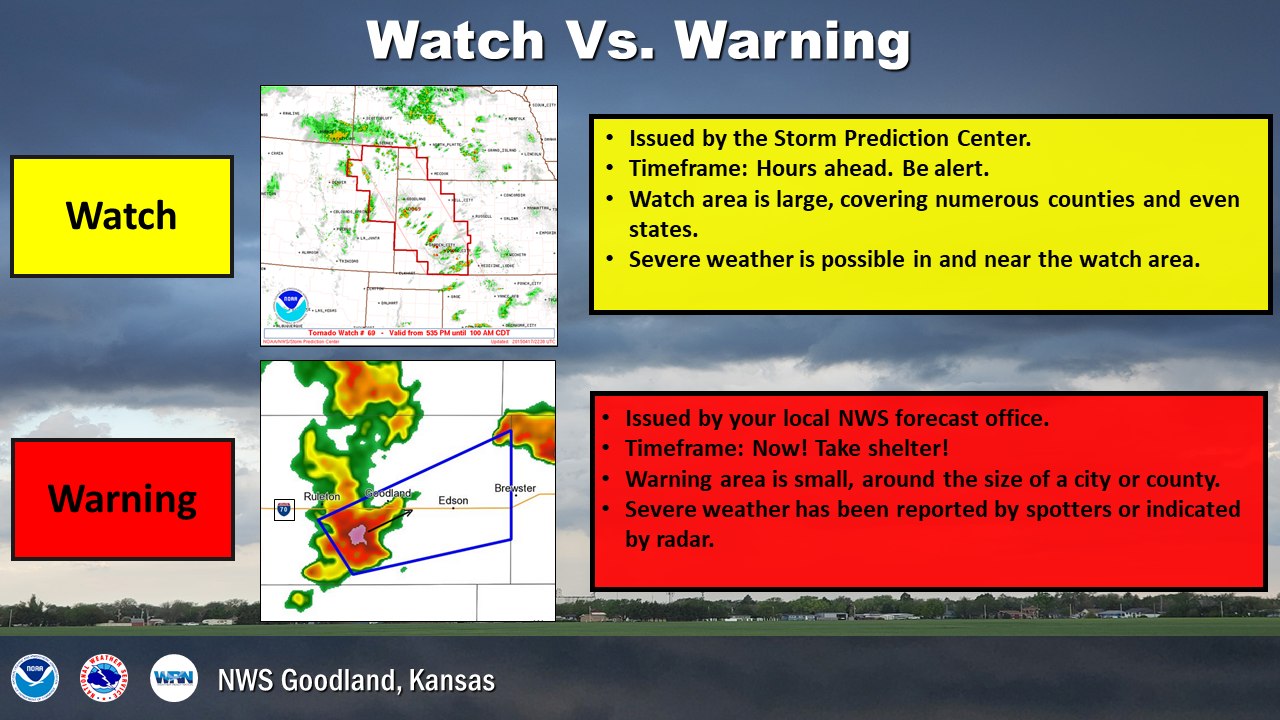

Nws Flood Warning Key Safety Tips And Actions To Take

May 25, 2025

Nws Flood Warning Key Safety Tips And Actions To Take

May 25, 2025 -

Your Escape To The Country Choosing The Right Property And Lifestyle

May 25, 2025

Your Escape To The Country Choosing The Right Property And Lifestyle

May 25, 2025 -

Nemecke Firmy A Hromadne Prepustanie Analyza Aktualnej Situacie

May 25, 2025

Nemecke Firmy A Hromadne Prepustanie Analyza Aktualnej Situacie

May 25, 2025 -

Real Madrid E Uefa Dan Doert Yildizli Sorusturma Son Durum

May 25, 2025

Real Madrid E Uefa Dan Doert Yildizli Sorusturma Son Durum

May 25, 2025

Latest Posts

-

Atletico Madrid In 3 Maclik Durgunlugunun Sonu

May 25, 2025

Atletico Madrid In 3 Maclik Durgunlugunun Sonu

May 25, 2025 -

3 Maclik Bekleyis Sonrasi Atletico Madrid In Zaferi

May 25, 2025

3 Maclik Bekleyis Sonrasi Atletico Madrid In Zaferi

May 25, 2025 -

Atletico Madrid 3 Mac Sonra Kazanmanin Tadini Cikariyor

May 25, 2025

Atletico Madrid 3 Mac Sonra Kazanmanin Tadini Cikariyor

May 25, 2025 -

Atletico Madrid In 3 Maclik Galibiyetsizligi Kirildi

May 25, 2025

Atletico Madrid In 3 Maclik Galibiyetsizligi Kirildi

May 25, 2025 -

Atletico Madrid 3 Maclik Hasret Son Buldu

May 25, 2025

Atletico Madrid 3 Maclik Hasret Son Buldu

May 25, 2025