The Impact Of Federal Debt On Mortgage Rates And Availability

Table of Contents

The Relationship Between Federal Debt and Interest Rates

A fundamental economic principle dictates an inverse relationship between federal debt and interest rates. Simply put: higher federal debt generally leads to higher interest rates. This isn't a direct, immediate cause-and-effect, but rather a complex interplay of economic forces.

- Increased government borrowing competes with private borrowing, driving up demand for loanable funds. When the government borrows heavily to finance its spending, it increases the overall demand for money available for lending. This increased demand pushes interest rates higher across the board.

- Higher demand leads to increased interest rates across the board, including mortgages. This increased competition for loanable funds affects all borrowers, including those seeking mortgages. As a result, mortgage rates tend to rise along with other interest rates.

- The Federal Reserve's response to high debt can influence interest rate hikes. To combat inflation often associated with high debt, the Federal Reserve (the central bank of the US) may raise interest rates to cool down the economy. These increases directly impact mortgage rates.

- Inflation, often linked to high debt, also contributes to interest rate increases. High levels of federal debt can contribute to inflation. When prices rise, the Federal Reserve often responds by raising interest rates to curb inflation, further affecting mortgage rates.

Further Detail: Inflation expectations play a critical role. If the market anticipates future inflation, it will demand higher interest rates to compensate for the erosion of purchasing power. Economic indicators like the Consumer Price Index (CPI) are closely watched by the Fed and provide insights into inflation trends, influencing their decisions regarding interest rate adjustments.

How Increased Federal Debt Affects Mortgage Availability

Higher interest rates, a direct consequence of increased federal debt, significantly impact mortgage availability. This effect manifests in several ways:

- Higher interest rates increase the monthly payments, potentially pricing out potential homebuyers. Even a small increase in the interest rate can substantially increase the total cost of a mortgage over its lifespan, making homeownership unaffordable for many.

- Lenders may tighten lending standards, reducing the number of approved applications. With higher rates and increased economic uncertainty, lenders become more cautious, implementing stricter creditworthiness requirements.

- Reduced mortgage availability can lead to decreased competition and potentially higher fees. A smaller pool of lenders may translate to less competitive interest rates and potentially higher fees for borrowers.

- This can disproportionately affect first-time homebuyers and those with lower credit scores. Individuals with lower credit scores or smaller down payments are particularly vulnerable to higher interest rates and stricter lending criteria.

Further Detail: The impact ripples through the entire housing market. Reduced mortgage availability can lead to decreased demand for homes, potentially causing price corrections. Government-backed mortgage programs, such as those offered by the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA), play a crucial role in mitigating some of these effects, but they cannot fully offset the impact of high interest rates.

Government Actions and Their Impact on Mortgage Rates and Debt

Government policies, both fiscal and monetary, significantly influence the relationship between federal debt and mortgage rates.

- Fiscal policy (government spending and taxation) directly affects the level of federal debt. Increased government spending without corresponding increases in revenue leads to higher levels of federal debt, putting upward pressure on interest rates.

- Monetary policy (actions by the Federal Reserve) influences interest rates, impacting mortgages. The Fed’s actions, like raising or lowering the federal funds rate, directly affect the cost of borrowing, influencing mortgage rates.

- Government interventions in the housing market (e.g., tax credits) can also influence affordability. Government programs aimed at boosting homeownership can partially offset the negative impact of higher interest rates but don't eliminate the underlying relationship between debt and rates.

- Debt ceiling debates and their implications for market confidence and interest rates. Uncertainty surrounding the debt ceiling can negatively impact market confidence, potentially leading to higher interest rates as investors demand higher returns to offset the perceived risk.

Further Detail: The long-term consequences of unchecked federal debt rise are potentially severe. Sustained high interest rates can stifle economic growth, impacting job creation and overall economic stability.

Strategies for Navigating a High-Debt Environment When Buying a Home

Even in a high-federal-debt environment, homeownership remains achievable with careful planning and strategic actions.

- Improve your credit score to qualify for better interest rates. A higher credit score demonstrates creditworthiness to lenders, securing access to better interest rates and terms.

- Save a larger down payment to reduce the loan amount and monthly payments. A larger down payment lowers the amount borrowed and, consequently, the monthly mortgage payments.

- Shop around for the best mortgage rates and terms. Comparing offers from multiple lenders is crucial to securing the most favorable mortgage.

- Consider adjustable-rate mortgages (ARMs) or other alternative loan options (with caution). ARMs can offer initially lower rates, but they carry risks associated with fluctuating interest rates. Thoroughly understand the terms before opting for an ARM.

- Consult with a financial advisor to create a personalized plan. A financial advisor can provide tailored guidance based on your specific financial situation and goals.

Further Detail: Careful financial planning is paramount. Create a realistic budget that accounts for not only the monthly mortgage payment but also property taxes, homeowner’s insurance, and potential maintenance costs.

