Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's valuation analysis employs a multi-faceted approach, incorporating various methods to gauge the overall health and potential of the equity market. Their assessment considers both absolute and relative valuations, combining quantitative models with qualitative insights.

-

Methodology: BofA utilizes a combination of methodologies, including price-to-earnings ratios (P/E), price-to-sales ratios (P/S), discounted cash flow (DCF) models, and relative valuation metrics compared to historical averages and peer companies. This holistic approach provides a more comprehensive picture than relying on a single metric.

-

Key Findings: While specific data points are subject to change and require access to BofA's proprietary reports, their recent analyses generally suggest that while some sectors might appear overvalued based on certain metrics, the overall market isn't drastically overpriced. BofA often highlights the importance of considering individual company performance and future growth prospects, rather than relying solely on broad market indices. This nuanced perspective is crucial for informed investment decisions.

-

Sectoral Analysis: BofA's reports typically identify specific sectors they deem relatively attractive or unattractive based on their valuation analysis. For instance, sectors exhibiting strong fundamental growth despite moderate valuations may be highlighted as attractive, while those with high valuations but weaker fundamentals might be flagged as less appealing. This granular approach assists investors in making sector-specific allocations.

-

Comparison to Other Analysts: BofA's analysis is often compared and contrasted with the views of other prominent investment banks and research firms. Understanding the consensus view, along with any dissenting opinions, allows investors to form a more balanced perspective on market valuations. This comparative analysis provides valuable context and helps investors assess the robustness of BofA's conclusions.

Addressing Investor Concerns about a Potential Recession

Recession fears are a significant driver of market uncertainty. BofA's analysis directly addresses these concerns by incorporating recessionary risks into its valuation models.

-

Recession Likelihood: BofA's economists regularly update their projections on the probability of a recession. Their assessments consider various economic indicators, including inflation rates, interest rate movements, consumer spending, and business investment. While acknowledging the possibility of a recession, their outlook isn't necessarily uniformly pessimistic.

-

Incorporating Recessionary Risks: BofA’s valuation models factor in potential downside scenarios. This means their valuations account for the possibility of reduced earnings and cash flows during a recession, leading to more conservative estimates. This approach helps investors prepare for potential market corrections.

-

Sectoral Impact: The impact of a recession isn't uniform across all sectors. BofA’s analysis often highlights the differing vulnerabilities of various sectors. For instance, cyclical sectors (like consumer discretionary) are usually more sensitive to economic downturns than defensive sectors (like utilities). Understanding this differential impact allows for better portfolio management during challenging times.

-

Risk Mitigation Strategies: BofA frequently provides recommendations for mitigating recessionary risks. This typically involves diversification, strategic asset allocation, and a focus on companies with strong balance sheets and resilient business models. They emphasize the importance of building a robust portfolio capable of withstanding economic headwinds.

Investment Strategies Based on BofA's Valuation Analysis

BofA's investment strategies are directly informed by their valuation analysis and macroeconomic forecasts.

-

Suggested Strategies: Based on their valuation models and economic outlook, BofA often suggests a mix of investment strategies. These might include a blend of growth stocks, value stocks, and fixed-income instruments, tailored to specific risk tolerances and investment horizons.

-

Diversification and Asset Allocation: BofA strongly emphasizes the importance of diversification across asset classes and sectors. This minimizes risk by reducing reliance on any single investment. Proper asset allocation ensures a portfolio's alignment with an investor's risk profile and financial goals.

-

Growth vs. Value Stocks: The relative attractiveness of growth versus value stocks often depends on market conditions and BofA's valuation assessments. During periods of uncertainty, value stocks (with lower valuations relative to their fundamentals) may be favored, while periods of robust growth might favor growth stocks.

-

Risk Tolerance: BofA consistently stresses the importance of aligning investment strategies with individual risk tolerance. Investors with higher risk tolerance might allocate more to growth stocks, while those with lower tolerance might favor more conservative options like bonds.

The Role of Long-Term Investing in Navigating Market Volatility

Navigating market volatility requires a long-term perspective.

-

Benefits of Long-Term Investing: A long-term buy-and-hold strategy can help investors weather market fluctuations. By avoiding attempts to time the market, investors can benefit from compounding returns over the long term.

-

Market Timing's Limitations: Attempting to time the market—buying low and selling high—is notoriously difficult and often unsuccessful. Market fluctuations are unpredictable, making precise timing nearly impossible.

-

Patience and Discipline: Long-term investing necessitates patience and discipline. Investors need to avoid emotional reactions to short-term market volatility and stick to their investment plan.

Conclusion:

Bank of America's analysis of current stock market valuations offers investors a measure of reassurance amid current market uncertainties. While acknowledging recessionary risks, BofA’s assessment suggests that current valuations are not necessarily alarming, and strategic investing remains a viable path. By understanding BofA's methodology and considering their recommended investment strategies, investors can navigate the current climate more effectively.

Call to Action: Don't let market volatility deter you from exploring opportunities. Conduct thorough research, consider your risk tolerance, and develop a well-informed investment strategy based on the insights provided by experts like BofA on stock market valuations. Start planning your investment strategy today!

