Student Loan Default: Avoiding A Major Credit Score Hit

Table of Contents

Understanding Your Student Loan Repayment Options

Navigating the complexities of student loan repayment is crucial to avoiding default. Several options exist, and choosing the right one can significantly impact your monthly payments and overall debt burden.

Federal Student Loan Repayment Plans

The federal government offers several income-driven repayment (IDR) plans designed to make student loan payments more manageable based on your income and family size. These include:

- Income-Based Repayment (IBR): Payments are calculated based on your discretionary income and loan balance.

- Pay As You Earn (PAYE): Similar to IBR, but with potentially lower payments.

- Revised Pay As You Earn (REPAYE): Combines features of IBR and PAYE, offering potentially even lower payments.

- Income-Contingent Repayment (ICR): Payments are based on your income and family size, with a fixed repayment period.

Each plan has specific eligibility requirements and payment calculation methods. For detailed information and to determine which plan best suits your situation, visit the official government websites: and [Link to relevant government website for repayment plans]. Many plans offer loan forgiveness after 20 or 25 years of on-time payments, but this should not be your primary reason for choosing a plan. Always carefully consider your current financial situation.

Consolidation and Refinancing Options

Consolidating multiple student loans into a single loan can simplify repayment by combining multiple monthly payments into one. However, it might not always lower your interest rate. Refinancing, on the other hand, involves replacing your existing loans with a new loan, often at a lower interest rate. This can reduce your monthly payments, but it's crucial to understand the implications:

- Benefits: Simplified repayment, potentially lower interest rates (refinancing).

- Drawbacks: Potential loss of federal loan benefits like income-driven repayment plans and forgiveness programs (if refinancing federal loans with a private lender).

Refinancing federal loans with a private lender is a significant decision. Weigh the potential benefits of a lower interest rate against the loss of federal protections.

Communicating with Your Loan Servicer

Proactive communication with your loan servicer is vital. If you anticipate difficulty making payments, contact them immediately. Don't wait until you're in default. Here are some effective communication strategies:

- Explain your situation honestly and clearly: Provide details about your financial hardship.

- Explore options like forbearance or deferment: These temporarily postpone your payments but may accrue interest.

- Negotiate a payment plan: Work with your servicer to create a payment plan you can realistically afford.

Early and open communication can prevent a default and help you find a workable solution.

Budgeting and Financial Planning Strategies to Prevent Default

Effective budgeting and financial planning are crucial for avoiding student loan default.

Creating a Realistic Budget

Tracking your income and expenses is the first step. A realistic budget incorporates all your expenses, including your student loan payments. Several budgeting tools and apps can assist:

- Mint: A popular free budgeting app.

- YNAB (You Need A Budget): A well-regarded budgeting method and app.

- Personal Capital: Offers free financial planning tools.

Allocate a portion of your income specifically for student loan payments. Prioritize this expense just like rent or utilities.

Exploring Additional Income Sources

Increasing your income can make a significant difference. Explore options like:

- Part-time jobs: Supplement your primary income with a part-time position.

- Freelancing or side hustles: Utilize your skills to generate extra income.

- Negotiating a raise: Explore opportunities for increased income at your current job.

Every extra dollar earned can be directed towards your student loan debt.

Seeking Professional Financial Advice

Don't hesitate to seek help from a financial advisor or credit counselor. Many resources offer free or low-cost financial guidance:

- National Foundation for Credit Counseling (NFCC): Provides credit counseling services.

- Financial aid offices at colleges and universities: Can offer guidance and support.

The Consequences of Student Loan Default

The consequences of student loan default are severe and long-lasting.

Credit Score Impact

Defaulting on student loans significantly damages your credit score. This can make it difficult to obtain credit in the future, impacting your ability to:

