The Cost Of Tariffs: Examining The Losses Of Trump's Billionaire Network

Table of Contents

The Tariffs Imposed and Their Intended Impact

Trump's administration implemented a series of tariffs, ostensibly to protect American industries and jobs. However, the economic impact was far more complex and, for some, devastating.

Steel and Aluminum Tariffs

These tariffs, justified on national security grounds, targeted imports of steel and aluminum from several countries. The stated aim was to safeguard domestic steel and aluminum producers and create jobs.

- Specific Tariffs: A 25% tariff on steel imports and a 10% tariff on aluminum imports were imposed.

- Affected Companies: While some domestic steel producers initially benefited, the automotive and construction industries, heavy users of steel and aluminum, faced significant cost increases. Companies like Ford and General Motors, for example, saw their production costs rise. Although a direct link to specific losses in Trump's billionaire network within these industries is difficult to definitively prove, indirect effects through supply chains undoubtedly occurred.

- Initial Economic Projections: Initial projections suggested minimal job creation, with many economists warning of higher prices for consumers and retaliatory tariffs.

Tariffs on Chinese Goods

The most significant tariffs targeted Chinese goods, covering a vast range of products. This escalated into a full-blown trade war with China imposing retaliatory tariffs on American goods.

- Specific Goods Affected: The tariffs impacted various sectors, including consumer electronics, agricultural products, and manufactured goods. Examples include clothing, electronics, and furniture.

- Affected Companies with Ties to Trump's Network: While pinpointing direct financial losses for specific billionaires is complex due to opaque financial structures, certain industries—such as those involved in real estate development—faced increased material costs, which impacted profitability.

- Resulting Trade War: The trade war led to significant uncertainty and disruption in global supply chains, harming businesses on both sides.

The Economic Theory Behind the Tariffs (and its flaws)

Trump's tariff strategy leaned heavily on protectionist principles, arguing that tariffs would protect American jobs and reduce trade deficits. This differed from prevailing economic theories advocating for free trade.

- Economic Arguments for Protectionism: Proponents argued that tariffs would shield domestic industries from foreign competition, allowing them to grow and create jobs.

- Counterarguments and Evidence of Negative Impacts: However, economic studies overwhelmingly show that tariffs lead to higher prices for consumers, reduced consumer choice, and retaliatory tariffs from other countries, ultimately harming economic growth. The trade war triggered by these policies undeniably exemplifies this.

Financial Losses within Trump's Billionaire Network

While definitively proving direct financial losses solely attributable to tariffs for Trump's associates requires detailed financial disclosure, which is often lacking, we can explore potential avenues of impact.

Case Studies of Affected Businesses

Determining direct causality is challenging, but examining industries with significant import reliance affected by tariffs can highlight potential impacts.

- Company Names, Industry, Estimated Financial Losses: While precise figures are difficult to obtain, industries like apparel manufacturing (potentially impacting companies with ties to Trump's network) experienced increased input costs resulting from tariffs. Analysis suggests a decreased overall profitability for these companies, although direct quantification related to tariffs is complicated.

- Relationship to Trump's Network: The challenge lies in separating the effects of tariffs from other economic factors affecting business performance.

Impact on Stock Prices and Investments

The stock market reacted negatively to the escalation of trade tensions.

- Specific Examples of Stock Price Fluctuations: Companies heavily reliant on global trade or those with significant Chinese supply chains experienced significant stock price drops during the trade war. This impacted various investment portfolios, including those likely held by individuals associated with Trump's network.

- Correlation Between Tariff Announcements and Market Reactions: Stock market analysis demonstrates a clear negative correlation between tariff announcements and the performance of companies reliant on international trade.

Hidden Costs and Indirect Impacts

Beyond the direct financial hits to businesses, the tariffs generated hidden costs.

- Examples of Rising Prices: Consumers faced higher prices for many imported goods, reducing their purchasing power.

- Layoffs in Affected Industries: Job losses occurred not only in sectors directly targeted by tariffs but also in related industries affected by supply chain disruptions.

- Disruptions in Supply Chains: The trade war significantly disrupted global supply chains, leading to production delays and increased costs for businesses.

The Broader Economic Consequences of Trump's Tariffs

The economic impact of Trump's tariffs extended far beyond the billionaire network.

Impact on US Consumers

The tariffs directly affected US consumers.

- Specific Examples of Price Increases: Higher tariffs translated into higher prices for many goods and services, reducing consumer purchasing power.

- Surveys Demonstrating Consumer Spending Reductions: Studies indicate a decline in consumer spending due to rising prices and economic uncertainty.

- Impact on Inflation: Tariffs contributed to inflationary pressures, eroding the value of the dollar.

International Trade Relations

The aggressive tariff policy severely damaged US relations with major trading partners.

- Impacts on Specific Trade Agreements: The tariffs strained several trade agreements and fostered distrust between the US and other nations.

- Examples of Strained Relations with Trading Partners: The trade war with China and retaliatory actions from other countries severely damaged long-standing trade relationships.

- Trade Deficits: While intended to reduce trade deficits, the tariffs largely failed to achieve this goal.

