The Simplest Dividend Strategy: Maximize Your Returns

Table of Contents

Understanding Dividend Investing Basics

Before diving into specific strategies, let's clarify the fundamentals.

-

What are Dividends? Dividends are payments made by companies to their shareholders, typically from their profits. These payments represent a share of the company's earnings. The tax implications depend on whether they're qualified dividends (generally taxed at a lower rate than ordinary income) or non-qualified dividends. Many investors utilize Dividend Reinvestment Plans (DRIPs), automatically reinvesting dividends to buy more shares, accelerating growth through compounding.

-

Dividend Yield vs. Payout Ratio: Understanding these metrics is crucial for evaluating dividend stocks. Dividend yield represents the annual dividend per share relative to the stock price (Annual Dividend/Stock Price * 100%). A high dividend yield might seem attractive, but a high payout ratio (Dividends Paid/Earnings * 100%) can indicate a company is paying out more than it can sustainably afford. For example, a company with a high yield but a payout ratio exceeding 80% might be unsustainable in the long term. Sustainable dividend payouts are key to long-term success.

-

Types of Dividend Stocks: The market offers various dividend stock types:

- High-yield dividend stocks: Offer higher-than-average dividend yields, often from mature, established companies. However, always carefully examine the payout ratio.

- Growth stocks with dividend payouts: Companies focusing on growth alongside regular dividend payments, balancing capital appreciation and income.

- Blue-chip dividend stocks: Large, well-established companies with a long history of paying consistent dividends, often considered more stable investments.

Selecting High-Yield Dividend Stocks for Your Portfolio

Building a successful dividend portfolio requires careful stock selection.

-

Focus on Financial Strength: Prioritize financially sound companies with a proven track record of consistent dividend payments. Analyze key financial ratios:

- Debt-to-equity ratio: A low ratio indicates lower financial risk.

- Dividend payout ratio: As mentioned, this should ideally be sustainable, below 80% for most companies.

-

Diversification is Key: Diversifying your portfolio across different sectors and industries minimizes risk. A well-diversified approach reduces the impact of poor performance in one sector. Consider sector-specific ETFs or spreading investments across multiple companies and industries.

-

Research and Due Diligence: Thorough research is non-negotiable. This includes:

- Reviewing company financials: Scrutinize income statements, balance sheets, and cash flow statements.

- Analyzing industry trends: Understand the industry's outlook and the company's competitive position.

- Assessing management quality: Evaluate the competence and integrity of the company's management team. Utilize reputable financial news websites, company investor relations pages, and SEC filings (EDGAR database) for your research.

Optimizing Your Dividend Strategy for Maximum Returns

Several strategies can further enhance your dividend income.

-

Dividend Reinvestment Plans (DRIPs): DRIPs allow you to automatically reinvest your dividends to purchase more shares, leveraging the power of compounding. This strategy accelerates your portfolio growth over the long term.

-

Tax-Advantaged Accounts: Holding dividend stocks within tax-advantaged accounts like IRAs or 401(k)s minimizes your tax liability on dividend income, allowing more of your returns to compound.

-

Long-Term Perspective: Dividend investing thrives on a long-term approach. Market fluctuations are inevitable. Patience and consistent contributions are crucial for maximizing returns.

Dealing with Market Volatility

Even the best dividend stocks experience price fluctuations. Market downturns are unavoidable. A long-term approach is crucial for weathering these storms. Understanding your risk tolerance is essential; if market volatility causes undue stress, consider adjusting your portfolio accordingly.

Conclusion

This simplest dividend strategy, focusing on selecting financially sound companies with a history of consistent dividend payouts, diversification, and reinvestment, can lead to significant long-term gains. Remember, thorough research and a long-term perspective are essential to maximize your returns from dividend investing. Don't delay—start building your high-yield dividend portfolio today and experience the power of passive income generation. Begin your journey towards financial freedom with the simplest dividend strategy and watch your returns grow!

