The $16 Billion Question: Will Trump's Tariffs Cripple California's Revenue?

Table of Contents

California's Trade Dependence and Tariff Vulnerability

California's robust economy is heavily reliant on international trade, making it particularly vulnerable to the ripple effects of trade wars. Trump's tariffs, and subsequent retaliatory measures from other countries, created a perfect storm threatening key Californian industries.

Agricultural Exports Heavily Affected

California's agricultural sector is a global powerhouse, exporting billions of dollars worth of products annually. Retaliatory tariffs imposed by countries like China significantly impacted key exports.

- Wine: Chinese tariffs on California wine severely hampered exports, leading to losses for vineyards and related businesses. Estimates from the Wine Institute suggest millions of dollars in lost revenue.

- Almonds: Similar tariffs on almonds significantly reduced demand from key export markets, impacting California's almond growers and processing facilities.

- Fruits and Nuts: A wide range of fruits and nuts experienced reduced export volumes, affecting farmers and the broader agricultural supply chain.

Manufacturing and the Supply Chain

California's manufacturing sector, while smaller than its service sector, is also vulnerable to tariff-induced disruptions. Increased input costs due to tariffs on imported materials, coupled with reduced demand for exports, led to challenges for many manufacturers.

- Electronics Manufacturing: Increased costs for imported components hampered production, forcing some manufacturers to raise prices or reduce output.

- Aerospace and Defense: Disruptions to global supply chains affected the aerospace industry, leading to delays and increased production costs.

- Textiles and Apparel: Tariffs on imported fabrics and materials increased production costs for California-based clothing manufacturers.

Tourism and the Service Sector

While not directly targeted by tariffs, California's tourism sector felt the indirect impact of a slowing global economy. Decreased consumer spending due to economic uncertainty dampened tourism revenue.

- Hospitality: Hotels and restaurants experienced reduced occupancy and lower spending per guest.

- Retail: Retail sales declined as consumers tightened their budgets in response to economic anxieties.

- Entertainment: The entertainment industry, including theme parks and movie studios, saw a reduction in visitor numbers and revenue.

State Budgetary Implications and Mitigation Strategies

The potential $16 billion revenue shortfall resulting from Trump's tariffs presented a significant challenge for California's state budget.

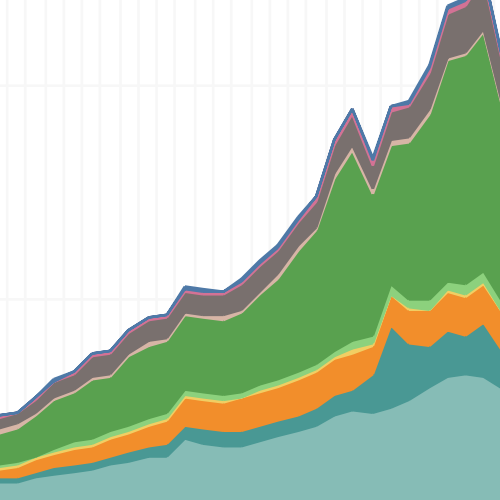

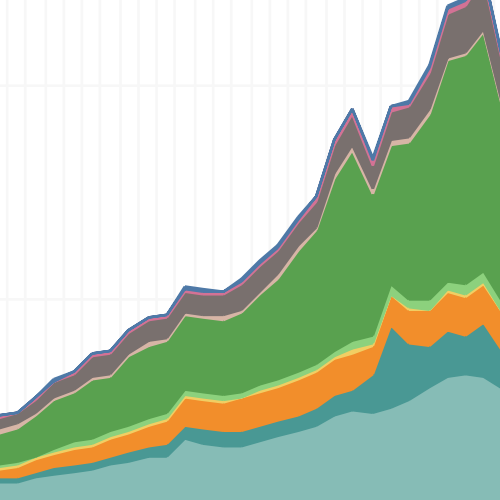

Projected Revenue Shortfalls

Various economic models projected substantial shortfalls in state tax revenue due to reduced economic activity across various sectors. These projections varied based on the duration and intensity of the trade war.

- Sales Tax Revenue: Decreased consumer spending directly impacted sales tax revenue, a major source of state funding.

- Corporate Income Tax Revenue: Reduced profits in affected industries led to lower corporate income tax payments.

- Personal Income Tax Revenue: Job losses and reduced wages in affected sectors translated to lower personal income tax collections.

State Government Responses

The California state government implemented several strategies to mitigate the negative impact of Trump's tariffs.

- Economic Diversification Initiatives: The state invested in programs to diversify the economy, reducing reliance on vulnerable sectors.

- Support for Affected Industries and Workers: Financial assistance and retraining programs were offered to businesses and workers in affected industries.

