The Effect Of US Tariffs On Shein's London Stock Market Debut

Table of Contents

Shein's Business Model and US Market Dependence

Shein's business model hinges on its ability to deliver trendy clothing at incredibly low prices. This is achieved through a highly efficient, vertically integrated supply chain, primarily based in Asia, and a relentless focus on speed and scale. However, this model is heavily reliant on the US market, which contributes significantly to its overall revenue. Understanding Shein's dependence on the US is critical to assessing the impact of US tariffs.

- Shein's US Revenue: While precise figures remain undisclosed, various reports suggest the US accounts for a substantial portion – potentially over 30% – of Shein's total revenue.

- Key Product Categories Affected: Tariffs primarily impact clothing and textile products, which constitute the core of Shein's offerings. This includes apparel, accessories, and footwear.

- Supply Chain Vulnerability: Shein's sourcing strategies, while efficient, are concentrated in regions heavily impacted by US trade policies. Any shift in tariff rates directly impacts their production costs.

The Impact of US Tariffs on Shein's Profitability

Increased US tariffs translate directly into higher production and import costs for Shein. This directly impacts their profit margins, a key factor investors will scrutinize during the IPO. To offset these increased costs, Shein may be forced to raise prices, potentially affecting consumer demand.

- Estimated Cost Increase: Depending on the specific tariff rates, the increase in production costs could range from several percentage points to potentially even double-digit figures, significantly eroding profitability.

- Mitigation Strategies: Shein might explore various mitigation strategies, such as shifting sourcing to other regions, increasing automation to reduce labor costs, or negotiating better deals with suppliers. However, these strategies may not fully offset the tariff impact.

- Consumer Behavior: Price increases could lead to decreased consumer demand, especially in a price-sensitive market like fast fashion. This could necessitate a significant shift in their marketing and sales strategies.

Investor Sentiment and Shein's Valuation

The uncertainty surrounding US tariffs poses a significant threat to investor confidence in Shein's IPO. This uncertainty directly affects Shein's valuation and the amount of funding it can secure. Investors will carefully consider the potential long-term impact of these tariffs on the company's profitability and growth.

- Valuation Range: Without considering tariffs, Shein's valuation could fall within a high range. However, the inclusion of tariff-related risks could significantly lower this estimation, potentially affecting the IPO pricing.

- Key Investor Considerations: Investors will be keenly interested in Shein's strategies to mitigate the impact of tariffs, its risk assessment, and its contingency plans.

- Comparison to Competitors: Investors will also compare Shein's situation with that of other fast-fashion companies affected by similar tariffs, assessing the company's relative resilience and preparedness.

Shein's Strategic Responses to US Tariffs

To navigate the challenges presented by US tariffs, Shein needs to proactively implement effective mitigation strategies. These strategies could involve diversifying its supply chain, exploring alternative sourcing locations, or investing in technological advancements.

- Automation and Technology: Investing in automation technologies can help reduce reliance on labor-intensive processes and potentially offset some of the cost increases related to tariffs.

- Alternative Sourcing: Exploring alternative sourcing regions, such as Southeast Asia or even parts of Africa, could lessen Shein's reliance on regions targeted by US tariffs.

- Strategic Partnerships: Forming strategic alliances with suppliers or logistics companies could provide access to more favorable pricing and minimize the effects of tariffs.

Conclusion: Navigating the Tariff Landscape: Shein's London IPO and Beyond

The "Effect of US Tariffs on Shein's London Stock Market Debut" is substantial and requires careful consideration. While Shein's business model has proven successful, its heavy reliance on the US market and its sensitivity to tariff fluctuations present significant risks. Investors need to assess these risks thoroughly before investing in the IPO. Shein's ability to adapt and effectively mitigate the impact of these tariffs will be a crucial determinant of its long-term success, both in the London market and globally. Stay informed about the evolving situation and its broader implications for the global fast-fashion industry. You can find further resources on US trade policy and Shein's business through reputable financial news sources and government websites.

Featured Posts

-

New Baby For Max Verstappen Name Announcement Before Miami Race

May 05, 2025

New Baby For Max Verstappen Name Announcement Before Miami Race

May 05, 2025 -

Louisiana Derby 2025 A Guide To The Odds Field And Kentucky Derby Implications

May 05, 2025

Louisiana Derby 2025 A Guide To The Odds Field And Kentucky Derby Implications

May 05, 2025 -

What Happened In Two Days At A Wild Crypto Party

May 05, 2025

What Happened In Two Days At A Wild Crypto Party

May 05, 2025 -

Temperature Plunge In West Bengal Weather Update And Forecast

May 05, 2025

Temperature Plunge In West Bengal Weather Update And Forecast

May 05, 2025 -

Analyzing The Grand Theft Auto Vi Trailer A Second Look

May 05, 2025

Analyzing The Grand Theft Auto Vi Trailer A Second Look

May 05, 2025

Latest Posts

-

Analyzing Darjeelings Traffic Problems Strategies For Improvement

May 05, 2025

Analyzing Darjeelings Traffic Problems Strategies For Improvement

May 05, 2025 -

Darjeelings Slow Traffic Movement A Growing Concern

May 05, 2025

Darjeelings Slow Traffic Movement A Growing Concern

May 05, 2025 -

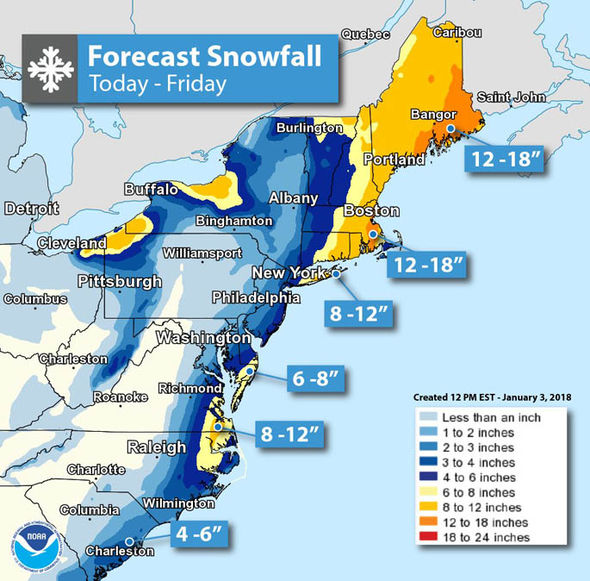

Winter Storm Watch Snow Forecast For New York New Jersey And Connecticut

May 05, 2025

Winter Storm Watch Snow Forecast For New York New Jersey And Connecticut

May 05, 2025 -

Snow In Ny Nj And Ct Predicting The Next Winter Storm

May 05, 2025

Snow In Ny Nj And Ct Predicting The Next Winter Storm

May 05, 2025 -

Cancelled Fight Ufc 314 Suffers Setback With Removal Of Knockout Artists Matchup

May 05, 2025

Cancelled Fight Ufc 314 Suffers Setback With Removal Of Knockout Artists Matchup

May 05, 2025