Student Loan Debt: Navigating The Government's Increased Enforcement

Table of Contents

Understanding the Increased Enforcement

The government's approach to student loan repayment is shifting, leading to significant changes that borrowers need to understand.

Changes in Collection Practices

The government is employing more aggressive strategies to recover student loan debt. These include:

- Increased Wage Garnishment: The government can now garnish a larger percentage of your wages to repay your student loans. This can significantly impact your monthly budget.

- Tax Refund Offset: Your federal tax refund can be seized to pay off your student loan debt. This can leave you with little or no refund.

- Credit Bureau Reporting Changes: Delinquent student loans are reported to credit bureaus, negatively impacting your credit score. This can make it harder to obtain loans, rent an apartment, or even get a job.

- More Aggressive Collection Agencies: The government is increasingly contracting with private collection agencies to pursue borrowers, leading to more frequent and potentially harassing contact.

These changes significantly impact borrowers' financial well-being and necessitate proactive engagement with their student loan debt.

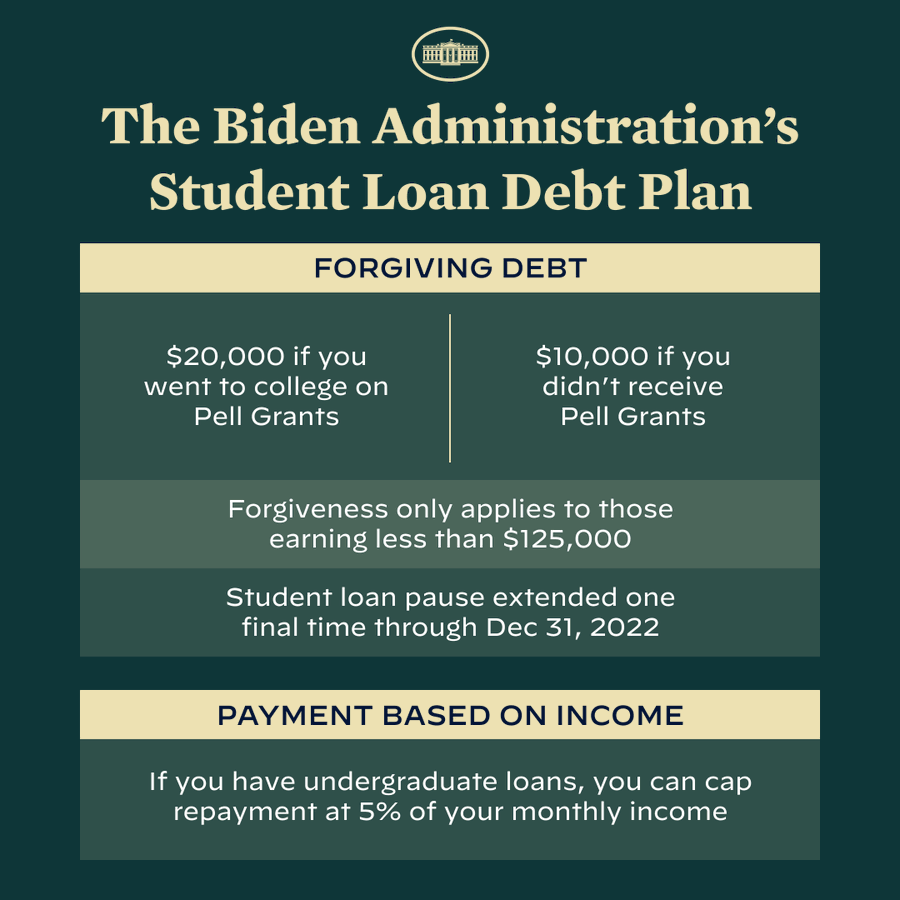

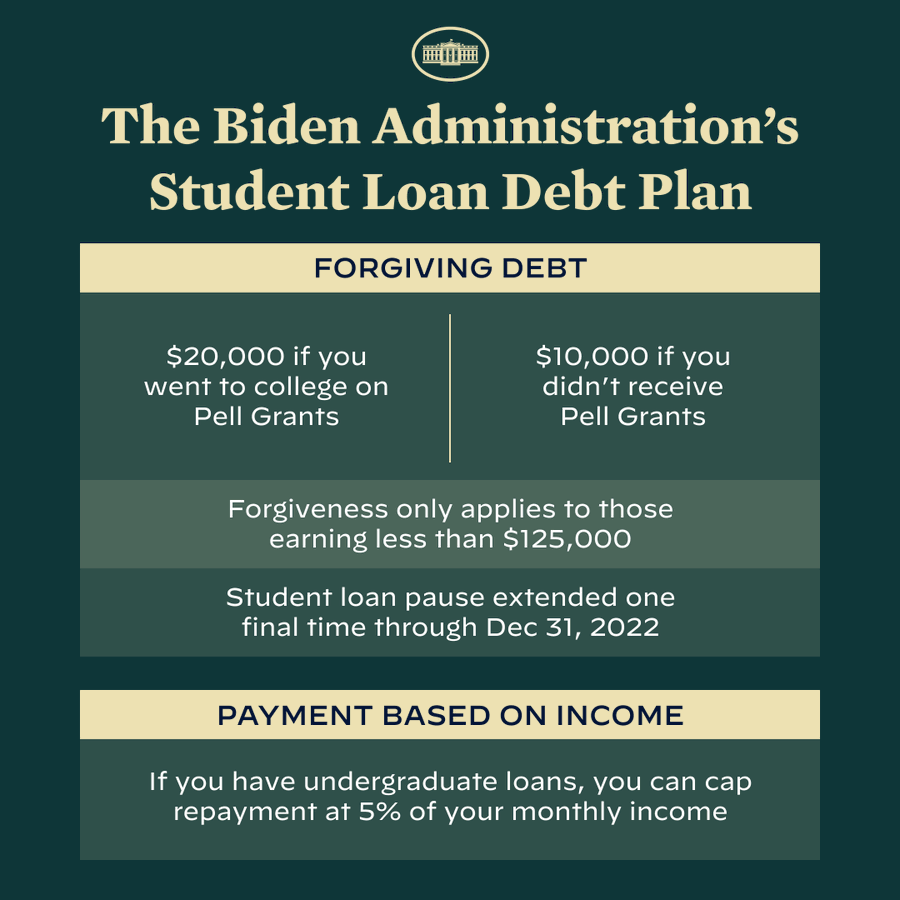

New Regulations and Legislation

Recent legislative changes have further complicated the student loan repayment process.

- Changes to Income-Driven Repayment Plans: Eligibility criteria and payment calculations for income-driven repayment (IDR) plans are constantly evolving, potentially making them less beneficial for some borrowers. Understanding these changes is crucial.

