The Correlation Between Elon Musk's Temper And Tesla's Stock

Table of Contents

Musk's Controversial Tweets and Their Immediate Market Impact

Elon Musk's Twitter account is legendary, both for its announcements of groundbreaking Tesla projects and its controversial pronouncements. His prolific tweeting has frequently led to significant, and often immediate, impacts on Tesla's stock price.

The "Going Private" Tweet and Subsequent SEC Investigation

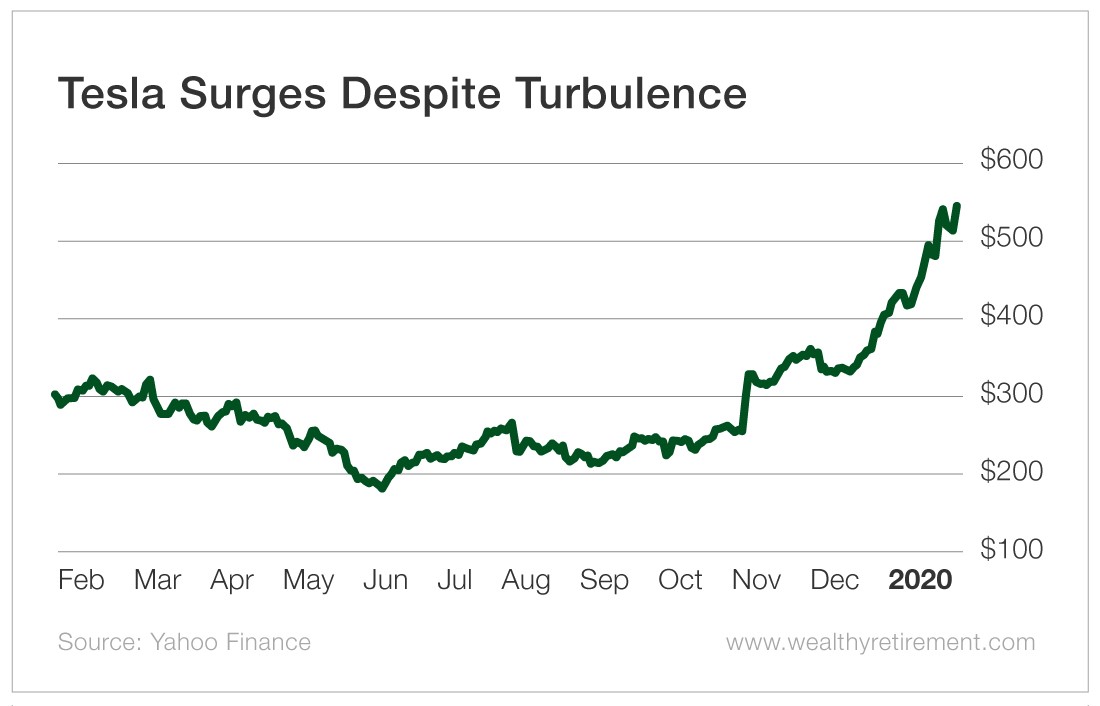

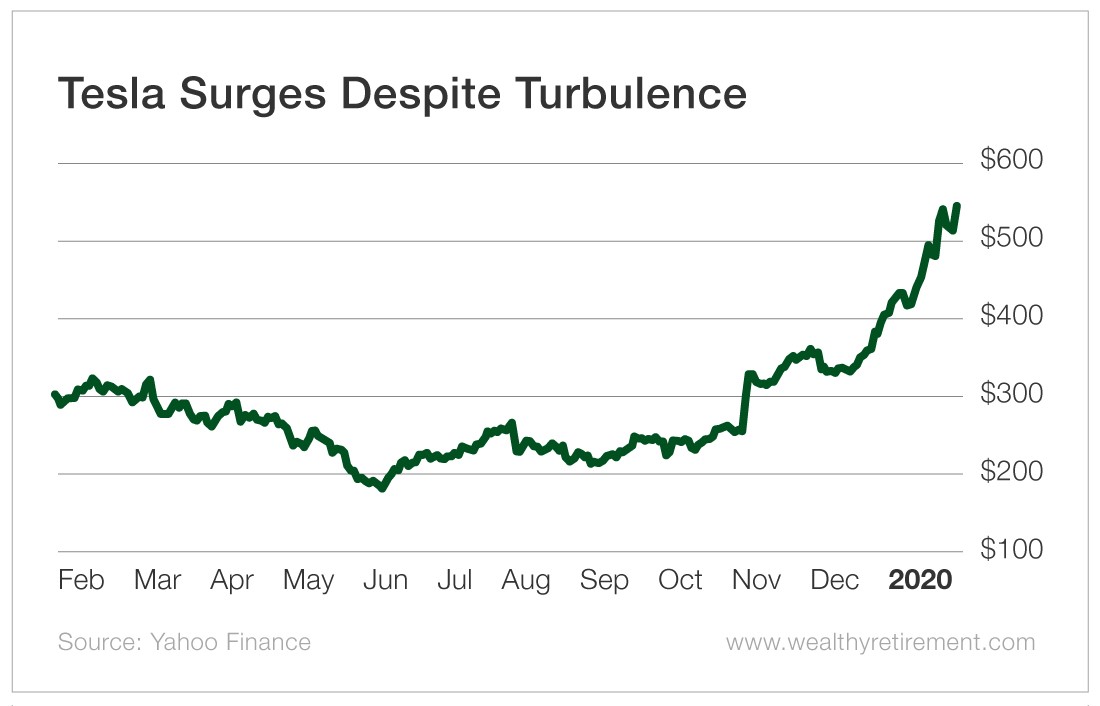

Perhaps the most infamous example is Musk's August 2018 tweet stating his intention to take Tesla private at $420 per share. This tweet sent shockwaves through the market, leading to a dramatic increase in Tesla's stock price followed by significant volatility. The SEC launched an investigation, ultimately resulting in a settlement where Musk was forced to step down as chairman and Tesla paid a substantial fine. This saga significantly damaged investor confidence and highlighted the risks associated with Musk's impulsive communication style.

- Stock price drop: Following the SEC investigation and settlement, Tesla's stock experienced a considerable decline.

- SEC fines: The hefty fines levied against both Musk and Tesla underscored the seriousness of the situation and its impact on regulatory compliance.

- Impact on investor confidence: The "going private" tweet eroded trust among investors, creating uncertainty and impacting future investment decisions.

- Legal ramifications: The legal battles and settlements surrounding the tweet resulted in substantial financial and reputational costs for Tesla and Musk.

Other Notable Controversial Tweets and Statements

Beyond the "going private" tweet, numerous other instances demonstrate a clear correlation between Musk's pronouncements and Tesla's stock price. For example, tweets about production targets, competitive landscapes, or even seemingly unrelated topics have triggered market reactions. Analyzing these events requires considering the broader context of market sentiment and news cycles. However, the pattern remains clear: Musk's words carry significant weight and can profoundly impact investor perception of Tesla.

- Specific tweet examples: [Insert links to examples of specific tweets and their associated market reactions].

- Market reactions: Document the immediate and subsequent stock price fluctuations following specific controversial tweets.

- Media coverage: Analyze how media coverage amplified the impact of Musk's tweets on Tesla’s stock.

