Stock Market Valuations: A BofA Analysis And Reasons For Investor Calm

Table of Contents

BofA's Current Valuation Assessment

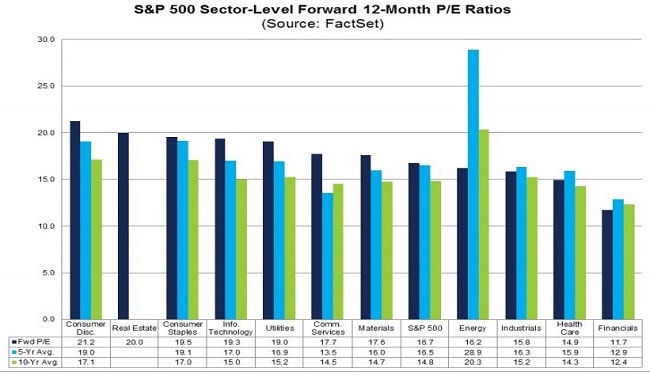

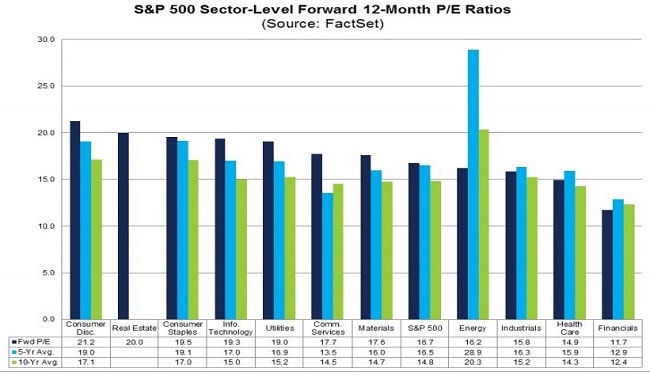

BofA regularly publishes reports assessing stock market valuations, employing a range of metrics to gauge market health. Their analyses often incorporate price-to-earnings ratios (P/E), price-to-sales ratios (P/S), market capitalization, and discounted cash flow (DCF) models to provide a comprehensive picture. These sophisticated valuation models allow for a nuanced understanding beyond simple price movements.

- Key Findings: BofA's most recent reports (insert specific report details and dates here if available) may indicate (insert BofA's overall assessment – e.g., a slightly overvalued market, specific sectors overvalued, etc.). These findings are often accompanied by detailed explanations and supporting data.

- Sectoral Analysis: For example, BofA might highlight the technology sector as potentially overvalued based on high P/E ratios relative to historical averages and projected earnings growth, while the energy sector might be deemed undervalued due to strong earnings and relatively low valuations. (Insert specific examples from BofA reports, citing sources if possible).

- Historical Comparison: Current valuations are frequently compared to historical averages to identify potential deviations and assess the degree of overvaluation or undervaluation. This long-term perspective provides context and helps determine if current valuations are sustainable or represent a bubble.

- Valuation Models: BofA's use of diverse valuation models, including DCF analysis, provides a robust assessment. DCF, which projects future cash flows to determine present value, is particularly useful in evaluating companies with strong growth potential.

Factors Contributing to Investor Calm

Despite potential valuation concerns highlighted by BofA and others, investor sentiment remains relatively calm. Several factors contribute to this apparent resilience:

- Interest Rate Decisions: Recent interest rate decisions by central banks (specify which banks and their actions), while potentially impacting future economic growth, have, in some instances, provided a degree of market stability by offering clarity (or, alternatively, have created uncertainty and volatility, depending on the current market conditions. Analyze the situation relevant to the time of writing).

- Inflation Expectations: Current inflation rates (cite specific data) and expectations for future inflation significantly influence investor confidence. Stable or declining inflation tends to support market calm, while rising inflation can increase uncertainty.

- Economic Growth Projections: Positive economic growth projections (cite sources) bolster investor confidence, even if valuations appear high. However, overly optimistic forecasts can also mask underlying risks.