- New Eligibility Criteria: Eligibility requirements for student loan forgiveness programs are often stringent and subject to change. Staying informed about these changes is critical for those hoping to qualify.

- Potential for Stricter Enforcement of Repayment Terms: The government is becoming stricter in enforcing the terms of your student loan agreement. Missing payments or failing to meet other requirements can have severe consequences.

Staying abreast of these changes requires consistent monitoring of official government websites and communication with your loan servicer.

Protecting Yourself from Aggressive Collection Tactics

Knowing your rights and communicating effectively are essential to avoiding predatory collection practices.

Understanding Your Rights

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive debt collection tactics. You have the right to:

- Dispute Inaccurate Information: If you believe information on your student loan account is incorrect, you have the right to dispute it.

- Request Validation of Debt: You can request verification that the debt is legitimate and belongs to you.

- Limits on Contact from Collectors: Collectors are limited in when and how often they can contact you. Harassing or abusive behavior is prohibited.

Understanding and exercising these rights is crucial in protecting yourself from unfair collection practices. The Consumer Financial Protection Bureau (CFPB) website offers valuable resources on your rights under the FDCPA.

Communicating Effectively with Loan Servicers

Proactive and clear communication with your loan servicer is vital.

- Maintain Detailed Records: Keep records of all communication, including dates, times, and the content of conversations.

- Respond Promptly to Official Notices: Respond promptly to any official notices from your loan servicer or the government.

