Tesla's Response To Shareholder Lawsuits In The Wake Of Musk's Compensation

Table of Contents

The Nature of the Shareholder Lawsuits Against Tesla

Several shareholder lawsuits have targeted Tesla, primarily focusing on the controversial compensation package granted to Elon Musk. These lawsuits allege significant flaws in the structure and justification of this compensation.

Allegations of Executive Compensation Excess

- Exorbitant Stock Options: Lawsuits allege that the compensation package, largely comprised of stock options, is excessively generous, far exceeding industry norms for CEOs of comparable companies. Plaintiffs argue that the sheer scale of the package dilutes existing shareholder value.

- Unrealistic Performance Metrics: The lawsuits claim that the performance metrics tied to the vesting of Musk's stock options are unrealistically easy to achieve, essentially guaranteeing him a massive payout regardless of Tesla's actual performance.

- Breach of Fiduciary Duty: Plaintiffs argue that the Tesla board breached its fiduciary duty to shareholders by approving such a lavish compensation package, prioritizing Musk's personal enrichment over the interests of shareholders.

- Financial Impact: The lawsuits point to the significant impact of the compensation package on Tesla's financial statements, highlighting its effect on earnings per share and overall financial health. Specific numbers, if publicly available from court documents, should be included here (e.g., "$X billion in stock options"). Reference specific lawsuit filings and case numbers (if publicly available) to provide further credibility.

Lack of Transparency in Compensation Structure

- Opaque Approval Process: Lawsuits highlight the lack of transparency surrounding the design and approval process of Musk's compensation package, raising concerns about the independence and objectivity of the board's decision.

- Potential Conflicts of Interest: The close relationship between Musk and the board members raises concerns about potential conflicts of interest in the approval process, suggesting that the board may not have acted in the best interests of all shareholders.

- Regulatory Scrutiny: Mention any regulatory inquiries or Securities and Exchange Commission (SEC) investigations into the compensation structure. This adds weight to the seriousness of the allegations.

Tesla's Legal Defenses and Strategies

Tesla has vigorously defended itself against these lawsuits, employing various legal strategies to counter the claims.

Arguments Presented by Tesla's Legal Team

- Performance-Based Justification: Tesla's legal team argues that Musk's compensation is performance-based, directly linked to the achievement of ambitious yet attainable targets that significantly increased Tesla's market capitalization and overall success.

- Long-Term Value Creation: They emphasize the long-term value creation attributed to Musk's leadership and vision, arguing that the compensation package is a worthwhile investment considering the transformative growth under his leadership.

- Shareholder Approval (if applicable): If the compensation package had any form of shareholder approval, this should be mentioned as part of Tesla's defense.

- Legal Precedents: Tesla's legal team likely cites legal precedents supporting the board's authority in setting executive compensation, provided these precedents exist and align with their defense.

Settlement Attempts and Outcomes

This section should detail any settlement attempts made by Tesla to resolve the lawsuits. If settlements occurred, provide details of the terms. If cases are ongoing, mention the current status of the litigation, including key upcoming events such as court hearings or depositions. Include information on any court rulings made thus far.

Impact on Tesla's Stock Price and Investor Confidence

The shareholder lawsuits and the resulting negative publicity have had a noticeable impact on Tesla's stock price and investor confidence.

Market Reactions to the Lawsuits

- Stock Price Volatility: Document the fluctuations in Tesla's stock price following the filing of the lawsuits, including both upward and downward trends.

- Negative Investor Sentiment: Analyze the impact of the negative media coverage and the consequent erosion of investor confidence. Mention any significant sell-offs or changes in analyst ratings.

- Visual Representation: Include relevant charts or graphs illustrating the stock price trends to provide a clear visual representation of the market's reaction.

Long-Term Implications for Tesla's Governance

The lawsuits have significant implications for Tesla's corporate governance, impacting future compensation structures and executive oversight.

- Potential Governance Changes: Discuss potential changes to Tesla's compensation committees, board composition, or internal control mechanisms that may arise in response to the lawsuits.