- Trade Promotion Efforts: The state actively pursued new trade agreements and partnerships to diversify export markets.

Federal Policy Impact and Lobbying Efforts

California played an active role in influencing federal trade policy through lobbying efforts and alliances with other states.

- Lobbying Efforts: State officials engaged in extensive lobbying to urge the federal government to reconsider or mitigate the impact of tariffs.

- Alliances with Other States: California formed alliances with other states impacted by tariffs to exert greater influence on federal policy.

- Legislative Solutions: The state explored legislative options to address the economic challenges posed by the tariffs.

Long-Term Economic Consequences and Uncertainties

The long-term economic consequences of Trump's tariffs remain uncertain, but several key trends emerged.

Shifting Global Trade Dynamics

The trade war forced California businesses to reassess their global supply chains and explore new trade partnerships.

- Reshoring and Nearshoring: Some companies began shifting production back to the US or to closer countries to reduce reliance on affected regions.

- New Trade Partnerships: California sought to diversify its export markets by forging new trade agreements with countries less affected by the trade war.

- Long-Term Economic Restructuring: The tariffs may have accelerated long-term shifts in the California economy, leading to restructuring and adaptation in certain sectors.

Uncertainty and Forecasting Challenges

Precisely forecasting the long-term impact of Trump's tariffs on California's economy proved challenging due to the complexity of the situation.

- Economic Model Limitations: Economic models struggled to capture the full range of indirect and long-term effects of the trade war.

- Unpredictability of Trade Policy: The evolving nature of trade policy made accurate forecasting extremely difficult.

- Lagged Effects: The full consequences of the tariffs may take years to fully manifest, making accurate short-term predictions unreliable.

Resilience and Adaptation

Despite the challenges, California demonstrated resilience and a capacity to adapt to changing global trade dynamics.

- Innovation and Technology: The state's strong technology sector proved relatively resilient to the trade war.

- Economic Diversification: Efforts to diversify the economy helped mitigate the negative impact on vulnerable sectors.

- Skilled Workforce: California's highly skilled workforce enabled businesses to adapt and innovate in response to new challenges.

Conclusion: The Lasting Impact of Trump's Tariffs on California's Revenue – A Call to Action

Trump's tariffs posed a significant threat to California's economy, with the potential for a $16 billion revenue shortfall. The agricultural sector, manufacturing, and even the tourism industry felt the impact. While the state government implemented various mitigation strategies, the long-term consequences remain uncertain and complex to predict. Understanding the full impact of Trump's tariffs on California's revenue is crucial for the state's future. Stay informed on how Trump's tariffs are impacting California's revenue to support effective policy solutions and advocate for a more stable and predictable trade environment.

Featured Posts

-

Gurriels Pinch Hit Rbi Single Propels Padres To Victory Over Braves

May 16, 2025

Gurriels Pinch Hit Rbi Single Propels Padres To Victory Over Braves

May 16, 2025 -

Understanding The Fallout Congos Cobalt Export Ban And The Anticipation Of A New Quota System

May 16, 2025

Understanding The Fallout Congos Cobalt Export Ban And The Anticipation Of A New Quota System

May 16, 2025 -

Vercel Fights Back Against La Ligas Controversial Piracy Blocks

May 16, 2025

Vercel Fights Back Against La Ligas Controversial Piracy Blocks

May 16, 2025 -

Tampa Bay Rays Sweep Of Padres Fueled By Rookie Chandler Simpsons Performance

May 16, 2025

Tampa Bay Rays Sweep Of Padres Fueled By Rookie Chandler Simpsons Performance

May 16, 2025 -

Ohio Train Derailment Lingering Toxic Chemicals Found In Buildings Months Later

May 16, 2025

Ohio Train Derailment Lingering Toxic Chemicals Found In Buildings Months Later

May 16, 2025

Latest Posts

-

Parallel Universes A Fictional Chat Between Two Max Muncys

May 16, 2025

Parallel Universes A Fictional Chat Between Two Max Muncys

May 16, 2025 -

Why This Mlb All Star Rejected The Torpedo Bat

May 16, 2025

Why This Mlb All Star Rejected The Torpedo Bat

May 16, 2025 -

Dodgers Max Muncy A Hypothetical Conversation With His Alternate Self

May 16, 2025

Dodgers Max Muncy A Hypothetical Conversation With His Alternate Self

May 16, 2025 -

Mlb All Stars Torpedo Bat Confession Why He Hated It

May 16, 2025

Mlb All Stars Torpedo Bat Confession Why He Hated It

May 16, 2025 -

A Max Muncy Meets Dodgers Max Muncy An Imagined Conversation

May 16, 2025

A Max Muncy Meets Dodgers Max Muncy An Imagined Conversation

May 16, 2025