Stock Market Valuations: BofA Assures Investors, Dispelling Valuation Worries

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's message isn't a simple "all clear" signal. Instead, their analysis provides a more nuanced perspective on stock market valuations, urging investors to look beyond headline figures and short-term market fluctuations.

Focus on Long-Term Growth Potential

BofA emphasizes the crucial role of long-term earnings growth projections in assessing valuations. They argue that short-term market volatility and seemingly high valuations shouldn't overshadow the potential for substantial growth over the next several years. Focusing solely on current price-to-earnings ratios (P/E ratios) without considering future earnings growth paints an incomplete picture.

- Focus on earnings growth forecasts for the next 3-5 years: BofA likely uses sophisticated models to project future earnings, considering factors such as technological advancements, industry trends, and macroeconomic conditions. This long-term view provides a more comprehensive assessment of the market's intrinsic value.

- Consider the impact of innovation and technological advancements: Disruptive technologies and innovative business models can significantly drive long-term earnings growth, justifying seemingly high current valuations. Companies pioneering advancements in AI, biotechnology, or renewable energy, for instance, might command higher valuations reflecting their future potential.

- Analyze industry-specific growth drivers: BofA's analysis likely delves into specific industry sectors, identifying those poised for significant growth and those facing headwinds. This sector-specific approach provides a more granular understanding of valuation disparities across the market.

The Role of Interest Rates and Inflation

BofA acknowledges the undeniable impact of rising interest rates and persistent inflation on stock market valuations. Higher interest rates increase the cost of borrowing, impacting corporate profitability and making bonds a more attractive alternative investment. Inflation erodes purchasing power and can squeeze corporate margins. However, BofA's analysis likely suggests that much of these impacts are already priced into the market.

- Discuss the relationship between bond yields and equity valuations: Rising bond yields often lead to lower equity valuations as investors seek the perceived safety and higher returns of bonds. BofA likely analyzed this relationship to determine the extent to which current equity valuations already reflect the impact of higher interest rates.

- Analyze the impact of inflation on corporate earnings and profitability: Inflation's effect on corporate earnings is complex. While it can increase prices, it also boosts input costs. BofA's analysis probably considers this interplay to understand the net impact on corporate profitability and subsequent valuations.

- Consider the Federal Reserve's monetary policy and its influence on valuations: The Federal Reserve's actions directly influence interest rates and inflation. BofA likely incorporates the Fed's expected future policy decisions into their valuation models, accounting for the potential impact on the market.

Sector-Specific Valuation Analysis

BofA’s assessment isn't a one-size-fits-all judgment. Their analysis likely differentiates between sectors, identifying some as relatively overvalued and others as offering compelling investment opportunities. This granular approach is crucial for navigating the complexities of the stock market.

- Highlight specific sectors BofA deems attractively valued: These sectors likely demonstrate robust growth potential relative to their current valuations, making them potentially attractive investment targets.

- Mention sectors where BofA suggests caution due to higher valuations: Investors should exercise caution in these sectors, potentially reducing exposure or conducting more thorough due diligence before investing.

- Explain the methodology used to analyze sector-specific valuations: Understanding the methodology used by BofA provides crucial context for their conclusions, allowing investors to assess the validity and reliability of their findings.

Addressing Common Investor Concerns about Stock Market Valuations

Many investors harbor legitimate concerns about stock market valuations. BofA's analysis likely addresses these directly, offering a more balanced perspective.