- Enhanced Transparency: The lawsuits may lead to increased transparency in future executive compensation decisions, fostering improved communication with shareholders.

- Investor Relations: The long-term impact on investor relations and corporate responsibility will be significant, requiring Tesla to build and maintain trust among its investors.

Conclusion: Analyzing Tesla's Response to Shareholder Lawsuits and Looking Ahead

This article examined Tesla's response to shareholder lawsuits stemming from Elon Musk's compensation package. We explored the nature of the lawsuits, Tesla's legal defenses, and the impact on the company's stock price and investor confidence. Key takeaways include the significant financial implications of the package, the ongoing legal battles, and the potential for long-term changes in Tesla's corporate governance. Analyzing Tesla's legal strategies reveals a complex interplay of performance-based arguments and the inherent challenges of balancing executive compensation with shareholder interests. To stay informed about the evolving developments in this case and its implications for corporate governance and executive compensation, continue monitoring legal updates and financial news related to Tesla. Further research into similar cases and regulatory changes affecting executive compensation will provide a more comprehensive understanding of Tesla's shareholder lawsuit responses and their potential impact on future corporate practices.

Featured Posts

-

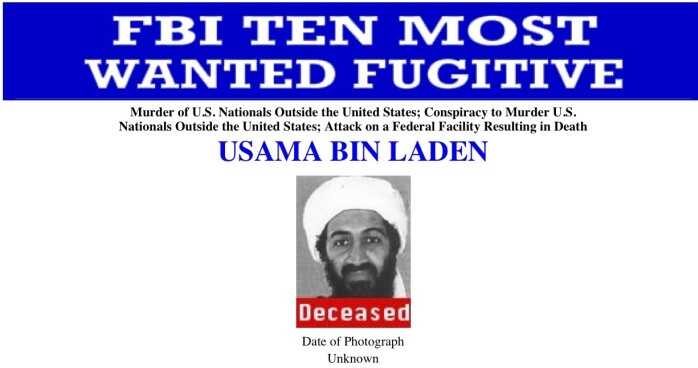

Asamh Bn Ladn Ky Shkhsyt Awr An Ke Hamywn Ka Jayzh Alka Yagnk Ka Tjzyh

May 18, 2025

Asamh Bn Ladn Ky Shkhsyt Awr An Ke Hamywn Ka Jayzh Alka Yagnk Ka Tjzyh

May 18, 2025 -

Turning Renovation Nightmares Into Dreams The Role Of A House Therapist

May 18, 2025

Turning Renovation Nightmares Into Dreams The Role Of A House Therapist

May 18, 2025 -

Declassified Call Netflix Show Sheds Light On Bin Ladens Capture

May 18, 2025

Declassified Call Netflix Show Sheds Light On Bin Ladens Capture

May 18, 2025 -

Understanding The Complexity Of Japans Metropolis

May 18, 2025

Understanding The Complexity Of Japans Metropolis

May 18, 2025 -

Reddit Service Interruption Thousands Affected

May 18, 2025

Reddit Service Interruption Thousands Affected

May 18, 2025

Latest Posts

-

Kanye West And Bianca Censori Spain Dinner Date After Split Claims

May 18, 2025

Kanye West And Bianca Censori Spain Dinner Date After Split Claims

May 18, 2025 -

Is It Back On Bianca Censori And Kanye West Seen Together In Spain

May 18, 2025

Is It Back On Bianca Censori And Kanye West Seen Together In Spain

May 18, 2025 -

Kane Uest Publikatsiya Instruktsii Dlya Pokhoron Vdokhnovlyonnoy Pashey Tekhnikom

May 18, 2025

Kane Uest Publikatsiya Instruktsii Dlya Pokhoron Vdokhnovlyonnoy Pashey Tekhnikom

May 18, 2025 -

Today Show Viewers Demand Permanent Change After Jenna Bush Hager Segment

May 18, 2025

Today Show Viewers Demand Permanent Change After Jenna Bush Hager Segment

May 18, 2025 -

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025