Featured Posts

-

Darjeeling Tea Industry A Look At Current Concerns And Sustainability

May 04, 2025

Darjeeling Tea Industry A Look At Current Concerns And Sustainability

May 04, 2025 -

Nigel Farage Receives Death Threat From Afghan Migrant During Uk Trip

May 04, 2025

Nigel Farage Receives Death Threat From Afghan Migrant During Uk Trip

May 04, 2025 -

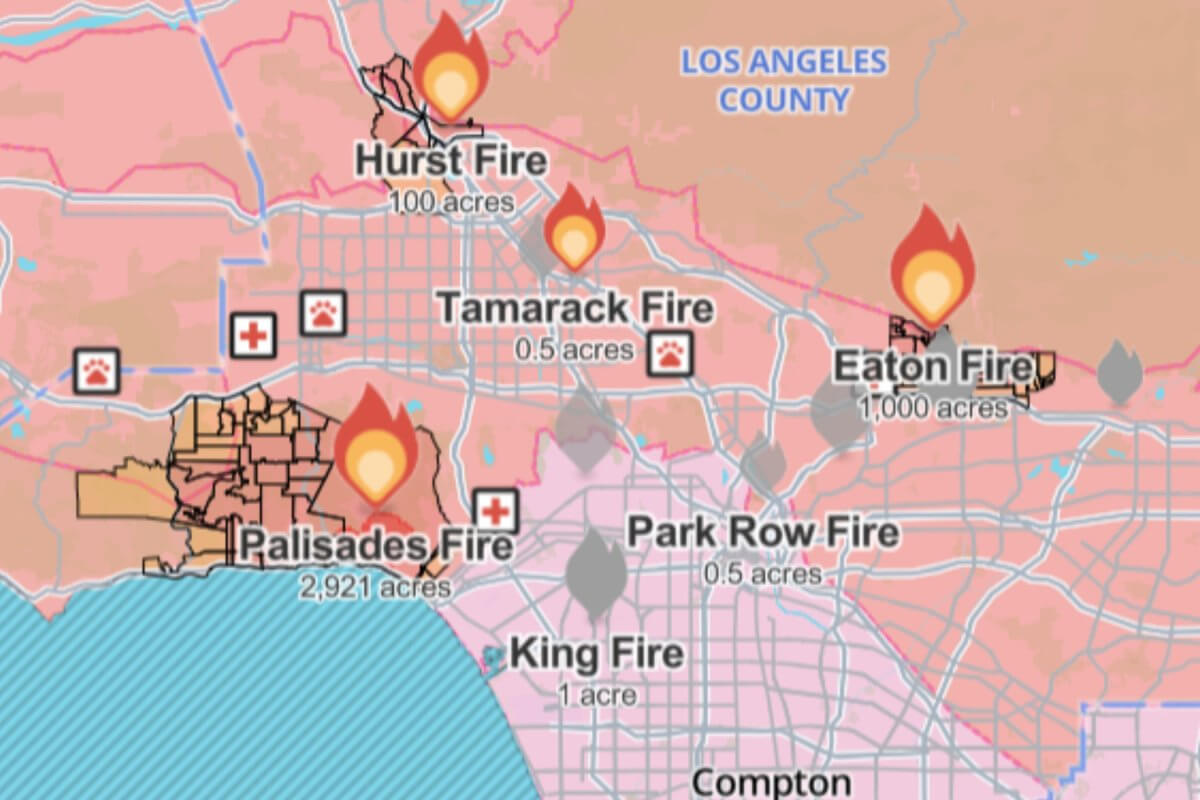

Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Betting Markets

May 04, 2025

Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Betting Markets

May 04, 2025 -

Innomotics Eneco And Johnson Controls Groundbreaking Heat Pump Project

May 04, 2025

Innomotics Eneco And Johnson Controls Groundbreaking Heat Pump Project

May 04, 2025 -

Marvels Quality Control Addressing Criticisms Of Recent Films And Series

May 04, 2025

Marvels Quality Control Addressing Criticisms Of Recent Films And Series

May 04, 2025

Latest Posts

-

Bengal Heatwave Alert Four Districts On High Alert

May 04, 2025

Bengal Heatwave Alert Four Districts On High Alert

May 04, 2025 -

Anna Kendricks 3 Word Blake Lively Verdict Goes Viral

May 04, 2025

Anna Kendricks 3 Word Blake Lively Verdict Goes Viral

May 04, 2025 -

Wb Weather Update Heatwave Warning For Four Bengal Districts

May 04, 2025

Wb Weather Update Heatwave Warning For Four Bengal Districts

May 04, 2025 -

South Bengal Heatwave 5 Districts Face Extreme Temperatures

May 04, 2025

South Bengal Heatwave 5 Districts Face Extreme Temperatures

May 04, 2025 -

Anna Kendricks Blake Lively Comment Fans Obsessed

May 04, 2025

Anna Kendricks Blake Lively Comment Fans Obsessed

May 04, 2025