Stock Market Valuation Concerns: BofA Offers Reassurance For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's recent reports have shed light on the factors contributing to the current high valuations and offer justifications for these levels. Understanding their assessment is crucial for investors grappling with stock market valuation concerns.

Factors Contributing to High Valuations

Several macroeconomic factors have influenced the current high valuations in the stock market. BofA's analysis highlights several key contributors:

- Low Interest Rates: Persistently low interest rates make borrowing cheaper for companies, boosting investment and increasing profitability. This, in turn, supports higher stock prices.

- Quantitative Easing (QE): Central bank policies like QE have injected significant liquidity into the market, driving up asset prices, including stocks.

- Strong Corporate Earnings: Many companies have reported robust earnings growth, bolstering investor confidence and justifying higher valuations.

- Technological Innovation: Rapid technological advancements and the growth of sectors like technology and renewable energy have driven significant investment and increased market capitalization.

These factors contribute to a higher price-to-earnings (P/E) ratio and other valuation metrics, leading to concerns about potential overvaluation. BofA's analysis, however, suggests a more nuanced perspective on stock market valuation.

BofA's Justification for Current Levels

Despite the seemingly high valuations, BofA's analysis argues that current levels are, to a large extent, justified. Their reasoning incorporates the following points:

- Future Growth Potential: BofA highlights the significant growth potential of many companies, especially in innovative sectors, suggesting that current valuations reflect future earnings expectations.

- Low Inflation Expectations: Low inflation rates imply that the real return on equity investments remains attractive, supporting the current valuation levels.

- Strong Balance Sheets: Many companies have strong balance sheets and ample cash reserves, mitigating risks associated with high valuations.

- Sustained Economic Growth: BofA’s forecasts suggest continued economic growth, further supporting higher valuations in the long term. This positive outlook helps address many stock market valuation concerns.

Addressing Investor Concerns about Potential Overvaluation

While BofA provides a reassuring outlook, it's crucial to acknowledge legitimate concerns about potential overvaluation.

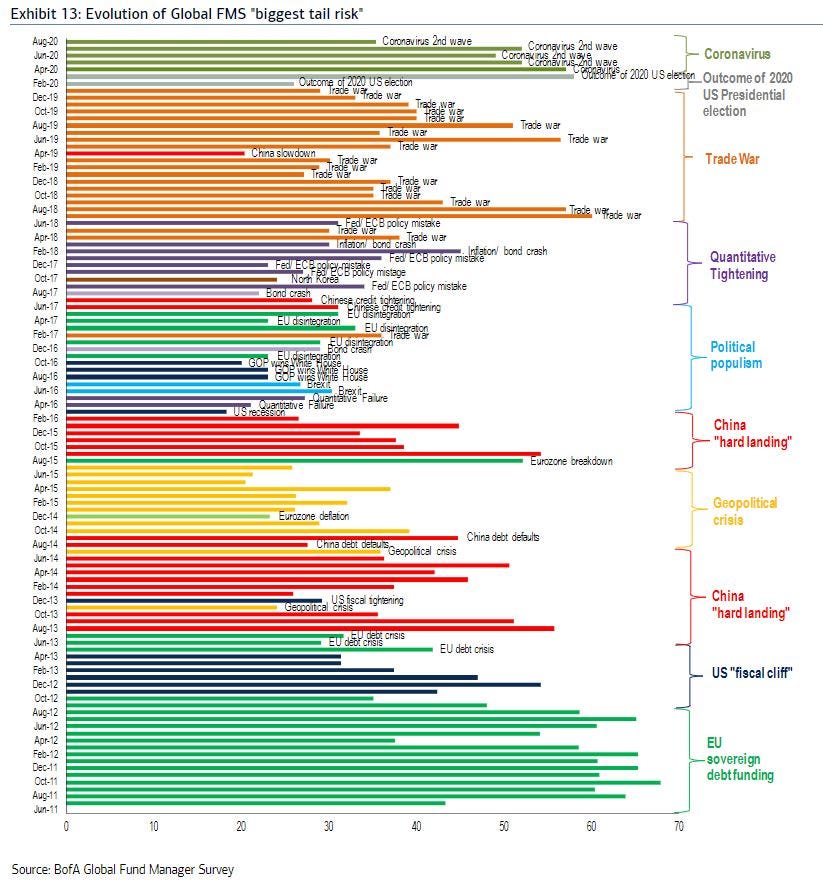

Identifying Potential Risks

Several factors could potentially lead to a market correction or downturn:

- Interest Rate Hikes: A sharp increase in interest rates could significantly impact corporate borrowing costs and reduce profitability, leading to lower valuations.