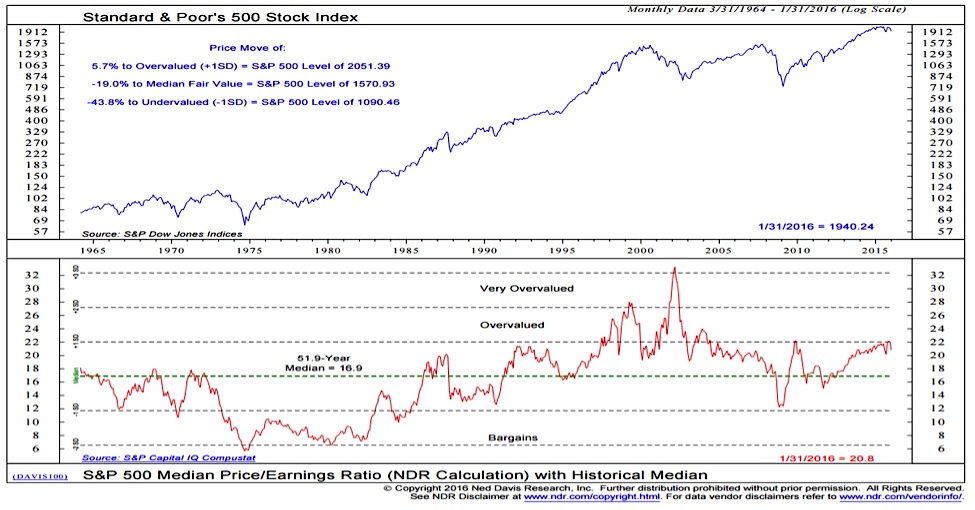

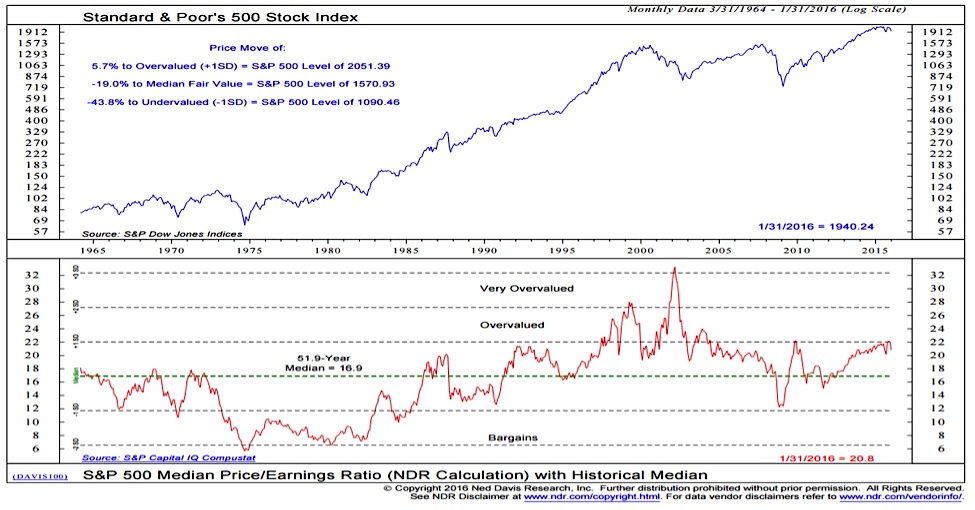

The Price-to-Earnings Ratio (P/E) Debate

The P/E ratio is a widely used valuation metric, but it's not without limitations. BofA likely addresses concerns around high P/E ratios, contextualizing them within historical averages and emphasizing alternative metrics.

- Discuss the limitations of using P/E ratio in isolation: The P/E ratio alone can be misleading. Factors like growth rates, industry dynamics, and accounting practices need to be considered.

- Introduce alternative valuation metrics (e.g., Price-to-Sales, Price-to-Book): Using multiple valuation metrics provides a more comprehensive picture than relying on a single metric.

- Compare current P/E ratios to historical averages and industry benchmarks: Contextualizing current P/E ratios within historical trends and comparing them to industry peers helps determine whether current valuations are truly excessive.

Geopolitical Risks and Market Volatility

Geopolitical instability and market volatility are significant sources of investor anxiety. BofA likely acknowledges these risks but suggests that their impact is already largely factored into current valuations.

- Discuss the potential impact of geopolitical events on market valuations: Major geopolitical events can trigger market sell-offs, impacting valuations.

- Analyze the market's historical response to similar events: Examining past market reactions to similar events can help assess the potential impact of current geopolitical risks.

- Highlight BofA's strategies for mitigating geopolitical risks: BofA likely outlines strategies for investors to navigate geopolitical uncertainty and manage risk effectively.