- Geopolitical Risks: Geopolitical events (mention specific examples, if relevant) can introduce significant uncertainty. However, markets have demonstrated a capacity to absorb shocks, sometimes exhibiting surprising resilience.

- Market Resilience: The market’s ability to absorb negative news and shocks, particularly those anticipated, demonstrates a level of inherent stability.

The Role of Corporate Earnings

Corporate earnings reports play a crucial role in shaping stock market valuations and investor sentiment. Strong earnings growth can justify seemingly high valuations.

- Earnings Impact: Recent corporate earnings reports (mention specific examples if available) have (explain the impact of these reports, whether they were positive, negative, or mixed and the subsequent effect on market sentiment).

- Earnings Growth and Valuations: A strong correlation exists between earnings growth and stock valuations. Companies exhibiting robust earnings growth tend to command higher valuations.

- Profit Margins: Profit margins, reflecting a company's profitability, are a key indicator closely followed by investors. Healthy profit margins underpin higher valuations.

Potential Risks and Cautions

While investor calm prevails, it's crucial to acknowledge potential risks:

- Market Correction/Recession: The possibility of a market correction or even a recession remains a significant risk. High valuations increase vulnerability to negative shocks.

- Valuation Bubbles: Certain sectors might be experiencing valuation bubbles, characterized by prices significantly exceeding intrinsic value. This poses a substantial risk of a sharp correction.

- Downside Risks: Unforeseen events, such as geopolitical instability or unexpected economic downturns, represent significant downside risks that can dramatically impact stock market valuations.

Conclusion

BofA's analysis provides valuable insights into current stock market valuations. While factors like strong corporate earnings and interest rate decisions have contributed to investor calm, potential risks, including the possibility of a market correction or recession, cannot be ignored. Understanding these valuations and the contributing factors is crucial for developing effective investment strategies. Stay informed on stock market valuations, monitor BofA's analysis and other market indicators, and make informed decisions about your stock market investments. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Featured Posts