- Seek Clarification When Needed: Don't hesitate to contact your servicer to clarify any confusing information or to address concerns.

Clear and concise communication will help avoid misunderstandings and potential legal problems.

Exploring Options for Managing Student Loan Debt

Several options exist to help manage and potentially reduce your student loan debt burden.

Income-Driven Repayment (IDR) Plans

IDR plans base your monthly payments on your income and family size. Several plans are available:

- PAYE (Pay As You Earn): Caps monthly payments at 10% of discretionary income.

- REPAYE (Revised Pay As You Earn): Similar to PAYE, but with potential for loan forgiveness after 20 or 25 years.

- IBR (Income-Based Repayment): Another income-driven plan with varying payment caps.

- ICR (Income-Contingent Repayment): A plan based on income and loan amount.

Each plan has specific eligibility criteria and payment calculations. Compare the plans carefully to determine which is best for your situation.

Loan Consolidation and Refinancing

Consolidating or refinancing your loans can simplify repayment, potentially lowering your monthly payments. However:

- Potential for Lower Monthly Payments: Consolidation can combine multiple loans into one, often with a lower monthly payment.

- Simplification of Loan Management: Managing one loan is easier than juggling several.

- Potential for Higher Interest Rates: Refinancing might offer a lower interest rate, but not always. Carefully compare rates before refinancing.

Student Loan Forgiveness Programs

Several programs offer potential loan forgiveness, though eligibility requirements are strict:

- Public Service Loan Forgiveness (PSLF): For those working in public service.

- Teacher Loan Forgiveness: For teachers who meet specific requirements.

- Other Specialized Programs: Other programs may exist for specific professions or situations.

Thoroughly research eligibility criteria before applying for any forgiveness program.

Conclusion

The government's increased enforcement of student loan debt necessitates proactive management. Understanding your rights under the FDCPA, communicating effectively with your loan servicer, and exploring options like IDR plans, consolidation, and forgiveness programs are crucial steps. Don't let student loan debt overwhelm you. Take control by exploring the options outlined in this article and start planning your student loan repayment strategy today. If you need assistance navigating these complexities, consider seeking professional advice from a financial advisor specializing in student loan debt management. Remember, proactive planning is key to successfully managing your student loan debt.