- Inflationary Pressures: A surge in inflation could erode corporate earnings and reduce investor confidence, impacting stock prices.

- Geopolitical Risks: Uncertain geopolitical events can create market volatility and negatively affect stock valuations.

- Market Corrections: Even with a positive long-term outlook, short-term market corrections are a normal part of the investment cycle, and investors should be prepared for them.

BofA's Mitigation Strategies and Recommendations

BofA suggests several strategies to mitigate these risks and navigate the current market environment:

- Diversification: Diversifying investments across different sectors and asset classes reduces overall portfolio risk.

- Sector Selection: Focusing on sectors with strong growth prospects and resilience to economic downturns can enhance portfolio performance.

- Long-Term Investment Horizon: Maintaining a long-term investment strategy minimizes the impact of short-term market fluctuations.

- Regular Portfolio Review: Regularly reviewing and rebalancing your portfolio allows you to adapt to changing market conditions. This is essential for managing stock market valuation risks effectively.

Alternative Perspectives and Expert Opinions

It's important to consider diverse perspectives when assessing market valuations. While BofA offers a relatively optimistic outlook, other analysts hold differing opinions.

Contrasting Views on Market Valuations

Some analysts express concerns about the current valuations, highlighting the potential for a market correction driven by factors like rising interest rates or increased inflation. These contrasting views underscore the need for careful analysis and a diversified investment approach. The market valuation debate remains ongoing, with considerable variation in analyst opinions. This emphasizes the importance of individual research and risk assessment.

Conclusion: Reassurance and Call to Action

BofA's analysis offers a reassuring perspective on current stock market valuations, acknowledging potential risks while highlighting the justifications for current levels. Their recommendations emphasize diversification, sector selection, and a long-term investment horizon as key strategies for mitigating risks. Understanding these factors and employing sound investment strategies is crucial for navigating the complexities of the market and managing stock market valuation concerns effectively.

Don't let stock market valuation concerns paralyze you. Use BofA's insights to inform your investment decisions and navigate the market with confidence. Learn more about managing your stock market valuation risks today!

Featured Posts

-

January 6th Hearing Star Cassidy Hutchinson To Publish Memoir

May 26, 2025

January 6th Hearing Star Cassidy Hutchinson To Publish Memoir

May 26, 2025 -

D C Pride 2024 A Comprehensive Guide To Events And Celebrations

May 26, 2025

D C Pride 2024 A Comprehensive Guide To Events And Celebrations

May 26, 2025 -

Advocate Highlights Paramedic Success At Emergency Services Games

May 26, 2025

Advocate Highlights Paramedic Success At Emergency Services Games

May 26, 2025 -

4 Goluen Adami Soerloth La Liga Da Ilk 30 Dakikanin Kahramani

May 26, 2025

4 Goluen Adami Soerloth La Liga Da Ilk 30 Dakikanin Kahramani

May 26, 2025 -

Fujifilm X Half Camera A Fun And Refreshing Hands On Experience

May 26, 2025

Fujifilm X Half Camera A Fun And Refreshing Hands On Experience

May 26, 2025

Latest Posts

-

Abd De Tueketici Kredileri Mart Ayinda Artti Detayli Analiz

May 28, 2025

Abd De Tueketici Kredileri Mart Ayinda Artti Detayli Analiz

May 28, 2025 -

Beklentileri Geride Birakan Abd Tueketici Kredileri Artisi

May 28, 2025

Beklentileri Geride Birakan Abd Tueketici Kredileri Artisi

May 28, 2025 -

Abd Tueketici Kredileri Beklentilerin Uezerinde Bueyueme

May 28, 2025

Abd Tueketici Kredileri Beklentilerin Uezerinde Bueyueme

May 28, 2025 -

Understanding Tribal Loans Direct Lenders And Bad Credit

May 28, 2025

Understanding Tribal Loans Direct Lenders And Bad Credit

May 28, 2025 -

Abd De Tueketici Kredileri Beklentileri Asti Eyluel 2023 Analizi

May 28, 2025

Abd De Tueketici Kredileri Beklentileri Asti Eyluel 2023 Analizi

May 28, 2025