-

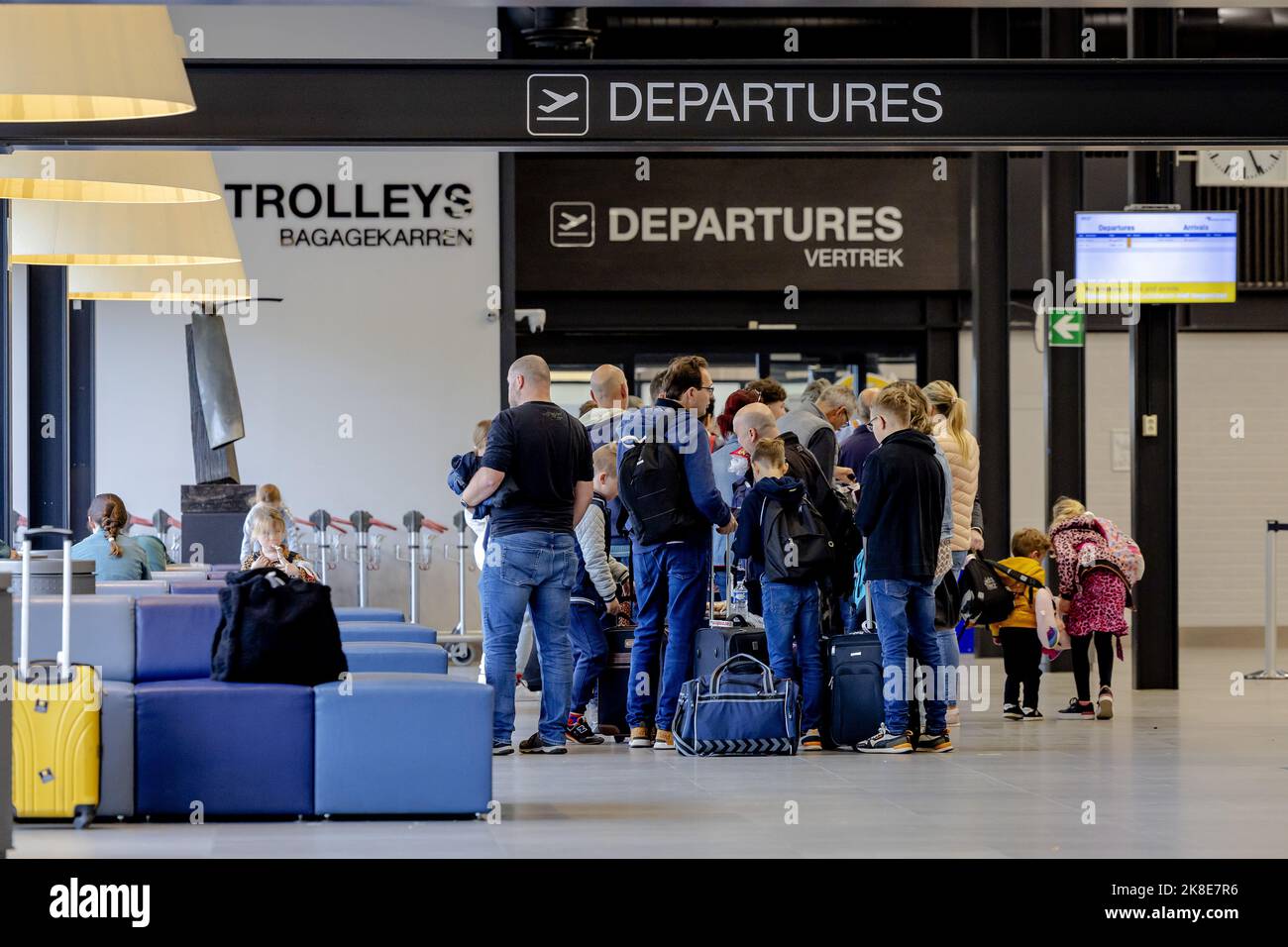

Analyse Passagiersaantallen Maastricht Airport Begin 2025

May 19, 2025

Analyse Passagiersaantallen Maastricht Airport Begin 2025

May 19, 2025 -

Trump Tan Gazze Paylasimi Skandali Dansoezler Altin Heykeller Ve Elon Musk In Rolue

May 19, 2025

Trump Tan Gazze Paylasimi Skandali Dansoezler Altin Heykeller Ve Elon Musk In Rolue

May 19, 2025 -

Svts Eurovision Beredskap Om Kaj Vinner I Basel

May 19, 2025

Svts Eurovision Beredskap Om Kaj Vinner I Basel

May 19, 2025 -

Saving The Jersey Battle Of Flowers One Mans Determination

May 19, 2025

Saving The Jersey Battle Of Flowers One Mans Determination

May 19, 2025 -

Nyt Mini Crossword Today Hints And Answers For February 26 2025

May 19, 2025

Nyt Mini Crossword Today Hints And Answers For February 26 2025

May 19, 2025

Latest Posts

-

Report Paige Bueckers To Be A Top Wnba Draft Pick

May 19, 2025

Report Paige Bueckers To Be A Top Wnba Draft Pick

May 19, 2025 -

The Paige Bueckers Effect Boosting The Dallas Wings And The Wnbas Momentum

May 19, 2025

The Paige Bueckers Effect Boosting The Dallas Wings And The Wnbas Momentum

May 19, 2025 -

Cannes Film Festival 2025 Kristen Stewarts Directorial Debut Celebrated

May 19, 2025

Cannes Film Festival 2025 Kristen Stewarts Directorial Debut Celebrated

May 19, 2025 -

Paige Bueckers Enters Wnba Draft Analysis And Predictions

May 19, 2025

Paige Bueckers Enters Wnba Draft Analysis And Predictions

May 19, 2025 -

Kristen Stewart In The Chronology Of Water A Review Of A Troubled Artists Journey

May 19, 2025

Kristen Stewart In The Chronology Of Water A Review Of A Troubled Artists Journey

May 19, 2025