- Buy a home

- Secure a car loan

- Rent an apartment

- Obtain credit cards

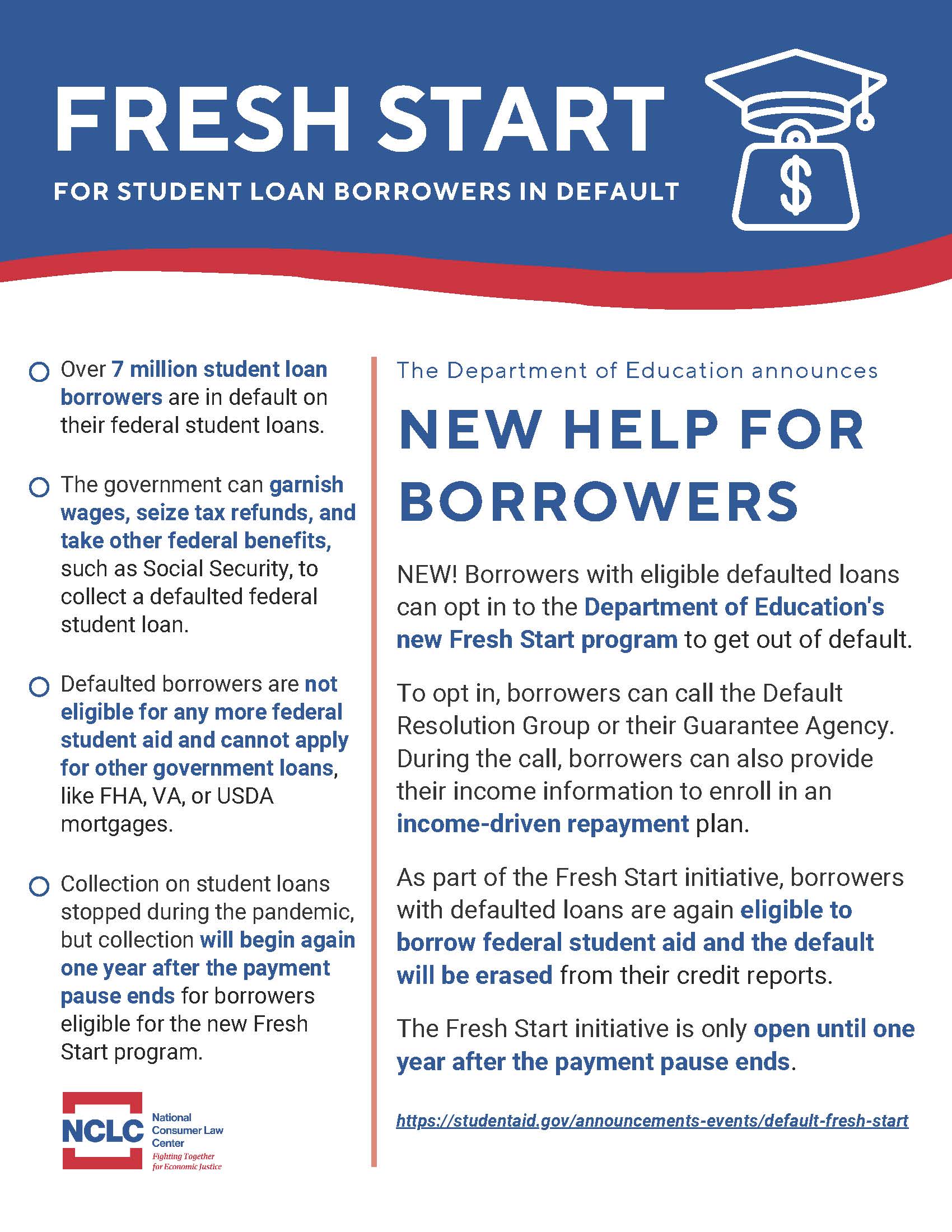

Wage Garnishment and Tax Refund Offset

The government can garnish your wages or offset your tax refund to recover the defaulted loan amount. This can significantly impact your ability to meet your financial obligations.

Difficulty Obtaining Future Loans and Credit

A student loan default remains on your credit report for seven years, making it much harder to obtain future loans and credit. This long-term consequence can severely limit your financial opportunities.

Conclusion

Avoiding student loan default requires proactive planning and management. Understanding your repayment options, creating a realistic budget, and communicating openly with your loan servicer are essential steps. Ignoring your student loan debt can lead to severe consequences, damaging your credit score and limiting your financial future. Don't let student loan default ruin your financial future. Take control of your student loan debt today by exploring your repayment options and creating a budget. Act now to protect your credit score and secure your financial well-being. Visit the resources mentioned above to find the help you need.

Featured Posts

-

Find Free Streaming Of Seattle Mariners Vs Chicago Cubs Spring Training Game

May 17, 2025

Find Free Streaming Of Seattle Mariners Vs Chicago Cubs Spring Training Game

May 17, 2025 -

Broadcoms V Mware Acquisition At And T Highlights A Staggering 1 050 Cost Increase

May 17, 2025

Broadcoms V Mware Acquisition At And T Highlights A Staggering 1 050 Cost Increase

