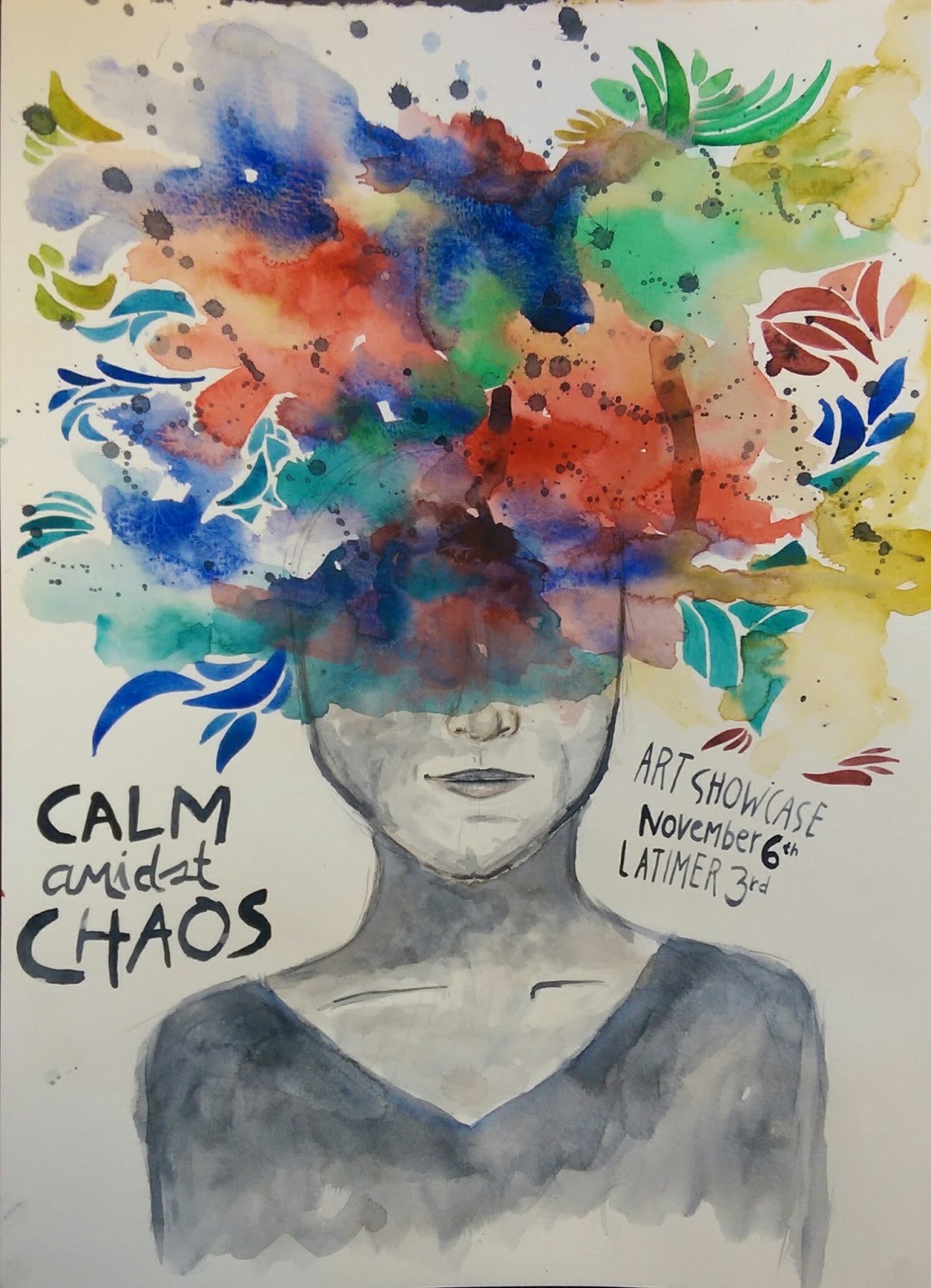

Stock Market Valuations: BofA's Case For Calm Amidst High Prices

Table of Contents

H2: BofA's Key Arguments for a Cautious, Yet Steady Approach

BofA's approach to current high stock prices isn't one of alarm, but rather of cautious optimism. Their strategy emphasizes a long-term perspective, acknowledging the inherent volatility of the market while focusing on sustainable growth.

H3: The Importance of Long-Term Investing

BofA stresses the critical importance of long-term investing strategies. Their perspective highlights the resilience of well-diversified portfolios in the face of short-term market fluctuations. Focusing solely on short-term gains can lead to impulsive decisions, often detrimental to long-term wealth building.

- Focus on long-term growth potential rather than short-term gains: Instead of reacting to daily market swings, concentrate on the potential for long-term appreciation of your investments.

- Highlight the historical performance of the market despite periods of high valuations: History shows that the market has historically recovered from periods of high valuations. While corrections are inevitable, long-term investors have generally been rewarded for their patience.

- Emphasize the importance of diversification in mitigating risk: A diversified portfolio, strategically spread across different asset classes and sectors, helps reduce overall risk and cushions against losses in any single investment.