Featured Posts

-

Analiza Trzista Nekretnina Srpski Kupci U Fokus

May 17, 2025

Analiza Trzista Nekretnina Srpski Kupci U Fokus

May 17, 2025 -

Is Homeownership Possible With Significant Student Loan Debt

May 17, 2025

Is Homeownership Possible With Significant Student Loan Debt

May 17, 2025 -

Wednesdays Market Rally Rockwell Automation Leads The Charge

May 17, 2025

Wednesdays Market Rally Rockwell Automation Leads The Charge

May 17, 2025 -

26 Eama Tfsl Bynhma Twm Krwz Wana Dy Armas Qst Hb Mthyrt Lljdl

May 17, 2025

26 Eama Tfsl Bynhma Twm Krwz Wana Dy Armas Qst Hb Mthyrt Lljdl

May 17, 2025 -

Bof As View Why Current Stock Market Valuations Shouldnt Worry Investors

May 17, 2025

Bof As View Why Current Stock Market Valuations Shouldnt Worry Investors

May 17, 2025

Latest Posts

-

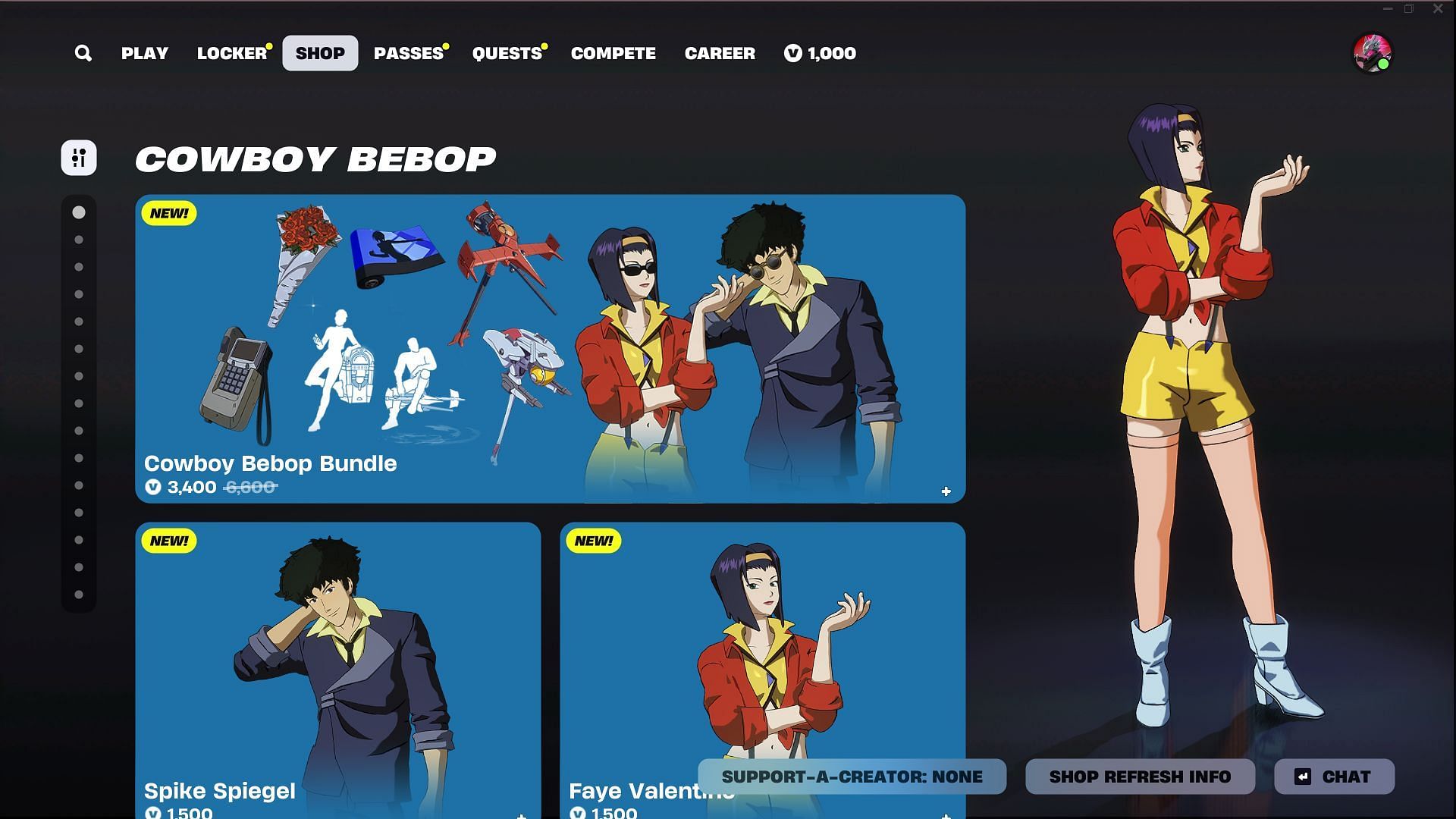

Fortnite Cowboy Bebop Skin Bundle Price And Availability Of Faye Valentine And Spike Spiegel

May 17, 2025

Fortnite Cowboy Bebop Skin Bundle Price And Availability Of Faye Valentine And Spike Spiegel

May 17, 2025 -

Real Money Online Casinos New Zealand 7 Bit Casino Review And Guide

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino Review And Guide

May 17, 2025 -

Find The Best Online Casino In New Zealand 7 Bit Casino Compared

May 17, 2025

Find The Best Online Casino In New Zealand 7 Bit Casino Compared

May 17, 2025 -

Online Casino New Zealand 7 Bit Casino Expert Rating And Player Reviews

May 17, 2025

Online Casino New Zealand 7 Bit Casino Expert Rating And Player Reviews

May 17, 2025 -

New Zealands Top Online Casinos For Real Money Is 7 Bit Casino The Best

May 17, 2025

New Zealands Top Online Casinos For Real Money Is 7 Bit Casino The Best

May 17, 2025