The Connection Between China's Steel Output And Falling Iron Ore Prices

Table of Contents

China's Dominance in Steel Production and Iron Ore Consumption

China's massive steel production capacity and its corresponding demand for iron ore are undeniable forces shaping the global market. China accounts for over half of the world's steel production, dwarfing all other nations. This massive production requires a huge amount of iron ore imports, making China the world's largest importer of this crucial raw material. Changes in Chinese steel production directly and significantly impact global iron ore demand, creating a ripple effect throughout the supply chain.

- China accounts for over half of the world's steel production. This sheer volume underscores its influence on global iron ore prices.

- This massive production requires a huge amount of iron ore imports. Australia and Brazil are major exporters, heavily reliant on the Chinese market.

- Changes in Chinese steel production directly impact global iron ore demand. Even slight variations in output can cause significant price fluctuations.

- Government policies significantly influence steel production. Environmental regulations, infrastructure projects, and economic stimulus packages all play a crucial role. For example, increased environmental regulations aimed at reducing carbon emissions can lead to production cuts, subsequently impacting iron ore demand.

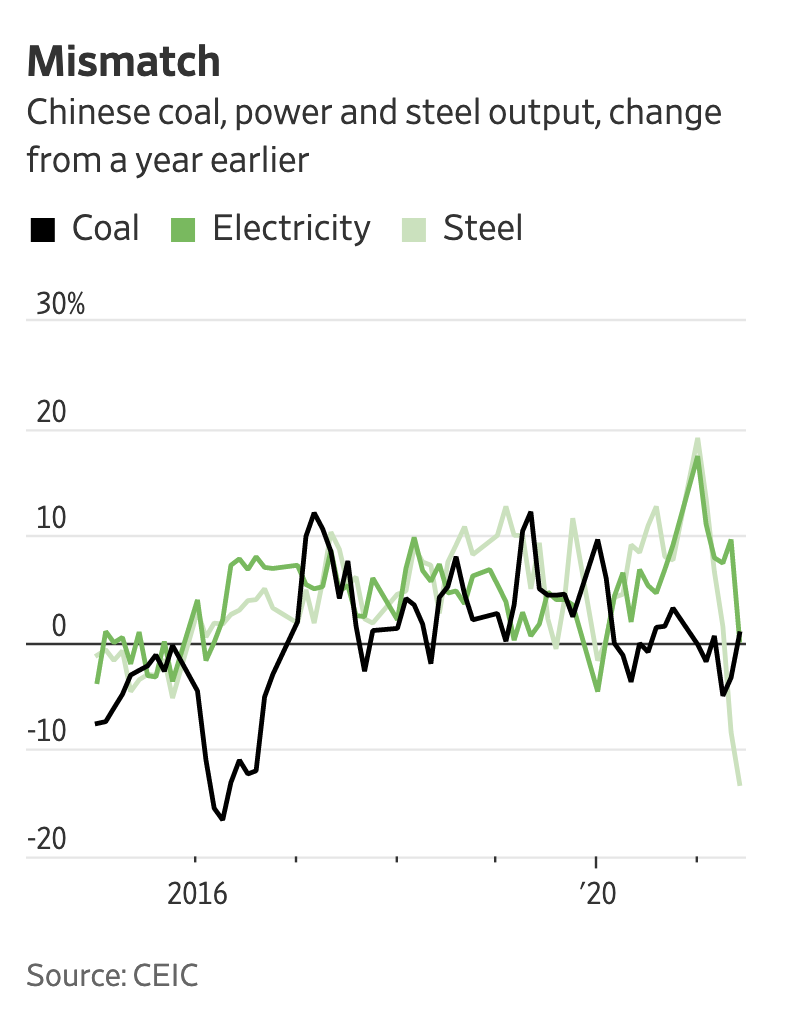

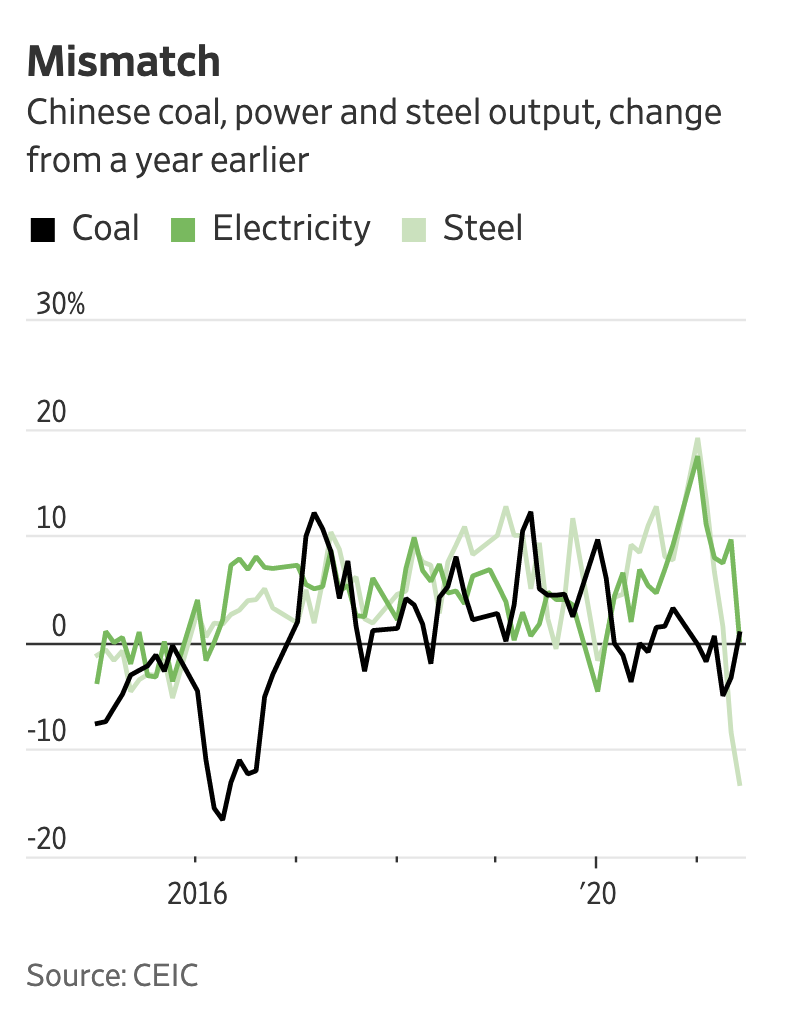

Factors Affecting China's Steel Output and Their Impact on Iron Ore Prices

Several key factors influence China's steel output, consequently affecting iron ore prices. Understanding these interconnected elements is vital for predicting market trends.

Real Estate Sector Slowdown

The slowdown in China's real estate market has had a profound impact on steel demand and, consequently, iron ore prices.

- Reduced construction activity leads to lower steel demand. As fewer buildings are constructed, the need for steel diminishes.

- Lower steel demand translates to lower iron ore demand. This reduced demand directly impacts the price of iron ore.

- Government policies aimed at stabilizing the real estate market can influence steel demand. These policies, whether they stimulate or restrict construction, have far-reaching consequences for the entire supply chain.

Government Regulations and Environmental Policies

China's increasingly stringent environmental policies are another critical factor.

- Increased focus on emission reduction leads to production cuts in steel mills. This is a deliberate government strategy to improve air quality and combat climate change.

- Production quotas and stricter environmental regulations limit steel output. These regulations directly impact the overall production capacity of Chinese steel mills.