Conclusion

Trump's tariff policies, while aiming to protect American industries, resulted in significant economic losses, impacting not only consumers but potentially even members of his billionaire network through indirect consequences. The hidden costs and indirect impacts, such as increased prices, supply chain disruptions, and damaged international relations, far outweigh any potential benefits. Understanding the true cost of tariffs is crucial for informed policymaking. Continue your research on the long-term economic implications of protectionist measures to form your own conclusions on The Cost of Tariffs.

Featured Posts

-

The Eu And Us Tariffs A Call For Stronger Action From France

May 09, 2025

The Eu And Us Tariffs A Call For Stronger Action From France

May 09, 2025 -

Latest News Williams F1 And The Doohan Colapinto Driver Situation

May 09, 2025

Latest News Williams F1 And The Doohan Colapinto Driver Situation

May 09, 2025 -

Bitcoin Market Rebound Opportunities And Risks For Investors

May 09, 2025

Bitcoin Market Rebound Opportunities And Risks For Investors

May 09, 2025 -

Elon Musks Net Worth Explodes Tesla Rally Fuels Billions In Gains Post Dogecoin Step Back

May 09, 2025

Elon Musks Net Worth Explodes Tesla Rally Fuels Billions In Gains Post Dogecoin Step Back

May 09, 2025 -

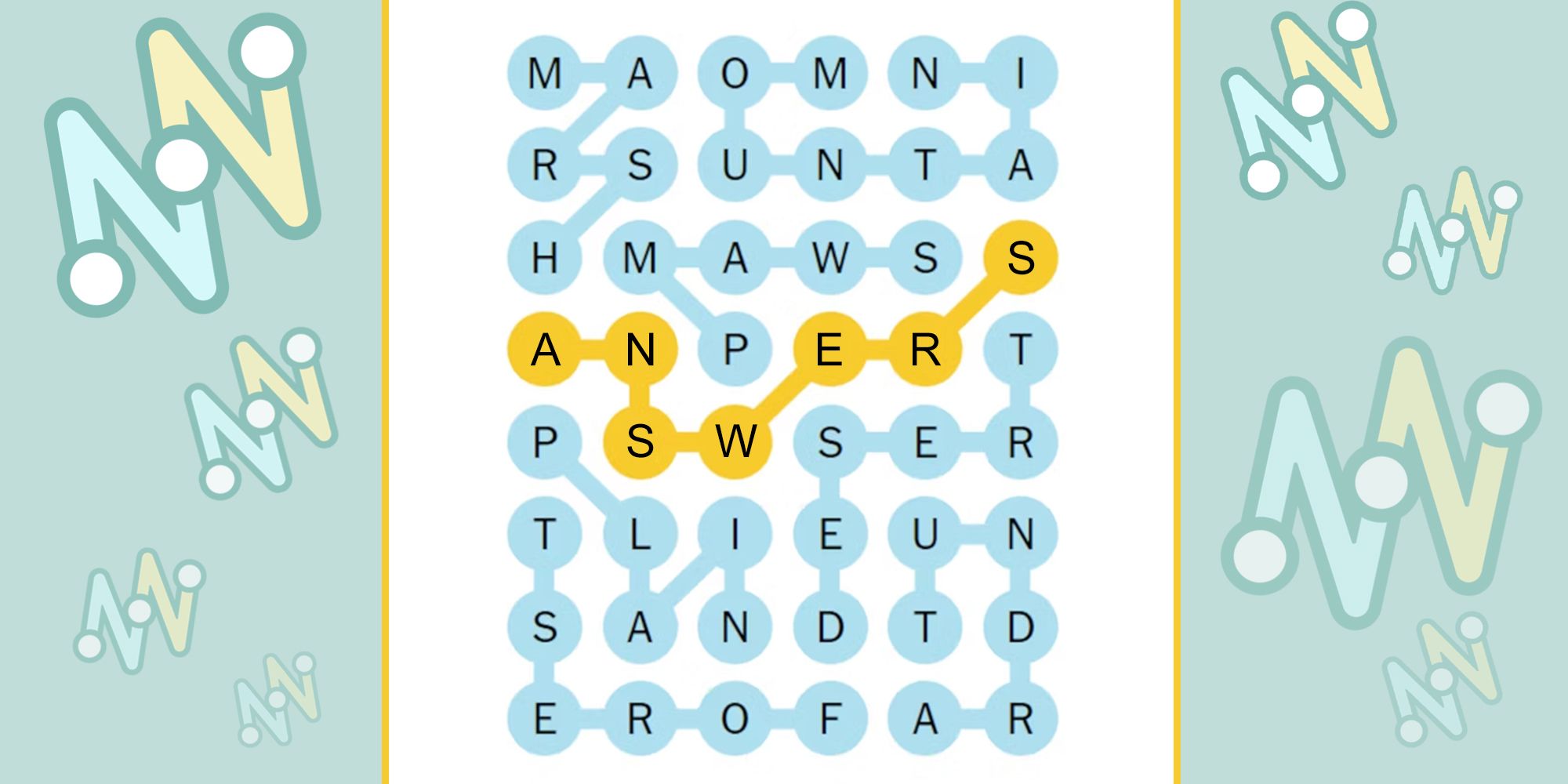

Nyt Strands Game 403 Hints And Solutions For April 10th

May 09, 2025

Nyt Strands Game 403 Hints And Solutions For April 10th

May 09, 2025