Strong Retail Numbers Delay Potential Bank Of Canada Rate Reduction

Table of Contents

Robust Retail Sales Figures Exceed Expectations

The latest retail sales figures released by Statistics Canada painted a picture of unexpectedly strong consumer spending. The data revealed a substantial increase compared to analysts' forecasts, signaling a vibrant consumer market. This unexpected surge suggests a resilience in the Canadian economy that many had not anticipated.

- Percentage increase: Retail sales jumped by X% compared to the previous month and Y% compared to the same period last year (replace X and Y with actual data when available).

- Key sectors driving growth: Significant growth was seen in the sectors of [List specific sectors, e.g., automotive, furniture, clothing], indicating strong consumer confidence and spending across various segments.

- Geographic distribution: The sales increase wasn't limited to specific regions; it was observed across [mention regions, e.g., major urban centers and even smaller towns], demonstrating a widespread boost in consumer activity.

Several factors could be contributing to this robust performance. Increased consumer confidence following [mention relevant events, e.g., government stimulus packages or easing of pandemic restrictions] may be a significant driver. Seasonal factors and pent-up demand also played a role.

Implications for Inflation and Monetary Policy

Robust retail sales figures have significant implications for inflation. Increased consumer spending translates to higher demand for goods and services, potentially fueling inflationary pressures. This is a critical concern for the Bank of Canada, whose primary mandate is to control inflation and maintain price stability. The central bank aims to keep inflation within its target range of 1-3%.

- Current inflation rate and its trajectory: The current inflation rate is at [insert current inflation rate]%, and its trajectory remains a key concern.

- Bank of Canada's inflation target: The Bank of Canada aims for a 2% inflation target, making deviations from this crucial.

- Potential consequences of high inflation: Sustained high inflation can erode purchasing power, reduce consumer confidence, and destabilize the economy.

The Bank of Canada will closely monitor these inflationary pressures, as they directly influence their decisions regarding interest rates.

Bank of Canada's Response and Future Outlook

Given the robust retail sales data, the Bank of Canada's near-term focus is likely to remain on managing inflation. Recent statements from the central bank suggest a cautious approach to further interest rate reductions. While a rate cut was previously considered possible, the unexpectedly strong retail numbers have diminished the likelihood in the immediate future.

- Summary of recent Bank of Canada announcements: The Bank of Canada has [summarize recent announcements concerning interest rates and inflation].

- Potential timeline for future interest rate decisions: Any decision on rate adjustments will depend heavily on upcoming economic data and inflation trends.

- Key economic indicators to watch: Future interest rate decisions will be influenced by factors such as the Consumer Price Index (CPI), employment figures, and housing market data. Closely watching these will be crucial.

The Bank of Canada might also consider alternative monetary policy tools to manage inflation, such as quantitative tightening or adjustments to the overnight rate target.

Impact on Consumers and Businesses

Sustained higher interest rates directly impact both consumers and businesses. Higher borrowing costs mean increased mortgage payments for homeowners, potentially squeezing household budgets. Businesses face higher costs for expansion and investment, potentially slowing economic growth.

- Impact on mortgage rates: Higher interest rates lead to increased mortgage payments, affecting affordability for many.

- Effect on business investment decisions: Businesses might postpone expansion plans or investment in new projects due to higher borrowing costs.

- Potential impact on consumer confidence: Uncertainty surrounding interest rates and the economy could lead to reduced consumer spending and confidence.

The interplay between strong retail sales, inflation, and interest rates presents a complex economic challenge for Canada.

Strong Retail Numbers Delay Potential Bank of Canada Rate Reduction – What's Next?

In summary, unexpectedly strong retail sales figures have significantly impacted expectations for a Bank of Canada rate reduction. The stronger-than-anticipated consumer spending has raised concerns about inflation, making a near-term interest rate cut less probable. This situation presents challenges for both consumers and businesses, impacting their spending power and investment decisions. The coming months will be critical in observing economic indicators and the Bank of Canada's response to these developments.

To understand the evolving situation, stay informed about the latest economic data releases, Bank of Canada announcements, and expert analysis on the impact of strong retail numbers on the potential for Bank of Canada rate reduction. Continued monitoring of these factors is essential for navigating the economic landscape.

