Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA generally holds a nuanced view on current stock market valuations, neither outright declaring them overvalued nor significantly undervalued. Instead, they emphasize a more sector-specific approach, highlighting pockets of opportunity and risk within the broader market. Their assessment relies on a multifaceted analysis incorporating several key valuation metrics.

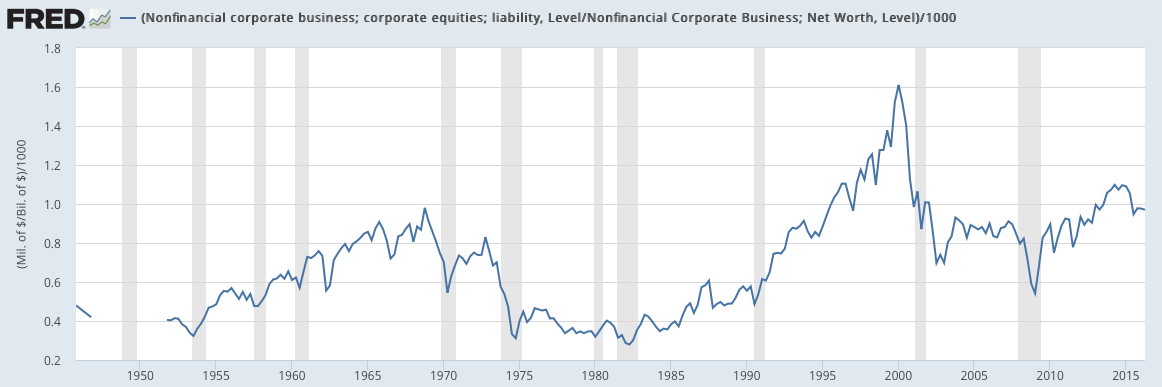

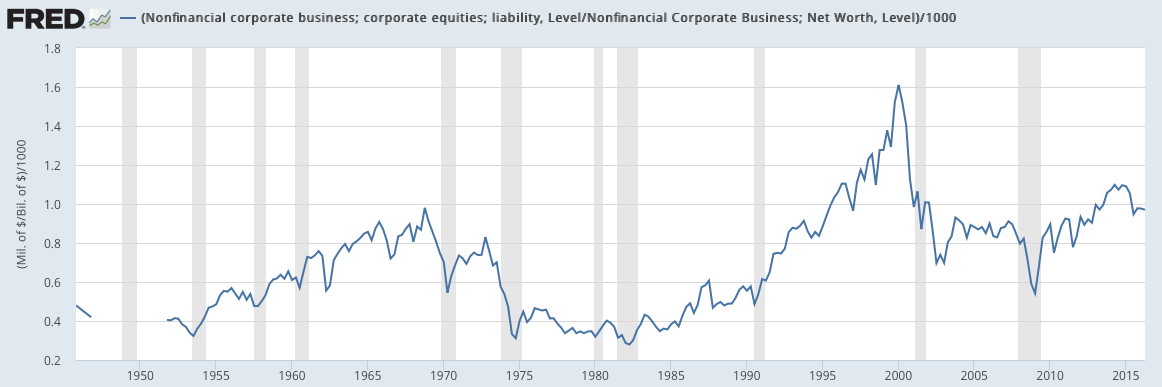

- Specific valuation metrics: BofA employs a range of metrics including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (Shiller PE). These provide a comprehensive picture of market valuation, considering historical context and cyclical adjustments.

- Comparison to historical valuations: By comparing current metrics to historical averages, BofA establishes a benchmark for assessing whether current valuations are exceptionally high or low relative to past performance. This historical context is crucial for tempering short-term market anxieties.

- Sector-specific analysis: BofA's analysis doesn't paint the entire market with the same brush. They identify specific sectors—potentially highlighting technology, energy, or consumer staples—as particularly interesting from a valuation standpoint, offering investors focused opportunities.