Conclusion

The impact of federal debt on mortgage rates and availability is significant and multifaceted. Higher federal debt generally leads to higher interest rates, making mortgages less accessible, particularly for first-time homebuyers. Understanding this complex relationship is essential for making sound financial decisions. By carefully managing your finances, improving your credit score, and researching available options, you can increase your chances of successfully navigating the mortgage market even in a high-federal-debt environment. Remember to thoroughly research and prepare before taking the step towards securing a mortgage; understanding the impact of federal debt is a crucial aspect of this preparation.

Featured Posts

-

Nyt Mini Crossword Answers For March 24 2025

May 19, 2025

Nyt Mini Crossword Answers For March 24 2025

May 19, 2025 -

Ufc 313 Controversy Fighter Admits Defeat Following Robbery Accusations

May 19, 2025

Ufc 313 Controversy Fighter Admits Defeat Following Robbery Accusations

May 19, 2025 -

Gazze Deki Trump Skandali Dansoezler Altin Ve Sok Edici Detaylar

May 19, 2025

Gazze Deki Trump Skandali Dansoezler Altin Ve Sok Edici Detaylar

May 19, 2025 -

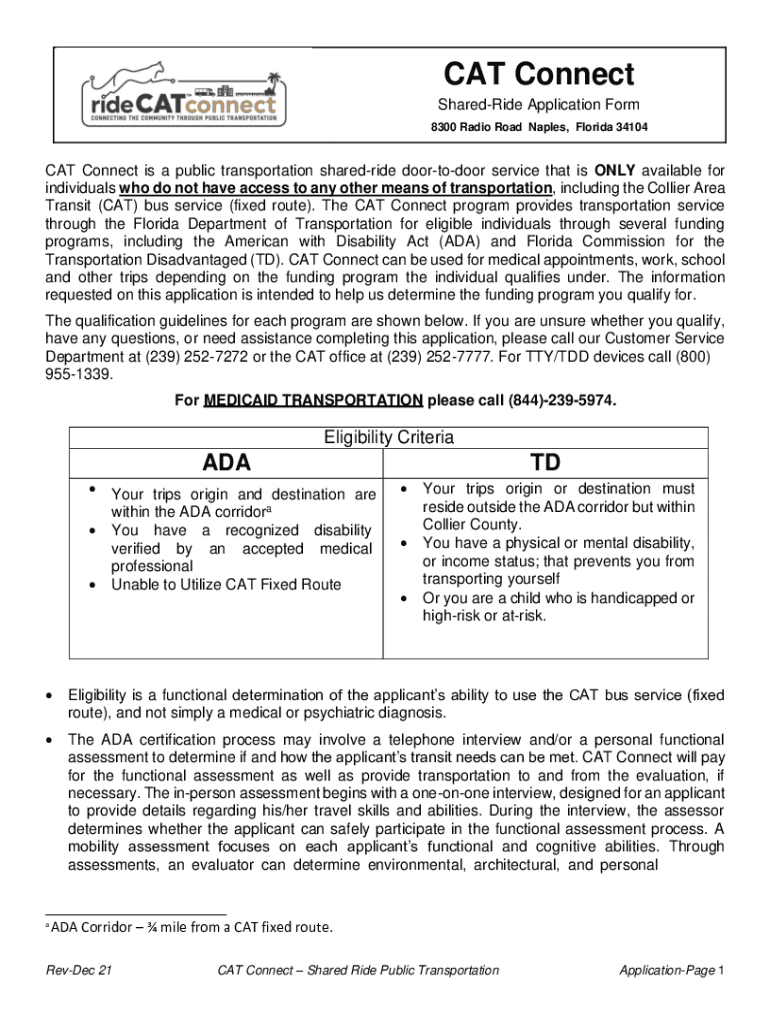

Collier County School Bus Safety Concerns Raised After Children Left At Wrong Stop

May 19, 2025

Collier County School Bus Safety Concerns Raised After Children Left At Wrong Stop

May 19, 2025 -

A Day For Paige City Honors Bueckers Wnba Entry

May 19, 2025

A Day For Paige City Honors Bueckers Wnba Entry

May 19, 2025

Latest Posts

-

Jennifer Lawrence And Cooke Maroney Welcome Second Child

May 19, 2025

Jennifer Lawrence And Cooke Maroney Welcome Second Child

May 19, 2025 -

Wednesday Afternoon Cardinal News And Notes Your Daily Dose Of St Louis Cardinals Updates

May 19, 2025

Wednesday Afternoon Cardinal News And Notes Your Daily Dose Of St Louis Cardinals Updates

May 19, 2025 -

Spotted Jennifer Lawrence And Cooke Maroney Following Baby No 2 News

May 19, 2025

Spotted Jennifer Lawrence And Cooke Maroney Following Baby No 2 News

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Couple Seen Together Amidst Baby Rumors

May 19, 2025

Jennifer Lawrence And Cooke Maroney Couple Seen Together Amidst Baby Rumors

May 19, 2025 -

New Photos Jennifer Lawrence And Cooke Maroney Following Second Child Reports

May 19, 2025

New Photos Jennifer Lawrence And Cooke Maroney Following Second Child Reports

May 19, 2025