Conclusion

BofA's analysis offers a reassuring message, albeit with necessary caveats. While concerns about stock market valuations are valid, a nuanced approach is essential. By considering long-term growth prospects, macroeconomic factors like interest rates and inflation, and sector-specific valuations, investors can form a more balanced perspective. BofA's reassurance underscores the importance of looking beyond simple valuation metrics and incorporating a thorough understanding of market dynamics and future growth potential when making investment decisions.

Call to Action: Understanding stock market valuations is paramount for making informed investment decisions. Learn more about BofA's comprehensive analysis and refine your investment strategy to encompass both current valuations and future growth projections. Don't let valuation worries paralyze you; equip yourself with knowledge and make confident investment decisions based on sound research and expert analysis of stock market valuations.

Featured Posts

-

Integracion Setlist Fm Ticketmaster Una Experiencia De Concierto Mejorada

May 30, 2025

Integracion Setlist Fm Ticketmaster Una Experiencia De Concierto Mejorada

May 30, 2025 -

Erstatter For Dolberg Fc Kobenhavns Jagt Pa En Ny Spydspids

May 30, 2025

Erstatter For Dolberg Fc Kobenhavns Jagt Pa En Ny Spydspids

May 30, 2025 -

Deutsche Bank Depositary Bank For Epiroc Adr Programs

May 30, 2025

Deutsche Bank Depositary Bank For Epiroc Adr Programs

May 30, 2025 -

Real Estate Crisis Home Sales At Record Lows

May 30, 2025

Real Estate Crisis Home Sales At Record Lows

May 30, 2025 -

Kawasaki Meluncurkan Tiga Jet Ski Premium Terbaru Di Indonesia

May 30, 2025

Kawasaki Meluncurkan Tiga Jet Ski Premium Terbaru Di Indonesia

May 30, 2025

Latest Posts

-

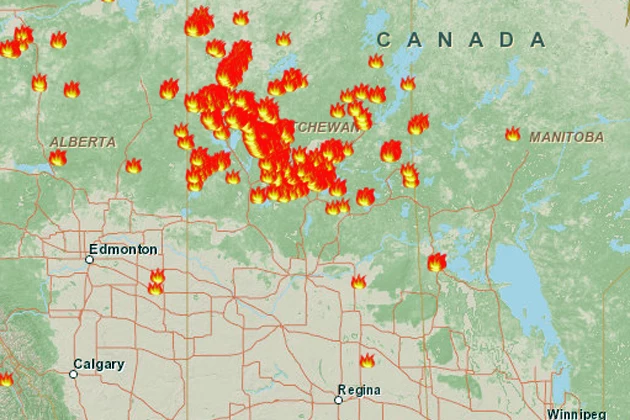

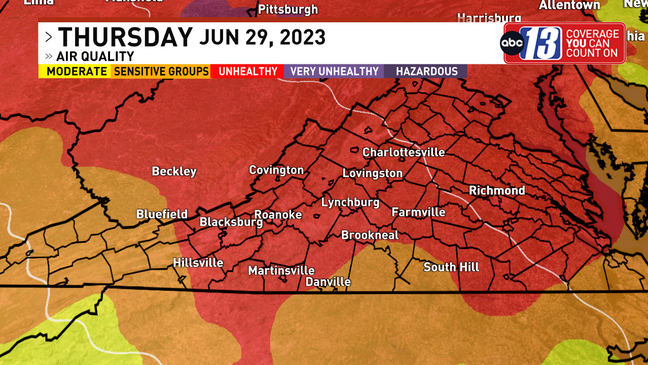

Urgent Air Quality Warning Minnesota And Canadian Wildfires

May 31, 2025

Urgent Air Quality Warning Minnesota And Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Cause Dangerous Air Quality In Minnesota

May 31, 2025

Canadian Wildfires Cause Dangerous Air Quality In Minnesota

May 31, 2025 -

Degraded Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025

Degraded Air Quality In Minnesota Due To Canadian Wildfires

May 31, 2025 -

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025