The Role of Interest Rates in Shaping Stock Market Valuations

Interest rates play a pivotal role in shaping stock market valuations. The relationship is inverse: rising interest rates generally put downward pressure on stock prices, while falling rates often lead to higher valuations.

- Present value of future earnings: Higher interest rates increase the discount rate used to calculate the present value of a company's future earnings. This reduces the perceived value of future cash flows, thereby impacting stock prices.

- BofA's interest rate predictions: BofA's predictions regarding future interest rate movements are crucial for understanding their valuation outlook. Their forecasts influence their assessment of whether current valuations are sustainable or represent a bubble.

- Impact on asset classes: Rising interest rates make bonds more attractive relative to stocks, potentially drawing investment away from equities and impacting stock market valuations. Understanding this dynamic is key to managing risk.

Economic Growth Projections and Their Influence on Stock Market Valuations

BofA's economic forecasts significantly shape their valuation outlook. Positive economic growth projections tend to support higher valuations, while negative forecasts can trigger market corrections.

- GDP growth, inflation, and unemployment: BofA's predictions for GDP growth, inflation, and unemployment are central to their analysis. Strong growth with contained inflation typically supports higher valuations, while high inflation and rising unemployment often lead to lower valuations.

- Investor confidence: BofA’s economic projections influence investor confidence. Positive forecasts generally boost investor sentiment and support higher stock prices, while negative forecasts can trigger risk aversion and market declines.

- Key economic indicators: BofA closely monitors various economic indicators – such as consumer spending, manufacturing activity, and housing starts – to gauge the health of the economy and refine their valuation models.

Geopolitical Factors and Their Impact on Stock Market Valuations

Geopolitical events introduce considerable uncertainty into the market and can significantly impact stock market valuations. BofA carefully assesses these risks.

- Specific geopolitical events: Events like the war in Ukraine, US-China trade relations, and other global conflicts directly affect investor sentiment and stock prices, impacting market valuations.

- Risk assessment: BofA analyzes the potential consequences of these events, assessing their impact on various sectors and the broader economy. This risk assessment informs their valuation models and investment recommendations.

- Reflection in valuations: The impact of geopolitical risks is reflected in current stock market valuations, with higher uncertainty often leading to lower valuations as investors demand a higher risk premium.

BofA's Strategies for Navigating Current Stock Market Valuations

Based on their valuation analysis, BofA likely recommends a balanced and diversified approach to investing.

- Investment strategies: This could include sector rotation, focusing on undervalued sectors, or a diversified portfolio across asset classes to mitigate risk.

- Risk management: BofA likely stresses the importance of risk management strategies, such as hedging and position sizing, to protect against potential market downturns.

- Opportunities and threats: Identifying specific opportunities and threats within the market, based on their valuation analysis, allows investors to strategically allocate capital and manage risk effectively.

Conclusion

BofA's assessment of current stock market valuations reveals a nuanced picture, neither overly optimistic nor excessively pessimistic. Their analysis considers a wide range of factors, including interest rates, economic growth projections, and geopolitical events. Understanding their perspectives on these influencing factors offers investors a clearer picture of the current market landscape. Understanding current stock market valuations is crucial for making informed investment decisions. Continue your research by exploring BofA's in-depth analysis of stock market valuations and develop a robust investment strategy.