May 17, 2025 -

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025 -

Financial Planning For Student Loan Borrowers Expert Tips

May 17, 2025

Financial Planning For Student Loan Borrowers Expert Tips

May 17, 2025 -

Crew Chief Admits Wrong Call Cost Detroit Pistons Game Against Knicks

May 17, 2025

Crew Chief Admits Wrong Call Cost Detroit Pistons Game Against Knicks

May 17, 2025

Latest Posts

-

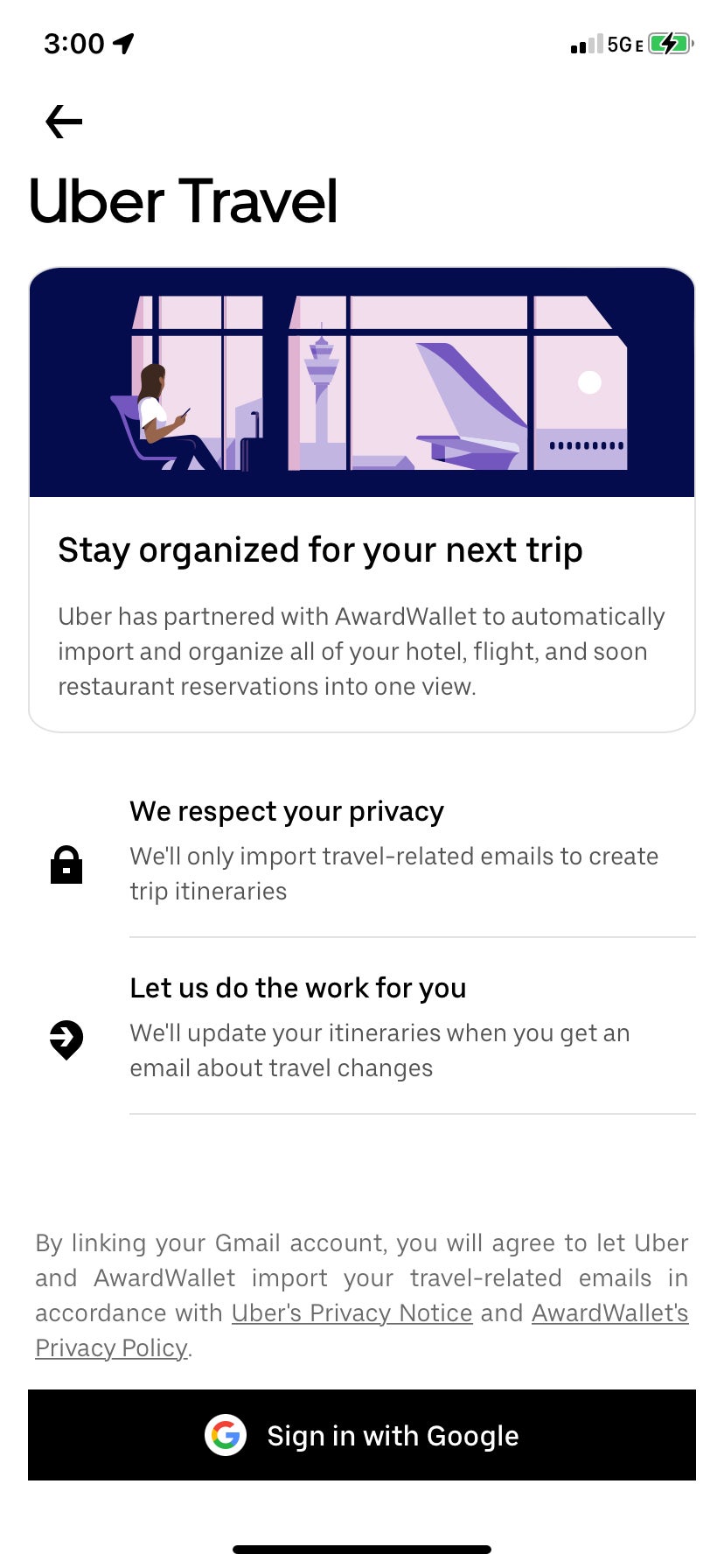

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025 -

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 17, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 17, 2025 -

Uber Expands Pet Friendly Rides In Delhi And Mumbai With Heads Up For Tails

May 17, 2025

Uber Expands Pet Friendly Rides In Delhi And Mumbai With Heads Up For Tails

May 17, 2025 -

Leave The United Center Easily With The New 5 Uber Shuttle

May 17, 2025

Leave The United Center Easily With The New 5 Uber Shuttle

May 17, 2025 -

Foodpanda Taiwan Acquisition Uber Cites Regulatory Problems Cancels Deal

May 17, 2025

Foodpanda Taiwan Acquisition Uber Cites Regulatory Problems Cancels Deal

May 17, 2025