H3: Analyzing Current Valuations in Context

BofA's assessment of current market valuations isn't a simple glance at Price-to-Earnings ratios (P/E) alone. They employ a multi-faceted approach, considering various valuation metrics and contextual factors.

- Explain the chosen valuation metrics and their limitations: While P/E ratios are widely used, BofA likely also considers Price-to-Sales ratios (P/S), along with other metrics like dividend yield and growth rates. Each metric offers a different perspective, and none are perfect indicators.

- Compare current valuations to historical averages and potential future growth scenarios: BofA likely compares current valuations to historical averages, considering factors like inflation and interest rates. They also project future earnings growth to assess whether current valuations are justified.

- Discuss factors that might justify higher-than-average valuations: Technological innovation, low interest rates, and strong corporate earnings can all support higher-than-average stock market valuations. BofA likely incorporates these factors into their assessment.

H3: The Role of Interest Rates and Economic Growth

The interplay between interest rates, economic growth, and stock market valuations is a crucial element of BofA's analysis.

- How do projected interest rate changes impact stock valuations? Rising interest rates generally increase borrowing costs for companies and can make bonds more attractive compared to stocks, potentially leading to lower stock valuations. BofA will consider the Federal Reserve's projections.

- What is BofA's forecast for economic growth, and how does it influence their view on the stock market? Strong economic growth typically supports higher stock valuations, while slowing growth or recessionary fears can lead to lower valuations. BofA's economic forecast is vital to their market outlook.

- Discuss potential risks associated with rising interest rates or slowing economic growth: BofA likely identifies and assesses potential risks, including inflation, recession, and geopolitical instability, and how these factors could impact stock market performance.

H3: Sector-Specific Valuations and Opportunities

BofA's analysis likely extends to a sector-specific level, identifying potential opportunities and risks within different market segments.

- Discuss specific sectors and their respective valuations: Some sectors might be overvalued based on their current earnings and growth prospects, while others could be undervalued and present attractive investment opportunities.

- Analyze the potential for growth within each sector: BofA likely analyzes industry trends, technological advancements, and regulatory changes to assess growth potential in different sectors.

- Identify potential opportunities and risks for investors within different market segments: This in-depth analysis assists investors in making informed decisions about sector-specific allocations within their portfolios.

3. Conclusion: Maintaining Calm and Navigating High Stock Market Valuations

BofA's measured approach to high stock market valuations emphasizes the importance of a long-term perspective, diversification, and a thorough understanding of the economic landscape. Their analysis incorporates multiple valuation metrics, considers the impact of interest rate changes and economic growth, and delves into sector-specific opportunities and risks. By understanding BofA's analysis of stock market valuations and incorporating a long-term perspective, you can navigate the current market with confidence. Start planning your investment strategy today!

Featured Posts

-

Could Ahmed Hassanein Become Egypts First Nfl Draft Pick

Apr 26, 2025

Could Ahmed Hassanein Become Egypts First Nfl Draft Pick

Apr 26, 2025 -

Pogacars Custom Colnago Speed Technology And The Quest For The Fastest Bike

Apr 26, 2025

Pogacars Custom Colnago Speed Technology And The Quest For The Fastest Bike

Apr 26, 2025 -

Designing The Future A Conversation With Microsofts Head Of Design On Ai

Apr 26, 2025

Designing The Future A Conversation With Microsofts Head Of Design On Ai

Apr 26, 2025 -

Nyt Spelling Bee Solution February 5th Puzzle 339 Hints And Help

Apr 26, 2025

Nyt Spelling Bee Solution February 5th Puzzle 339 Hints And Help

Apr 26, 2025 -

Chat Gpt Developer Open Ai Under Ftc Investigation

Apr 26, 2025

Chat Gpt Developer Open Ai Under Ftc Investigation

Apr 26, 2025

Latest Posts

-

Colman Domingos Norman Osborn Return His Spider Man Co Stars Reaction

May 06, 2025

Colman Domingos Norman Osborn Return His Spider Man Co Stars Reaction

May 06, 2025 -

Glyantseva Fotosesiya Rianna V Elegantnomu Rozhevomu Merezhivi

May 06, 2025

Glyantseva Fotosesiya Rianna V Elegantnomu Rozhevomu Merezhivi

May 06, 2025 -

Vibukhova Fotosesiya Rianni Rozheve Merezhivo Ta Spokuslivi Pozi

May 06, 2025

Vibukhova Fotosesiya Rianni Rozheve Merezhivo Ta Spokuslivi Pozi

May 06, 2025 -

Epatazhna Rianna Fotosesiya V Merezhivnomu Rozhevomu Vbranni

May 06, 2025

Epatazhna Rianna Fotosesiya V Merezhivnomu Rozhevomu Vbranni

May 06, 2025 -

Analyzing Spielbergs Latest Ufo Project A Retrospective Look At His Alien Themed Works

May 06, 2025

Analyzing Spielbergs Latest Ufo Project A Retrospective Look At His Alien Themed Works

May 06, 2025