- Analysis of investor responses: Examine investor sentiment indicators, such as trading volume and social media sentiment, in relation to specific tweets.

The Impact of Musk's Leadership Style on Employee Morale and Productivity

Musk's leadership style is often described as demanding, intense, and even ruthless. While this approach may drive innovation, it also carries potential downsides impacting employee morale, productivity, and ultimately, Tesla's overall performance, which directly affects the stock price.

High-Pressure Work Environment and Its Effect on Tesla's Performance

The high-pressure, fast-paced environment at Tesla, often attributed to Musk's leadership, has been linked to high employee turnover and burnout. This can negatively affect innovation, efficiency, and the long-term strategic vision of the company. A less-than-ideal work environment could lead to decreased productivity and potentially hamper Tesla's ability to compete effectively, leading to stock price vulnerability.

- Employee turnover: High turnover rates represent a loss of valuable expertise and institutional knowledge.

- Impact on innovation: Burnout and high pressure can stifle creativity and hinder the development of new technologies.

- Potential for decreased efficiency: A stressed workforce may be less efficient and productive, impacting production goals and profitability.

- Effects on long-term company strategy: Constant upheaval and high turnover can disrupt long-term strategic planning and execution.

Public Criticism of Employees and Its Consequences

Musk's public criticism of employees has also drawn scrutiny and controversy. Such actions can damage employee morale and the company’s overall reputation, ultimately impacting investor confidence and stock value. Transparency is valued, but excessive public criticism can create uncertainty and negatively influence how investors perceive Tesla’s internal dynamics.

- Specific examples: [Insert examples of public criticism and subsequent media response].

- Media response: Analyze how the media portrayed Musk's criticisms and their impact on public perception of Tesla.

- Effect on investor trust and confidence: Examine how these incidents potentially influenced investor sentiment and stock trading patterns.

The Influence of External Factors on the Correlation

It's crucial to acknowledge that the correlation between Musk's actions and Tesla's stock price isn't solely causal. External factors significantly influence Tesla's stock performance, independent of Musk's behavior.