- This reduction in steel production directly impacts iron ore price due to lower demand. The decreased need for iron ore leads to a downward pressure on prices.

Global Economic Slowdown

A global economic downturn significantly affects Chinese steel production and iron ore prices.

- Reduced global demand for steel impacts Chinese exports. A weaker global economy means less demand for Chinese-made steel products.

- Lower exports lead to lower domestic steel production. Chinese steel mills adjust their output to match reduced demand.

- Consequently, iron ore prices are affected due to reduced demand. The chain reaction from a global slowdown ripples through the entire iron ore market.

The Interplay Between Supply and Demand in the Iron Ore Market

The relationship between China’s steel output and global iron ore prices is fundamentally one of supply and demand.

- Increased steel production leads to higher iron ore demand, potentially driving prices up. This increased demand puts upward pressure on prices as suppliers struggle to meet the increased needs.

- Decreased steel production leads to lower iron ore demand, causing prices to fall. Conversely, lower demand leads to a surplus of iron ore, depressing prices.

- Other major iron ore producers (Australia, Brazil) play a significant role in influencing the market. While China's demand is paramount, the supply-side dynamics from these major producers also affect the overall price balance.

Conclusion

The relationship between China's steel output and falling iron ore prices is complex and multifaceted, influenced by a range of factors including the real estate market, environmental policies, and global economic conditions. Understanding this dynamic is crucial for navigating the volatility of the iron ore market. Staying informed about China's steel production forecasts and government policies is key to predicting future trends in China's steel output and iron ore prices. By closely monitoring these factors, businesses can make better-informed decisions to mitigate risk and capitalize on opportunities within this crucial market. Keep a close eye on indicators of China's steel output to anticipate shifts in iron ore prices and make strategic decisions.

Featured Posts

-

Quick 5 Hour Binge The Best Stephen King Show On Streaming

May 09, 2025

Quick 5 Hour Binge The Best Stephen King Show On Streaming

May 09, 2025 -

Trumps Presidency Examining Day 109 May 8th 2025

May 09, 2025

Trumps Presidency Examining Day 109 May 8th 2025

May 09, 2025 -

Paris Saint Germains Success Luis Enriques Impact On The French Champions

May 09, 2025

Paris Saint Germains Success Luis Enriques Impact On The French Champions

May 09, 2025 -

Inquiry Into Nottingham Attacks Former Judge Appointed

May 09, 2025

Inquiry Into Nottingham Attacks Former Judge Appointed

May 09, 2025 -

Anchorage Witnesses Second Anti Trump Protest In Two Weeks

May 09, 2025

Anchorage Witnesses Second Anti Trump Protest In Two Weeks

May 09, 2025