Featured Posts

-

Houston Astros Foundation College Classic Top College Baseball Teams Face Off

May 11, 2025

Houston Astros Foundation College Classic Top College Baseball Teams Face Off

May 11, 2025 -

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 11, 2025

Bank Of Canada Rate Cuts Economists Predict Renewed Cuts Amidst Tariff Job Losses

May 11, 2025 -

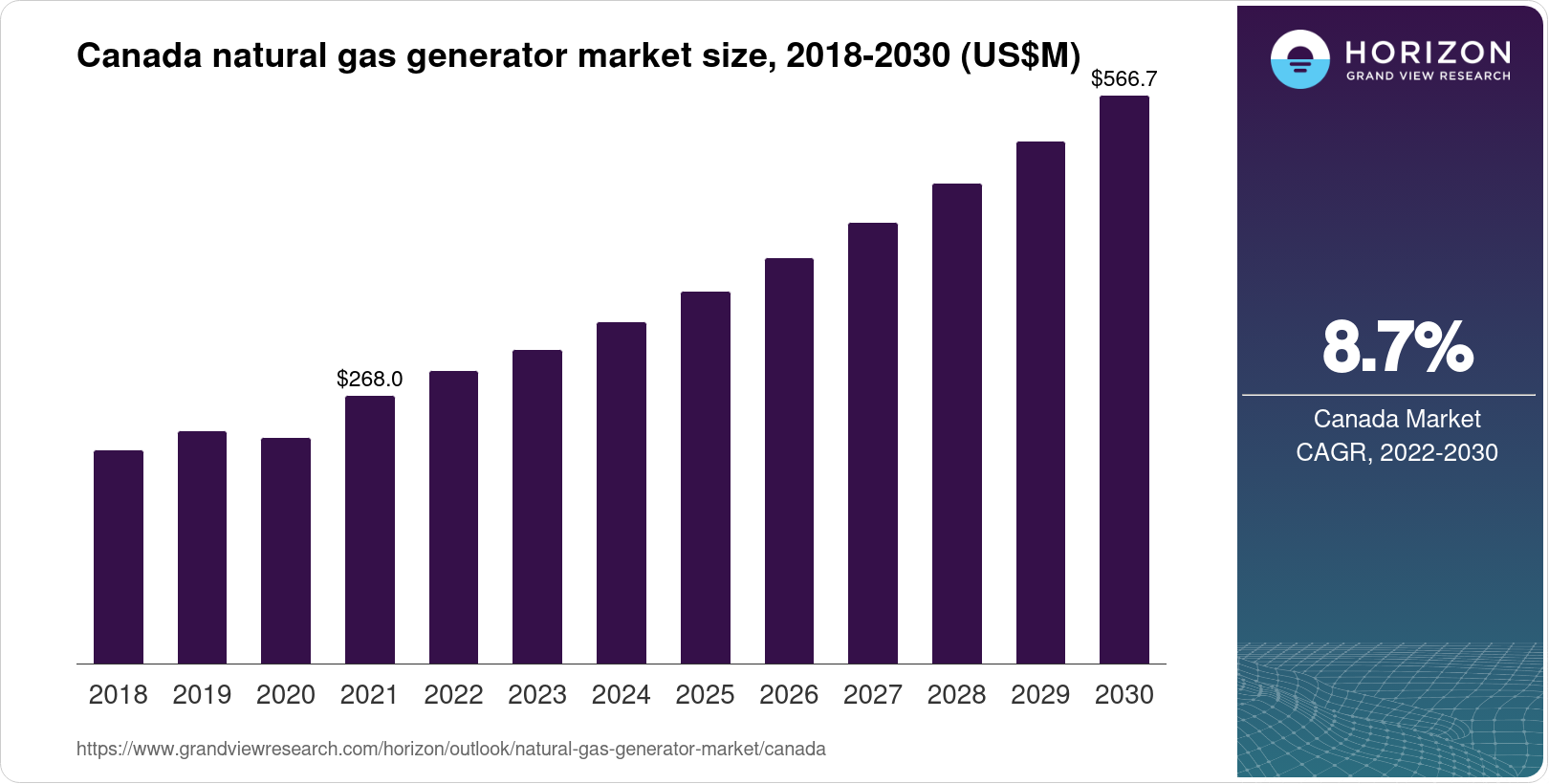

Growth Trajectory Of Canadas Leading Natural Gas Producer

May 11, 2025

Growth Trajectory Of Canadas Leading Natural Gas Producer

May 11, 2025 -

Elliotts Exclusive Investment In Russian Gas Pipeline

May 11, 2025

Elliotts Exclusive Investment In Russian Gas Pipeline

May 11, 2025 -

Pentagon Mulls Greenland Shift To Northern Command Trumps Legacy And Concerns

May 11, 2025

Pentagon Mulls Greenland Shift To Northern Command Trumps Legacy And Concerns

May 11, 2025