Featured Posts

-

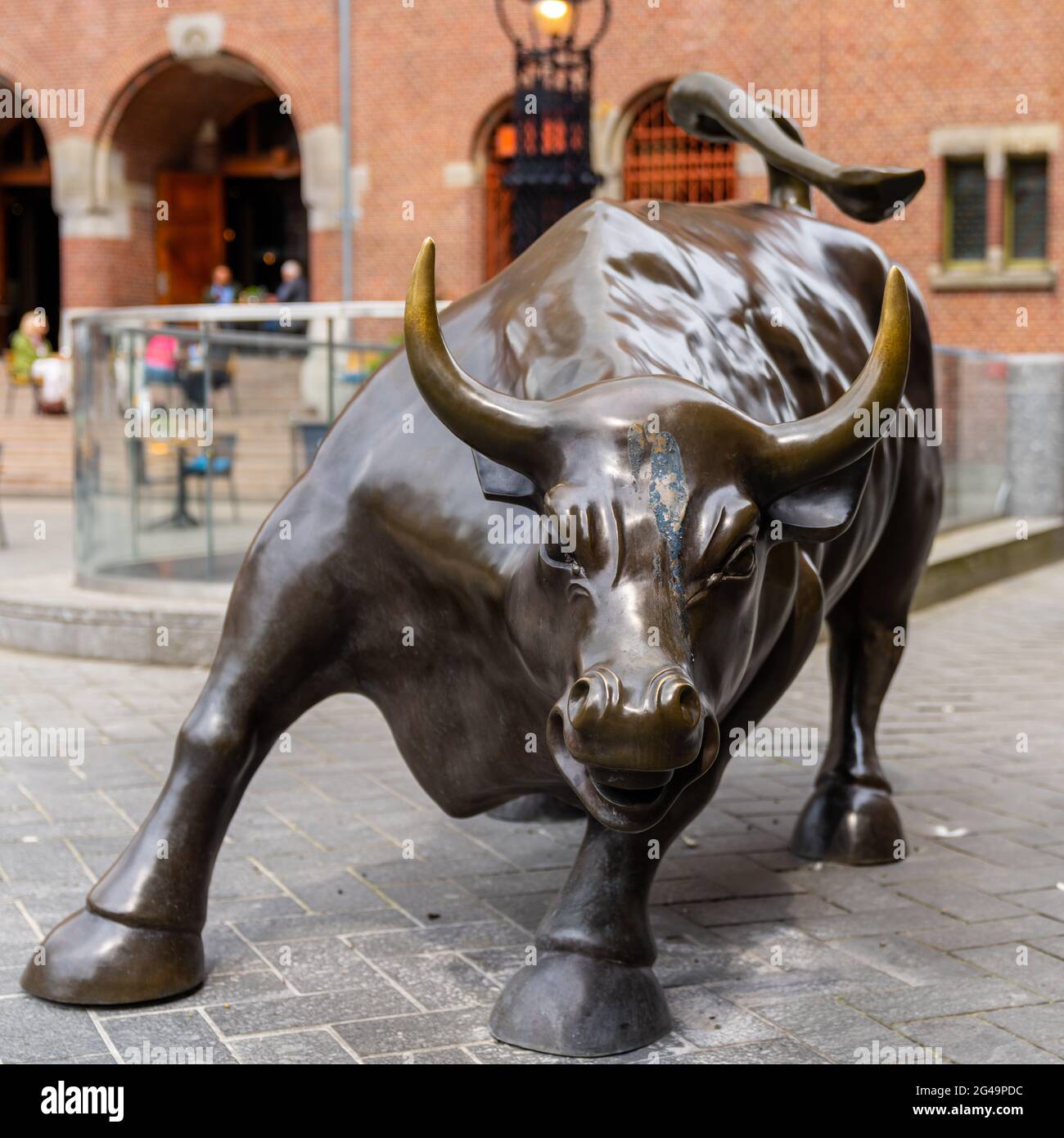

Amsterdam Stock Exchange Plunges 11 Loss Since Wednesday

May 25, 2025

Amsterdam Stock Exchange Plunges 11 Loss Since Wednesday

May 25, 2025 -

300 Podiumov Mercedes Analiz Dostizheniy Rassela I Khemiltona

May 25, 2025

300 Podiumov Mercedes Analiz Dostizheniy Rassela I Khemiltona

May 25, 2025 -

Impact Of Top Players On The Growth Of Tennis In China Italian Open Perspective

May 25, 2025

Impact Of Top Players On The Growth Of Tennis In China Italian Open Perspective

May 25, 2025 -

Nyr Porsche Macan Allt Sem Thu Tharft Ad Vita Um 100 Rafutgafuna

May 25, 2025

Nyr Porsche Macan Allt Sem Thu Tharft Ad Vita Um 100 Rafutgafuna

May 25, 2025 -

Flash Flood Warning South Florida Residents Urged To Prepare For Heavy Rain

May 25, 2025

Flash Flood Warning South Florida Residents Urged To Prepare For Heavy Rain

May 25, 2025

Latest Posts

-

Naomi Kempbell Semeynye Foto I Slukhi O Novykh Otnosheniyakh

May 25, 2025

Naomi Kempbell Semeynye Foto I Slukhi O Novykh Otnosheniyakh

May 25, 2025 -

Met Gala 2025 The Naomi Campbell Anna Wintour Rift And Its Alleged Consequences

May 25, 2025

Met Gala 2025 The Naomi Campbell Anna Wintour Rift And Its Alleged Consequences

May 25, 2025 -

Naomi Kempbell 55 Rokiv Naykraschi Foto Za Vsyu Kar Yeru

May 25, 2025

Naomi Kempbell 55 Rokiv Naykraschi Foto Za Vsyu Kar Yeru

May 25, 2025 -

Is Naomi Campbell Banned From The 2025 Met Gala A Wintour Feud Explored

May 25, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Wintour Feud Explored

May 25, 2025 -

Naomi Campbell And Anna Wintours Feud The Truth Behind The Met Gala Ban Rumors

May 25, 2025

Naomi Campbell And Anna Wintours Feud The Truth Behind The Met Gala Ban Rumors

May 25, 2025