Overall Market Trends and Economic Conditions

Broader market trends, economic conditions, and industry-specific factors play a significant role in Tesla's stock valuations. Recessions, interest rate hikes, or shifts in investor sentiment toward the broader electric vehicle (EV) market can impact Tesla's stock price, regardless of Musk's actions. It's essential to separate these external influences from the impact of Musk's individual behaviors.

- Examples of external factors impacting Tesla's stock: [List examples such as changes in commodity prices, interest rates, or general market trends].

- Separating Musk's influence from general market forces: Analyze stock price fluctuations during periods of both significant Musk-related news and periods with no significant Musk-related events.

Competition in the Electric Vehicle Market

Tesla faces increasing competition in the rapidly growing EV market. The actions of competitors, technological advancements, and evolving consumer preferences significantly impact Tesla's market share and, consequently, its stock price. Musk's actions can either enhance or diminish Tesla's competitive advantage, influencing investor sentiment.

- Key competitors: Identify Tesla's major competitors and their impact on the market.

- Market share fluctuations: Analyze how Tesla's market share changes in response to competitive pressures.

- Competitive pressures: Assess the intensity of competition and its effect on Tesla's profitability and growth.

- How Musk's actions influence the perception of Tesla vs. competitors: Examine how Musk’s public statements shape the perception of Tesla relative to its competitors.

Conclusion

This analysis reveals a clear, albeit complex, correlation between Elon Musk's temperament and Tesla's stock performance. While external market forces undoubtedly play a significant role, Musk's public statements and actions consistently demonstrate the power of CEO persona in influencing investor sentiment and market volatility. His controversial tweets, demanding leadership style, and public criticisms have undeniably created periods of significant stock fluctuation. Understanding this correlation is crucial for investors seeking to navigate the often unpredictable trajectory of Tesla's stock price. The volatility inherent in this relationship underscores the importance of careful consideration of both the company's fundamentals and the impact of its CEO's public image.

Call to Action: Stay informed about the latest news and developments surrounding both Elon Musk and Tesla to better understand this dynamic relationship and make informed investment decisions regarding Tesla stock. Further research into the correlation between Elon Musk's temper and Tesla's stock is encouraged for a comprehensive understanding of this volatile market dynamic.