Latest Posts

-

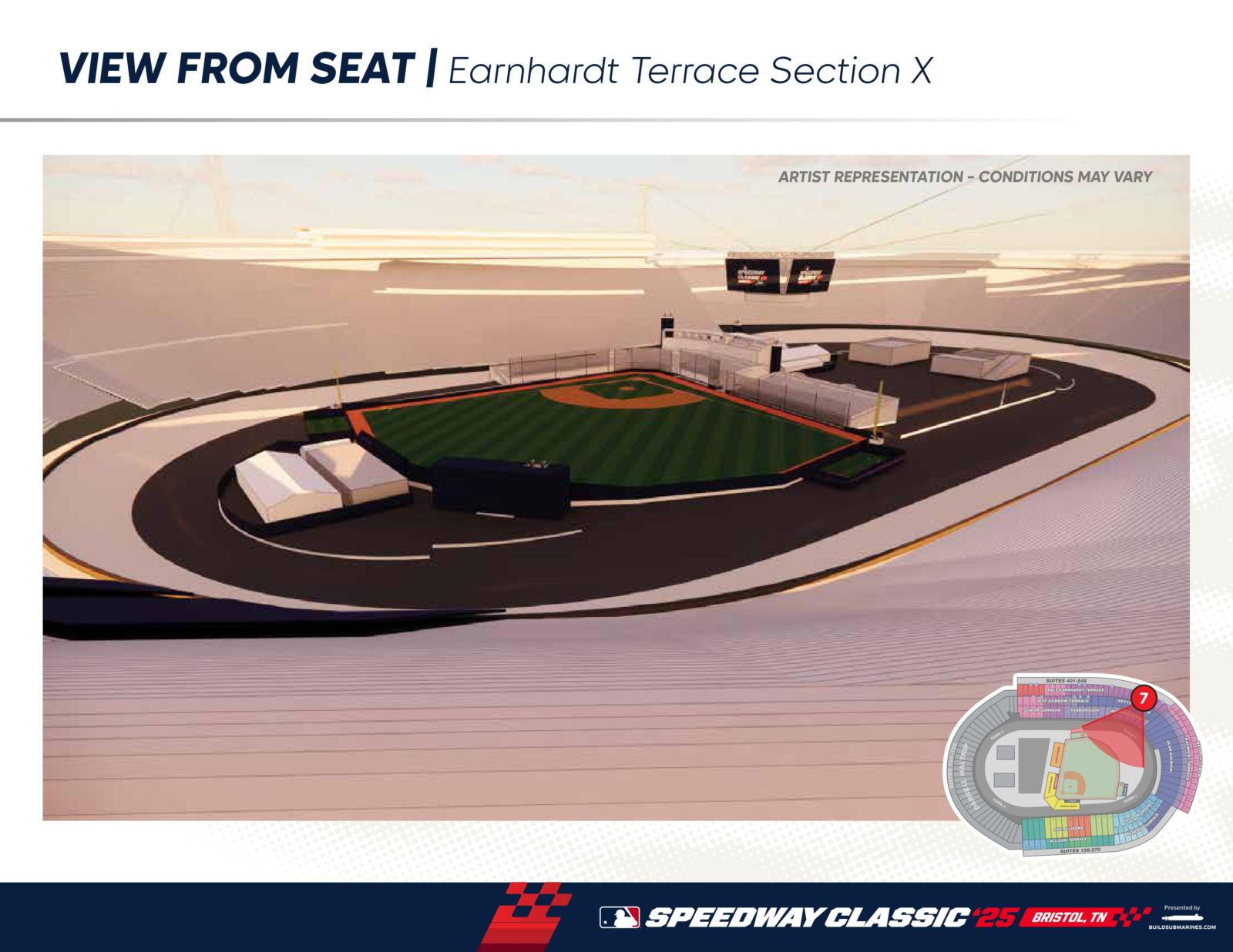

Manfreds Mlb Speedway Classic Predicting Fan Attendance At Bristol

May 11, 2025

Manfreds Mlb Speedway Classic Predicting Fan Attendance At Bristol

May 11, 2025 -

Mlb Speedway Classic In Bristol Assessing Fan Interest Under Manfreds Watch

May 11, 2025

Mlb Speedway Classic In Bristol Assessing Fan Interest Under Manfreds Watch

May 11, 2025 -

Bristol Mlb Speedway Classic Will Fans Turn Out For Manfred

May 11, 2025

Bristol Mlb Speedway Classic Will Fans Turn Out For Manfred

May 11, 2025 -

Manfred And The Bristol Mlb Speedway Classic A Look At Expected Fan Attendance

May 11, 2025

Manfred And The Bristol Mlb Speedway Classic A Look At Expected Fan Attendance

May 11, 2025 -

Aaron Judges 2024 Outlook A Yankees Magazine Deep Dive

May 11, 2025

Aaron Judges 2024 Outlook A Yankees Magazine Deep Dive

May 11, 2025