Featured Posts

-

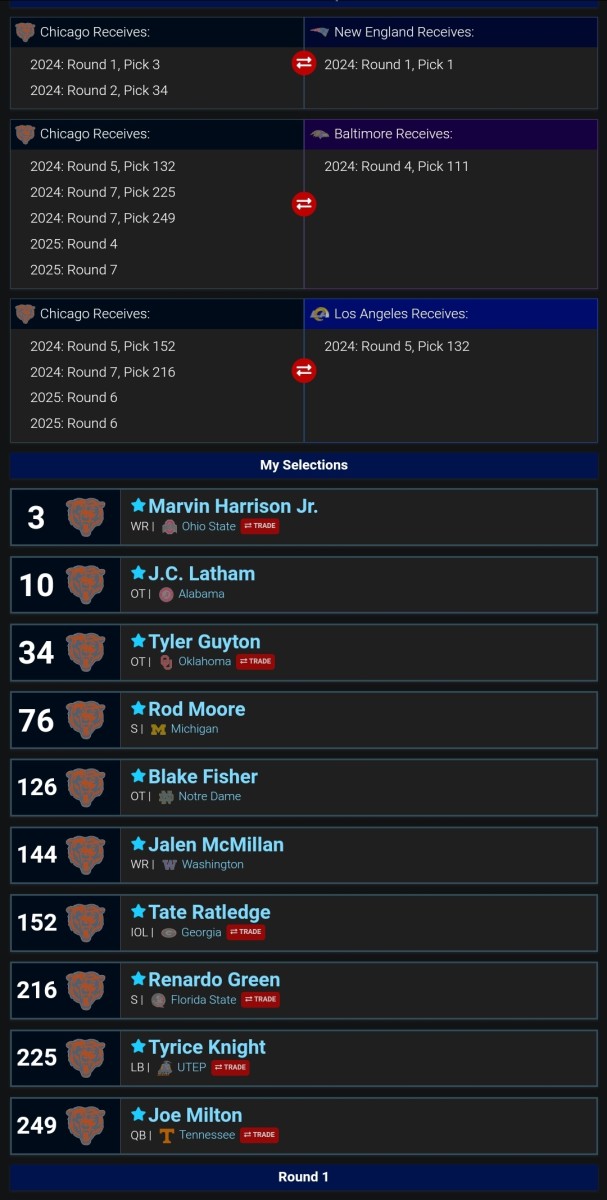

Will The Chicago Bears Draft A Game Changing Playmaker In 2025

Apr 25, 2025

Will The Chicago Bears Draft A Game Changing Playmaker In 2025

Apr 25, 2025 -

Melissa Mortons Show Stopping Garden At Harrogate Spring Flower Show

Apr 25, 2025

Melissa Mortons Show Stopping Garden At Harrogate Spring Flower Show

Apr 25, 2025 -

College Students Rush To Delete Op Eds Amid Trump Visa Concerns

Apr 25, 2025

College Students Rush To Delete Op Eds Amid Trump Visa Concerns

Apr 25, 2025 -

Is Sadie Sink The Next Jean Grey Spider Man 4 Casting Speculation

Apr 25, 2025

Is Sadie Sink The Next Jean Grey Spider Man 4 Casting Speculation

Apr 25, 2025 -

Trump Tariffs And Renault A Case Study In Automotive Setbacks

Apr 25, 2025

Trump Tariffs And Renault A Case Study In Automotive Setbacks

Apr 25, 2025

Latest Posts

-

Tristeza En El Futbol Argentino Tras La Perdida De Un Joven Referente De Afa

Apr 30, 2025

Tristeza En El Futbol Argentino Tras La Perdida De Un Joven Referente De Afa

Apr 30, 2025 -

Conmocion En El Futbol Argentino Por La Muerte De Un Joven Promesa De Afa

Apr 30, 2025

Conmocion En El Futbol Argentino Por La Muerte De Un Joven Promesa De Afa

Apr 30, 2025 -

Bao Ve Khoan Dau Tu Than Trong Khi Gop Von Vao Cong Ty Co Lich Su Bi Nghi Van Lua Dao

Apr 30, 2025

Bao Ve Khoan Dau Tu Than Trong Khi Gop Von Vao Cong Ty Co Lich Su Bi Nghi Van Lua Dao

Apr 30, 2025 -

Fallecimiento De Un Joven Referente De Afa El Futbol Argentino De Luto

Apr 30, 2025

Fallecimiento De Un Joven Referente De Afa El Futbol Argentino De Luto

Apr 30, 2025 -

Danh Gia Rui Ro Can Luu Y Gi Khi Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao

Apr 30, 2025

Danh Gia Rui Ro Can Luu Y Gi Khi Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao

Apr 30, 2025