Tesla Stock Plunge: Elon Musk's Timing And Dogecoin's Losses

Table of Contents

Elon Musk's Influence on Tesla Stock Volatility

Elon Musk's actions, both personal and professional, have a profound impact on Tesla's stock price. His influence is a double-edged sword, capable of boosting the stock with positive news but equally capable of triggering sharp declines. Understanding this influence is crucial for anyone invested in or considering investing in Tesla.

The Twitter Acquisition and its Impact

The acquisition of Twitter by Elon Musk placed immense financial strain on Tesla. The deal required Musk to sell a significant portion of his Tesla shares to secure funding, a move that triggered considerable investor concern. This sale not only reduced his direct ownership stake in Tesla but also signaled a potential shift in his priorities, leading to concerns about his dedication to Tesla's operations.

- Reduced time spent on Tesla operations: Musk's considerable focus on Twitter diverted his attention from Tesla's day-to-day management.

- Diversion of resources: The significant financial resources committed to the Twitter acquisition could have been allocated to Tesla's research, development, and expansion initiatives.

- Negative publicity impacting Tesla's brand image: The controversy surrounding the Twitter deal, including its cost and Musk's management style, negatively impacted Tesla's public image. This reduced investor confidence and contributed to the Tesla stock plunge.

Musk's Controversial Tweets and their Market Effect

Musk's history of unpredictable and controversial tweets has consistently triggered significant stock price swings for Tesla. His pronouncements, often made without prior notice or corporate vetting, introduce considerable volatility into the market.

- Market manipulation concerns: Regulatory bodies have expressed concerns about potential market manipulation through his tweets.

- Investor uncertainty: Musk's unpredictable behavior fosters uncertainty among investors, making it difficult to assess Tesla's future prospects accurately.

- Erosion of trust: The pattern of impulsive tweets and controversial announcements erodes investor trust and confidence in his leadership. This distrust contributes directly to the volatility and decline in the Tesla stock price.

The Dogecoin Connection and its Correlation with Tesla Stock

Elon Musk's outspoken promotion of Dogecoin has created a complex and concerning correlation between the cryptocurrency's performance and Tesla's stock price. This linkage introduces an additional layer of risk for Tesla investors.

Musk's Promotion of Dogecoin and its Price Fluctuations

Musk's enthusiastic endorsements of Dogecoin have dramatically influenced its price, creating significant volatility. This volatility is directly mirrored in some investors’ perception of Tesla, tying the performance of a highly speculative asset to a major automotive company.

- Dogecoin price volatility: Dogecoin's price is notoriously volatile, subject to rapid and unpredictable swings.

- Investor perception of risk: Investors may associate the risk inherent in Dogecoin with Tesla, impacting their overall assessment of the company's investment prospects.

- Linkage to Musk's image: The association between Musk and Dogecoin affects investor perceptions of his business judgment and risk tolerance.

The Impact of Dogecoin's Losses on Tesla Investors

The decline in Dogecoin's value has had a ripple effect, impacting investor confidence not just in Dogecoin itself, but also in Musk and, by extension, Tesla. Investors might perceive a correlation between risky ventures like Dogecoin and Tesla's future performance.

- Loss of investor trust: Some investors may question Musk's decision-making and lose faith in his ability to manage Tesla effectively.

- Diversification strategies: Investors might adjust their portfolios, reducing their exposure to Tesla due to perceived increased risk.

- Negative sentiment spillover: The negative sentiment surrounding Dogecoin's decline could easily spill over into the perception of Tesla, exacerbating the Tesla stock plunge.

Analyzing the Broader Market Conditions Contributing to the Tesla Stock Plunge

While Elon Musk's actions significantly contribute to Tesla's stock volatility, it is important to acknowledge the impact of broader macroeconomic factors and industry-specific challenges.

Macroeconomic Factors

The global economic landscape plays a significant role in the overall stock market performance, and Tesla is not immune to these influences.

- Inflationary pressures: Rising inflation rates reduce consumer spending and impact investor confidence.

- Interest rate hikes: Increased interest rates make borrowing more expensive, negatively impacting business investments and growth.

- Increased competition: The electric vehicle market is becoming increasingly competitive, with established and new players vying for market share.

Supply Chain Issues and Production Challenges

Tesla, like many manufacturers, faces ongoing challenges in maintaining consistent production levels due to various supply chain disruptions.

- Raw material shortages: The availability of crucial raw materials for battery production and vehicle manufacturing remains a persistent concern.

- Manufacturing bottlenecks: Production delays and bottlenecks can negatively impact Tesla's output and profitability.

- Production target misses: Failure to meet production targets can lead to investor concern about Tesla's growth trajectory.