Featured Posts

-

Watch 1923 Season 2 Episode 5 Online Tonight Free Streaming Guide

May 27, 2025

Watch 1923 Season 2 Episode 5 Online Tonight Free Streaming Guide

May 27, 2025 -

Combating Antisemitism Ajc Unveils Global Incident Tracking Initiative

May 27, 2025

Combating Antisemitism Ajc Unveils Global Incident Tracking Initiative

May 27, 2025 -

Alien Rogue Incursion Enhanced Edition Now Available For Platform

May 27, 2025

Alien Rogue Incursion Enhanced Edition Now Available For Platform

May 27, 2025 -

Atlanta Educator Ron Clarks Survivor Party A School Wide Celebration

May 27, 2025

Atlanta Educator Ron Clarks Survivor Party A School Wide Celebration

May 27, 2025 -

Could Emegha Fill Matetas Boots At Crystal Palace

May 27, 2025

Could Emegha Fill Matetas Boots At Crystal Palace

May 27, 2025

Latest Posts

-

Was Geschah Am 10 April Wichtige Ereignisse Und Historische Daten

May 30, 2025

Was Geschah Am 10 April Wichtige Ereignisse Und Historische Daten

May 30, 2025 -

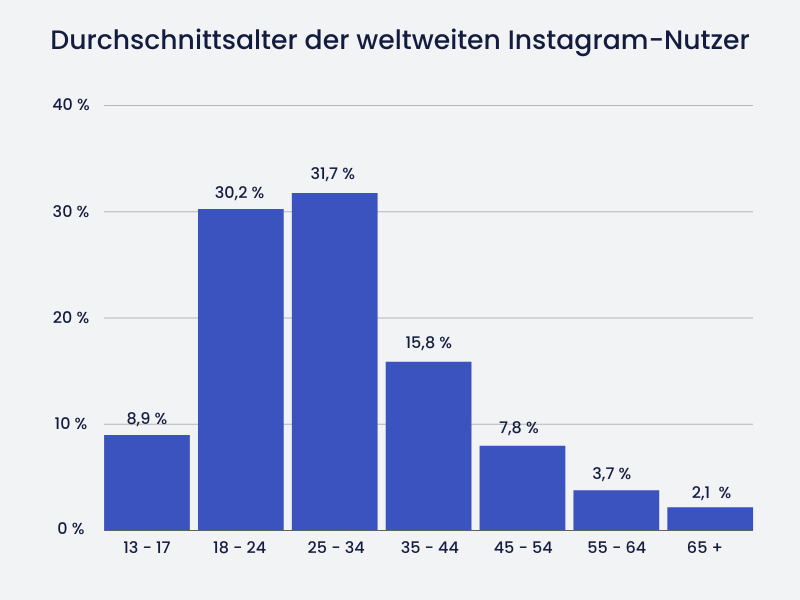

Steffi Graf Auf Instagram Wer Sind Ihre Lieblingsstars

May 30, 2025

Steffi Graf Auf Instagram Wer Sind Ihre Lieblingsstars

May 30, 2025 -

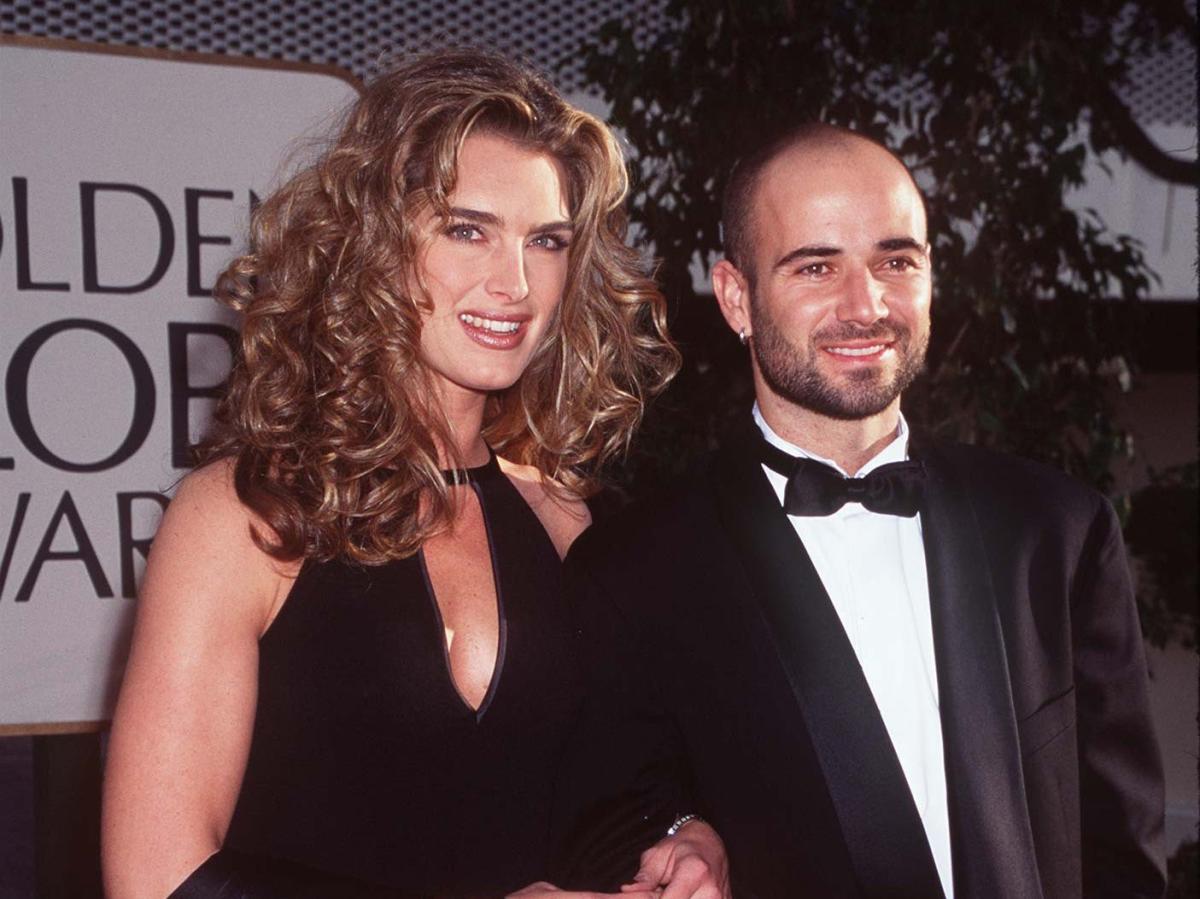

Brooke Shields Aging Gracefully And The Agassi Relationship

May 30, 2025

Brooke Shields Aging Gracefully And The Agassi Relationship

May 30, 2025 -

Sinner And Djokovic Key Contenders At The French Open

May 30, 2025

Sinner And Djokovic Key Contenders At The French Open

May 30, 2025 -

Gustafsson Warns Aspinall Poses A Significant Threat To Jones

May 30, 2025

Gustafsson Warns Aspinall Poses A Significant Threat To Jones

May 30, 2025