Conclusion

The recent Tesla stock plunge is a complex issue resulting from a combination of factors. Elon Musk's leadership style and business decisions, the volatility linked to Dogecoin, and broader macroeconomic headwinds have all played a significant role. Understanding these interconnected factors is crucial for navigating the volatile landscape of Tesla stock. Staying informed about the Tesla stock plunge and its underlying causes is vital for making informed investment decisions. Continue monitoring news and analysis related to Tesla stock and its future prospects to make the best choices for your portfolio.

Featured Posts

-

Debate Sobre Derechos Trans Arrestan A Universitaria Por Usar Bano De Mujeres

May 10, 2025

Debate Sobre Derechos Trans Arrestan A Universitaria Por Usar Bano De Mujeres

May 10, 2025 -

Fast Paced Fun St Albert Dinner Theatres New Farce

May 10, 2025

Fast Paced Fun St Albert Dinner Theatres New Farce

May 10, 2025 -

Njwm Krt Alqdm Almdkhnwn Hqayq Sadmt En Eadathm Aldart

May 10, 2025

Njwm Krt Alqdm Almdkhnwn Hqayq Sadmt En Eadathm Aldart

May 10, 2025 -

Attorney Generals Fentanyl Prop Public Response And Criticism

May 10, 2025

Attorney Generals Fentanyl Prop Public Response And Criticism

May 10, 2025 -

From Wolves Reject To European Champion His Rise To The Top

May 10, 2025

From Wolves Reject To European Champion His Rise To The Top

May 10, 2025

Latest Posts

-

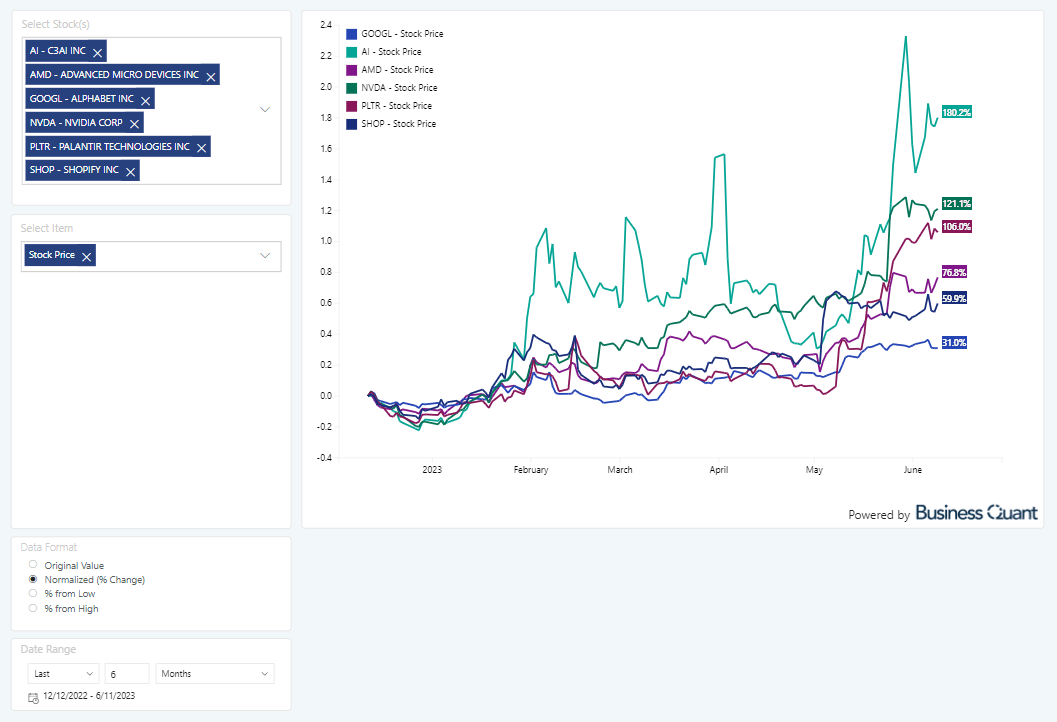

Is The Palantir Rally Sustainable New Analyst Forecasts Explored

May 10, 2025

Is The Palantir Rally Sustainable New Analyst Forecasts Explored

May 10, 2025 -

Revised Palantir Predictions Analyzing The Stocks Recent Performance

May 10, 2025

Revised Palantir Predictions Analyzing The Stocks Recent Performance

May 10, 2025 -

Bundesliga 2 Matchday 27 Results Cologne Now League Leaders

May 10, 2025

Bundesliga 2 Matchday 27 Results Cologne Now League Leaders

May 10, 2025 -

Palantir Stock Price Surge What Analysts Predict Next

May 10, 2025

Palantir Stock Price Surge What Analysts Predict Next

May 10, 2025 -

Palantirs Q1 2024 Results Assessing Government And Commercial Growth

May 10, 2025

Palantirs Q1 2024 Results Assessing Government And Commercial Growth

May 10, 2025